Buod ng kumpanya

| GMA CAPITAL Buod ng Pagsusuri | |

| Itinatag | 2016 |

| Rehistradong Bansa/Rehiyon | Argentina |

| Regulasyon | Walang Regulasyon |

| Mga Serbisyo | Sales & Trading, Asset Management, Corporate Finance, Wealth Management |

| Demo Account | ❌ |

| Platform ng Paggagalaw | / |

| Minimum na Deposito | $0 |

| Suporta sa Kustomer | Form ng Pakikipag-ugnayan |

| Telepono: (+54 11) 5273-1252 | |

| Email: info@gmacap.com | |

| Address: MIÑONES 2177, 4° PISO, CP 1428, CABA - Argentina | |

| X, LinkedIn, Instagram | |

Ang GMA CAPITAL ay isang di-regulado na kumpanya sa pananalapi na itinatag sa Argentina noong 2016. Nagbibigay ito ng iba't ibang mga serbisyong pinansiyal kabilang ang Sales & Trading, Asset Management, Corporate Finance, at Wealth Management. Gayunpaman, may kaunting impormasyon lamang sa kanilang opisyal na website.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Maraming mga channel ng suporta sa kustomer | Walang regulasyon |

| Iba't ibang mga serbisyo na inaalok | Limitadong impormasyon sa mga account |

| Walang demo accounts | |

| Kakulangan ng impormasyon sa mga platform ng pagtetrading |

Tunay ba ang GMA CAPITAL?

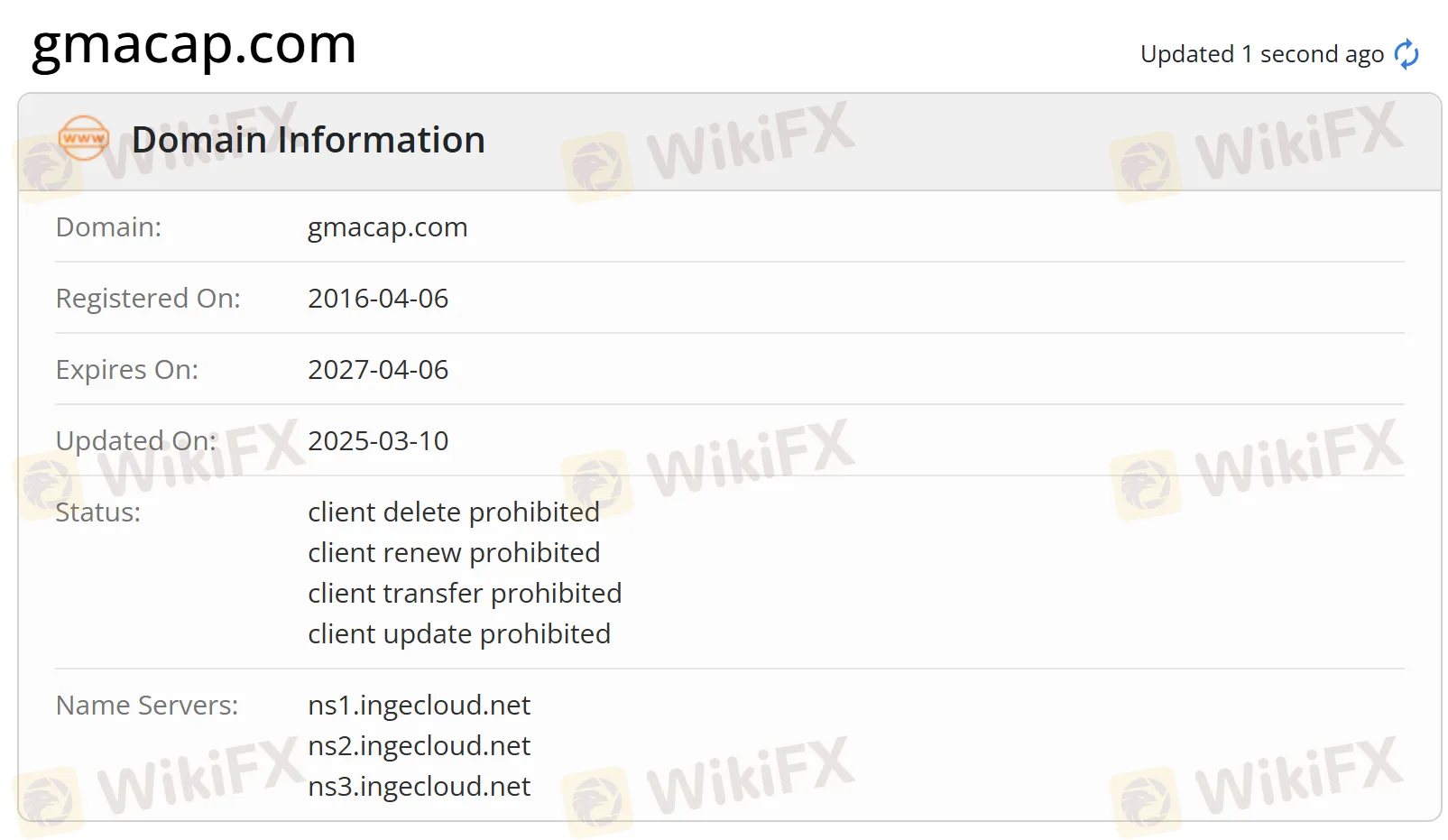

Sa kasalukuyan, ang GMA CAPITAL ay kulang sa wastong regulasyon. Ang kanilang domain ay nirehistro noong Abril 6, 2016, at ang kasalukuyang status ay “client Delete Prohibited, client Renew Prohibited, client Transfer Prohibited, client Update Prohibited”. Inirerekomenda namin na hanapin ang ibang mga reguladong kumpanya.

Mga Serbisyo ng GMA CAPITAL

Nag-aalok ang GMA CAPITAL ng mga serbisyong pinansiyal tulad ng Sales & Trading, Asset Management, Corporate Finance, at Wealth Management.

Account

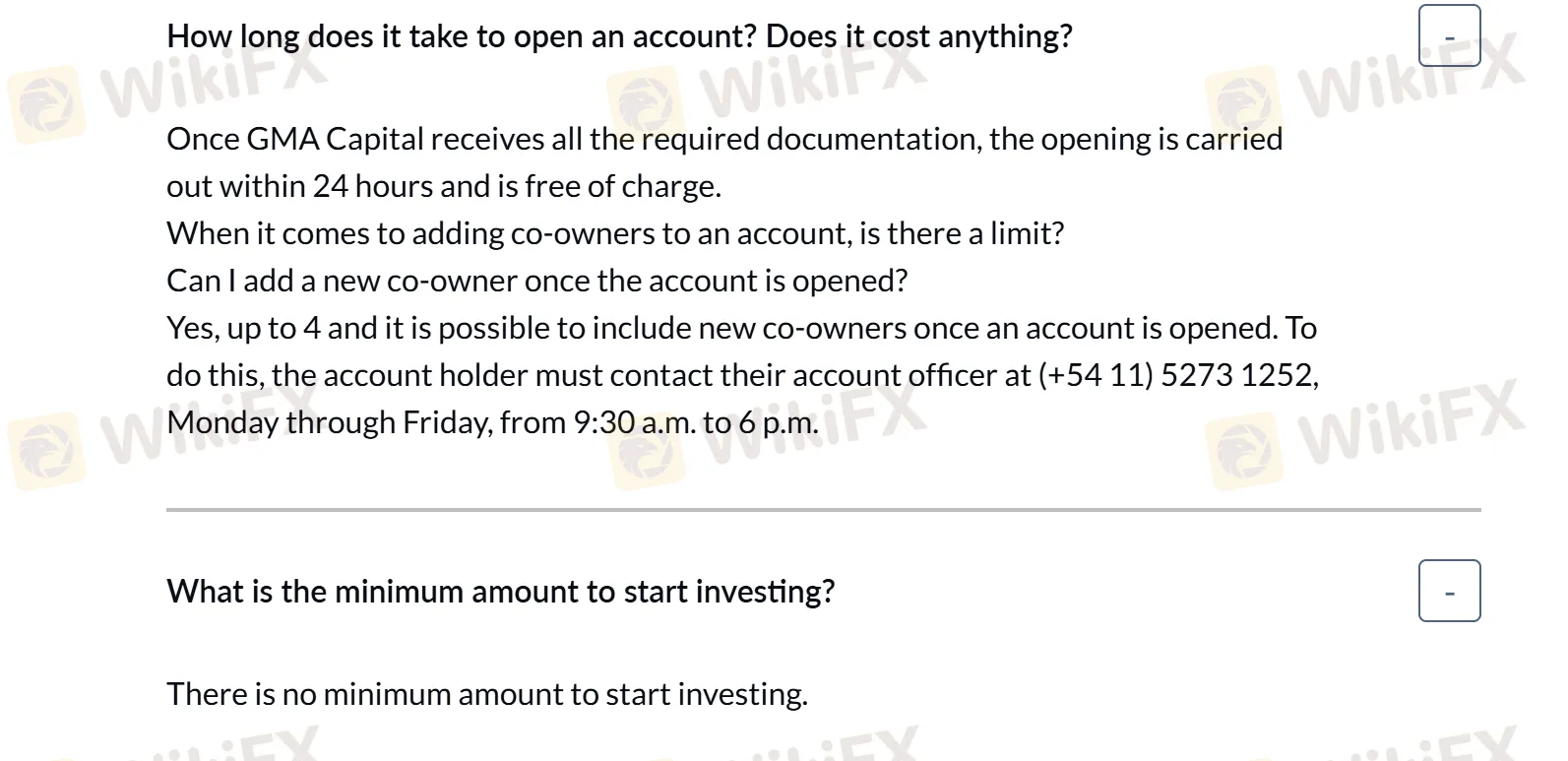

Walang impormasyon tungkol sa uri ng account. Ang alam lang natin ay ang pagbubukas ng account ay gagawin sa loob ng 24 oras at libre, at walang minimum na halaga para simulan ang pag-iinvest.

Deposito at Pag-withdraw

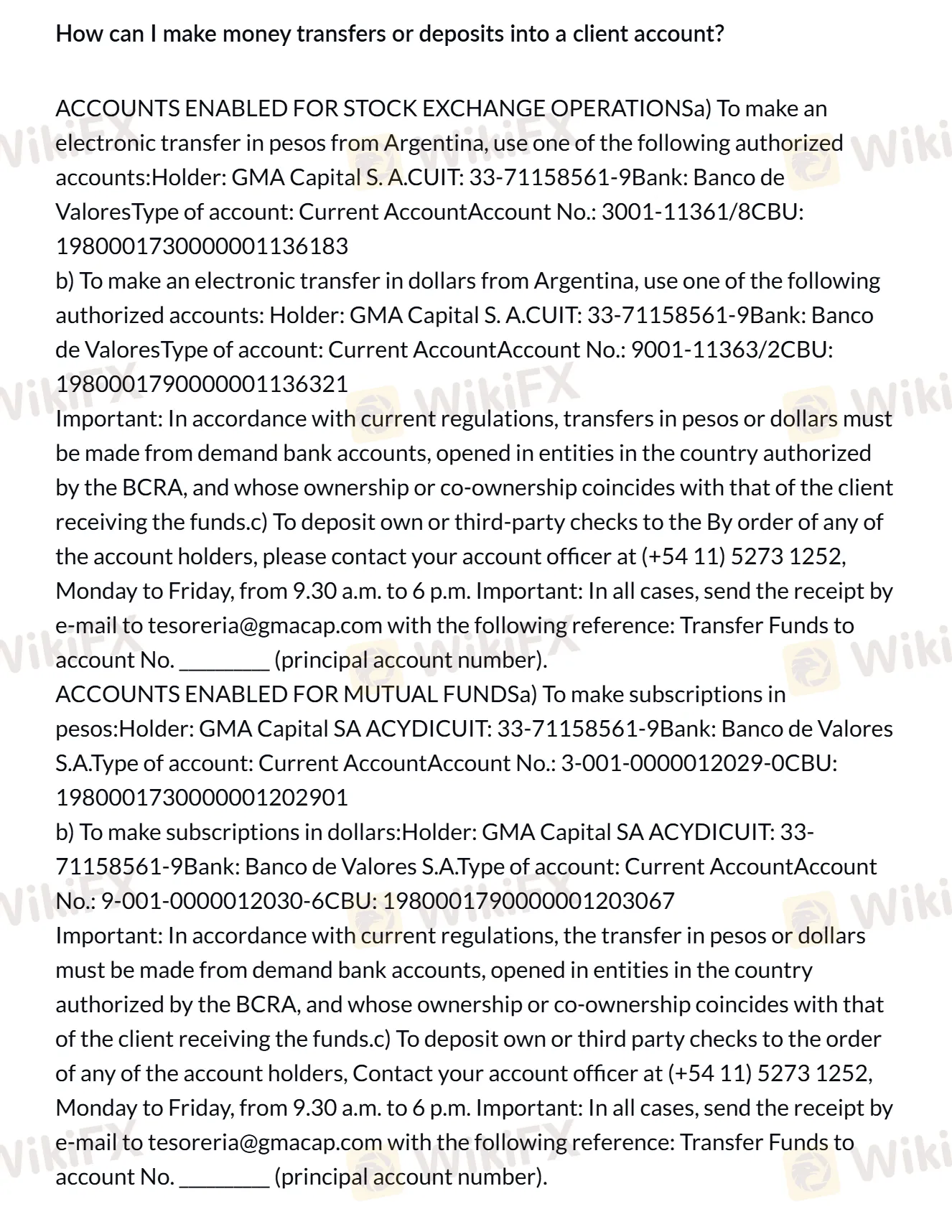

Sa GMA Capital, para sa deposits: Maaaring magawa ang mga electronic transfer sa pesos o dolyar mula sa Argentina sa pamamagitan ng partikular na awtorisadong mga account. Maaari ring ideposito ang mga tseke sa pamamagitan ng pakikipag-ugnayan sa account officer at pagpapadala ng resibo sa pamamagitan ng email. Ang mga deposits ay dapat manggaling sa mga BCRA - awtorisadong demand accounts na may katugmang pagmamay-ari.

Para sa pag-withdraw: Kasama sa mga opsyon ang mga bank transfer papunta sa mga account ng kliyente, mga cheque na ginawa para sa may-ari ng account, o mga electronic cheque (echeq). May araw-araw na limitasyon na nagbabawal sa bawat customer na higit sa dalawang pagbabayad ng pondo o pag-isyu ng cheque.