Resumo da empresa

| Standard BankResumo da Revisão | |

| Fundação | 1998 |

| País/Região Registrada | África do Sul |

| Regulação | Sem Regulação |

| Instrumentos de Mercado | CFDs, ETFs, Índices, Forex, Ações e Metais |

| Conta Demonstrativa | / |

| Alavancagem | / |

| Spread | / |

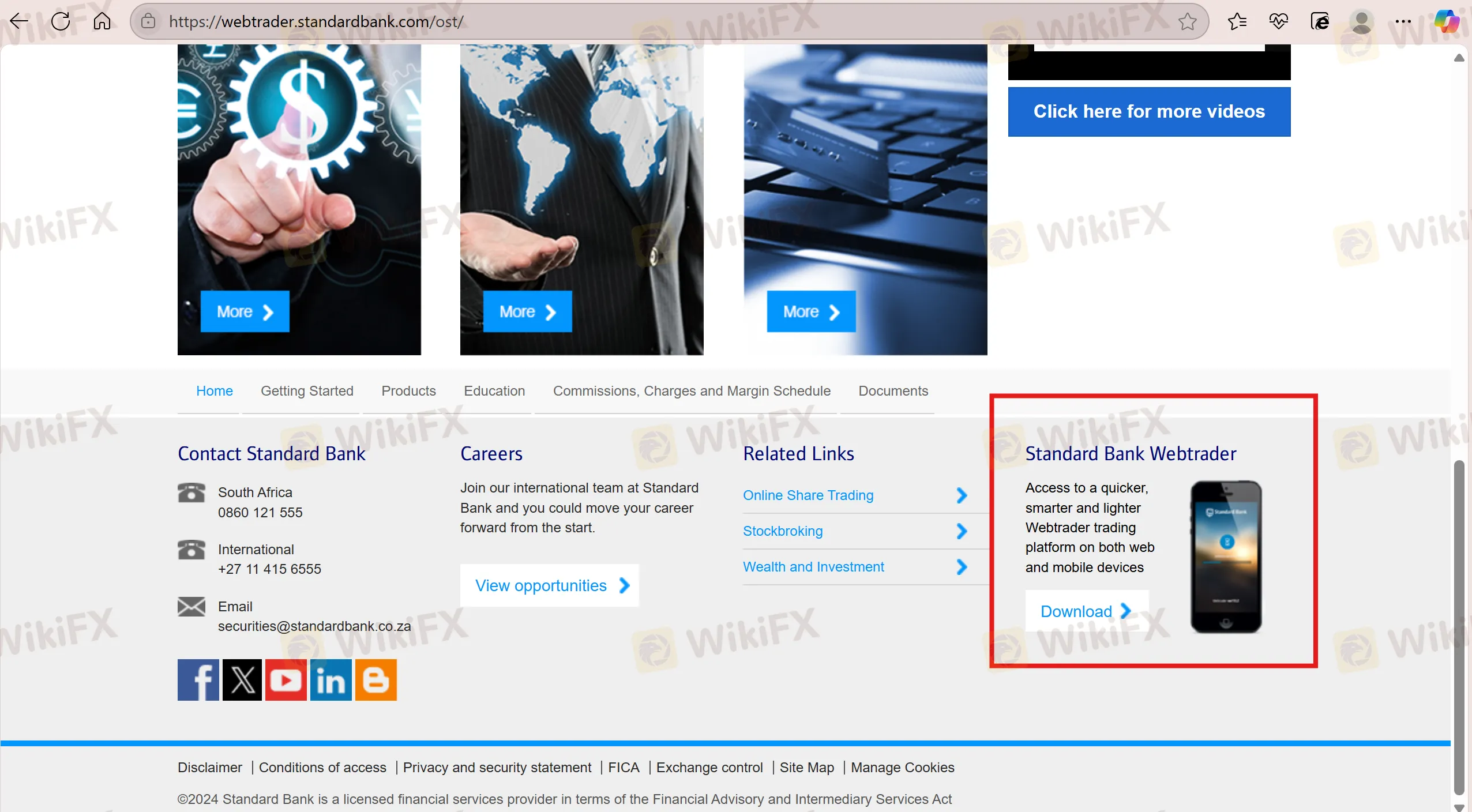

| Plataforma de Negociação | Standard Bank Webtrader |

| Depósito Mínimo | / |

| Suporte ao Cliente | Email: securities@standardbank.co.za |

| Tel: 0860 121 555 (África do Sul) | |

| Tel: +27 11 415 6555 (Internacional) | |

| Mídias Sociais: Facebook, YouTube, LinkedIn, Twitter, Blogger | |

Informações sobre Standard Bank

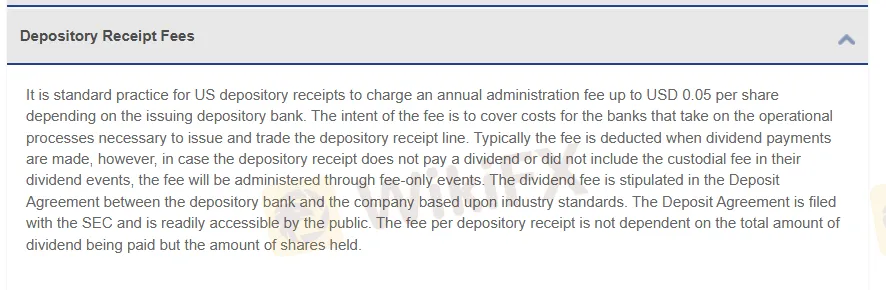

Standard Bank foi fundada em 1998 e registrada na África do Sul. Oferece mais de 20.275 instrumentos negociáveis, incluindo CFDs, ETFs, índices, forex, ações e metais, e suporta negociações através da plataforma Standard Bank Webtrader. Embora ofereça uma variedade de produtos e serviços financeiros sem cobrar taxas de transação, a empresa não é regulamentada e carece de informações detalhadas sobre as características da conta. Os investidores devem ter cautela quanto à sua legitimidade e transparência. Além disso, os depósitos incorrem em uma taxa de US$0,05, e os pagamentos geralmente levam dois dias úteis para serem concluídos.

Prós e Contras

| Prós | Contras |

| Variedade de produtos financeiros | Sem regulação |

| Histórico operacional longo | Informações limitadas sobre detalhes de negociação |

| Vários canais de contato | Taxas de depósito cobradas |

Standard Bank é Legítimo?

Standard Bank não é regulamentado, portanto, os traders precisam ter cautela ao negociar.

O Que Posso Negociar na Standard Bank?

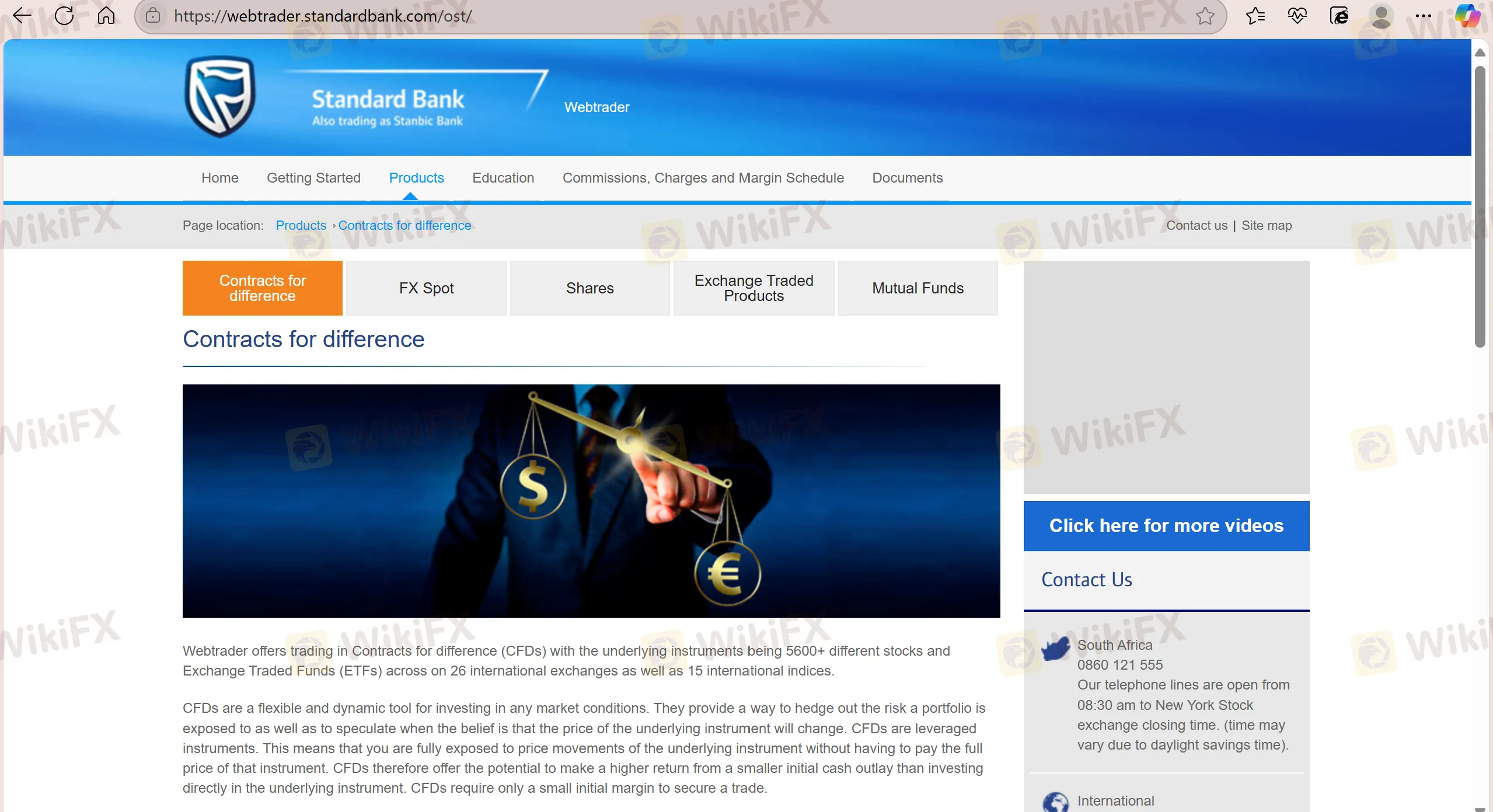

Standard Bank oferece uma ampla gama de mais de 20.275 instrumentos de negociação, incluindo CFDs, ETFs, Índices, Forex, Ações e Metais.

| Instrumentos Negociáveis | Suportado |

| CFDs | ✔ |

| ETFs | ✔ |

| Índices | ✔ |

| Forex | ✔ |

| Fundos | ✔ |

| Ações | ✔ |

| Metais | ✔ |

| Obrigações | ❌ |

| Criptomoedas | ❌ |

| Opções | ❌ |

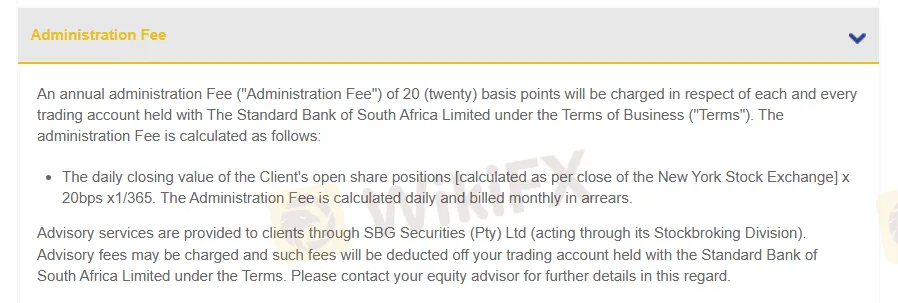

Taxas

Taxa de Administração: Serão cobrados 20 pontos base.

Plataforma de Negociação

Standard Bank suporta negociações na plataforma Standard Bank Webtrader. A plataforma não cobra taxas de transação, e a liquidação é concluída em até dois dias úteis.

| Plataforma de Negociação | Suportado | Dispositivos Disponíveis | Adequado para |

| Standard Bank Webtrader | ✔ | Móvel, Web | / |

| MT4 | ❌ | / | Iniciantes |

| MT5 | ❌ | / | Traders experientes |

Depósito e Saque

Os clientes podem depositar e sacar principalmente por transferência bancária, e será cobrada uma taxa de US$0,05 para depósitos.