公司簡介

| Standard Bank評論摘要 | |

| 成立年份 | 1998 |

| 註冊國家/地區 | 南非 |

| 監管 | 無監管 |

| 市場工具 | 差價合約、交易所買賣基金、指數、外匯、股票和金屬 |

| 模擬帳戶 | / |

| 槓桿 | / |

| 點差 | / |

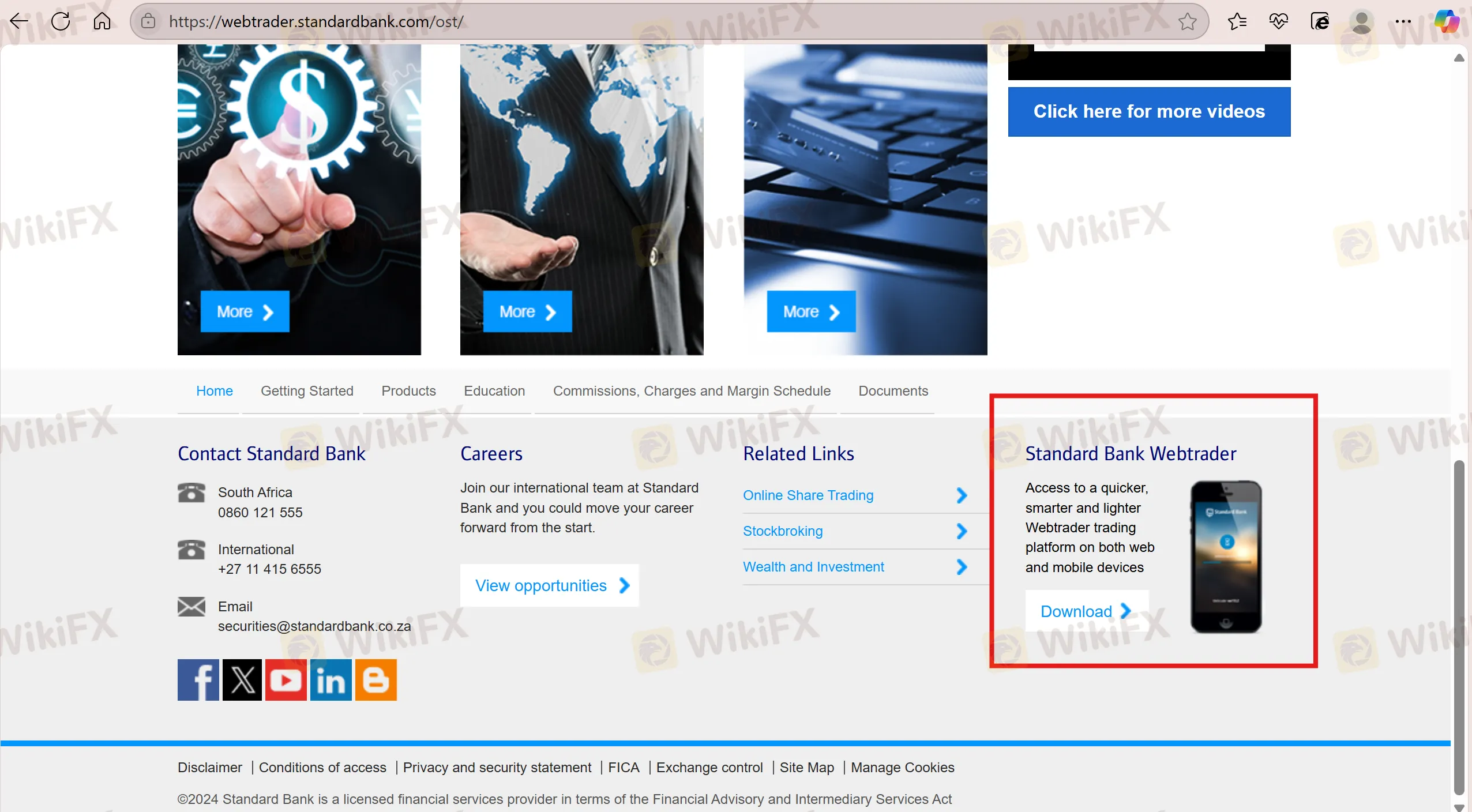

| 交易平台 | Standard Bank Webtrader |

| 最低存款 | / |

| 客戶支援 | 電郵:securities@standardbank.co.za |

| 電話:0860 121 555(南非) | |

| 電話:+27 11 415 6555(國際) | |

| 社交媒體:Facebook、YouTube、LinkedIn、Twitter、Blogger | |

Standard Bank 資訊

Standard Bank 成立於1998年,並在南非註冊。它提供超過20,275種可交易工具,包括差價合約、交易所買賣基金、指數、外匯、股票和金屬,並支援通過Standard Bank Webtrader平台進行交易。儘管它提供各種金融產品和服務而不收取交易費用,但該公司沒有受監管,並缺乏有關帳戶功能的詳細信息。投資者應對其合法性和透明度保持警惕。此外,存款需支付0.05美元的費用,結算通常需要兩個工作日完成。

優缺點

| 優點 | 缺點 |

| 多樣化的金融產品 | 無監管 |

| 悠久的運營歷史 | 有關交易詳情的信息有限 |

| 多種聯絡渠道 | 收取存款費用 |

Standard Bank 是否合法?

Standard Bank 沒有受監管,因此交易者在交易時需要保持警惕。

我可以在Standard Bank上交易什麼?

Standard Bank 提供超過20,275種交易工具,包括差價合約、交易所買賣基金、指數、外匯、股票和金屬。

| 可交易工具 | 支援 |

| 差價合約 | ✔ |

| 交易所買賣基金 | ✔ |

| 指數 | ✔ |

| 外匯 | ✔ |

| 基金 | ✔ |

| 股票 | ✔ |

| 金屬 | ✔ |

| 債券 | ❌ |

| 加密貨幣 | ❌ |

| 期權 | ❌ |

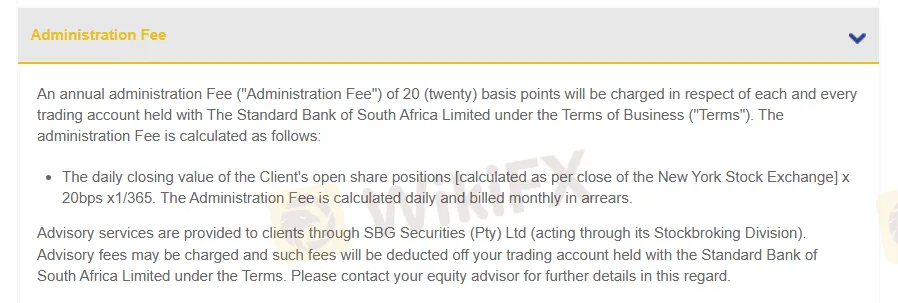

費用

管理費:將收取20個基點。

交易平台

Standard Bank 支援在Standard Bank Webtrader平台進行交易。該平台不收取交易費用,結算在兩個工作日內完成。

| 交易平台 | 支援 | 可用設備 | 適合對象 |

| Standard Bank Webtrader | ✔ | 手機、網頁 | / |

| MT4 | ❌ | / | 初學者 |

| MT5 | ❌ | / | 經驗豐富的交易者 |

存款和提款

客戶主要可以通過銀行轉帳進行存款和提款,存款將收取US$0.05的費用。