Unternehmensprofil

| Standard BankÜberprüfungszusammenfassung | |

| Gegründet | 1998 |

| Registriertes Land/Region | Südafrika |

| Regulierung | Keine Regulierung |

| Handelsinstrumente | CFDs, ETFs, Indizes, Devisen, Aktien und Metalle |

| Demokonto | / |

| Hebel | / |

| Spread | / |

| Handelsplattform | Standard Bank Webtrader |

| Mindesteinzahlung | / |

| Kundensupport | E-Mail: securities@standardbank.co.za |

| Tel: 0860 121 555 (Südafrika) | |

| Tel: +27 11 415 6555 (International) | |

| Soziale Medien: Facebook, YouTube, LinkedIn, Twitter, Blogger | |

Standard Bank Informationen

Standard Bank wurde 1998 gegründet und in Südafrika registriert. Es bietet über 20.275 handelbare Instrumente, darunter CFDs, ETFs, Indizes, Devisen, Aktien und Metalle, und unterstützt den Handel über die Standard Bank Webtrader-Plattform. Obwohl es eine Vielzahl von Finanzprodukten und -dienstleistungen ohne Transaktionsgebühren anbietet, ist das Unternehmen unreguliert und es fehlen detaillierte Informationen zu Kontofunktionen. Anleger sollten in Bezug auf Legitimität und Transparenz Vorsicht walten lassen. Darüber hinaus fallen bei Einzahlungen eine Gebühr von 0,05 US-Dollar an, und Abwicklungen dauern in der Regel zwei Werktage.

Vor- und Nachteile

| Vorteile | Nachteile |

| Eine Vielzahl von Finanzprodukten | Keine Regulierung |

| Langjährige Betriebshistorie | Begrenzte Informationen zu Handelsdetails |

| Verschiedene Kontaktmöglichkeiten | Gebühren für Einzahlungen |

Ist Standard Bank seriös?

Standard Bank ist nicht reguliert, daher sollten Trader beim Handel Vorsicht walten lassen.

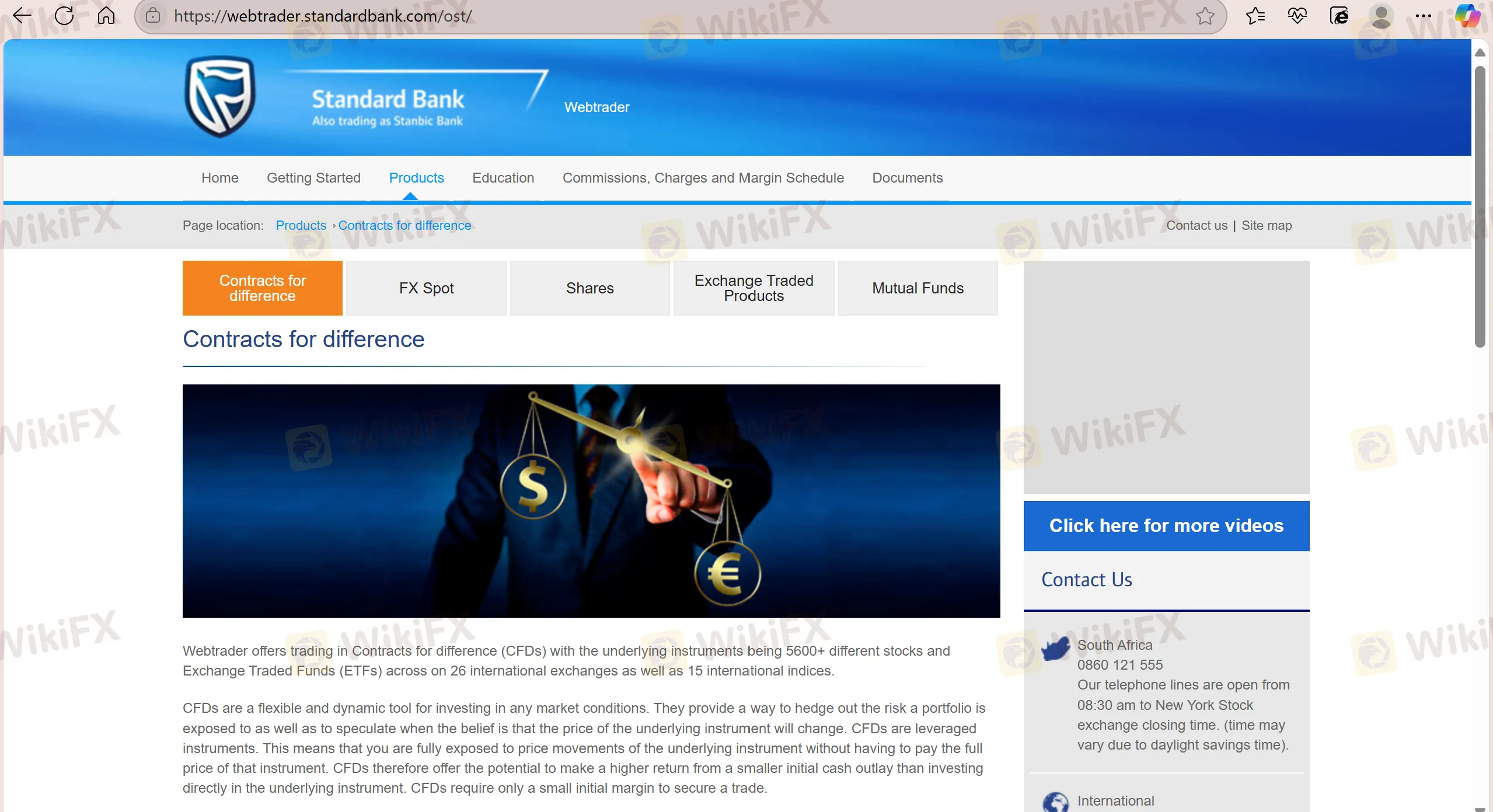

Was kann ich bei Standard Bank handeln?

Standard Bank bietet eine breite Palette von über 20.275 Handelsinstrumenten, darunter CFDs, ETFs, Indizes, Devisen, Aktien und Metalle.

| Handelsinstrumente | Unterstützt |

| CFDs | ✔ |

| ETFs | ✔ |

| Indizes | ✔ |

| Devisen | ✔ |

| Fonds | ✔ |

| Aktien | ✔ |

| Metalle | ✔ |

| Anleihen | ❌ |

| Kryptowährungen | ❌ |

| Optionen | ❌ |

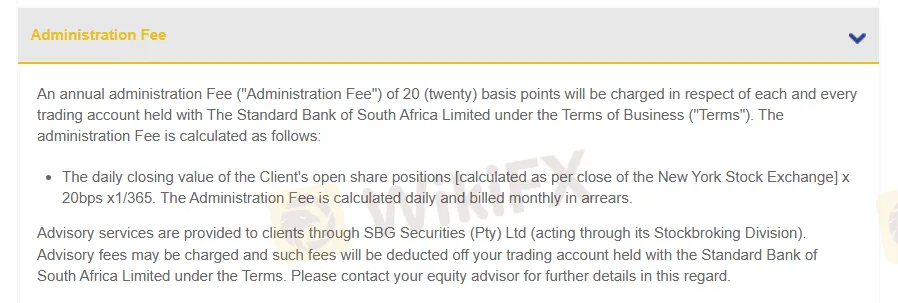

Gebühren

Verwaltungsgebühr: Es werden 20 Basispunkte berechnet.

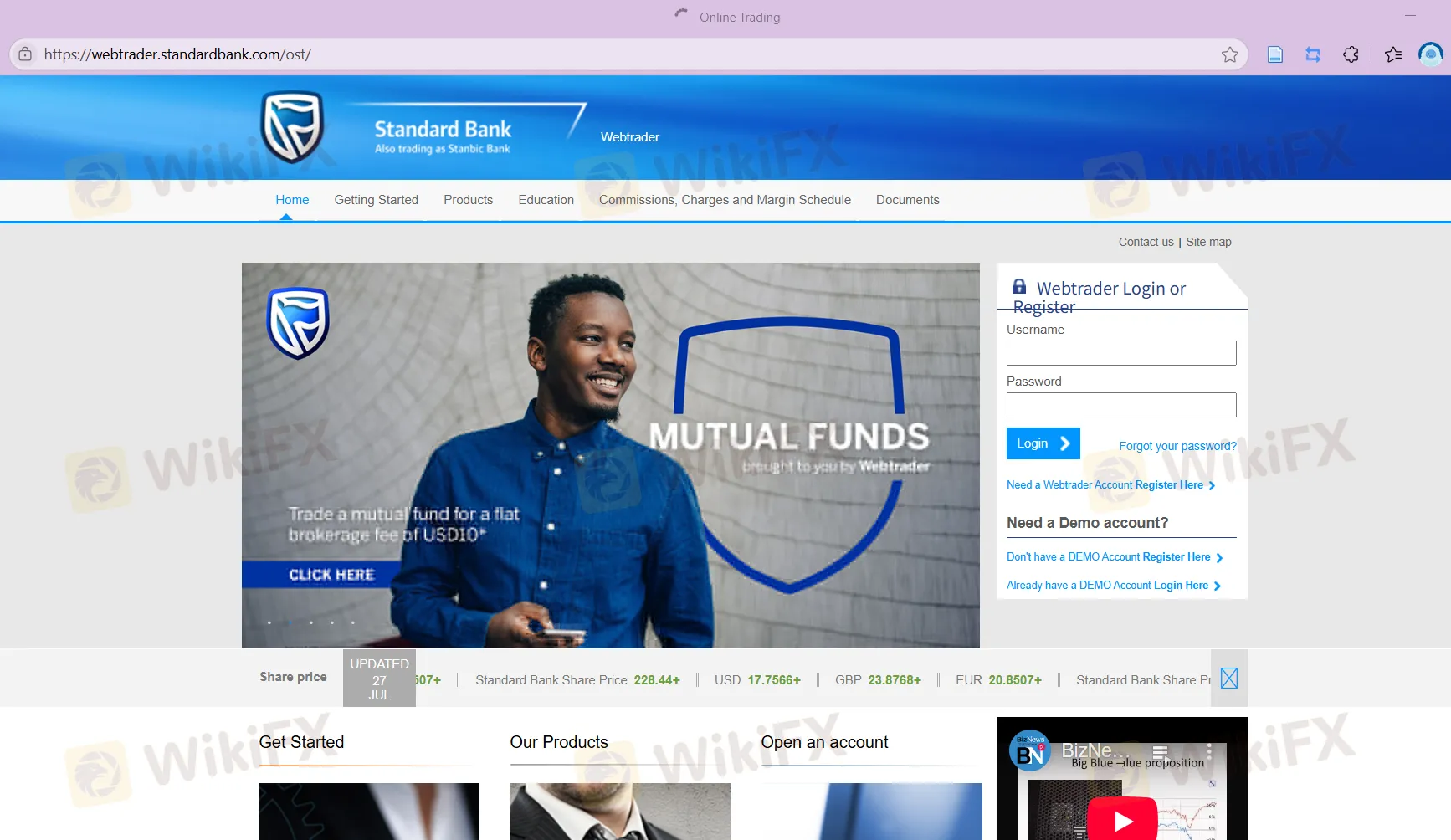

Handelsplattform

Standard Bank unterstützt den Handel auf der Standard Bank Webtrader Plattform. Die Plattform erhebt keine Transaktionsgebühren, und die Abwicklung erfolgt innerhalb von zwei Werktagen.

| Handelsplattform | Unterstützt | Verfügbare Geräte | Geeignet für |

| Standard Bank Webtrader | ✔ | Mobile, Web | / |

| MT4 | ❌ | / | Anfänger |

| MT5 | ❌ | / | Erfahrene Händler |

Ein- und Auszahlung

Kunden können hauptsächlich per Banküberweisung einzahlen und abheben, wobei eine Gebühr von US$0,05 für Einzahlungen erhoben wird.