회사 소개

| GMA CAPITAL 리뷰 요약 | |

| 설립 연도 | 2016 |

| 등록 국가/지역 | 아르헨티나 |

| 규제 | 규제 없음 |

| 서비스 | 판매 및 거래, 자산 관리, 기업 금융, 자산 관리 |

| 데모 계정 | ❌ |

| 거래 플랫폼 | / |

| 최소 입금액 | $0 |

| 고객 지원 | 문의 양식 |

| 전화: (+54 11) 5273-1252 | |

| 이메일: info@gmacap.com | |

| 주소: MIÑONES 2177, 4° PISO, CP 1428, CABA - 아르헨티나 | |

| X, LinkedIn, Instagram | |

GMA CAPITAL은 2016년 아르헨티나에서 설립된 규제되지 않은 금융 회사입니다. 판매 및 거래, 자산 관리, 기업 금융, 자산 관리 등 다양한 금융 서비스를 제공합니다. 그러나 공식 웹사이트에는 정보가 많이 없습니다.

장단점

| 장점 | 단점 |

| 다양한 고객 지원 채널 | 규제 없음 |

| 다양한 서비스 제공 | 계정에 대한 제한된 정보 |

| 데모 계정 없음 | |

| 거래 플랫폼에 대한 정보 부족 |

GMA CAPITAL의 신뢰성

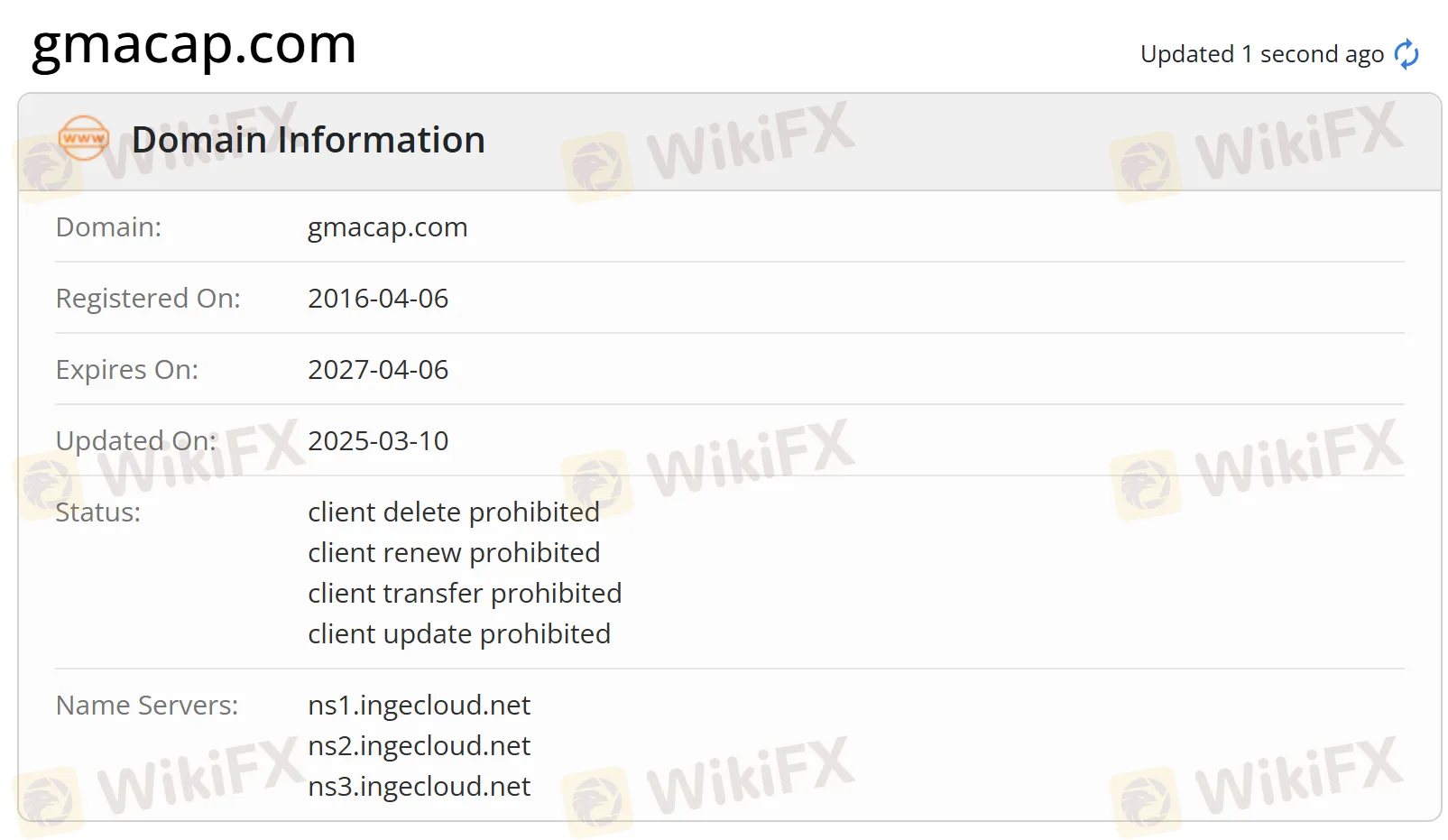

현재 GMA CAPITAL은 유효한 규제가 없습니다. 해당 도메인은 2016년 4월 6일에 등록되었으며 현재 상태는 “client Delete Prohibited, client Renew Prohibited, client Transfer Prohibited, client Update Prohibited”입니다. 규제된 기관을 찾는 것을 권장합니다.

GMA CAPITAL 서비스

GMA CAPITAL은 판매 및 거래, 자산 관리, 기업 금융, 자산 관리와 같은 금융 서비스를 제공합니다.

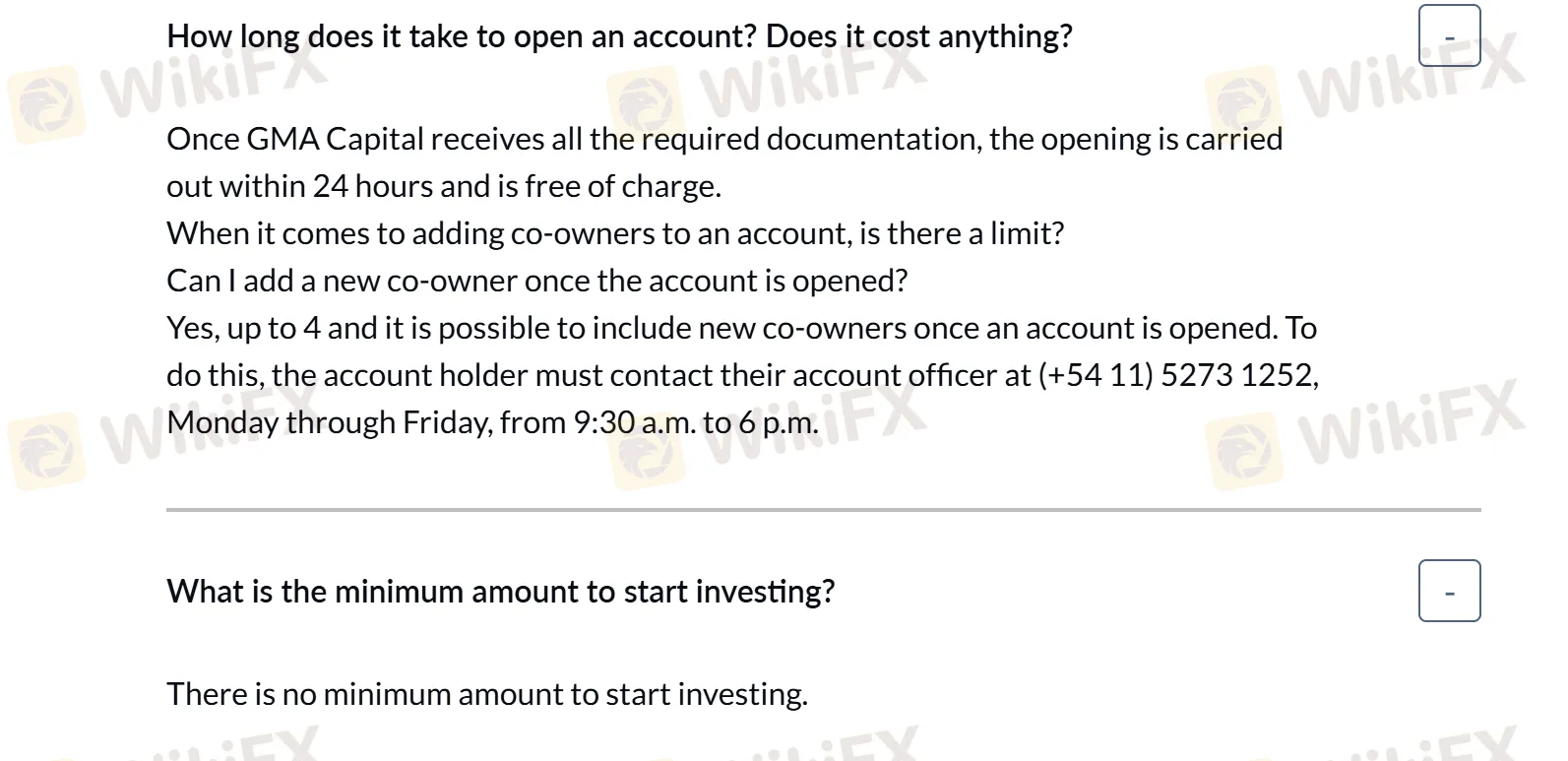

계정

계정 유형에 대한 정보가 없습니다. 알려진 것은 계정 개설이 24시간 이내에 무료로 이루어지며 투자를 시작하는 데 최소 금액이 없다는 것입니다.

입금 및 인출

GMA Capital에서는 입금: 아르헨티나의 페소 또는 달러로의 전자 이체는 특정 인증된 계정을 통해 이루어질 수 있습니다. 수표는 계정 담당자에게 연락하여 영수증을 이메일로 보내면 입금할 수 있습니다. 입금은 BCRA - 인증된 수요 계정에서 소유권이 일치해야 합니다.

출금에 대한 옵션은 고객 소유 계정으로의 은행 송금, 계정 소유자명의 수표, 또는 전자 수표(echeq)를 포함합니다. 매일 한도가 있어 각 고객은 자금 지급이나 수표 발행을 두 건 이상 할 수 없습니다.