Buod ng kumpanya

| Standard BankBuod ng Pagsusuri | ||

| Itinatag | 1998 | |

| Nakarehistrong Bansa/Rehiyon | Timog Africa | |

| Regulasyon | Mga Kasangkapan sa Merkado | CFDs, ETFs, Mga Indise, Forex, Mga Bahagi, at Metal |

| Demo Account | / | |

| Levadura | / | |

| Spread | / | |

| Platform ng Paggawa ng Kalakalan | Standard Bank Webtrader | |

| Minimum na Deposito | / | |

| Suporta sa Kustomer | Email: securities@standardbank.co.za | |

| Tel: 0860 121 555 (Timog Africa) | ||

| Tel: +27 11 415 6555 (Internasyonal) | ||

| Social Media: Facebook, YouTube, LinkedIn, Twitter, Blogger | ||

Impormasyon ng Standard Bank

Itinatag ang Standard Bank noong 1998 at nakarehistro sa Timog Africa. Nag-aalok ito ng higit sa 20,275 mga instrumento na maaaring i-trade, kabilang ang CFDs, ETFs, mga indise, forex, mga stocks, at metal, at sumusuporta sa kalakalan sa pamamagitan ng platapormang Standard Bank Webtrader. Bagaman nag-aalok ito ng iba't ibang mga produkto at serbisyo sa pinansya nang walang bayad sa mga transaksyon, ang kumpanya ay hindi nairehistro at kulang sa detalyadong impormasyon tungkol sa mga tampok ng account. Dapat mag-ingat ang mga mamumuhunan sa kanyang lehitimidad at kalinawan. Bukod dito, may bayad na US$0.05 ang mga deposito, at karaniwang tumatagal ng dalawang araw na negosyo upang makumpleto ang mga pagtutuos.

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

| Iba't ibang mga produkto sa pinansya | Walang regulasyon |

| Mahabang kasaysayan ng operasyon | Limitadong impormasyon sa mga detalye ng kalakalan |

| Iba't ibang mga paraan ng pakikipag-ugnayan | May bayad na singil sa mga deposito |

Tunay ba ang Standard Bank?

Ang Standard Bank ay hindi nairehistro, kaya't dapat mag-ingat ang mga mangangalakal sa pagkalakalan.

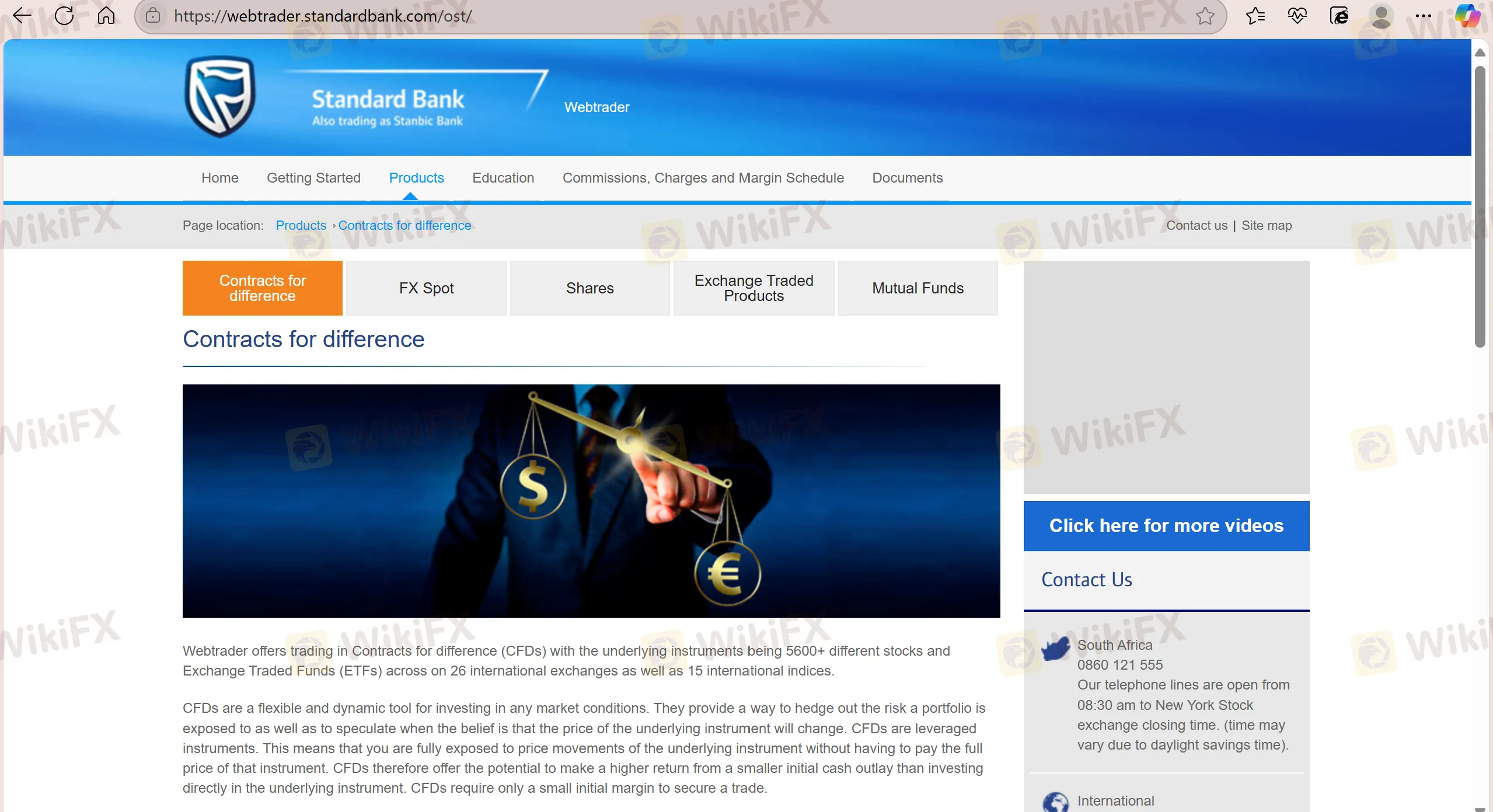

Ano ang Maaari Kong I-trade sa Standard Bank?

Standard Bank ay nag-aalok ng malawak na hanay ng higit sa 20,275 mga instrumento sa kalakalan, kabilang ang CFDs, ETFs, Indices, Forex, Shares, at Metals.

| Mga Instrumentong Maaring Kalakalan | Supported |

| CFDs | ✔ |

| ETFs | ✔ |

| Indices | ✔ |

| Forex | ✔ |

| Mga Pondo | ✔ |

| Shares | ✔ |

| Metals | ✔ |

| Bonds | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

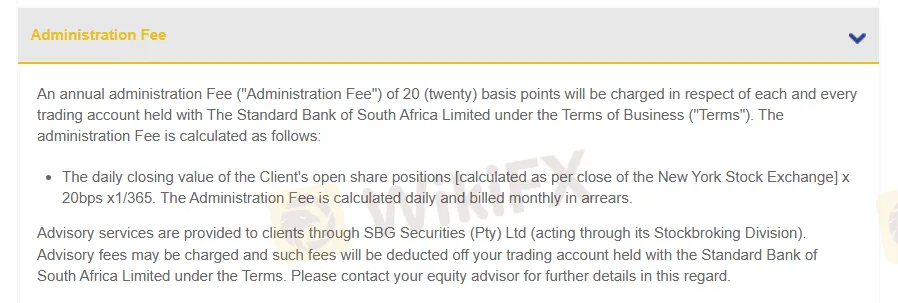

Mga Bayarin

Bayad sa Administrasyon: 20 puntos sa batayan ang ikakaltas.

Platform ng Kalakalan

Ang Standard Bank ay sumusuporta sa kalakalan sa plataporma ng Standard Bank Webtrader. Ang plataporma ay hindi nagpapataw ng bayad sa transaksyon, at ang paglilipat ay natatapos sa loob ng dalawang araw na negosyo.

| Platform ng Kalakalan | Supported | Mga Available na Dispositibo | Angkop para sa |

| Standard Bank Webtrader | ✔ | Mobile, Web | / |

| MT4 | ❌ | / | Mga Baguhan |

| MT5 | ❌ | / | Mga Dalubhasa sa kalakalan |

Deposito at Pag-Wiwithdraw

Ang mga customer ay maaaring magdeposito at mag-withdraw lalo na sa pamamagitan ng bank transfer, at may bayad na US$0.05 para sa mga deposito.