Perfil de la compañía

| GMA CAPITAL Resumen de la reseña | |

| Establecido | 2016 |

| País/Región Registrada | Argentina |

| Regulación | Sin regulación |

| Servicios | Ventas y Trading, Gestión de Activos, Finanzas Corporativas, Gestión Patrimonial |

| Cuenta Demo | ❌ |

| Plataforma de Trading | / |

| Depósito Mínimo | $0 |

| Soporte al Cliente | Formulario de contacto |

| Teléfono: (+54 11) 5273-1252 | |

| Email: info@gmacap.com | |

| Dirección: MIÑONES 2177, 4° PISO, CP 1428, CABA - Argentina | |

| X, LinkedIn, Instagram | |

GMA CAPITAL es una empresa financiera no regulada establecida en Argentina en 2016. Ofrece varios servicios financieros que incluyen Ventas y Trading, Gestión de Activos, Finanzas Corporativas y Gestión Patrimonial. Sin embargo, hay poca información en su sitio web oficial.

Pros y Contras

| Pros | Contras |

| Múltiples canales de soporte al cliente | Sin regulación |

| Se ofrecen varios servicios | Información limitada sobre cuentas |

| Sin cuentas de demostración | |

| Falta de información sobre plataformas de trading |

¿Es GMA CAPITAL Legítimo?

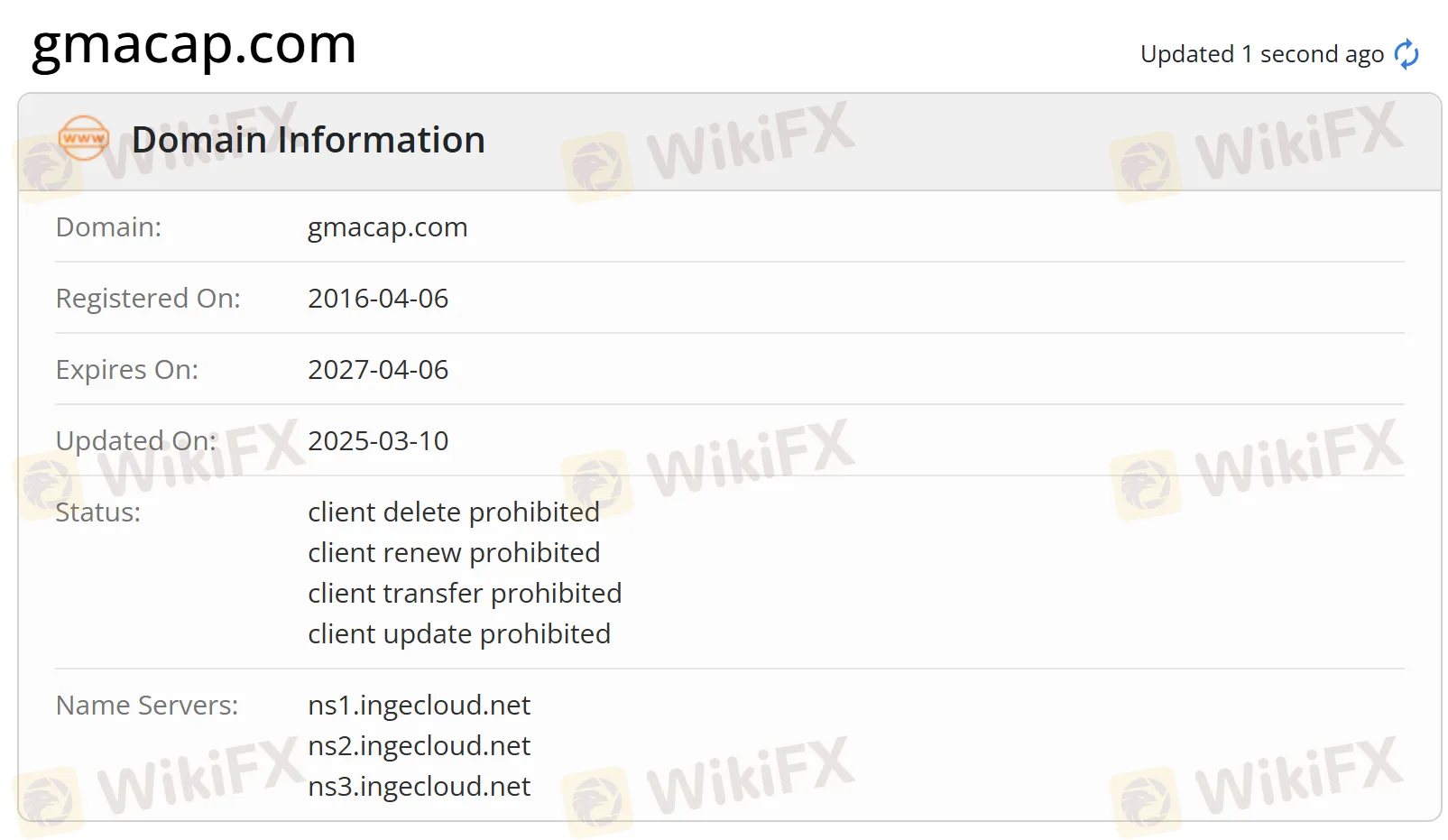

En la actualidad, GMA CAPITAL carece de regulación válida. Su dominio fue registrado el 6 de abril de 2016 y el estado actual es “cliente Eliminar Prohibido, cliente Renovar Prohibido, cliente Transferir Prohibido, cliente Actualizar Prohibido”. Le recomendamos buscar otras empresas reguladas.

Servicios de GMA CAPITAL

GMA CAPITAL ofrece servicios financieros como Ventas y Trading, Gestión de Activos, Finanzas Corporativas y Gestión Patrimonial.

Cuenta

No hay información sobre los tipos de cuenta. Lo único que sabemos es que la apertura de la cuenta se realizará en un plazo de 24 horas y es gratuita, y tampoco hay cantidad mínima para comenzar a invertir.

Depósito y Retiro

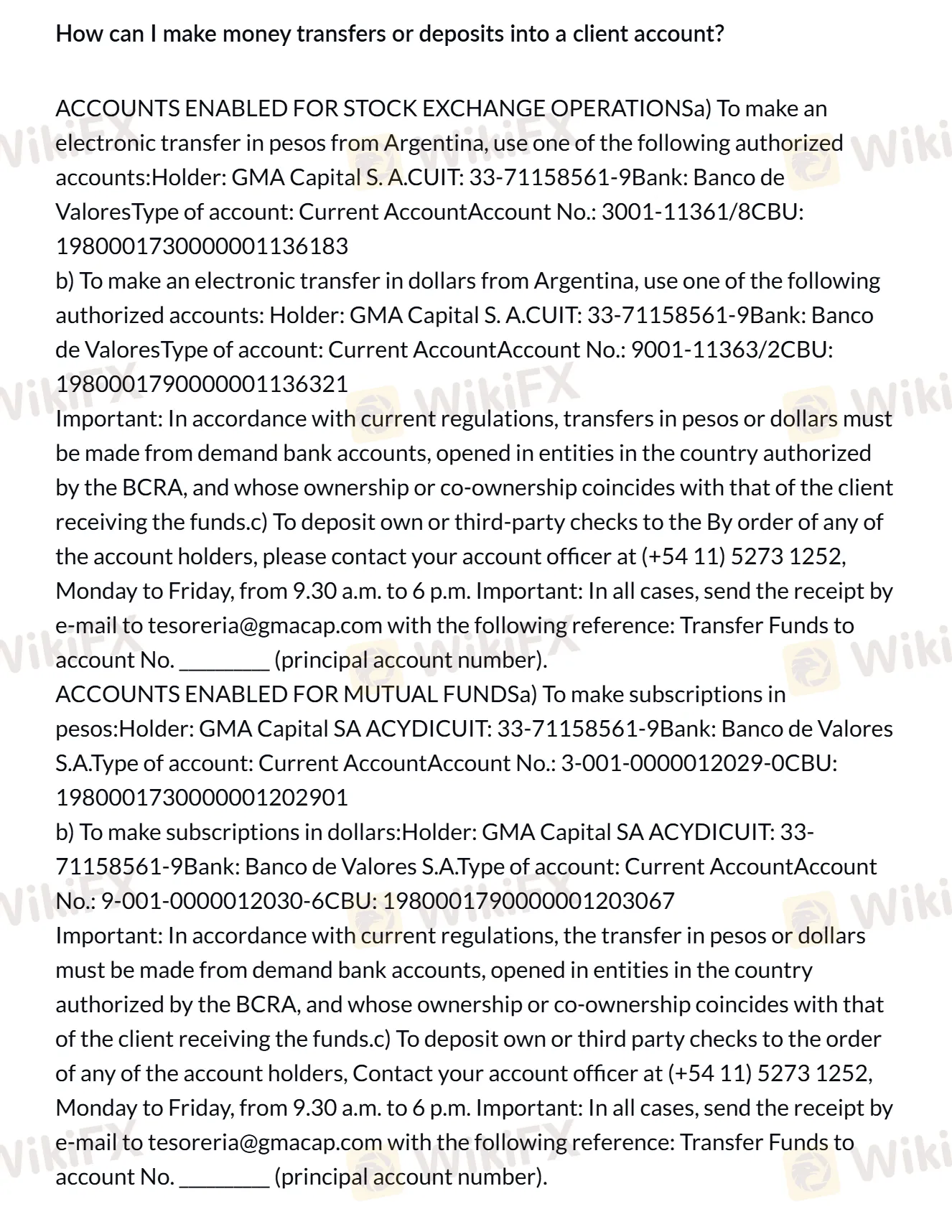

En GMA Capital, para depósitos: Se pueden realizar transferencias electrónicas en pesos o dólares desde Argentina a través de cuentas autorizadas específicas. Los cheques también se pueden depositar contactando al oficial de cuentas y enviando el recibo por correo electrónico. Los depósitos deben provenir de cuentas de demanda autorizadas por el BCRA con propiedad coincidente.

Para retiros: Las opciones incluyen transferencias bancarias a cuentas propiedad del cliente, cheques a nombre del titular de la cuenta o cheques electrónicos (echeq). Un límite diario restringe a cada cliente a no más de dos pagos de fondos o emisiones de cheques.