مقدمة عن الشركة

| Standard Bankملخص المراجعة | |

| تأسست | 1998 |

| البلد/المنطقة المسجلة | جنوب أفريقيا |

| التنظيم | لا يوجد تنظيم |

| أدوات السوق | CFDs، ETFs، مؤشرات، فوركس، أسهم، ومعادن |

| حساب تجريبي | / |

| الرافعة المالية | / |

| الانتشار | / |

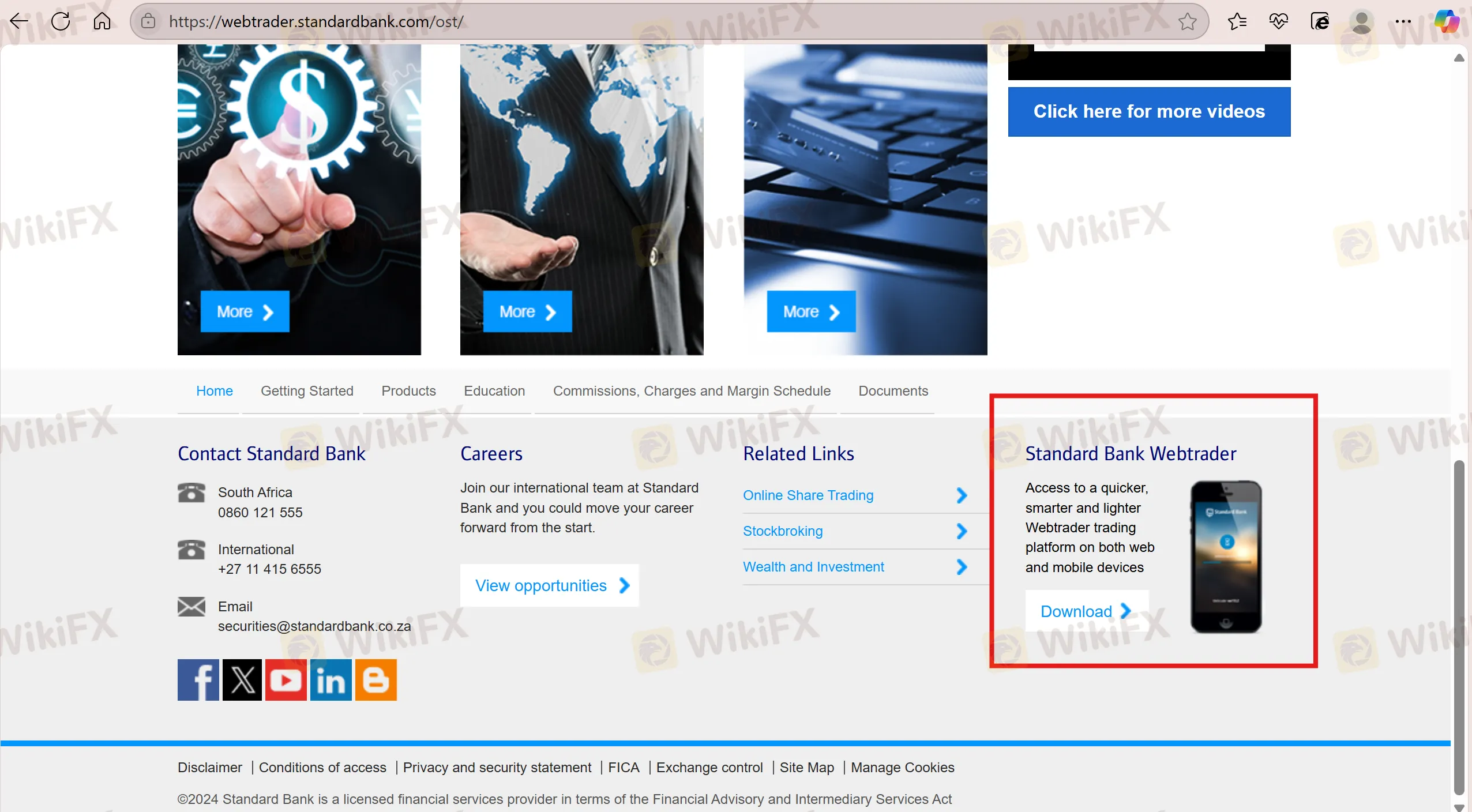

| منصة التداول | Standard Bank Webtrader |

| الحد الأدنى للإيداع | / |

| دعم العملاء | البريد الإلكتروني: securities@standardbank.co.za |

| هاتف: 0860 121 555 (جنوب أفريقيا) | |

| هاتف: +27 11 415 6555 (دولي) | |

| وسائل التواصل الاجتماعي: فيسبوك، يوتيوب، لينكد إن، تويتر، بلوجر | |

معلومات Standard Bank

تأسست Standard Bank في عام 1998 وتم تسجيلها في جنوب أفريقيا. تقدم أكثر من 20,275 صك قابل للتداول، بما في ذلك CFDs، ETFs، مؤشرات، فوركس، أسهم، ومعادن، وتدعم التداول من خلال منصة التداول Standard Bank Webtrader. على الرغم من تقديمها مجموعة متنوعة من المنتجات المالية والخدمات دون تحصيل رسوم المعاملات، إلا أن الشركة غير منظمة وتفتقر إلى معلومات مفصلة حول ميزات الحساب. يجب على المستثمرين ممارسة الحذر فيما يتعلق بشرعية وشفافية الشركة. بالإضافة إلى ذلك، تتحمل الودائع رسمًا بقيمة 0.05 دولار أمريكي، وتستغرق التسويات عادة يومي عملان لاكتمالها.

الإيجابيات والسلبيات

| الإيجابيات | السلبيات |

| مجموعة متنوعة من المنتجات المالية | لا يوجد تنظيم |

| تاريخ عمل طويل | معلومات محدودة حول تفاصيل التداول |

| قنوات اتصال متنوعة | تحصيل رسوم الإيداع |

هل Standard Bank شرعية؟

Standard Bank غير منظمة، لذلك يجب على التجار ممارسة الحذر عند التداول.

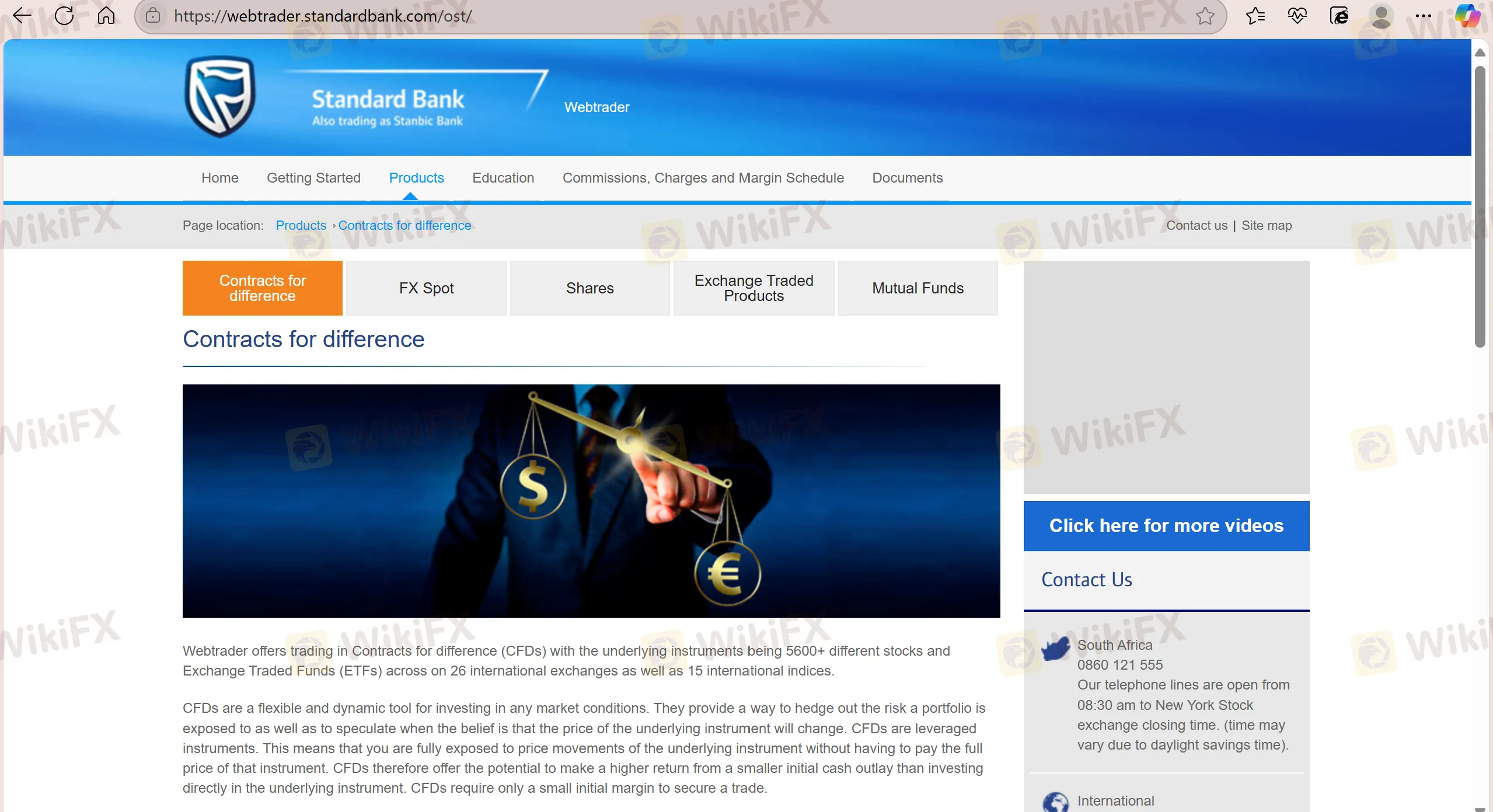

ما الذي يمكنني التداول به على Standard Bank؟

Standard Bank تقدم مجموعة واسعة تضم أكثر من 20,275 صك تداول، بما في ذلك CFDs، ETFs، مؤشرات، فوركس، أسهم، ومعادن.

| الصكوك التجارية | مدعوم |

| CFDs | ✔ |

| ETFs | ✔ |

| مؤشرات | ✔ |

| فوركس | ✔ |

| صناديق | ✔ |

| أسهم | ✔ |

| معادن | ✔ |

| سندات | ❌ |

| عملات رقمية | ❌ |

| خيارات | ❌ |

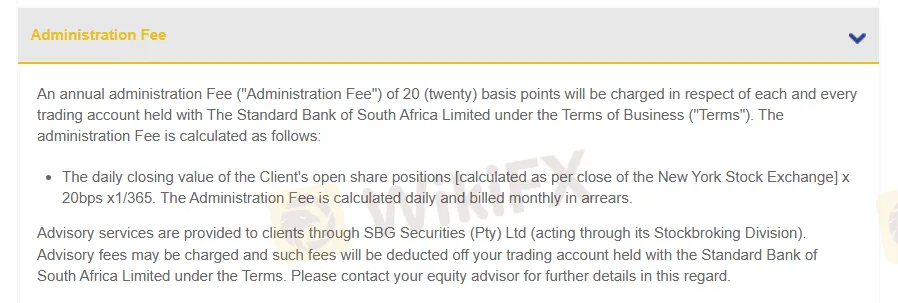

الرسوم

رسوم الإدارة: سيتم تحصيل 20 نقطة أساس.

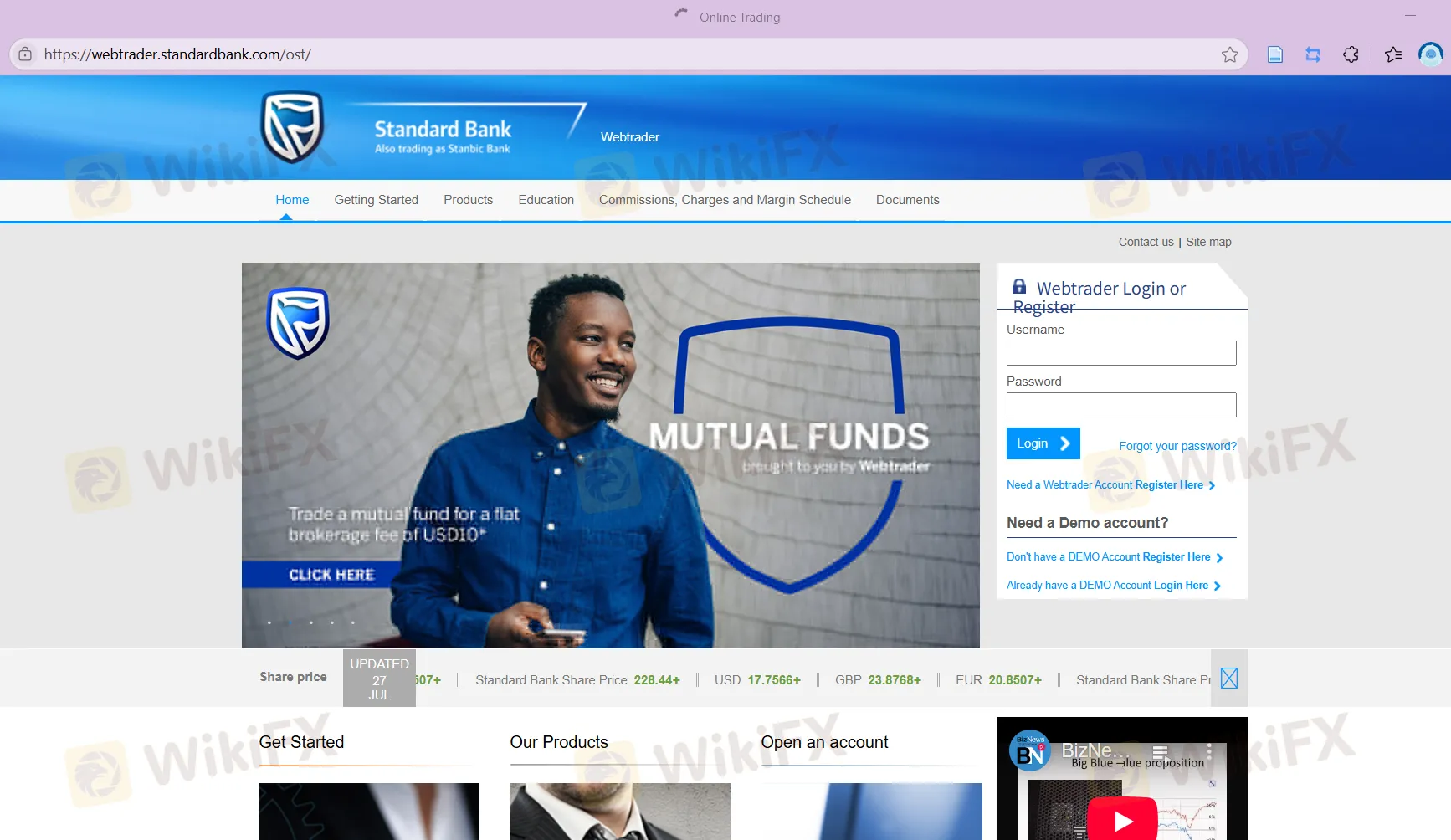

منصة التداول

Standard Bank تدعم التداول على منصة Standard Bank Webtrader. لا تفرض المنصة رسوم معاملات، ويتم إتمام التسوية خلال يومي عمل.

| منصة التداول | مدعوم | الأجهزة المتاحة | مناسبة لـ |

| Standard Bank Webtrader | ✔ | جوال، ويب | / |

| MT4 | ❌ | / | المبتدئين |

| MT5 | ❌ | / | تجار متمرسين |

الإيداع والسحب

يمكن للعملاء إجراء الإيداع والسحب أساسًا عبر التحويل البنكي، وسيتم تحصيل رسم قدره 0.05 دولار أمريكي عن الإيداعات.