Unternehmensprofil

| GMA CAPITAL Überprüfungszusammenfassung | |

| Gegründet | 2016 |

| Registriertes Land/Region | Argentinien |

| Regulierung | Keine Regulierung |

| Dienstleistungen | Vertrieb & Handel, Vermögensverwaltung, Unternehmensfinanzierung, Vermögensverwaltung |

| Demo-Konto | ❌ |

| Handelsplattform | / |

| Mindesteinzahlung | $0 |

| Kundensupport | Kontaktformular |

| Telefon: (+54 11) 5273-1252 | |

| E-Mail: info@gmacap.com | |

| Adresse: MIÑONES 2177, 4° PISO, CP 1428, CABA - Argentinien | |

| X, LinkedIn, Instagram | |

GMA CAPITAL ist ein unreguliertes Finanzunternehmen, das 2016 in Argentinien gegründet wurde. Es bietet verschiedene Finanzdienstleistungen, einschließlich Vertrieb & Handel, Vermögensverwaltung, Unternehmensfinanzierung und Vermögensverwaltung. Es gibt jedoch nur wenige Informationen auf seiner offiziellen Website.

Vor- und Nachteile

| Vorteile | Nachteile |

| Mehrere Kundensupport-Kanäle | Keine Regulierung |

| Verschiedene angebotene Dienstleistungen | Begrenzte Informationen zu Konten |

| Keine Demokonten | |

| Mangel an Informationen zu Handelsplattformen |

Ist GMA CAPITAL legitim?

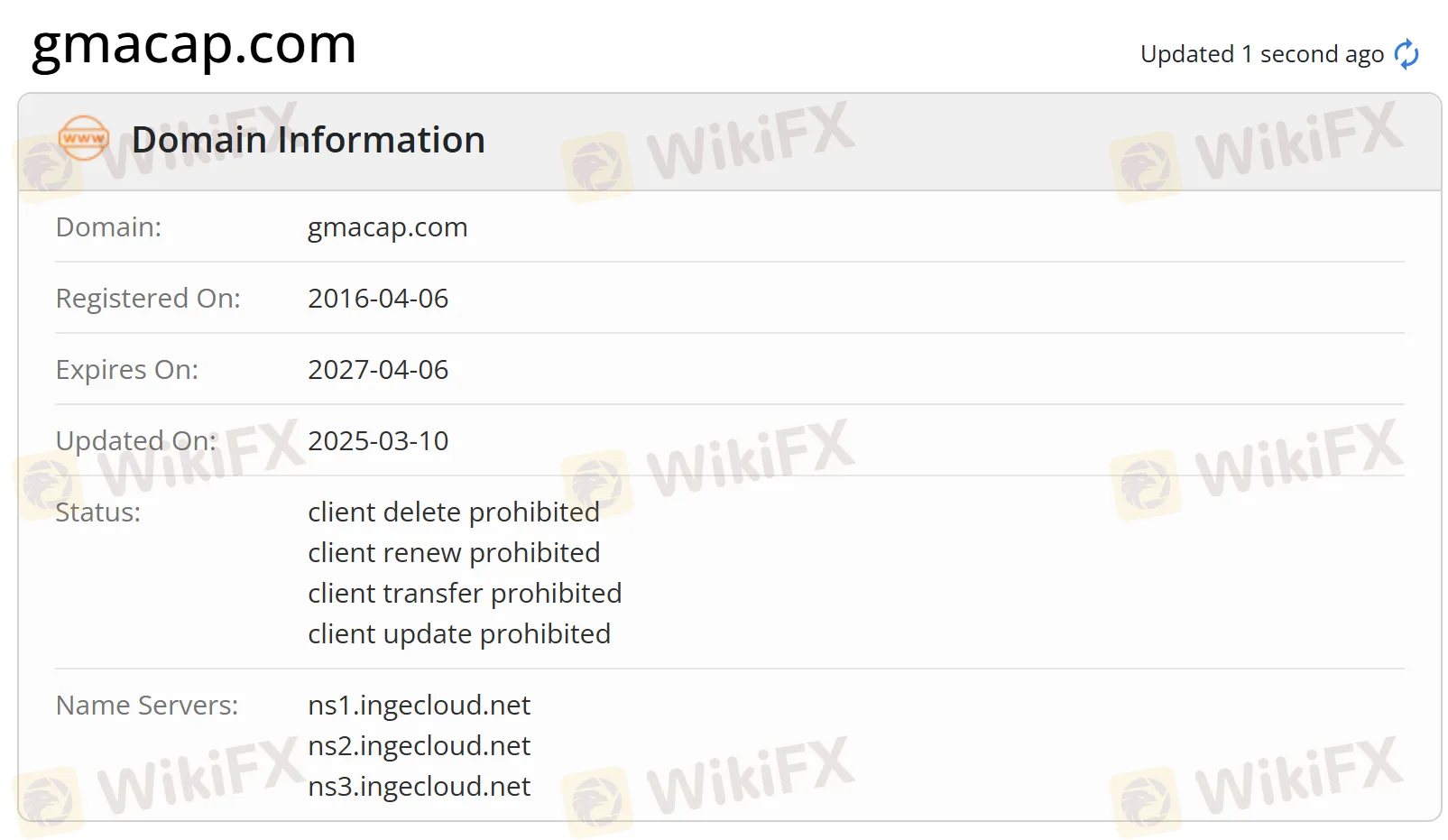

Derzeit fehlt es GMA CAPITAL an einer gültigen Regulierung. Die Domain wurde am 6. April 2016 registriert, und der aktuelle Status lautet “client Delete Prohibited, client Renew Prohibited, client Transfer Prohibited, client Update Prohibited”. Wir empfehlen Ihnen, nach anderen regulierten Unternehmen zu suchen.

GMA CAPITAL Dienstleistungen

GMA CAPITAL bietet Finanzdienstleistungen wie Vertrieb & Handel, Vermögensverwaltung, Unternehmensfinanzierung und Vermögensverwaltung an.

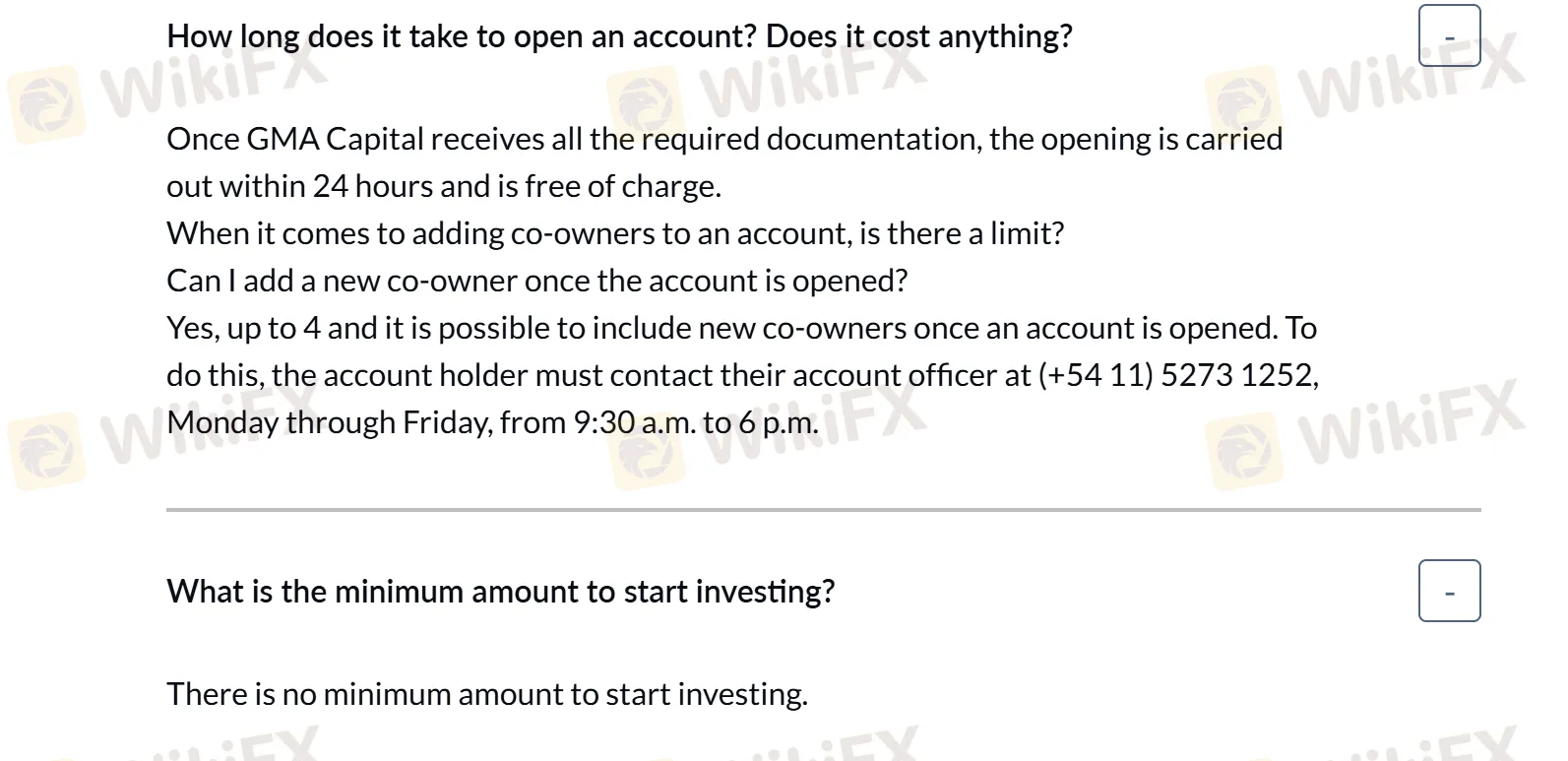

Konto

Es gibt keine Informationen zu Kontotypen. Das einzige, was wir wissen, ist, dass die Kontoeröffnung innerhalb von 24 Stunden durchgeführt wird und kostenlos ist, und es gibt auch keinen Mindestbetrag, um mit dem Investieren zu beginnen.

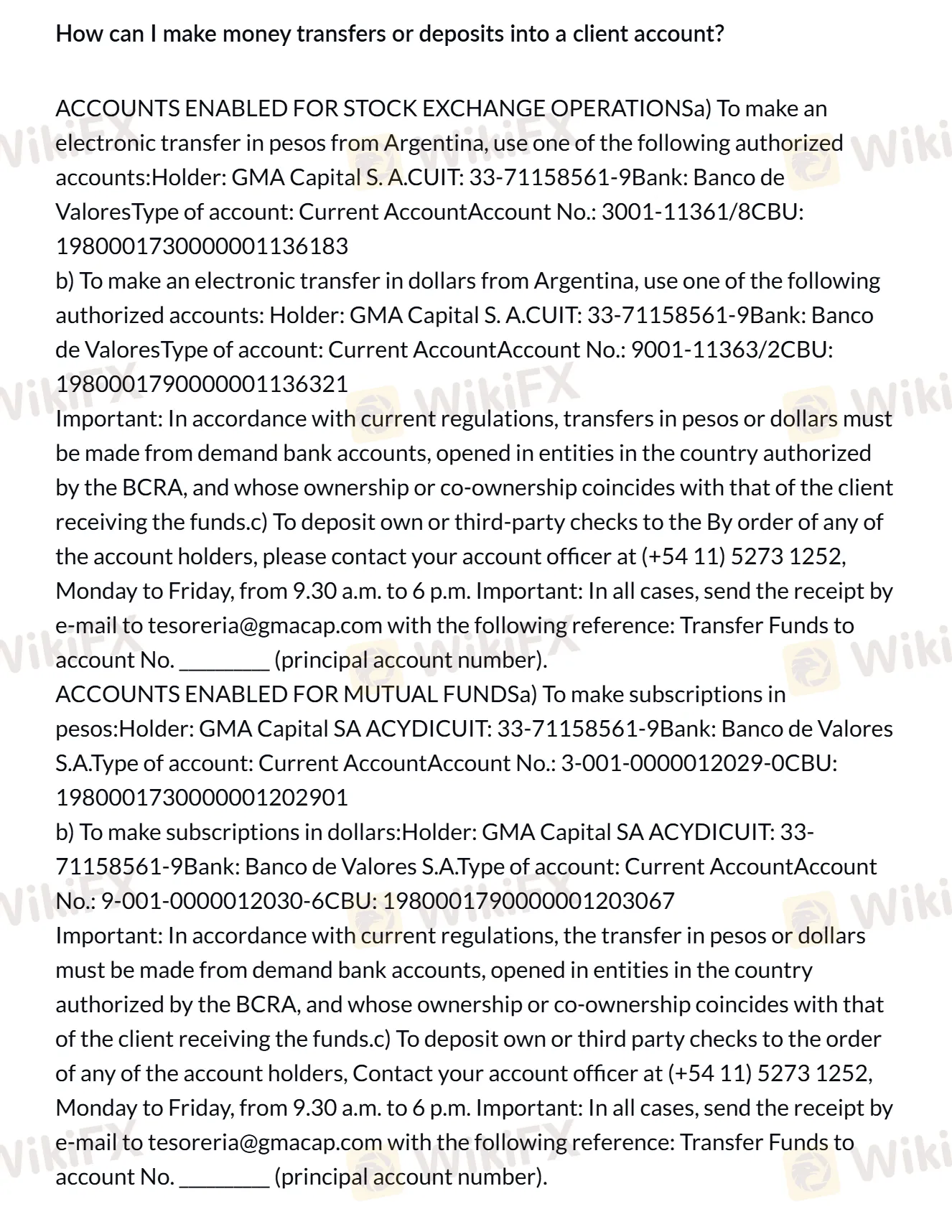

Einzahlung und Auszahlung

Bei GMA Capital können für Einzahlungen: Elektronische Überweisungen in Pesos oder Dollar aus Argentinien können über spezielle autorisierte Konten getätigt werden. Schecks können auch eingezahlt werden, indem Sie sich an den Kontobeamten wenden und den Beleg per E-Mail senden. Einzahlungen müssen von BCRA-autorisierten Nachfragekonten mit übereinstimmendem Eigentum stammen.

Für Auszahlungen: Die Optionen umfassen Banküberweisungen auf Kundenkonten, Schecks, die auf den Kontoinhaber ausgestellt sind, oder elektronische Schecks (echeq). Ein tägliches Limit beschränkt jeden Kunden auf höchstens zwei Zahlungen oder Scheckausstellungen.