Présentation de l'entreprise

| tobu-sec Résumé de l'examen | |

| Fondé | 2004 |

| Pays/Région Enregistré | Japon |

| Régulation | FSA |

| Produits d'Investissement | Actions, obligations, fonds d'investissement, contrats à terme, options |

| Plateforme de Trading | / |

| Support Client | Horaires de service : en semaine de 9h00 à 17h00 |

| Tél : 048-760-1826 | |

Informations sur tobu-sec

tobu-sec est une société financière japonaise, réglementée par la FSA, qui propose différents produits, notamment des actions, diverses obligations, des fonds d'investissement et des produits dérivés.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Longue histoire | Pas d'informations sur la plateforme de trading |

| Réglementé par la FSA | Pas d'informations sur les dépôts et retraits |

| Divers produits d'investissement | |

| Transparence des commissions |

tobu-sec est-il légitime ?

tobu-sec détient une licence de courtier Forex au détail réglementée par l'Agence des services financiers (FSA) au Japon avec un numéro de licence 関東財務局長(金商)第120号.

| Autorité de Régulation | Statut Actuel | Pays Réglementé | Type de Licence | Entité Licenciée | N° de Licence |

| Agence des services financiers (FSA) | Réglementé | Japon | Licence de courtier Forex au détail | tobu-sec株式会社 | 関東財務局長(金商)第120号 |

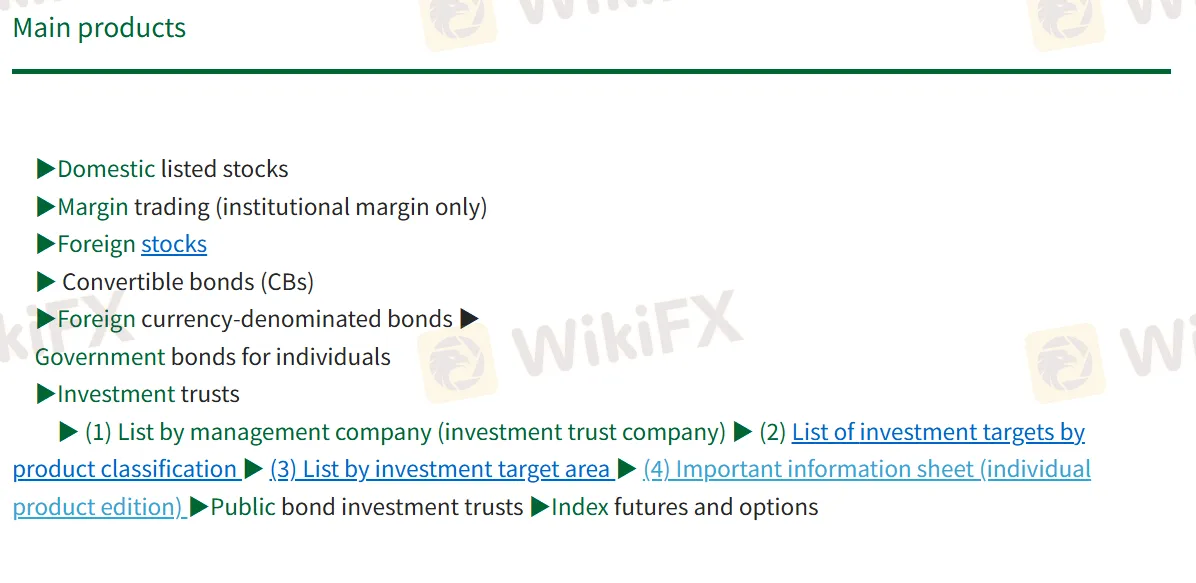

Produits

Les produits de Tobu-sec comprennent divers titres tels que des actions nationales et étrangères, divers types d'obligations, des fonds d'investissement et des produits dérivés tels que les contrats à terme sur indices et les options, ainsi que le trading sur marge institutionnel.

| Produits | Pris en charge |

| Actions | ✔ |

| Obligations | ✔ |

| Fonds d'investissement | ✔ |

| Contrats à terme | ✔ |

| Options | ✔ |

| Forex | ❌ |

| Matières premières | ❌ |

| Indices | ❌ |

| Cryptomonnaies | ❌ |

| ETFs | ❌ |

Commissions

Structure des commissions de courtage d'actions - Taux de commission de base

| Montant du contrat | Frais de commission (TTC 10%) |

| Moins de 1 million de yens | 1,265% du prix du contrat (Min. 2 750 yens) |

| 1M à 3M yens | 0,935% du prix du contrat + 3 300 yens |

| 3M à 5M yens | 0,880% du prix du contrat + 4 840 yens |

| 5M à 10M yens | 0,660% du prix du contrat + 15 840 yens |

| 10M à 30M yens | 0,550% du prix du contrat + 26 840 yens |

| 30M à 50M yens | 0,330% du prix du contrat + 92 840 yens |

| Plus de 50 millions de yens | 257 840 yens |

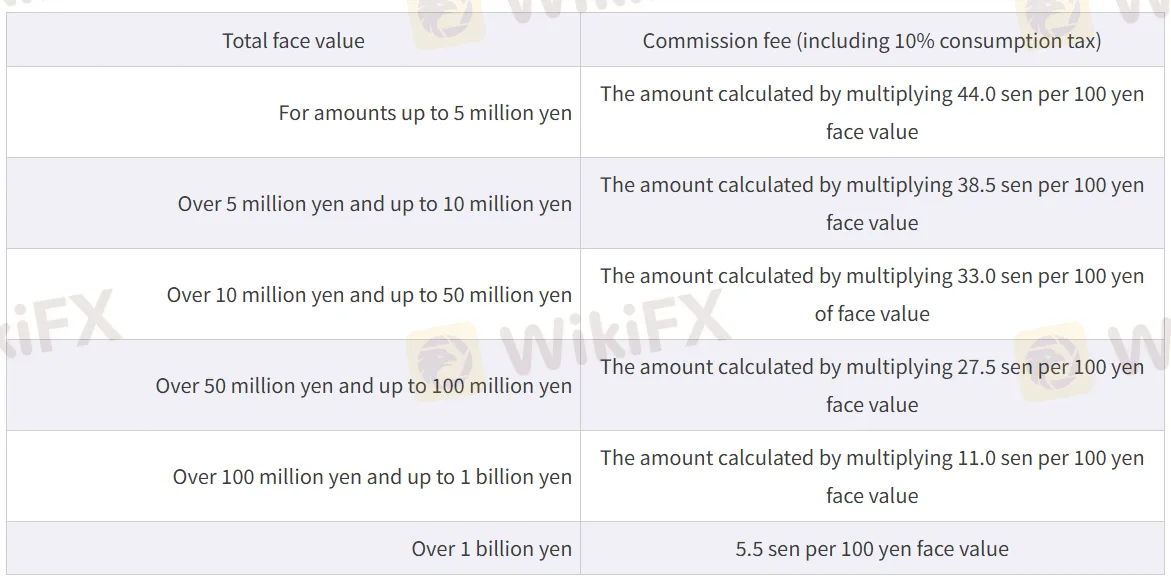

Taux de commission de courtage d'obligations - Obligations gouvernementales

| Valeur nominale totale | Frais de commission (TTC 10%) |

| Jusqu'à 5 millions de yens | 44,0 sen par tranche de 100 yens de valeur nominale |

| Plus de 5M à 10M yens | 38,5 sen par tranche de 100 yens de valeur nominale |

| Plus de 10M à 50M yens | 33,0 sen par tranche de 100 yens de valeur nominale |

| Plus de 50M à 100M yens | 27,5 sen par tranche de 100 yens de valeur nominale |

| Plus de 100M yens à 1 milliard de yens | 11,0 sen par tranche de 100 yens de valeur nominale |

| Plus de 1 milliard de yens | 5,5 sen par tranche de 100 yens de valeur nominale |

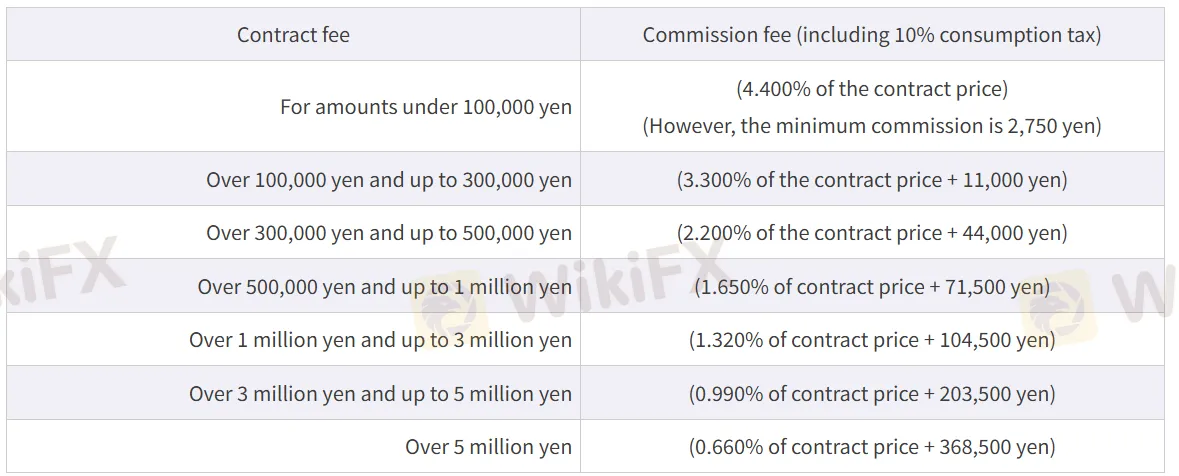

Commission des taux de commission de trading d'options sur titres

| Montant du contrat | Frais de commission (incl. 10% de taxe) |

| Moins de 100 000 yens | 4,400% du prix du contrat (minimum 2 750 yens) |

| 100 000 à 300 000 yens | 3,300% du prix du contrat + 11 000 yens |

| 300 000 à 500 000 yens | 2,200% du prix du contrat + 44 000 yens |

| 500 000 à 1M yens | 1,650% du prix du contrat + 71 500 yens |

| 1M à 3M yens | 1,320% du prix du contrat + 104 500 yens |

| 3M à 5M yens | 0,990% du prix du contrat + 203 500 yens |

| Plus de 5 millions de yens | 0,660% du prix du contrat + 368 500 yens |