Mansuber007

1-2年

How do Tobu-sec's overnight financing fees stack up against those of other brokers?

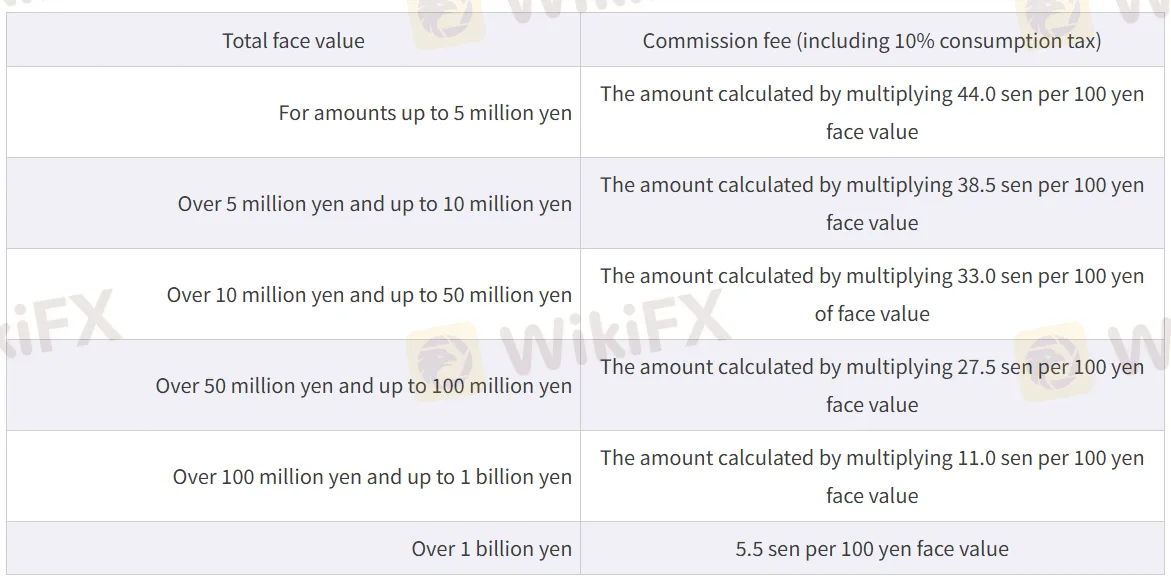

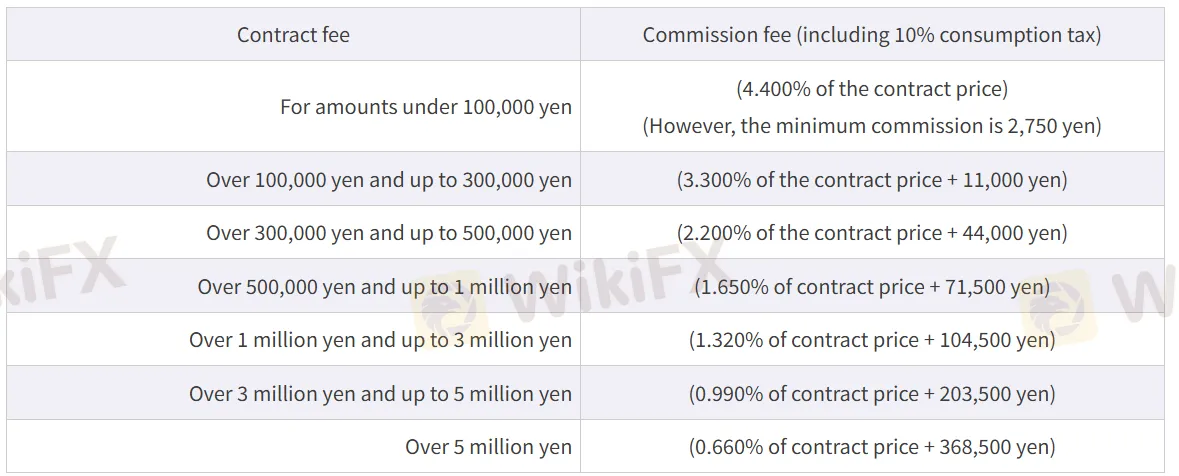

As an experienced trader who pays very close attention to broker costs, I found evaluating Tobu-sec for overnight financing fees surprisingly challenging. The main issue for me is that Tobu-sec’s publicly available information focuses on its securities commissions, with clear breakdowns for stocks, bonds, and options, but provides no explicit details on overnight financing or swap rates typically associated with leveraged or margin positions. This immediately sets Tobu-sec apart from many of the larger brokers I’ve worked with, especially international ones, where overnight financing costs are usually front-and-center and easy to compare.

Given that Tobu-sec is regulated by Japan’s Financial Services Agency (FSA), I do have some confidence in its adherence to fair practices and transparent disclosures. However, in trading, especially with leveraged products, I require precise, upfront information on all potential costs before making a commitment. The lack of clarity here makes it impossible for me to directly measure Tobu-sec’s competitiveness in overnight rates against other brokers I have used.

In my judgment, for traders who prioritize transparency in all fee structures—including the crucial overnight costs—Tobu-sec may fall short without further direct inquiry to their support team. Personally, I would exercise caution and seek explicit documentation before opening or holding any overnight positions, as hidden costs can seriously affect profitability. This lack of easily accessible information is a key reason I might hesitate to use Tobu-sec for active margin trading where overnight fees are significant.

Broker Issues

Fees and Spreads

ritzyshona

1-2年

Does tobu-sec provide a free demo account, and if so, are there any restrictions such as a time limit?

Based on my careful review of tobu-sec’s available information, I could not find any indication that they offer a free demo account, nor are there details about demo account features, such as time limitations or trading restrictions. As someone who values the ability to practice with virtual funds before committing real capital, this absence stands out to me. From my experience, a demo account is a crucial resource for both beginners and more seasoned traders seeking to test strategies in a risk-free environment. The lack of clear information about demo access with tobu-sec makes it difficult for me to recommend them to those who are new to trading or want to thoroughly explore the broker's services before depositing funds.

Furthermore, I noticed that transparency about trading platforms and deposit or withdrawal processes is also lacking. Without official statements or accessible information directly from the broker regarding demo accounts, I would advise prospective clients to approach with caution. For my own trading decisions, I place significant weight on comprehensive support and clear disclosures. Because the presence or absence of a demo account can have a direct effect on how I learn a new platform or system, I would personally want to confirm these details via direct contact with tobu-sec’s customer support before making any commitments.

Broker Issues

Platform

Leverage

Instruments

Account

Tricia54

1-2年

Is it possible to deposit cryptocurrency such as Bitcoin or USDT into my tobu-sec account?

Based on my experience assessing brokers with a careful eye on transparency and practical accessibility, I looked closely at tobu-sec’s product offering and operational details. Tobu-sec is a Japan-based financial services provider regulated by the FSA, and it focuses on traditional instruments like stocks, bonds, investment trusts, futures, and options. However, after a detailed examination, I found no indication that tobu-sec supports cryptocurrencies—either as a deposit method or as a tradable product. There isn’t any mention of Bitcoin, USDT, or other digital assets being accepted for client funding. In fact, cryptocurrencies and even products like commodities, indices, ETFs, and cryptos are specifically noted as unsupported.

In my conservative approach to risk and regulation, it’s vital for account funding methods to be explicitly laid out, especially when it comes to digital assets due to their legal and operational complexities in Japan. The absence of information about crypto deposits—and indeed, the absence of any cryptocurrency offerings—suggests that tobu-sec is not suitable if your goal is to interact with digital assets, either through deposits or trading. I would advise reaching out directly to customer service if you require absolute certainty, but from all available evidence, funding your account with Bitcoin or USDT is not possible at this broker. When handling your capital, especially with YMYL matters, I always recommend prioritizing regulated environments with clear, published policies for deposits and withdrawals.

Broker Issues

Deposit

Withdrawal

Eziol

1-2年

Which documents are usually needed to process my initial withdrawal on tobu-sec?

Based on my experience and careful review of brokers like tobu-sec that are regulated in Japan by the FSA, I always prepare standard documentation when processing an initial withdrawal. While tobu-sec’s own website and WikiFX listing do not provide explicit details about their withdrawal process, regulation by the Japanese FSA means the broker is subject to strict anti-money laundering (AML) and know-your-customer (KYC) requirements. In my routine with similarly regulated firms, I have typically needed to provide personal identification, such as a government-issued photo ID (passport or driver’s license), proof of address (utility bill or bank statement issued in the last three months), and sometimes documents verifying my bank account details for withdrawal purposes.

Regulated entities in Japan cannot legally process withdrawals without verifying these details, as it’s mandated for both security and compliance. In my experience, providing clear copies of these documents up front helps avoid delays. That said, because tobu-sec’s documentation requirements aren’t stated publicly, I am always careful to email or call their customer support during their stated hours (weekdays, 9:00 AM–5:00 PM) to confirm what’s needed before submitting a request. My cautious approach is driven by the importance of protecting my funds and ensuring I remain in line with stringent regulatory practices. For me, clarity on document requirements is a non-negotiable part of safely managing withdrawals from any regulated Japanese broker.

Broker Issues

Withdrawal

Deposit