Présentation de l'entreprise

| EGM Securities Résumé de l'examen | |

| Fondé | 2018 |

| Pays/Région Enregistré | Kenya |

| Régulation | Pas de régulation |

| Instruments de Marché | Devises, Matières Premières, Actions, Indices, ETF |

| Compte de Démo | ✅ |

| Effet de Levier | Jusqu'à 1:400 |

| Spread | À partir de 0,0 pips |

| Plateforme de Trading | MT4, MT5 |

| Dépôt Min | / |

| Support Client | Support 24/6 |

| WhatsApp : +254-730-676-002 | |

| Téléphone (Appel Gratuit Kenya) : 0800-211-185 | |

| Téléphone (International) : +254-730-676-002 | |

| Email : support@egmsecurities.com | |

| Adresse : 12th Floor, Tower 2, Delta Corner Towers, Waiyaki Way, Westlands, Nairobi, Kenya | |

| Bonus | Bonus de bienvenue de 30% supplémentaire sur le premier dépôt |

Informations sur EGM Securities

Fondé en 2018, EGM Securities est un courtier non réglementé enregistré au Kenya. Les instruments négociables avec un effet de levier maximal de 1:400 comprennent des devises, des matières premières, des actions, des indices et des ETF. Le courtier prend en charge les plateformes MT4 et MT5.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Support client 24/6 | Pas de régulation |

| Plateformes MT4 et MT5 disponibles | Dépôt minimum inconnu |

| Comptes de démo disponibles | |

| Divers instruments négociables | |

| Bonus offert | |

| Options de paiement populaires |

EGM Securities Est-il Légitime ?

EGM Securities n'est pas réglementé, même s'il prétend être agréé et réglementé par l'Autorité des Marchés de Capitaux du Kenya. Un courtier non réglementé n'est pas aussi sûr qu'un courtier réglementé.

Que Puis-je Trader sur EGM Securities ?

EGM Securities propose une large gamme d'instruments de marché, y compris devises, matières premières, actions, indices et ETF.

| Instruments négociables | Pris en charge |

| Devises | ✔ |

| Matières premières | ✔ |

| Actions | ✔ |

| Indices | ✔ |

| ETF | ✔ |

| Cryptos | ❌ |

| Obligations | ❌ |

| Options | ❌ |

| Fonds communs de placement | ❌ |

Effet de levier

L'effet de levier maximal est de 1:400, ce qui signifie que les profits et les pertes sont multipliés par 400. Notez qu'un effet de levier plus élevé peut améliorer le potentiel de profit tout en augmentant le risque, il est donc crucial d'avoir une gestion des risques appropriée.

Frais de EGM Securities

L'écart est à partir de 0,0 pips, et la commission est de 0 $. Plus l'écart est faible, plus la liquidité est rapide.

Plateforme de trading

EGM Securities collabore avec les plateformes de trading MT4 et MT5 de renom disponibles sur mobile, bureau et tablette pour le trading. Les traders débutants préfèrent MT4 à MT5. Les traders expérimentés sont plus adaptés à l'utilisation de MT5. MT4 et MT5 fournissent non seulement diverses stratégies de trading, mais mettent également en œuvre des systèmes EA.

| Plateforme de trading | Pris en charge | Appareils disponibles | Convient pour |

| MT4 | ✔ | Mobile/Bureau/Tablette | Débutants |

| MT5 | ✔ | Mobile/Bureau/Tablette | Traders expérimentés |

Dépôt et retrait

EGM Securities accepte les cartes de crédit, les virements bancaires, les portefeuilles électroniques, les portefeuilles de cryptomonnaie, l'argent mobile comme M-Pesa, et plus encore pour les dépôts et les retraits. Cependant, les délais de traitement des transferts et les frais associés sont inconnus.

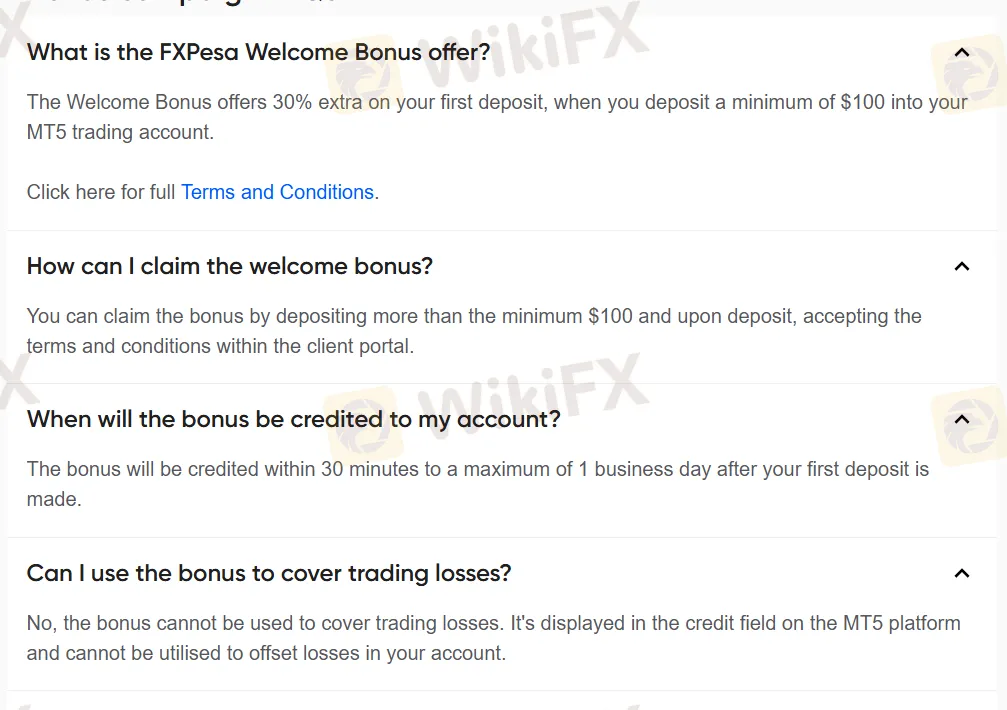

Bonus

Les traders peuvent recevoir un bonus de bienvenue de 30% supplémentaire sur le premier dépôt. Le bonus sera crédité dans un délai de 30 minutes à un maximum de 1 jour ouvrable après le premier dépôt.