Perfil de la compañía

| Standard BankResumen de la reseña | |

| Establecido | 1998 |

| País/Región registrado | Sudáfrica |

| Regulación | Sin regulación |

| Instrumentos de mercado | CFDs, ETFs, Índices, Forex, Acciones y Metales |

| Cuenta demo | / |

| Apalancamiento | / |

| Spread | / |

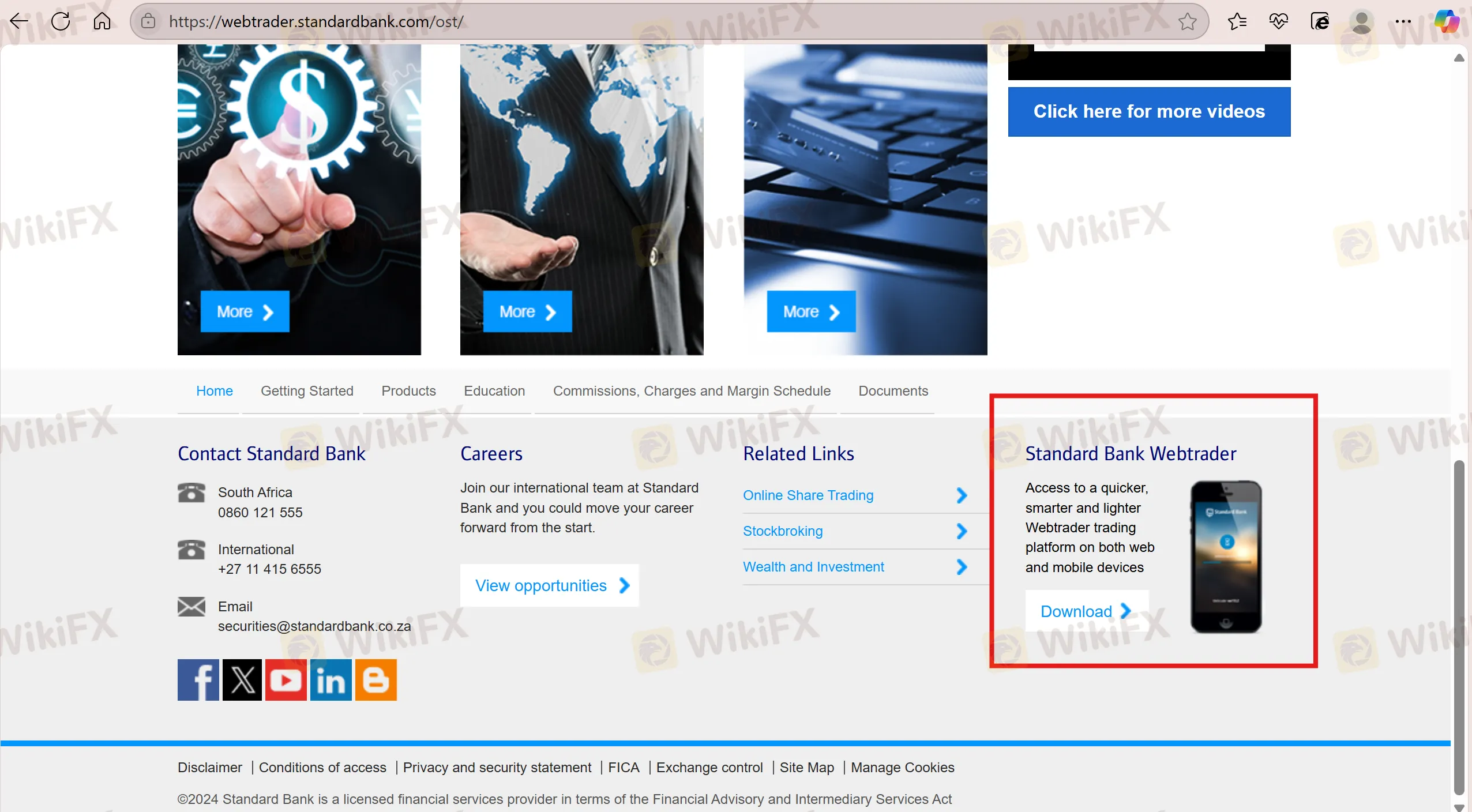

| Plataforma de trading | Standard Bank Webtrader |

| Depósito mínimo | / |

| Soporte al cliente | Email: securities@standardbank.co.za |

| Tel: 0860 121 555 (Sudáfrica) | |

| Tel: +27 11 415 6555 (Internacional) | |

| Redes sociales: Facebook, YouTube, LinkedIn, Twitter, Blogger | |

Información sobre Standard Bank

Standard Bank fue establecido en 1998 y se registró en Sudáfrica. Ofrece más de 20,275 instrumentos negociables, incluyendo CFDs, ETFs, índices, forex, acciones y metales, y admite el trading a través de la plataforma Standard Bank Webtrader. Aunque ofrece una variedad de productos y servicios financieros sin cobrar tarifas de transacción, la empresa no está regulada y carece de información detallada sobre las características de la cuenta. Los inversores deben ser cautelosos respecto a su legitimidad y transparencia. Además, los depósitos incurren en una tarifa de US$0.05 y las liquidaciones suelen tardar dos días hábiles en completarse.

Pros y contras

| Pros | Contras |

| Variedad de productos financieros | Sin regulación |

| Larga historia de operación | Información limitada sobre detalles de trading |

| Varios canales de contacto | Se cobran tarifas de depósito |

¿Es Standard Bank legítimo?

Standard Bank no está regulado, por lo que los traders deben ser cautelosos al operar.

¿Qué puedo negociar en Standard Bank?

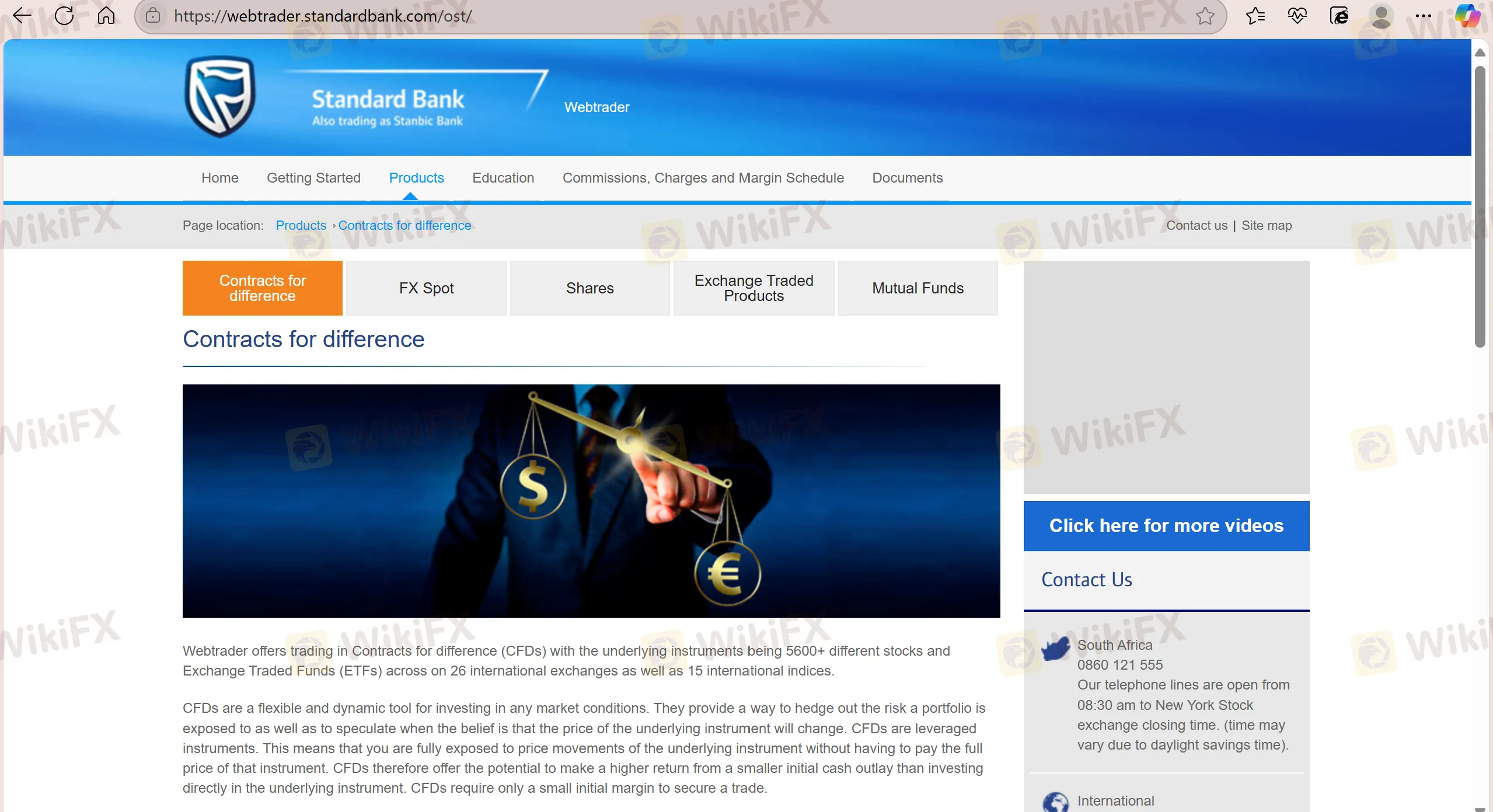

Standard Bank ofrece una amplia gama de más de 20,275 instrumentos de trading, incluyendo CFDs, ETFs, Índices, Forex, Acciones y Metales.

| Instrumentos Negociables | Soportado |

| CFDs | ✔ |

| ETFs | ✔ |

| Índices | ✔ |

| Forex | ✔ |

| Fondos | ✔ |

| Acciones | ✔ |

| Metales | ✔ |

| Bonos | ❌ |

| Criptomonedas | ❌ |

| Opciones | ❌ |

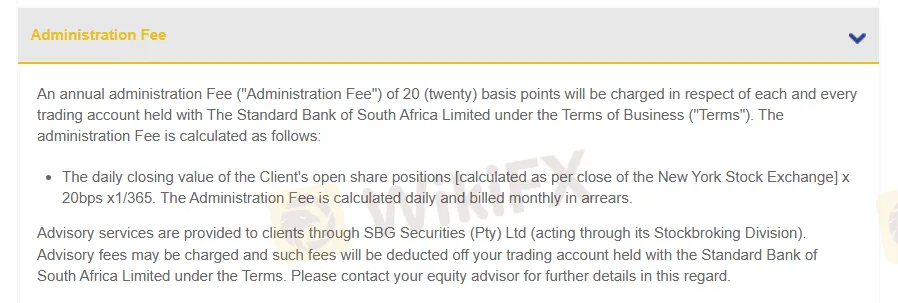

Tarifas

Tarifa de Administración: Se cobrará un 20 puntos básicos.

Plataforma de Trading

Standard Bank admite el trading en la plataforma Standard Bank Webtrader. La plataforma no cobra comisiones de transacción y el proceso de liquidación se completa en dos días hábiles.

| Plataforma de Trading | Soportado | Dispositivos Disponibles | Adecuado para |

| Standard Bank Webtrader | ✔ | Móvil, Web | / |

| MT4 | ❌ | / | Principiantes |

| MT5 | ❌ | / | Traders experimentados |

Depósito y Retiro

Los clientes pueden depositar y retirar principalmente a través de transferencia bancaria, y se cobrará una tarifa de US$0.05 por depósitos.