Buod ng kumpanya

| tobu-sec Buod ng Pagsusuri | |

| Itinatag | 2004 |

| Nakarehistrong Bansa/Rehiyon | Hapon |

| Regulasyon | FSA |

| Mga Produkto sa Pamumuhunan | Mga Stock, bond, investment trust, futures, options |

| Platform ng Paggawa ng Kalakalan | / |

| Suporta sa Customer | Oras ng Serbisyo: Lunes hanggang Biyernes 9:00 AM - 5:00 PM |

| Tel: 048-760-1826 | |

Impormasyon Tungkol sa tobu-sec

Ang tobu-sec ay isang Hapones na kumpanyang pinansyal, na regulado ng FSA, na nag-aalok ng iba't ibang mga produkto, kabilang ang mga stock, iba't ibang bond, investment trust, at derivatives.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Mahabang kasaysayan | Walang impormasyon sa platform ng kalakalan |

| Regulado ng FSA | Walang impormasyon sa pagdedeposito at pagwiwithdraw |

| Iba't ibang mga produkto sa pamumuhunan | |

| Transparency sa mga komisyon |

Tunay ba ang tobu-sec?

Ang tobu-sec ay may Retail Forex License na regulado ng Financial Services Agency (FSA) sa Hapon na may numerong lisensya na 関東財務局長(金商)第120号.

| Otoridad sa Regulasyon | Kasalukuyang Kalagayan | Reguladong Bansa | Uri ng Lisensya | Lisensyadong Entidad | Numero ng Lisensya |

| Financial Services Agency (FSA) | Regulado | Hapon | Retail Forex License | tobu-sec株式会社 | 関東財務局長(金商)第120号 |

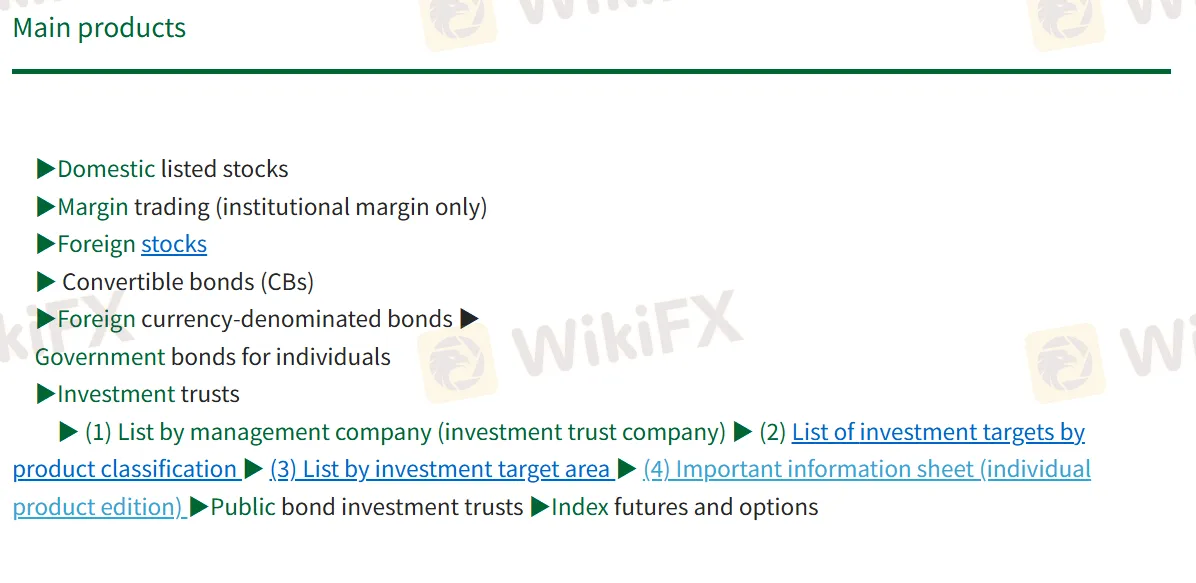

Mga Produkto

Ang mga produkto ng Tobu-sec ay kinabibilangan ng iba't ibang mga seguridad tulad ng domestic at foreign stocks, iba't ibang uri ng bonds, investment trusts, at derivatives tulad ng index futures at options, kasama ang institutional margin trading.

| Mga Produkto | Supported |

| Stocks | ✔ |

| Bonds | ✔ |

| Investment Trusts | ✔ |

| Futures | ✔ |

| Options | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptos | ❌ |

| ETFs | ❌ |

Komisyon

Stock Brokerage Commission Structure - Basic Stock Commission Rate

| Halaga ng Kontrata | Komisyon (kasama ang 10% buwis) |

| Mas mababa sa 1 milyong yen | 1.265% ng halaga ng kontrata (Min. 2,750 yen) |

| 1M hanggang 3M yen | 0.935% ng halaga ng kontrata + 3,300 yen |

| 3M hanggang 5M yen | 0.880% ng halaga ng kontrata + 4,840 yen |

| 5M hanggang 10M yen | 0.660% ng halaga ng kontrata + 15,840 yen |

| 10M hanggang 30M yen | 0.550% ng halaga ng kontrata + 26,840 yen |

| 30M hanggang 50M yen | 0.330% ng halaga ng kontrata + 92,840 yen |

| Higit sa 50 milyong yen | 257,840 yen |

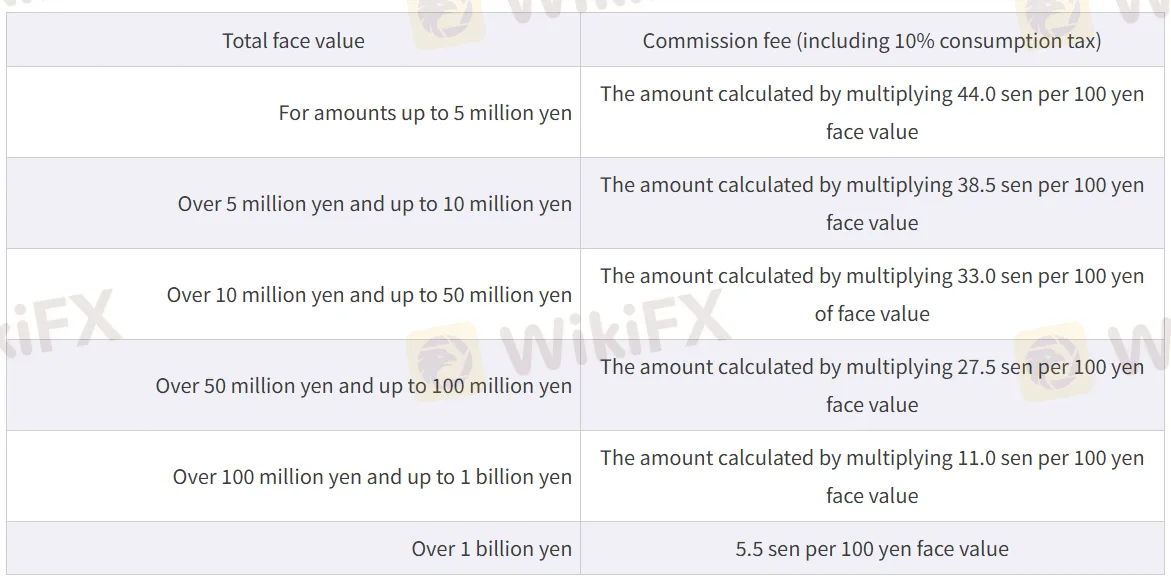

Bond Brokerage Commission Rates - Pamahalaan Bonds

| Kabuuang Halaga ng Mukha | Komisyon (kasama ang 10% buwis) |

| Hanggang sa 5 milyong yen | 44.0 sen bawat 100 yen halaga ng mukha |

| Higit sa 5M hanggang 10M yen | 38.5 sen bawat 100 yen halaga ng mukha |

| Higit sa 10M hanggang 50M yen | 33.0 sen bawat 100 yen halaga ng mukha |

| Higit sa 50M hanggang 100M yen | 27.5 sen bawat 100 yen halaga ng mukha |

| Higit sa 100M yen hanggang 1 bilyong yen | 11.0 sen bawat 100 yen halaga ng mukha |

| Higit sa 1 bilyong yen | 5.5 sen bawat 100 yen halaga ng mukha |

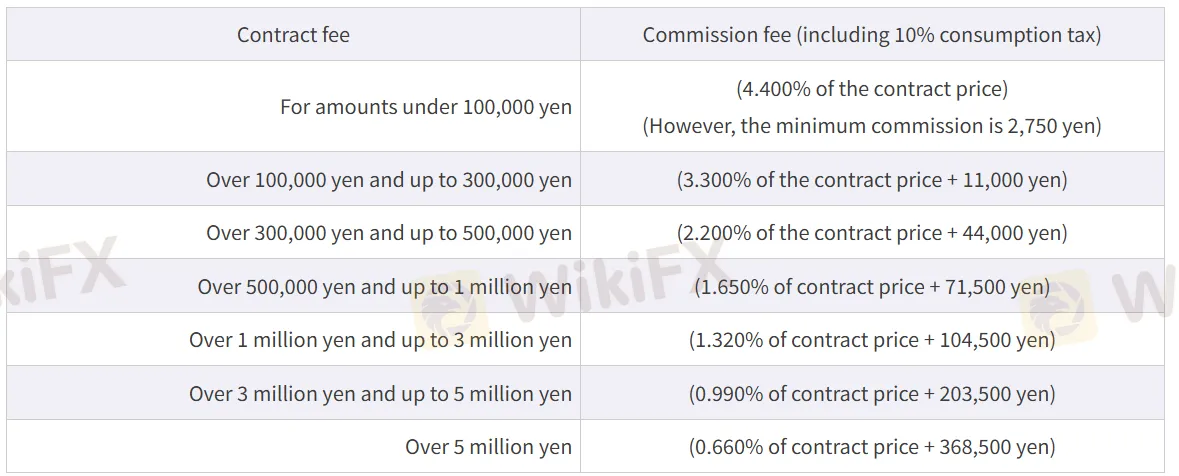

Komisyon sa Pagtitingi ng Securities Options Trading

| Halaga ng Kontrata | Bayad sa Komisyon (kasama ang 10% buwis) |

| Sa ilalim ng 100,000 yen | 4.400% ng presyo ng kontrata (Min. 2,750 yen) |

| 100,000 hanggang 300,000 yen | 3.300% ng presyo ng kontrata + 11,000 yen |

| 300,000 hanggang 500,000 yen | 2.200% ng presyo ng kontrata + 44,000 yen |

| 500,000 hanggang 1M yen | 1.650% ng presyo ng kontrata + 71,500 yen |

| 1M hanggang 3M yen | 1.320% ng presyo ng kontrata + 104,500 yen |

| 3M hanggang 5M yen | 0.990% ng presyo ng kontrata + 203,500 yen |

| Higit sa 5 milyong yen | 0.660% ng presyo ng kontrata + 368,500 yen |