Şirket özeti

| tobu-sec İnceleme Özeti | |

| Kuruluş Yılı | 2004 |

| Kayıtlı Ülke/Bölge | Japonya |

| Düzenleme | FSA |

| Yatırım Ürünleri | Hisse senetleri, tahviller, yatırım fonları, vadeli işlemler, opsiyonlar |

| İşlem Platformu | / |

| Müşteri Desteği | Hizmet Saatleri: Hafta içi 9:00 - 17:00 |

| Tel: 048-760-1826 | |

tobu-sec Bilgileri

tobu-sec, FSA tarafından düzenlenen Japon bir finansal kuruluş olup, hisse senetleri, çeşitli tahviller, yatırım fonları ve türevler de dahil olmak üzere farklı ürünler sunmaktadır.

Artıları ve Eksileri

| Artılar | Eksiler |

| Uzun geçmiş | İşlem platformu hakkında bilgi yok |

| FSA tarafından düzenlenir | Para yatırma ve çekme hakkında bilgi yok |

| Çeşitli yatırım ürünleri | |

| Komisyonlarda şeffaflık |

tobu-sec Güvenilir mi?

tobu-sec, Japonya'da FSA tarafından düzenlenen bir Perakende Forex Lisansına sahiptir ve lisans numarası 関東財務局長(金商)第120号'dir.

| Düzenleyici Otorite | Mevcut Durum | Düzenlenen Ülke | Lisans Türü | Lisanslı Kuruluş | Lisans No. |

| Finansal Hizmetler Ajansı (FSA) | Düzenlenmiş | Japonya | Perakende Forex Lisansı | tobu-sec株式会社 | 関東財務局長(金商)第120号 |

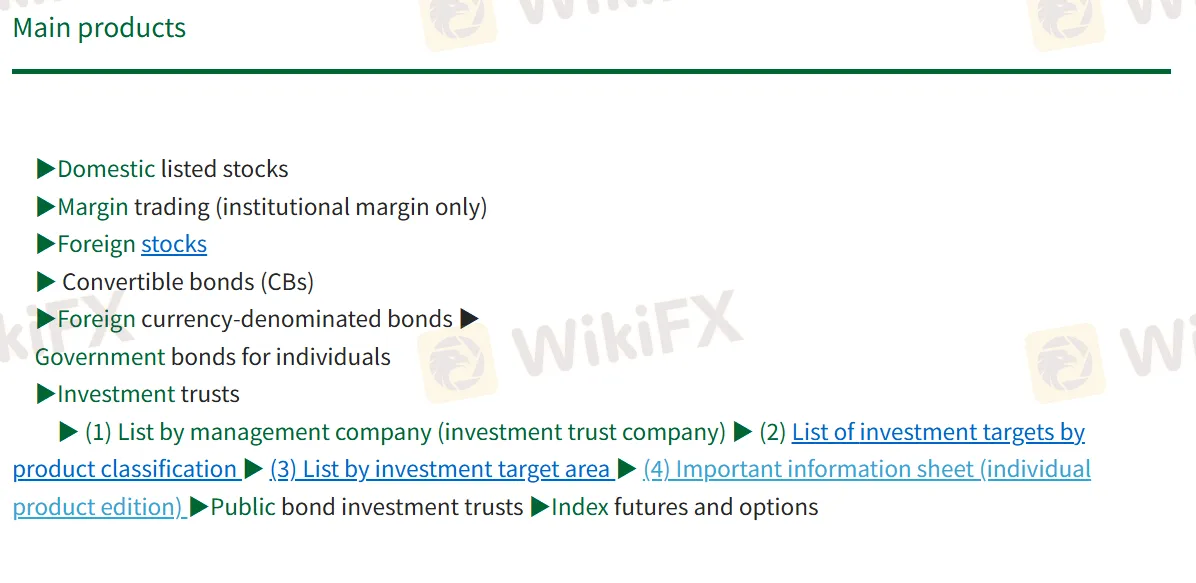

Ürünler

Tobu-sec'nin ürünleri, yerli ve yabancı hisse senetleri, çeşitli tahviller, yatırım fonları ve endeks vadeli işlemler ve opsiyonlar gibi türevler ile kurumsal marj ticareti yanında çeşitli menkul kıymetleri içermektedir.

| Ürünler | Desteklenen |

| Hisse Senetleri | ✔ |

| Tahviller | ✔ |

| Yatırım Fonları | ✔ |

| Vadeli İşlemler | ✔ |

| Opsiyonlar | ✔ |

| Forex | ❌ |

| Emtialar | ❌ |

| Endeksler | ❌ |

| Kriptolar | ❌ |

| ETF'ler | ❌ |

Komisyonlar

Hisse Aracılık Komisyon Yapısı - Temel Hisse Komisyon Oranı

| Sözleşme Tutarı | Komisyon Ücreti (KDV dahil) |

| 1 milyon yen'den az | Sözleşme fiyatının %1,265'i (Min. 2.750 yen) |

| 1M ila 3M yen | Sözleşme fiyatının %0,935'i + 3.300 yen |

| 3M ila 5M yen | Sözleşme fiyatının %0,880'i + 4.840 yen |

| 5M ila 10M yen | Sözleşme fiyatının %0,660'ı + 15.840 yen |

| 10M ila 30M yen | Sözleşme fiyatının %0,550'si + 26.840 yen |

| 30M ila 50M yen | Sözleşme fiyatının %0,330'u + 92.840 yen |

| 50 milyon yen'den fazla | 257.840 yen |

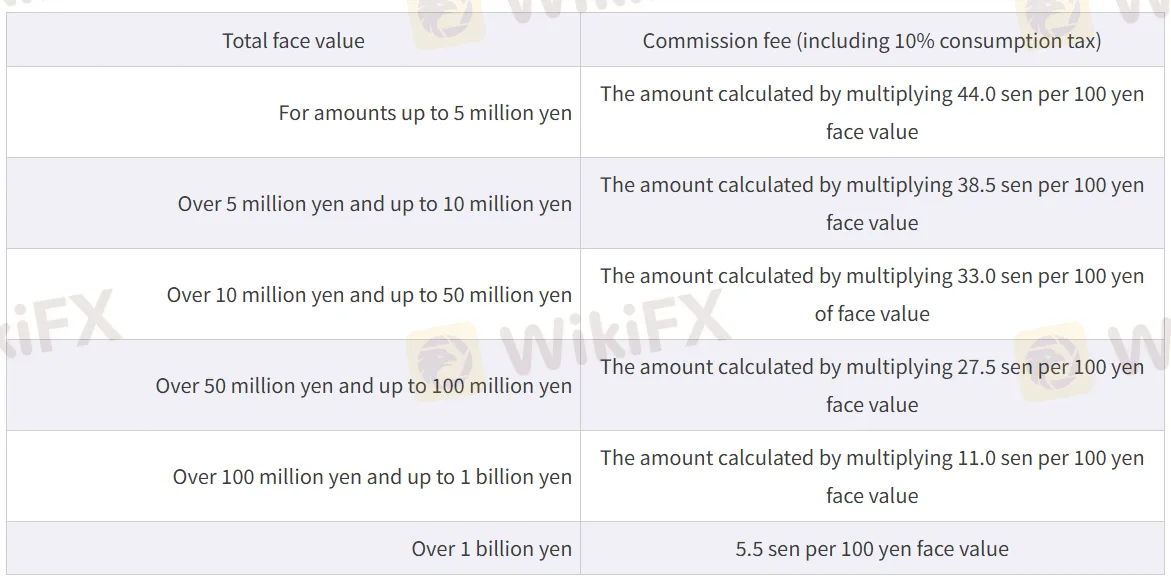

Tahvil Aracılık Komisyon Oranları - Devlet Tahvilleri

| Toplam Nominal Değer | Komisyon Ücreti (KDV dahil) |

| 5 milyon yen'e kadar | 100 yen nominal değer başına 44,0 sen |

| 5M ila 10M yen | 100 yen nominal değer başına 38,5 sen |

| 10M ila 50M yen | 100 yen nominal değer başına 33,0 sen |

| 50M ila 100M yen | 100 yen nominal değer başına 27,5 sen |

| 100M yen ila 1 milyar yen | 100 yen nominal değer başına 11,0 sen |

| 1 milyar yen'den fazla | 100 yen nominal değer başına 5,5 sen |

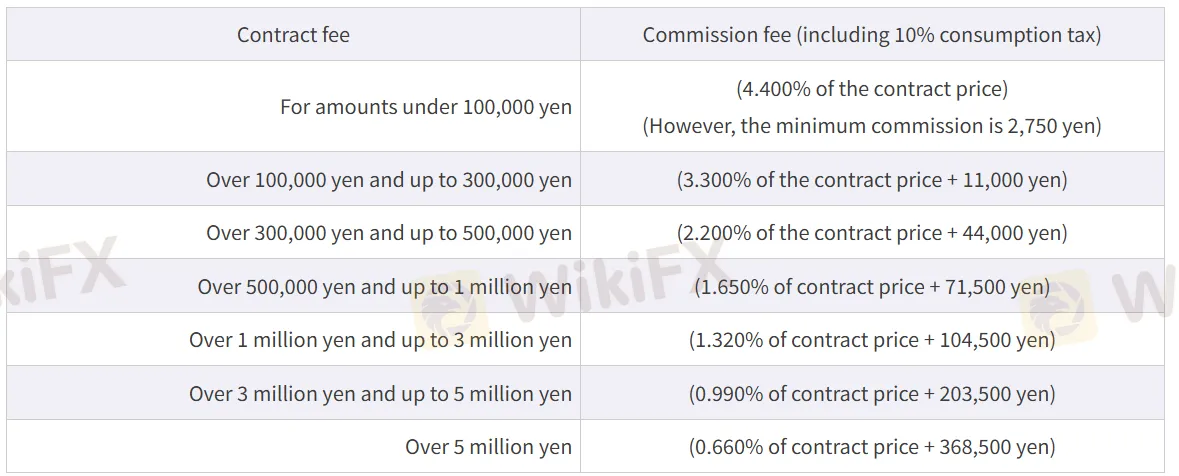

Menkul Kıymetler Opsiyonlar Ticaret Komisyon Oranları

| Sözleşme Tutarı | Komisyon Ücreti (KDV dahil) |

| 100.000 yen'in altında | Sözleşme fiyatının %4,400'ü (Minimum 2.750 yen) |

| 100.000 ile 300.000 yen arası | Sözleşme fiyatının %3,300'ü + 11.000 yen |

| 300.000 ile 500.000 yen arası | Sözleşme fiyatının %2,200'si + 44.000 yen |

| 500.000 ile 1M yen arası | Sözleşme fiyatının %1,650'si + 71.500 yen |

| 1M ile 3M yen arası | Sözleşme fiyatının %1,320'si + 104.500 yen |

| 3M ile 5M yen arası | Sözleşme fiyatının %0,990'ı + 203.500 yen |

| 5 milyon yen'in üzerinde | Sözleşme fiyatının %0,660'ı + 368.500 yen |