Présentation de l'entreprise

| Fidelity Résumé de l'examen | |

| Fondé | 1969 |

| Pays/Région Enregistré | USA |

| Régulation | SFC |

| Produits & Services | Fonds communs de placement mondiaux, régimes de retraite MPF & ORSO, solutions d'investissement thématiques et multi-actifs |

| Compte de Démo | ❌ |

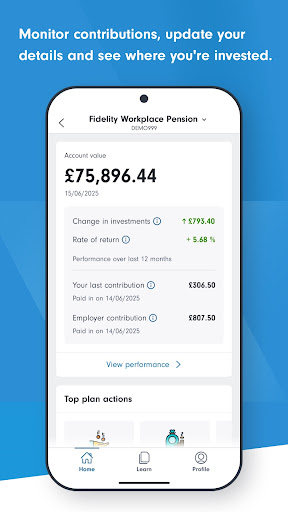

| Plateforme de Trading | Fidelity en ligne, Application mobile Fidelity |

| Dépôt Minimum | HK$1,000/mois (Plan d'investissement mensuel) |

| Support Client | Téléphone : (852) 2629 2629 |

| Email : hkenquiry@fil.com | |

Informations sur Fidelity

Fondée en 1969, Fidelity est une société financière réglementée par la SFC, offrant des solutions d'investissement internationales. Elle ne propose pas de FX ou de CFD, mais se concentre plutôt sur les fonds communs de placement, les régimes de retraite (MPF/ORSO) et les stratégies thématiques.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Réglementé par la SFC | Pas de compte de démonstration ou islamique (sans swap) |

| Large sélection de fonds communs de placement et solutions de retraite | Frais relativement élevés |

| Structure de frais échelonnée bénéficiant aux investisseurs à solde élevé | |

| Temps d'opération prolongé | |

| Divers types de comptes |

Fidelity Est-il Légitime ?

Oui, Fidelity est réglementé. Il est autorisé par la Securities and Futures Commission (SFC) de Hong Kong avec une licence de négociation de contrats à terme. Le numéro de licence est AAG408.

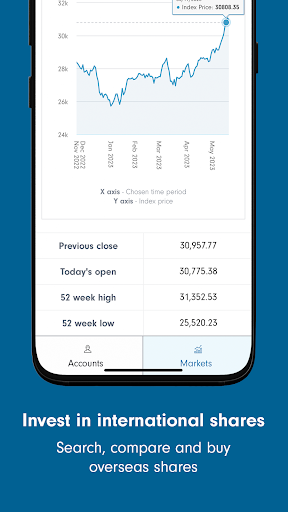

Produits et Services

Fidelity propose des fonds communs de placement mondiaux, des régimes de retraite (MPF & ORSO) et des investissements thématiques pour répondre aux objectifs financiers des investisseurs. Ils offrent la création de revenus, l'investissement durable et des stratégies multi-actifs.

| Produits & Services | Caractéristique |

| Fonds Communs de Placement | Fonds mondiaux dans différentes devises et catégories d'actifs |

| Investissement Thématique | Investissements à long terme basés sur les tendances mondiales et les thèmes d'innovation |

| Solutions Multi-Actifs | Portefeuilles diversifiés combinant différents types d'actifs |

| Investissement Durable | Centré sur les stratégies d'investissement ESG et responsables |

| MPF (Fonds de Prévoyance Obligatoire) | Fonds de retraite adaptés à différents profils de risque et de revenu |

| ORSO (Ordonnance sur les Régimes de Retraite Professionnelle) | Plans d'investissement de retraite parrainés par l'employeur |

| Stratégies de Revenus | Options d'investissement mondiales axées sur les revenus |

| Investissements Axés sur l'Asie | Fonds ciblant les opportunités de croissance sur les marchés asiatiques |

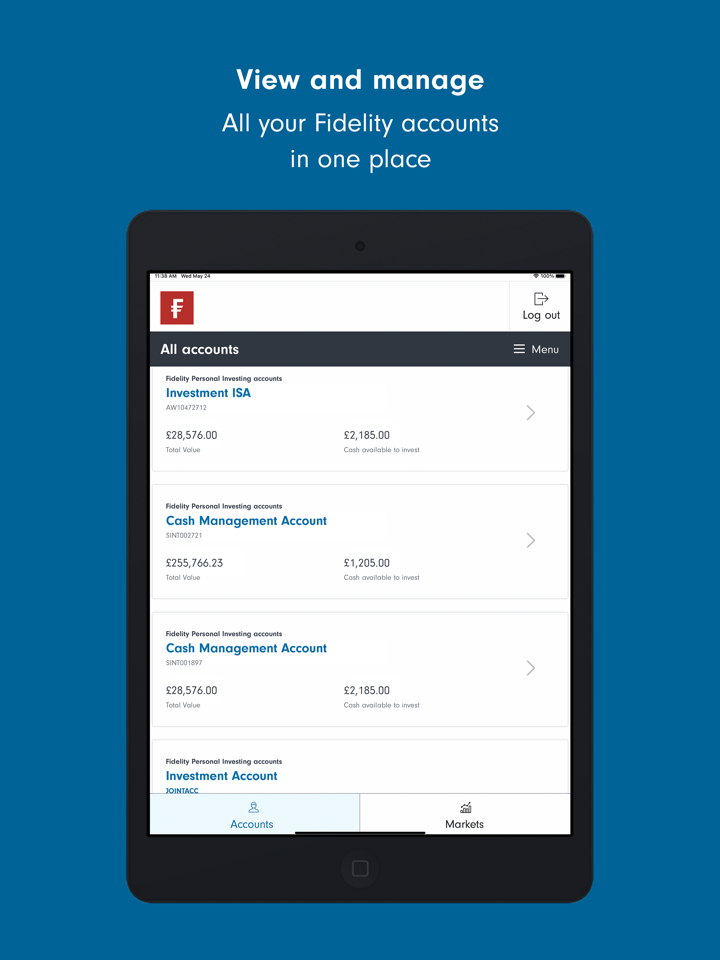

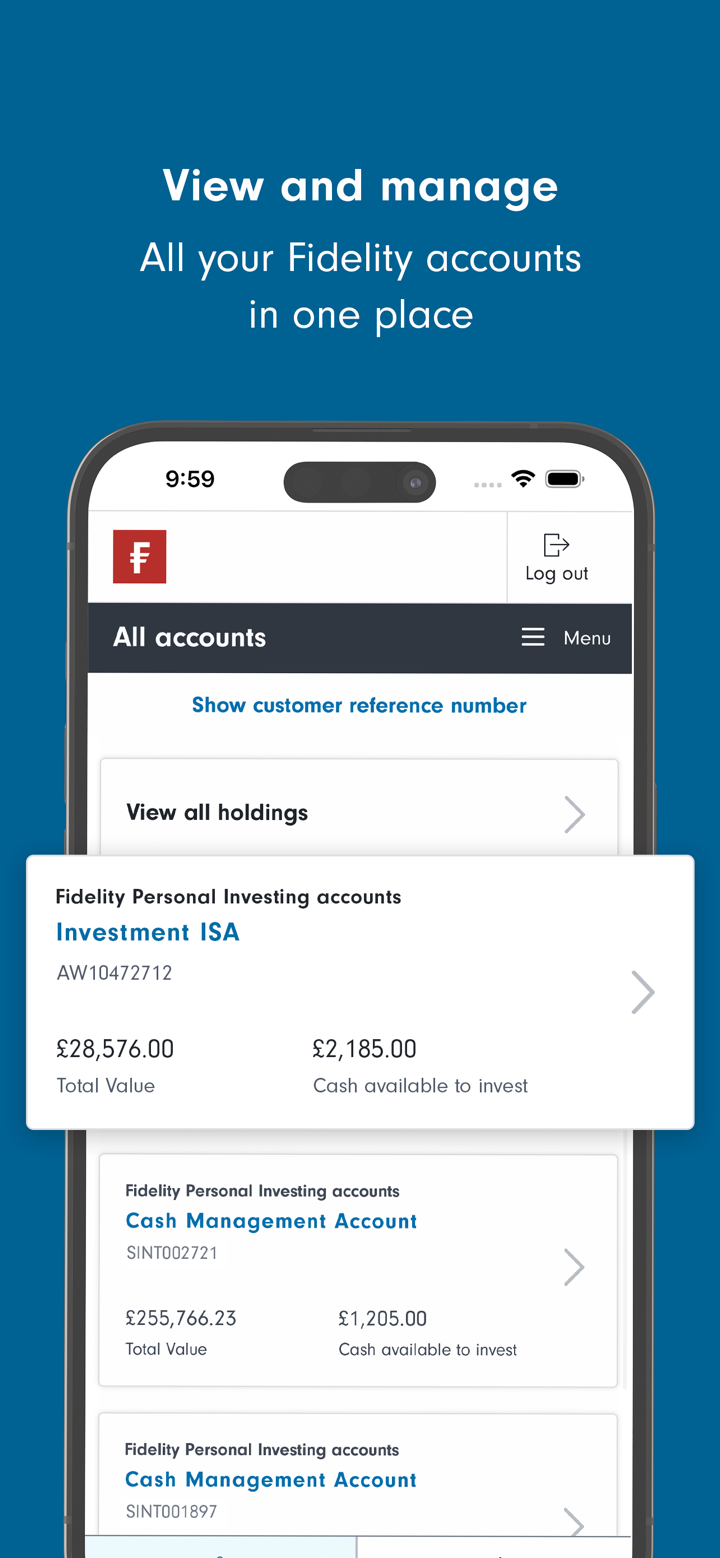

Type de Compte

Fidelity propose quatre types de comptes en direct : Investisseurs personnels, membres MPF/ORSO, Intermédiaires et Investisseurs institutionnels. Il n'y a pas de comptes de démonstration ou islamiques (sans swap) disponibles.

| Type de compte | Convient à |

| Investisseurs personnels | Particuliers gérant leurs propres investissements |

| Comptes MPF / ORSO | Employés et employeurs sous les régimes de retraite de Hong Kong |

| Intermédiaires | Conseillers, gestionnaires de patrimoine, consultants financiers |

| Investisseurs institutionnels | Institutions telles que des caisses de retraite, des entreprises et des family offices |

Frais de Fidelity

Les frais de Fidelity suivent une structure à paliers : les montants d'investissement plus importants bénéficient de frais plus bas, tandis que les investissements plus petits sont soumis à des frais plus élevés. Dans l'ensemble, sa structure de coûts est modérée à élevée selon les normes de l'industrie.

| Méthode d'investissement | Type de frais | Solde de l'investissement (USD) | Fonds en espèces | Fonds obligataires | Fonds actions et autres |

| Investissement forfaitaire | Frais de vente | ≥ 1 000 000 | 0,00% | 0,30% | 0,60% |

| 500 000 – <1 000 000 | 0,45% | 0,90% | |||

| 250 000 – <500 000 | 0,60% | 1,20% | |||

| 100 000 – <250 000 | 0,75% | 1,50% | |||

| 50 000 – <100 000 | 1,05% | 2,10% | |||

| <50 000 | 1,50% | 3,00% | |||

| Frais de transfert | ≥ 1 000 000 | 0,10% | - | ||

| 500 000 – <1 000 000 | 0,15% | - | |||

| 250 000 – <500 000 | 0,20% | - | |||

| 100 000 – <250 000 | 0,25% | - | |||

| 50 000 – <100 000 | 0,35% | - | |||

| <50 000 | 0,50% | - | |||

| Plan d'investissement mensuel | Frais de vente | <HK$20 000/mois | 1,00% | - | - |

| ≥HK$20 000/mois | 0,00% | - | - |

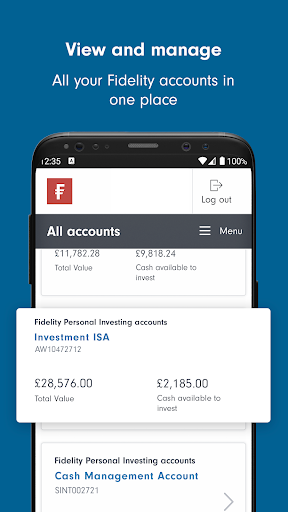

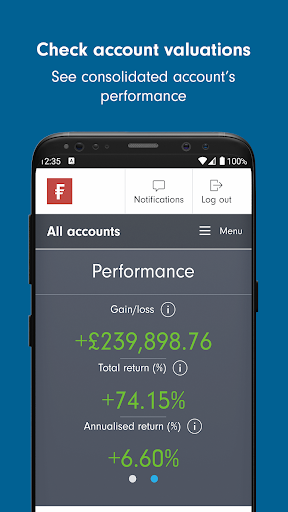

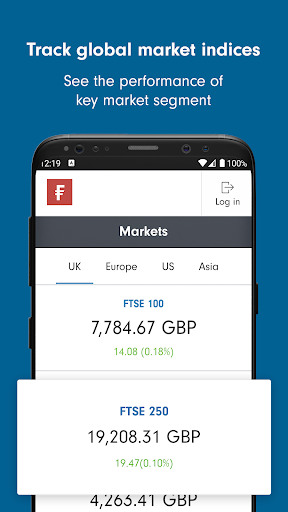

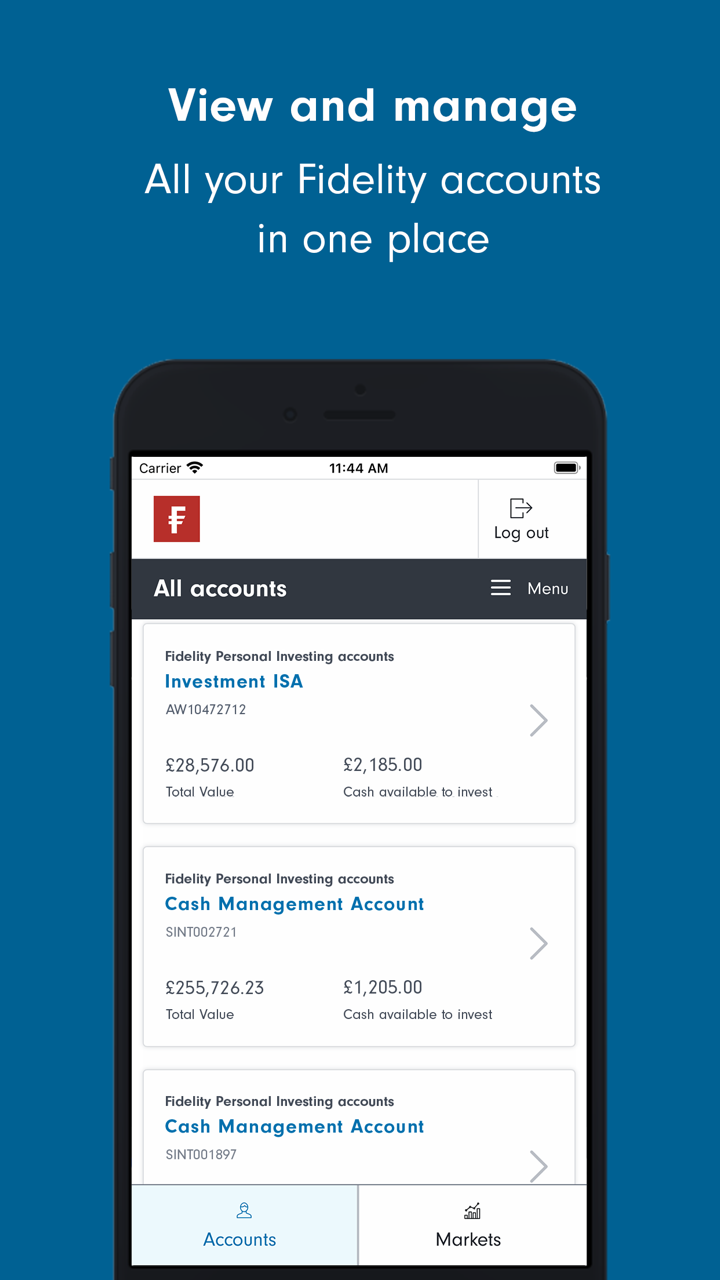

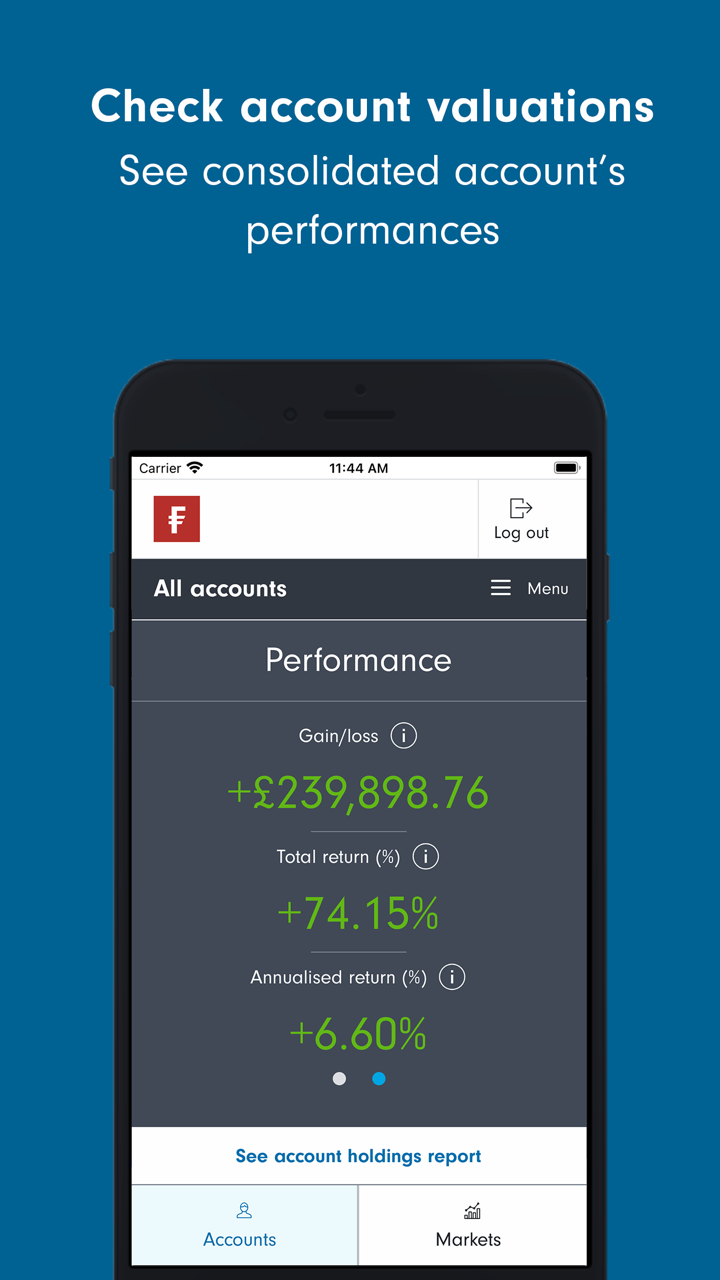

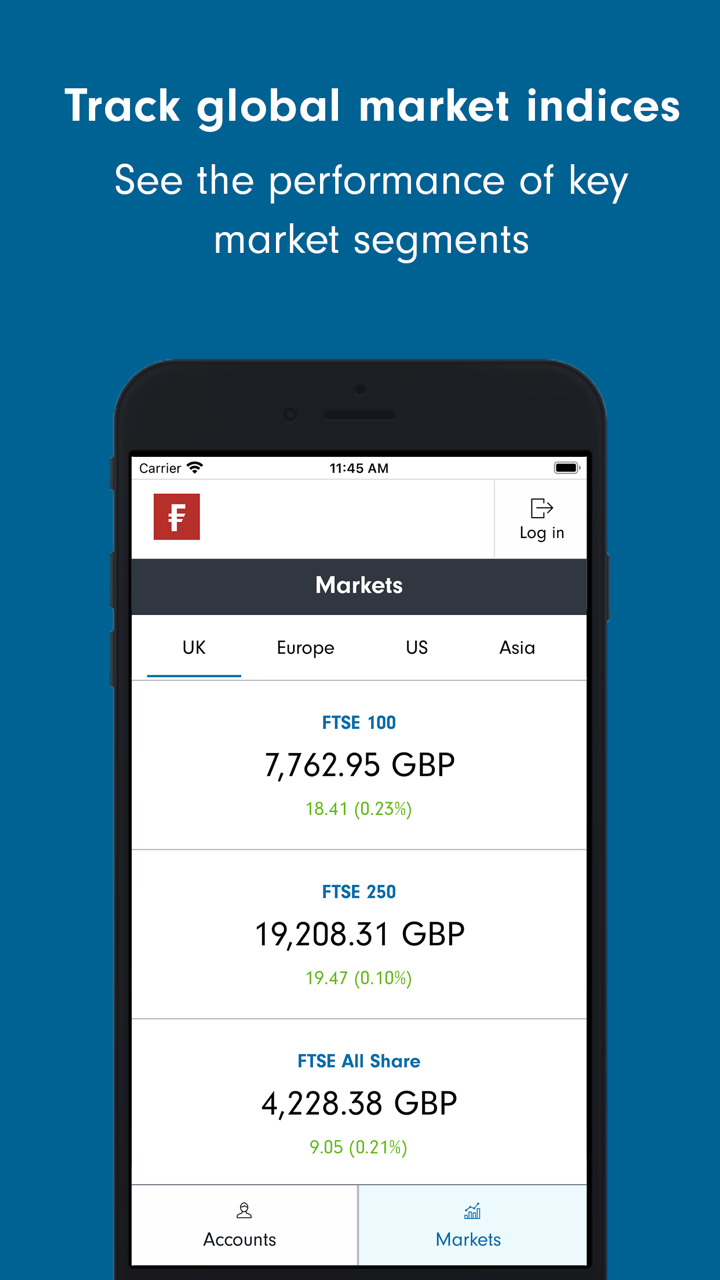

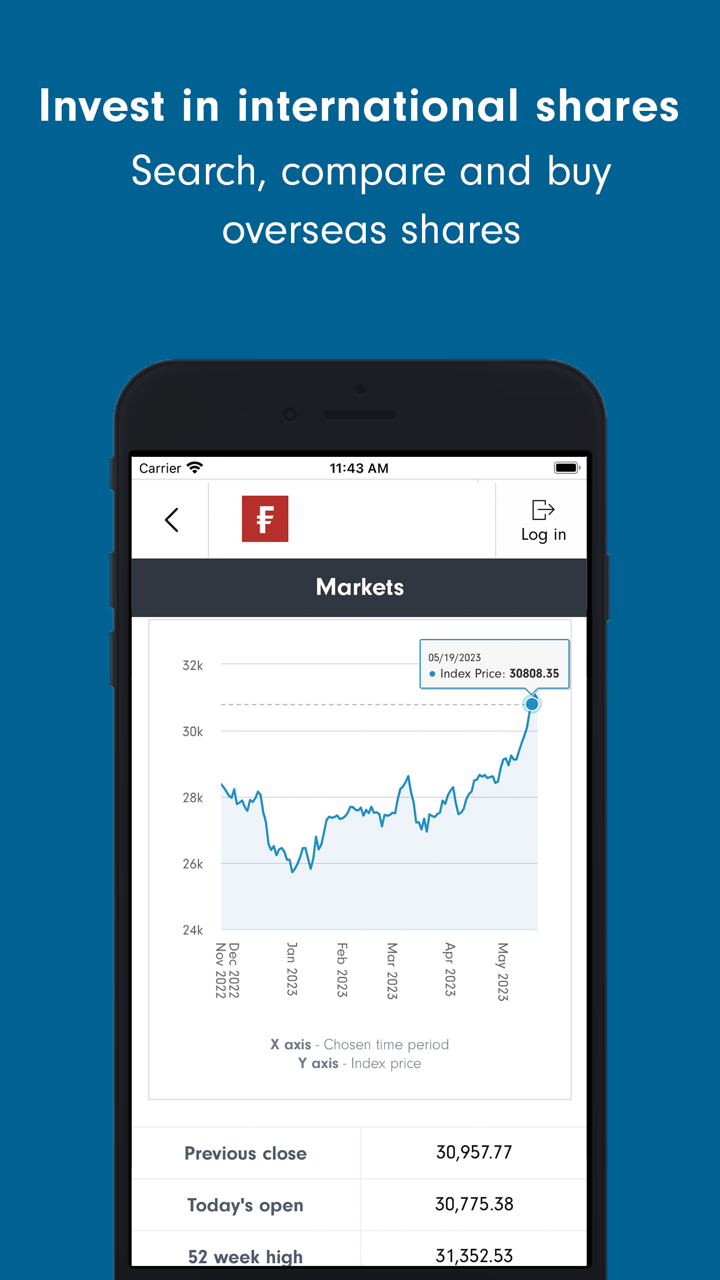

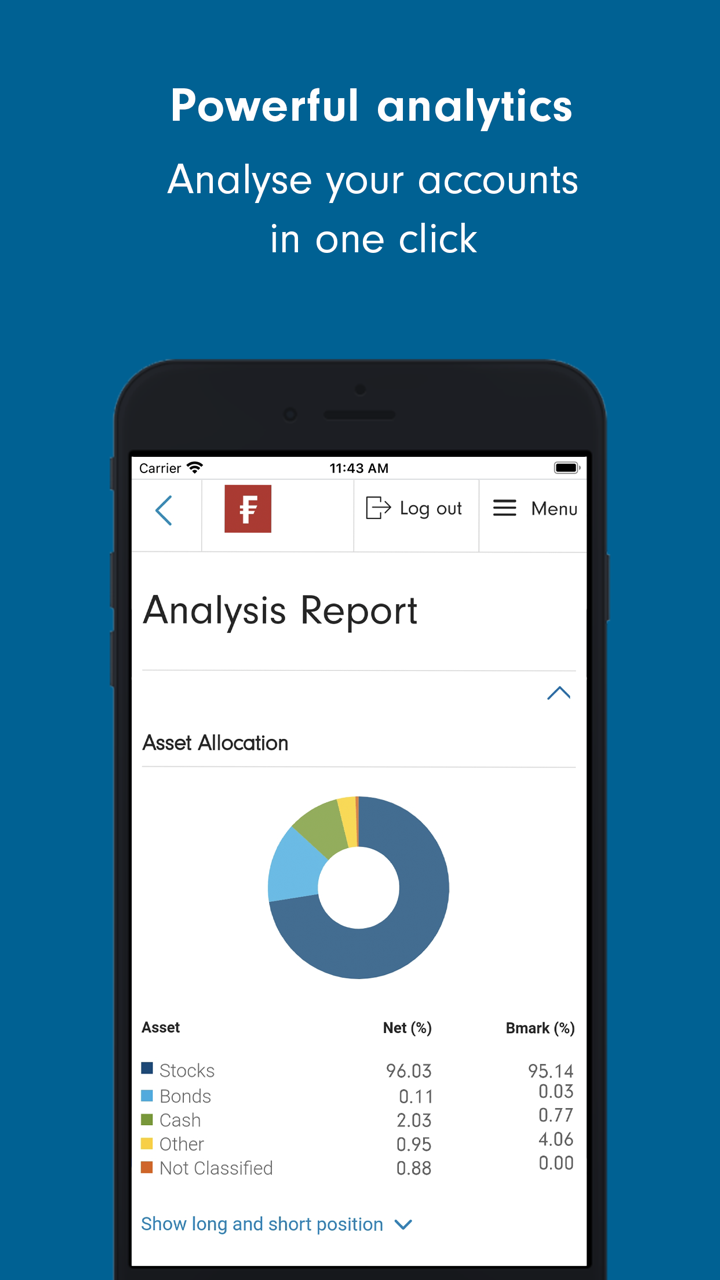

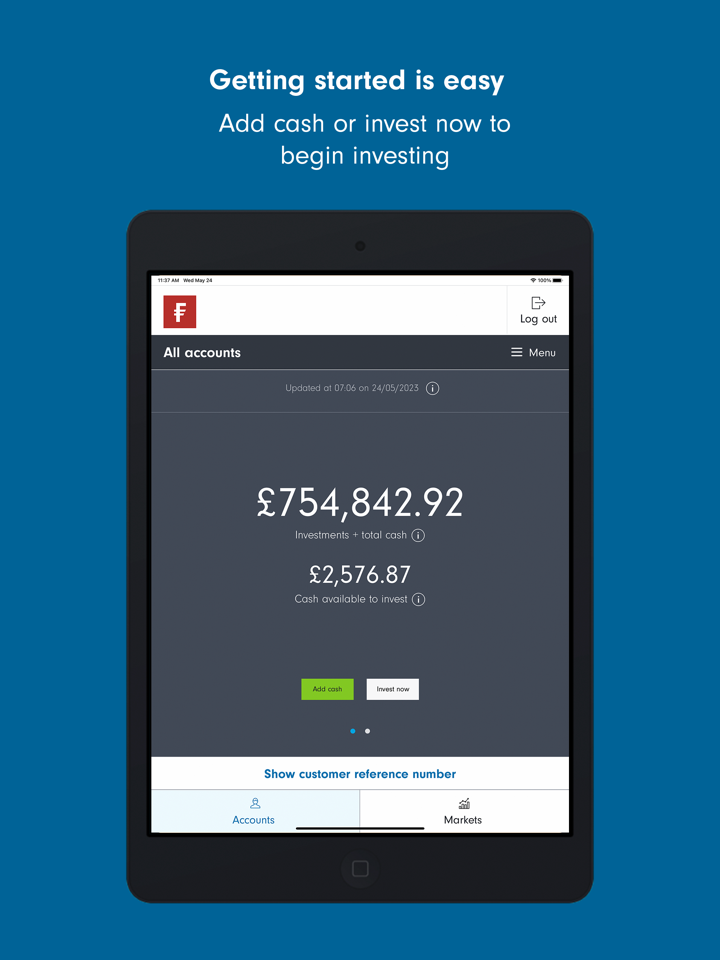

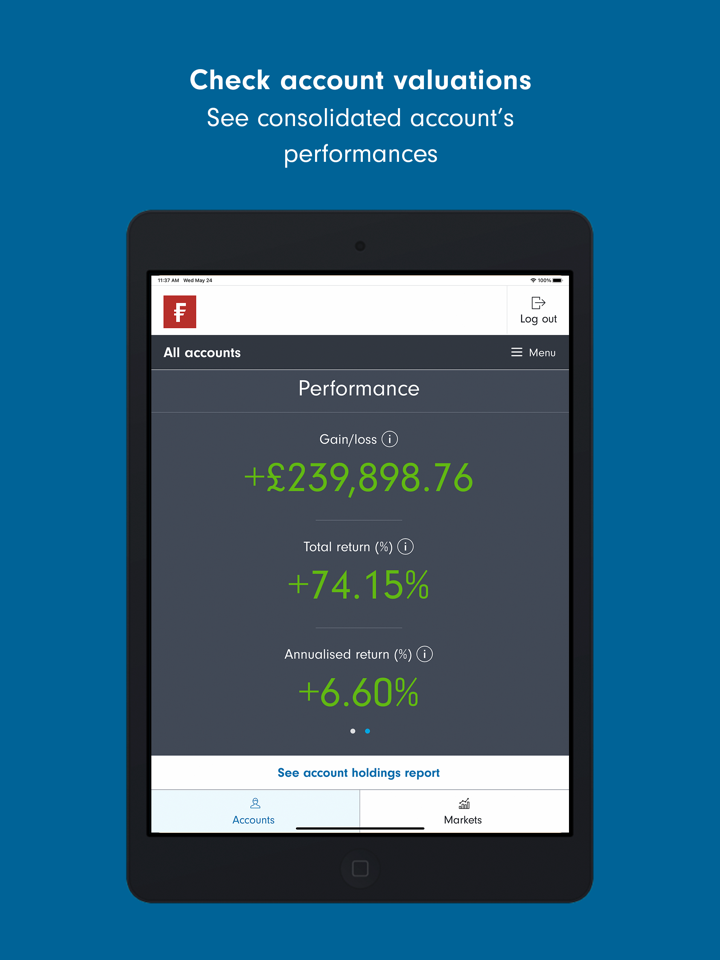

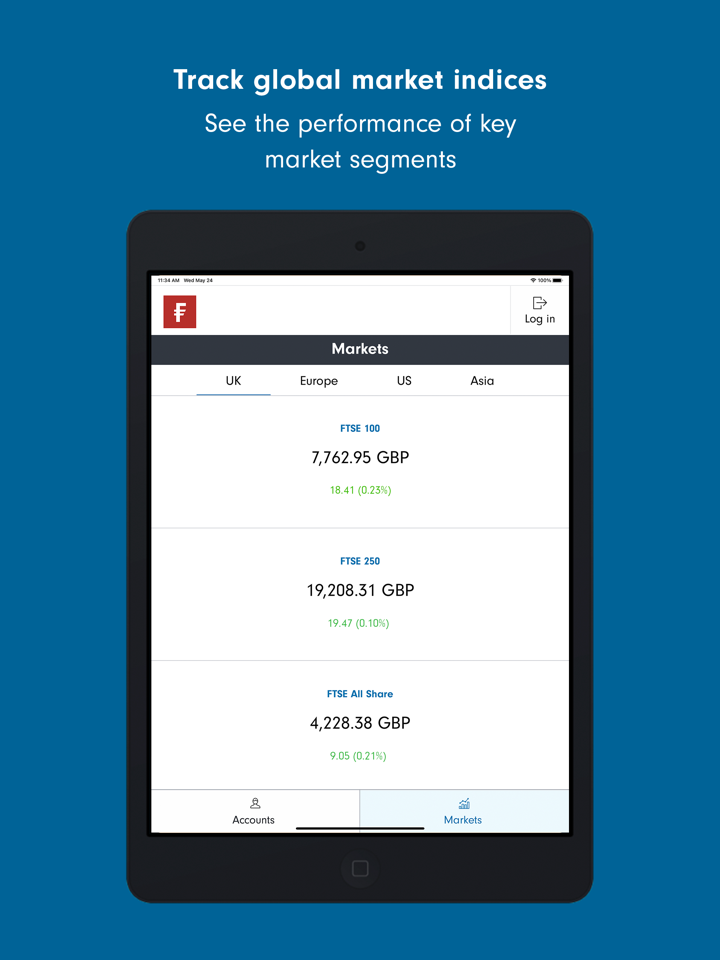

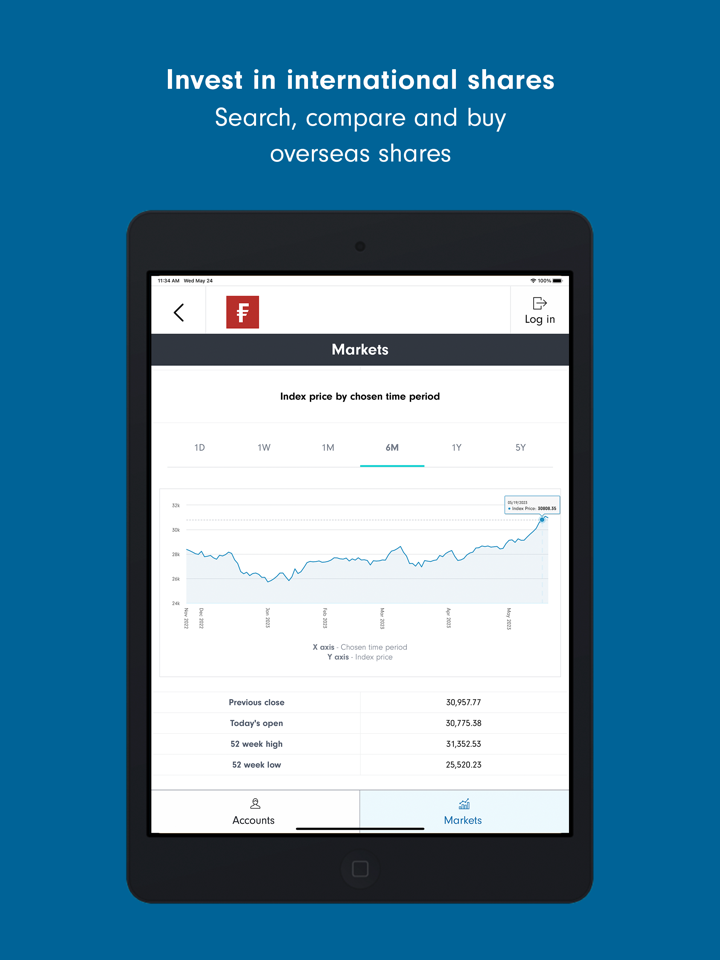

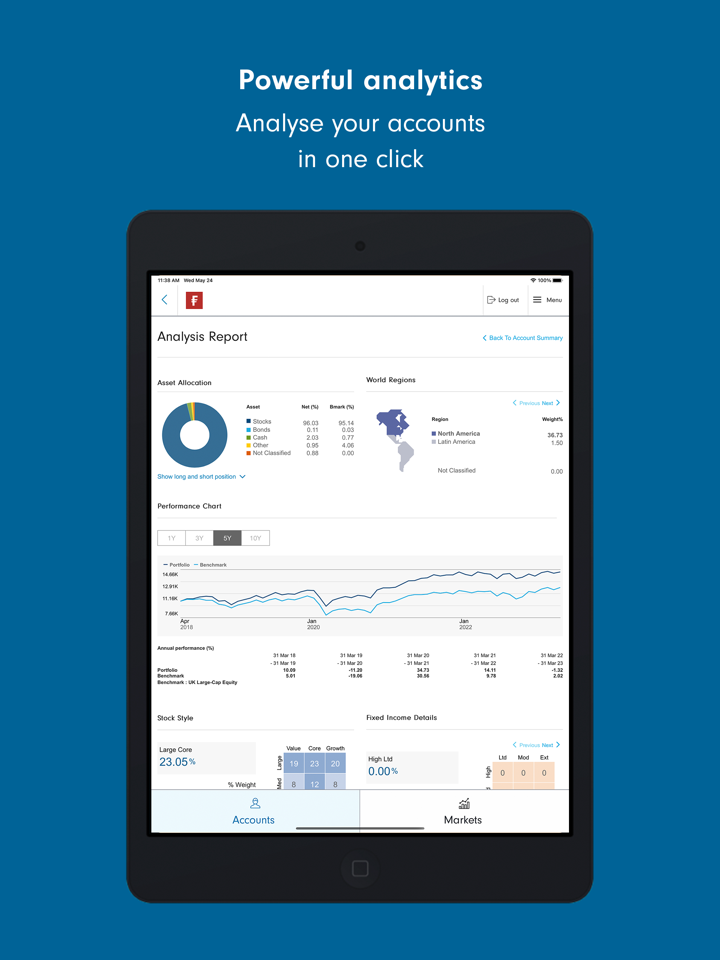

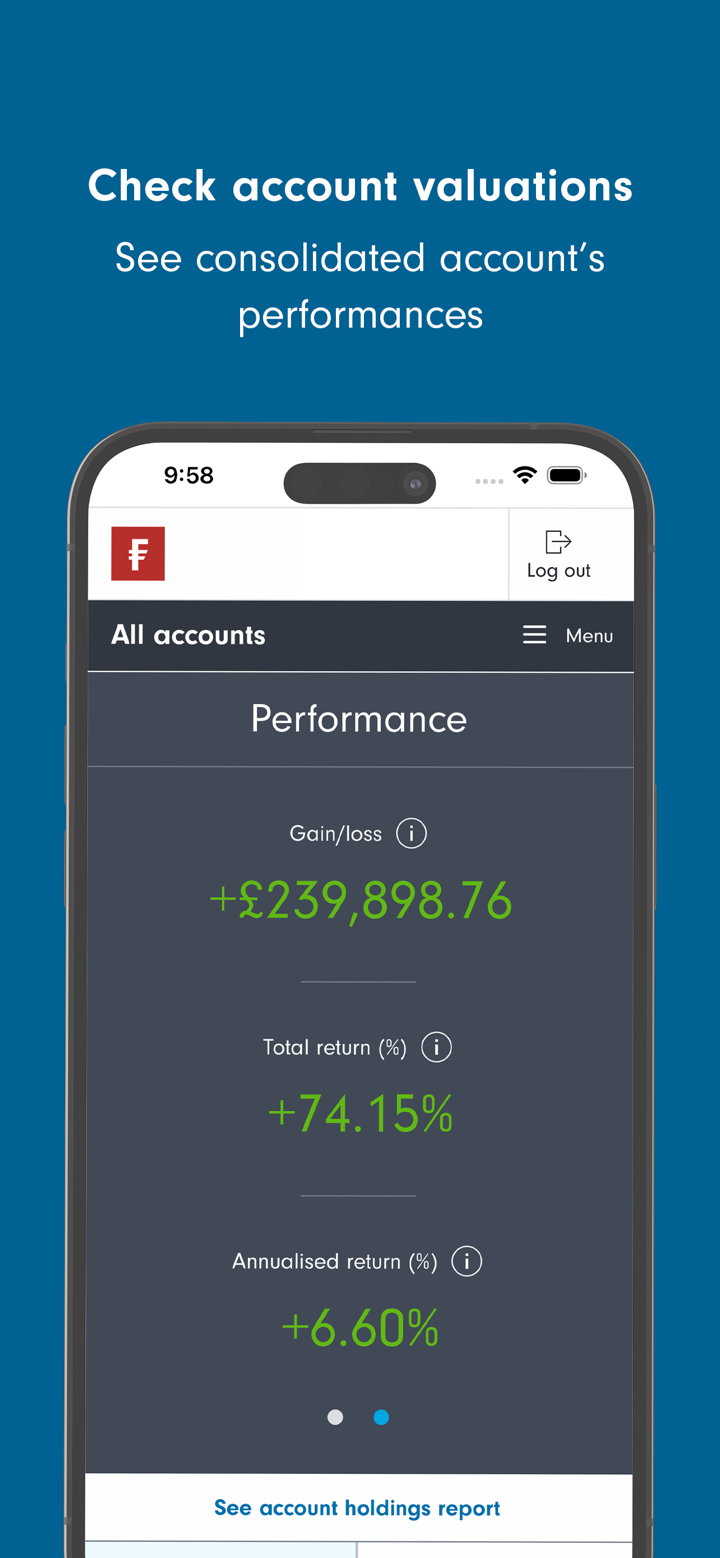

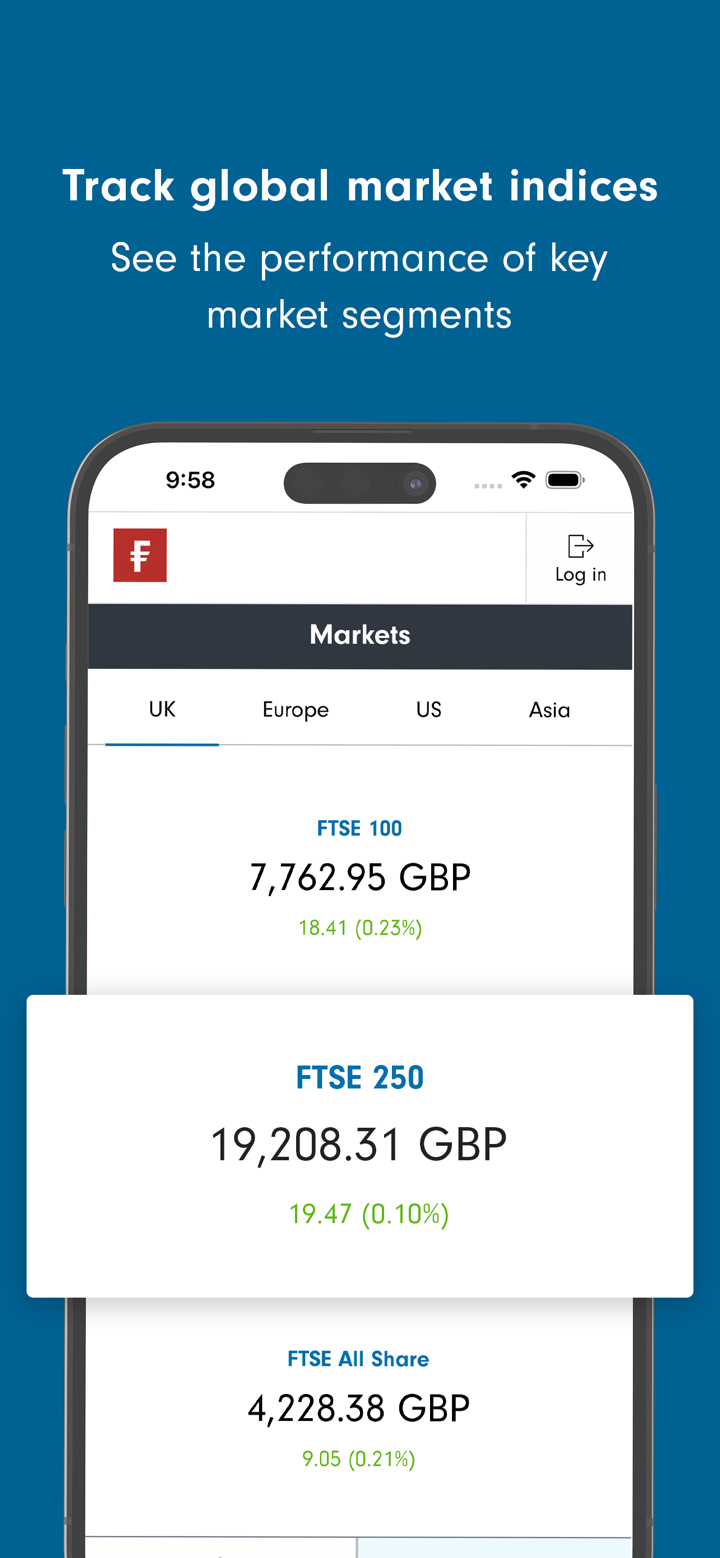

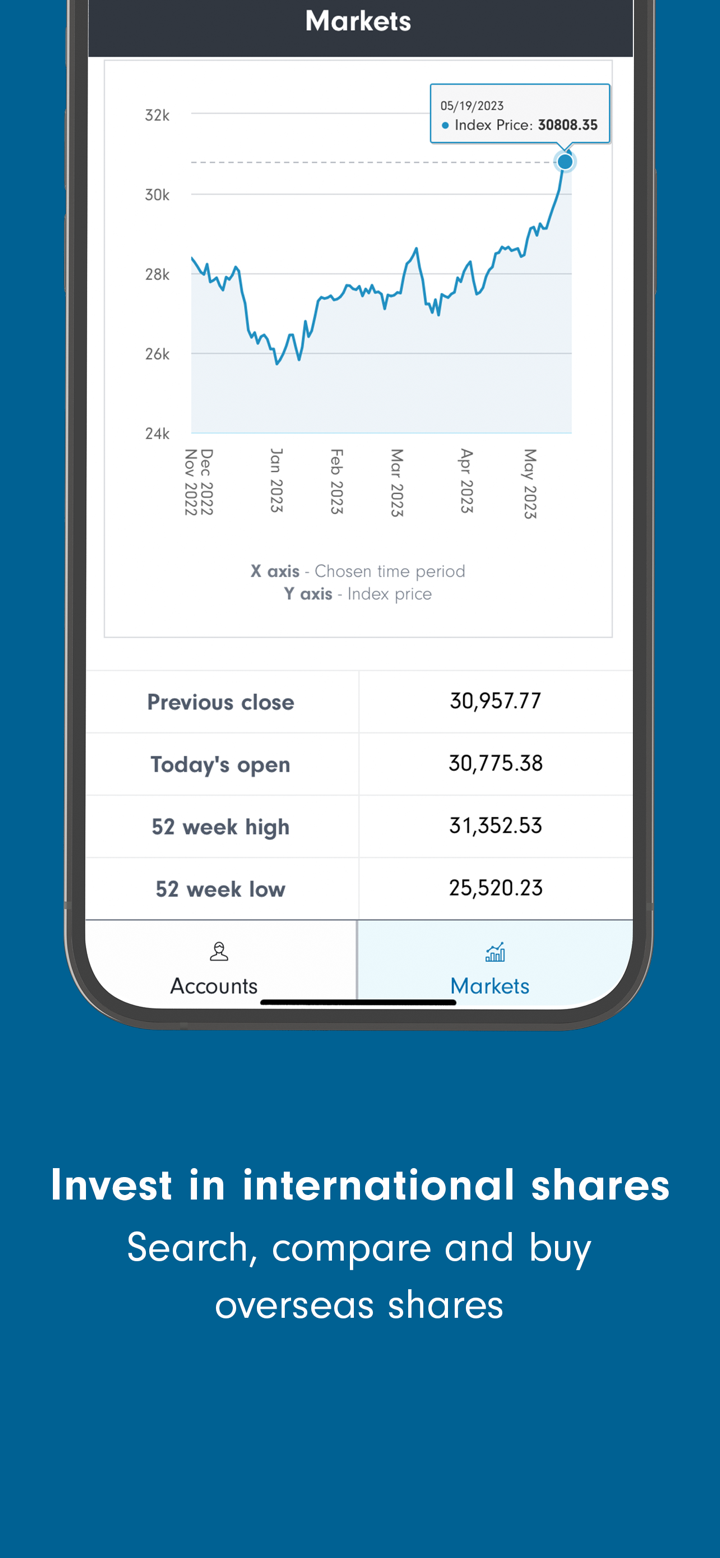

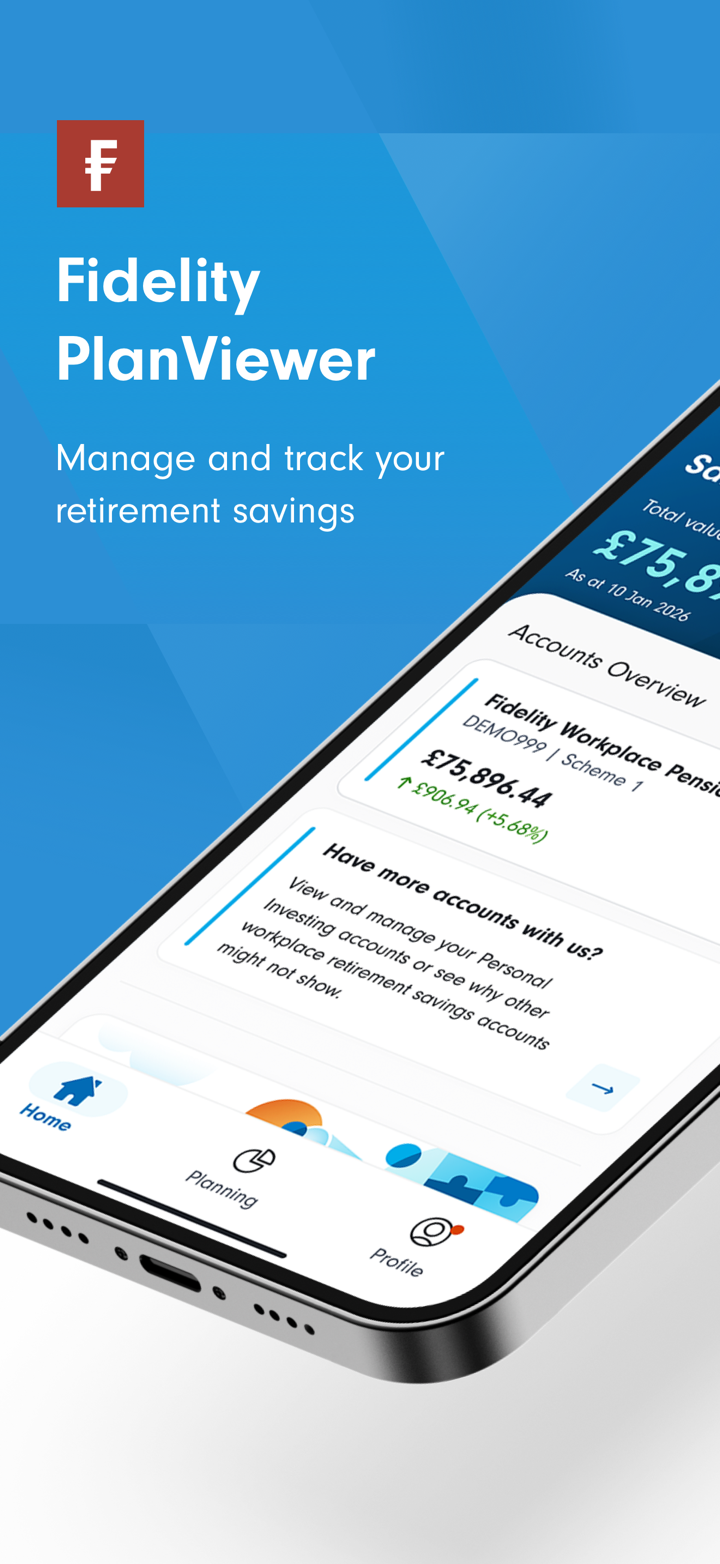

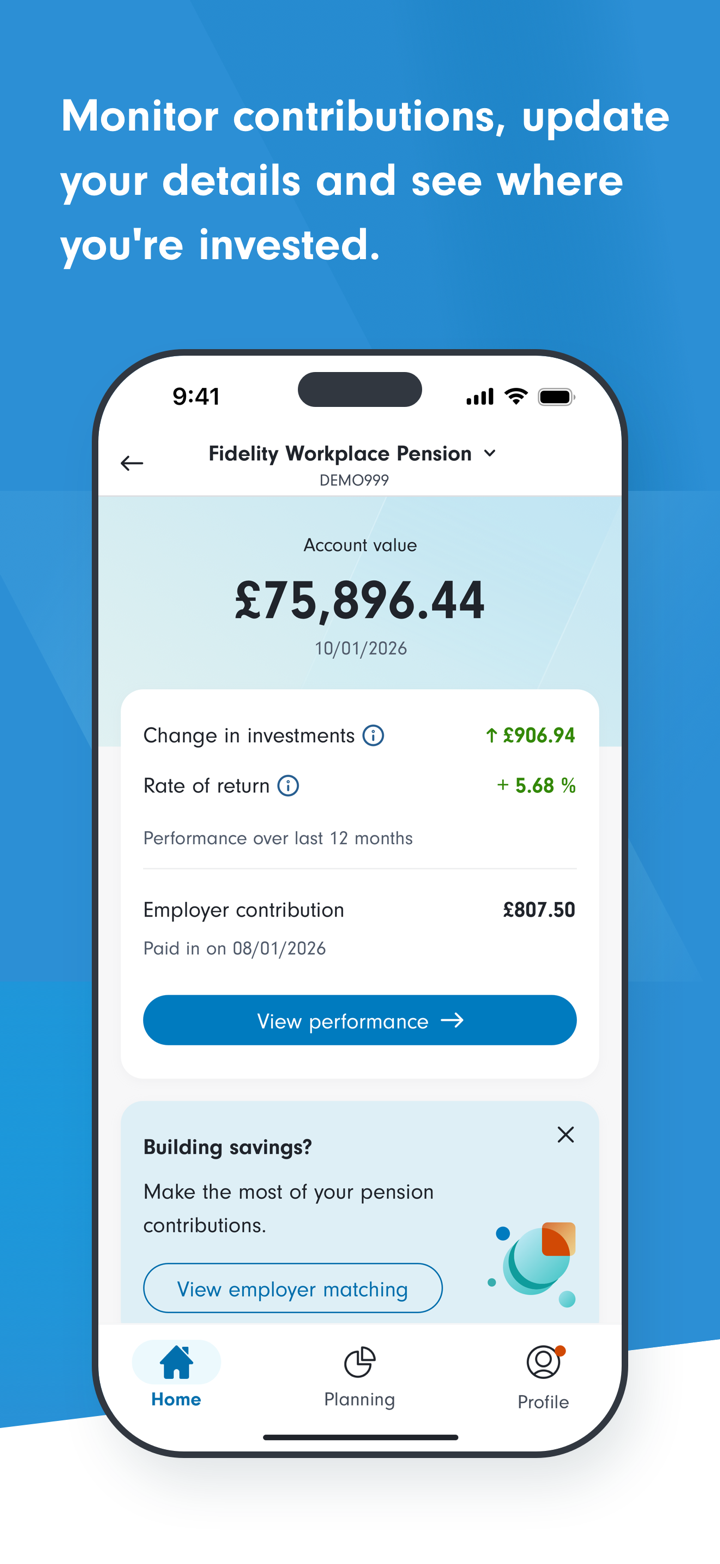

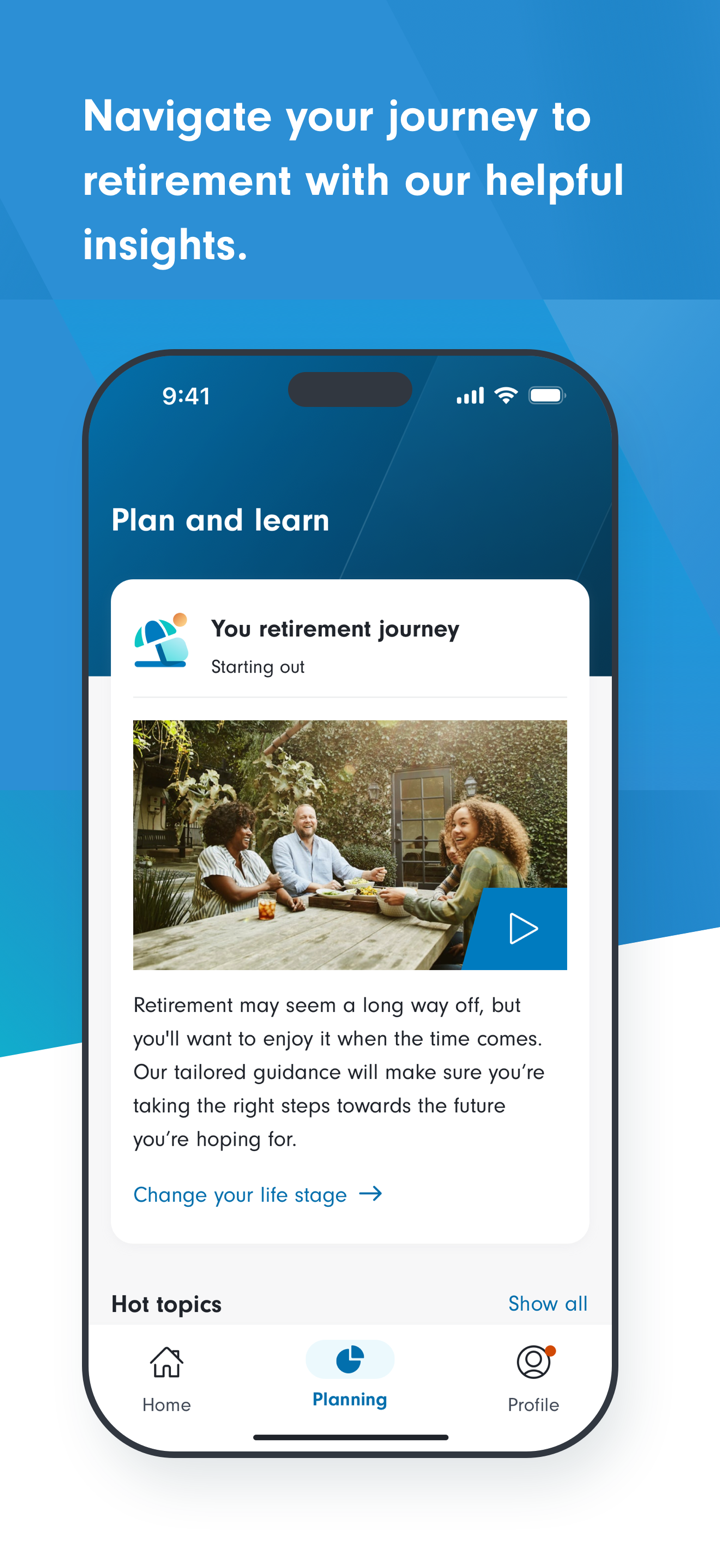

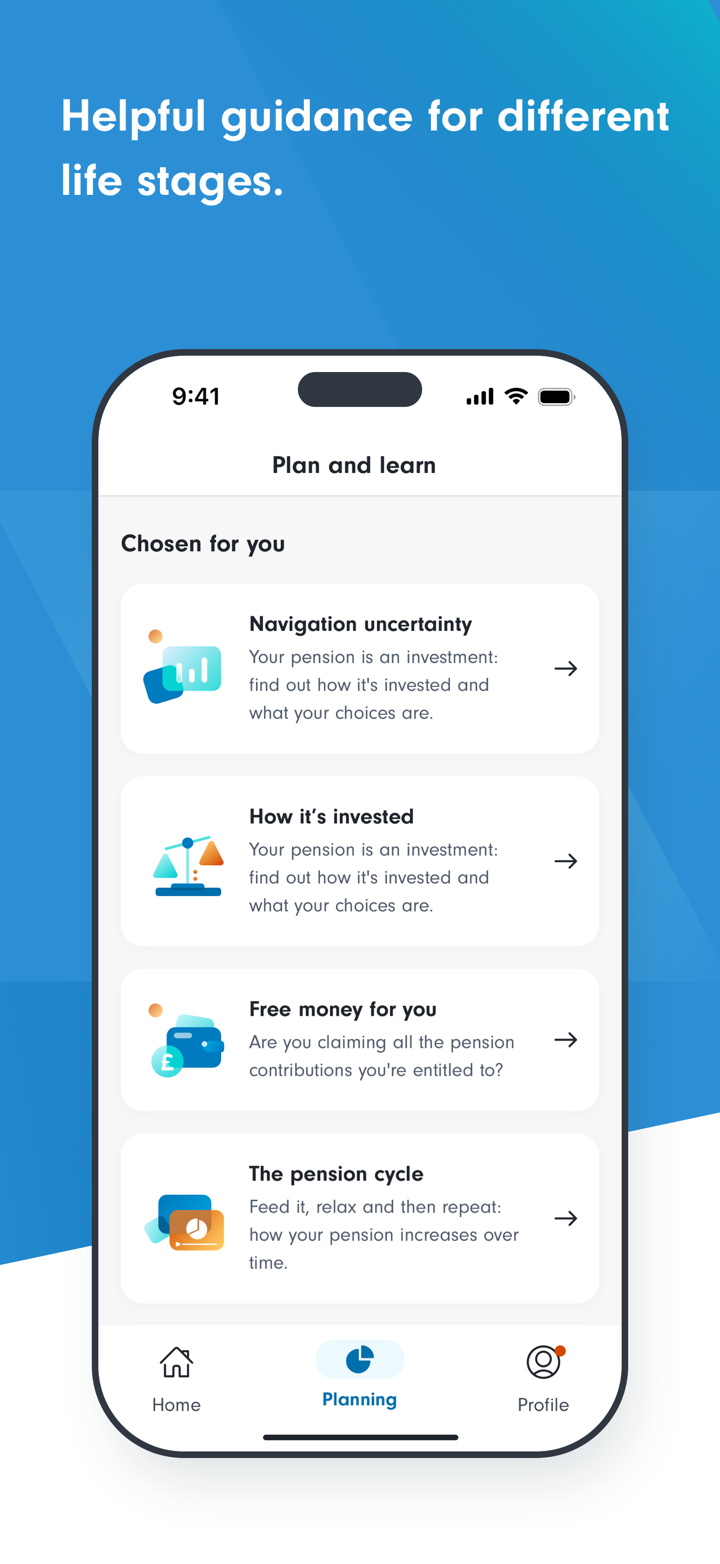

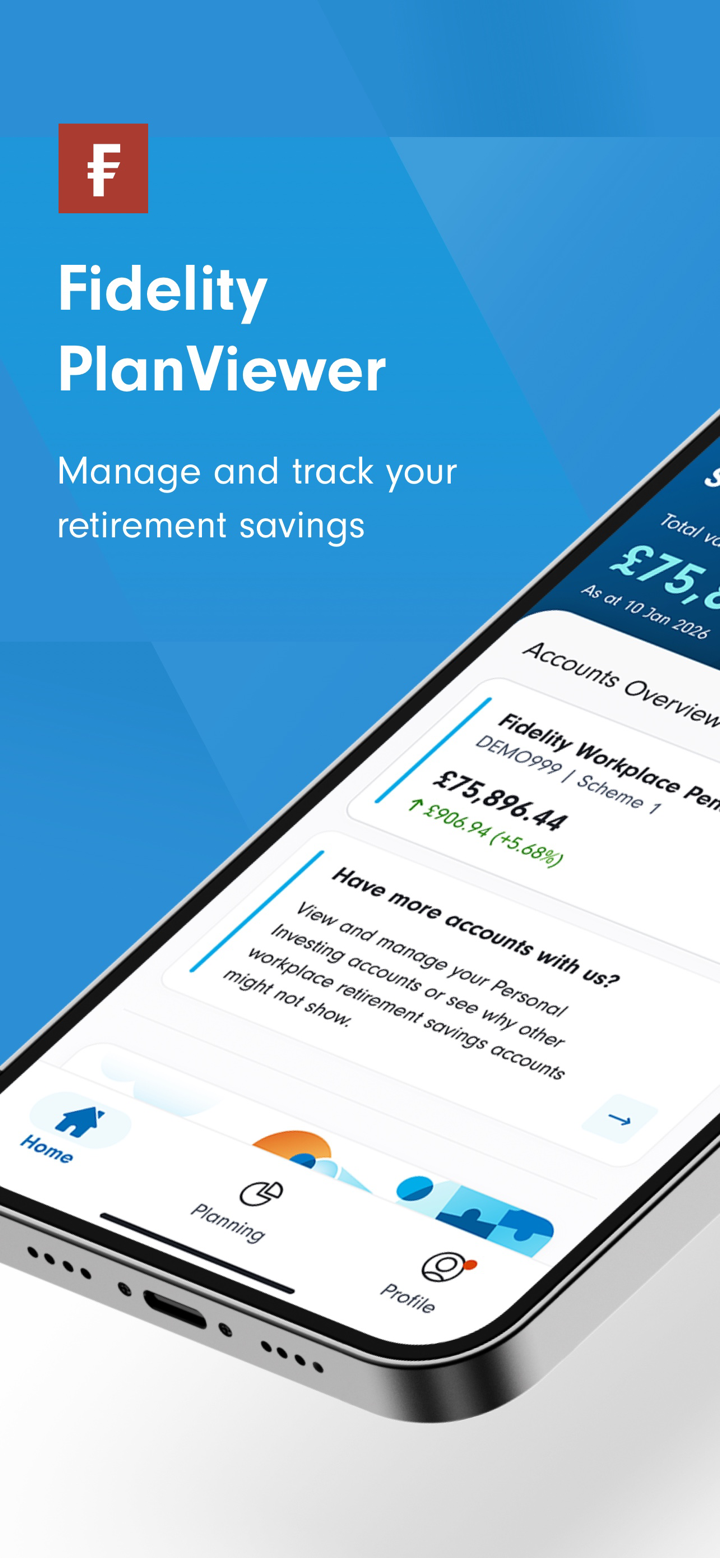

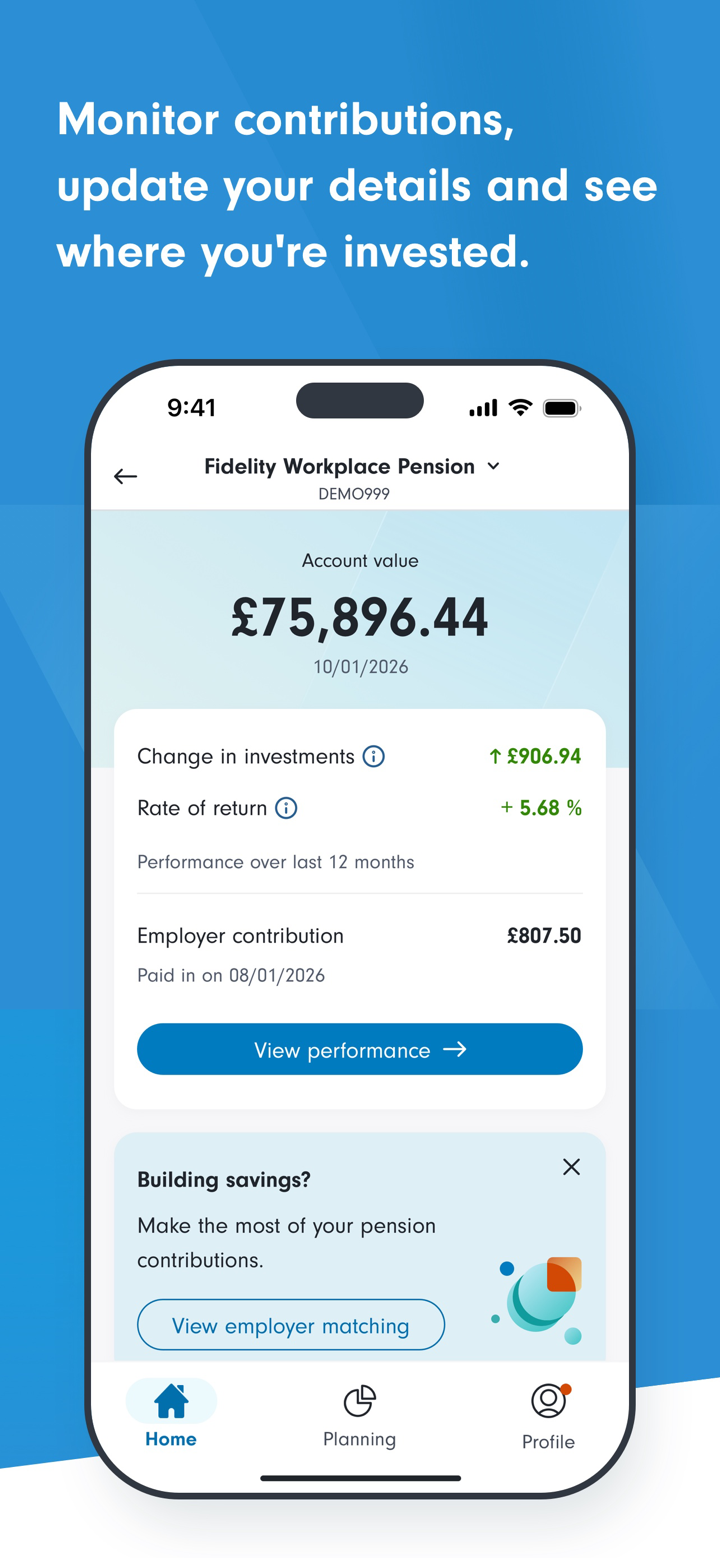

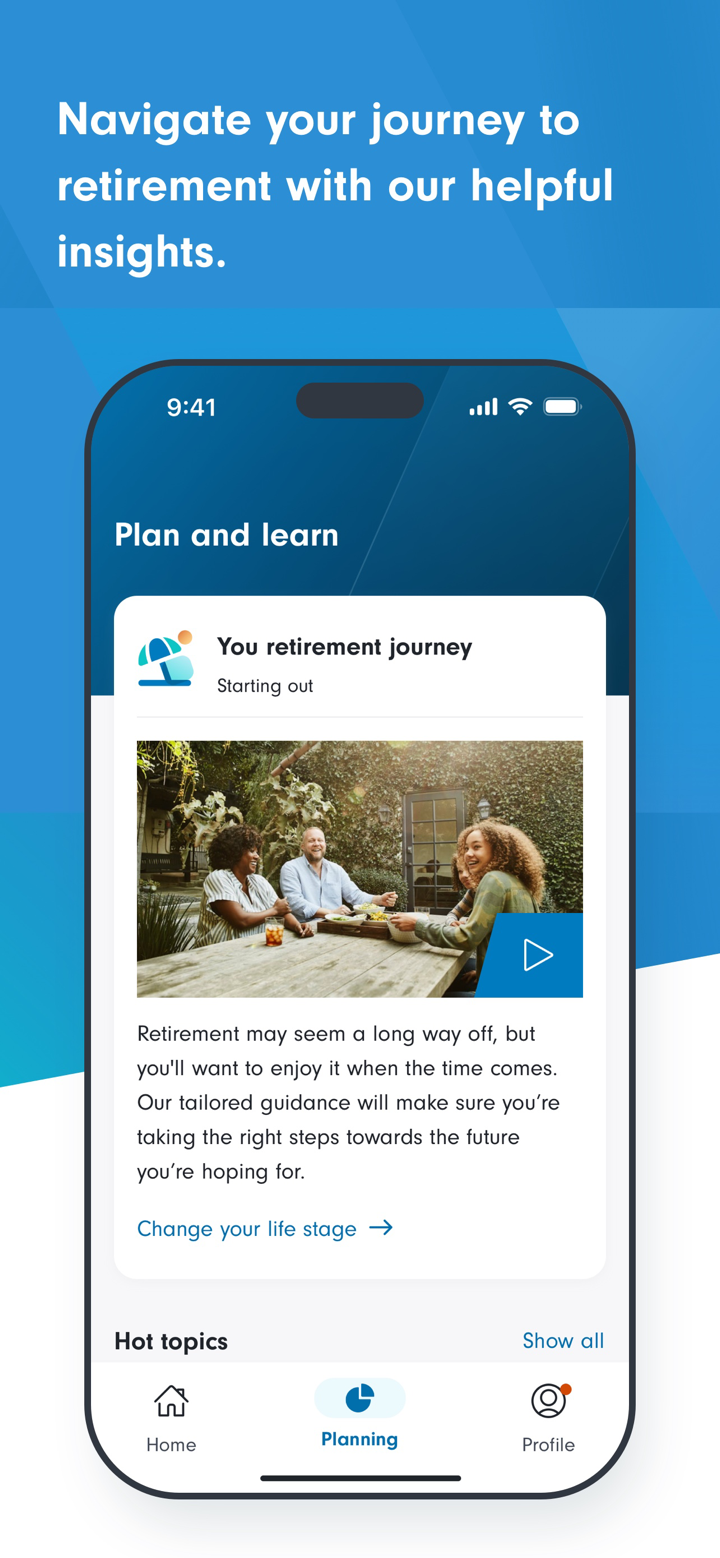

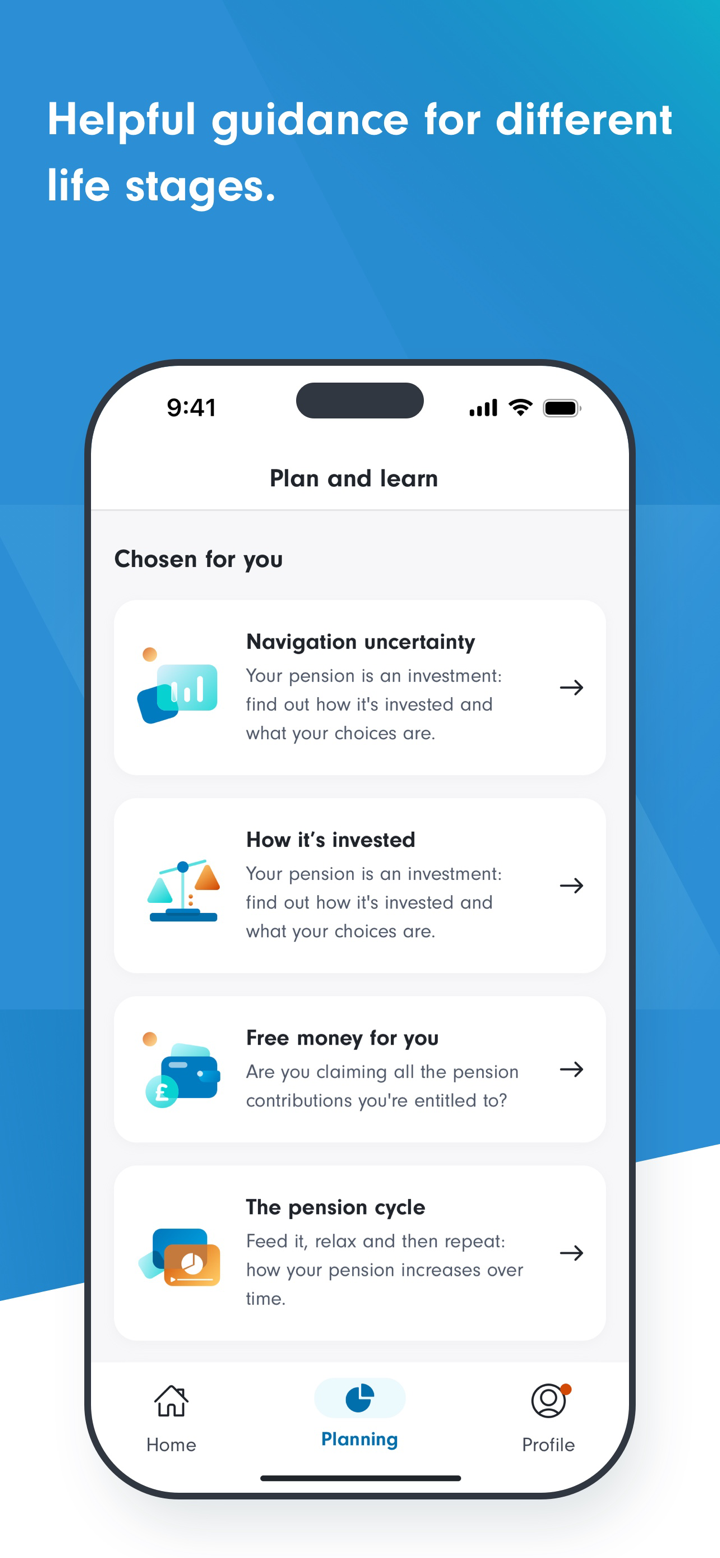

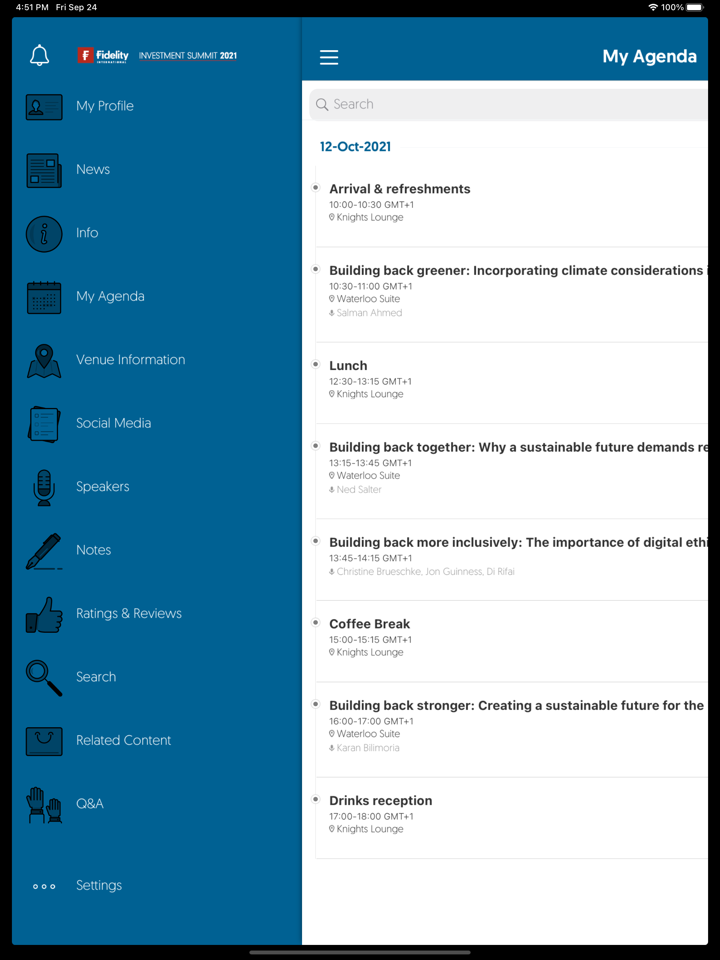

Plateforme de trading

| Plateforme de trading | Pris en charge | Appareils disponibles | Convient à |

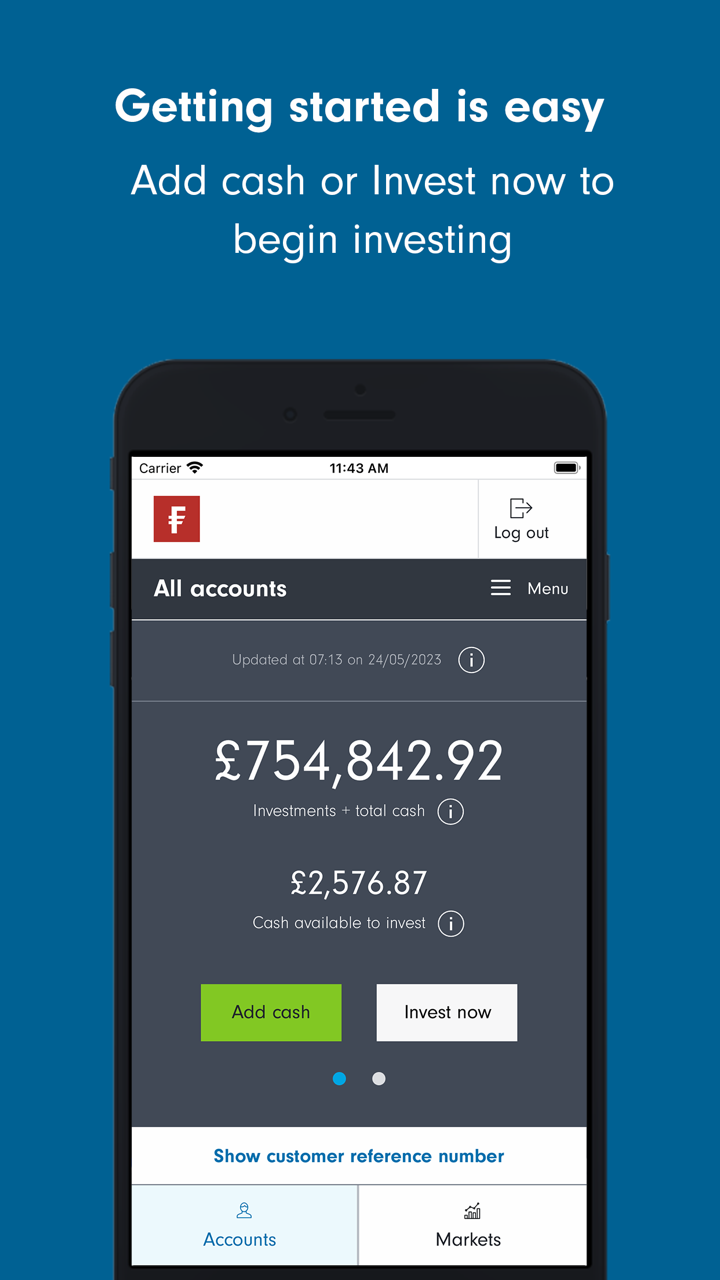

| Fidelity en ligne | ✔ | Web (PC, Mac) | Investisseurs à long terme gérant des portefeuilles en ligne |

| Application mobile Fidelity | ✔ | iOS, Android | Investisseurs ayant besoin d'un accès mobile à leur portefeuille |

Dépôt et retrait

Fidelity ne facture aucun frais supplémentaire pour les méthodes de dépôt ou de retrait standard. Cependant, des frais bancaires ou d'intermédiaire peuvent s'appliquer en fonction de la méthode utilisée. Le dépôt minimum est de HK$1,000 par fonds par mois pour les plans d'investissement mensuels ; aucun minimum spécifique n'est indiqué pour les investissements en capital.

| Méthode de paiement | Montant minimum | Frais | Délai de traitement |

| Virement télégraphique | / | Frais bancaires/intermédiaires | Dès réception des fonds compensés |

| Paiement de facture HSBC (Banque en ligne) | / | ❌ (sauf frais d'agent) | Immédiat |

| Traite bancaire / Mandat de caissier | / | Frais bancaires de l'agent | |

| Débit direct le même jour HSBC / Hang Seng | / | ❌ (des frais bancaires peuvent être facturés en cas de fonds insuffisants) | |

| Chèque personnel (compensé à HK) | HK$1,000,000 ou moins | ❌ | |

| Chèque personnel (non compensé à HK) | / | Des frais de collecte peuvent s'appliquer | Après compensation |