Perfil de la compañía

| tobu-sec Resumen de la reseña | |

| Fundación | 2004 |

| País/Región registrado | Japón |

| Regulación | FSA |

| Productos de inversión | Acciones, bonos, fondos de inversión, futuros, opciones |

| Plataforma de trading | / |

| Soporte al cliente | Horario de servicio: Lunes a viernes de 9:00 a. m. a 5:00 p. m. |

| Tel: 048-760-1826 | |

Información de tobu-sec

tobu-sec es una empresa financiera japonesa, regulada por la FSA, que ofrece diferentes productos, incluyendo acciones, diversos bonos, fondos de inversión y derivados.

Pros y contras

| Pros | Contras |

| Larga trayectoria | Sin información sobre la plataforma de trading |

| Regulado por la FSA | Sin información sobre depósitos y retiros |

| Diversos productos de inversión | |

| Transparencia en comisiones |

¿Es tobu-sec legítimo?

tobu-sec tiene una Licencia de Forex Minorista regulada por la Agencia de Servicios Financieros (FSA) en Japón con un número de licencia 関東財務局長(金商)第120号.

| Autoridad reguladora | Estado actual | País regulado | Tipo de licencia | Entidad con licencia | Número de licencia |

| Agencia de Servicios Financieros (FSA) | Regulado | Japón | Licencia de Forex Minorista | tobu-sec株式会社 | 関東財務局長(金商)第120号 |

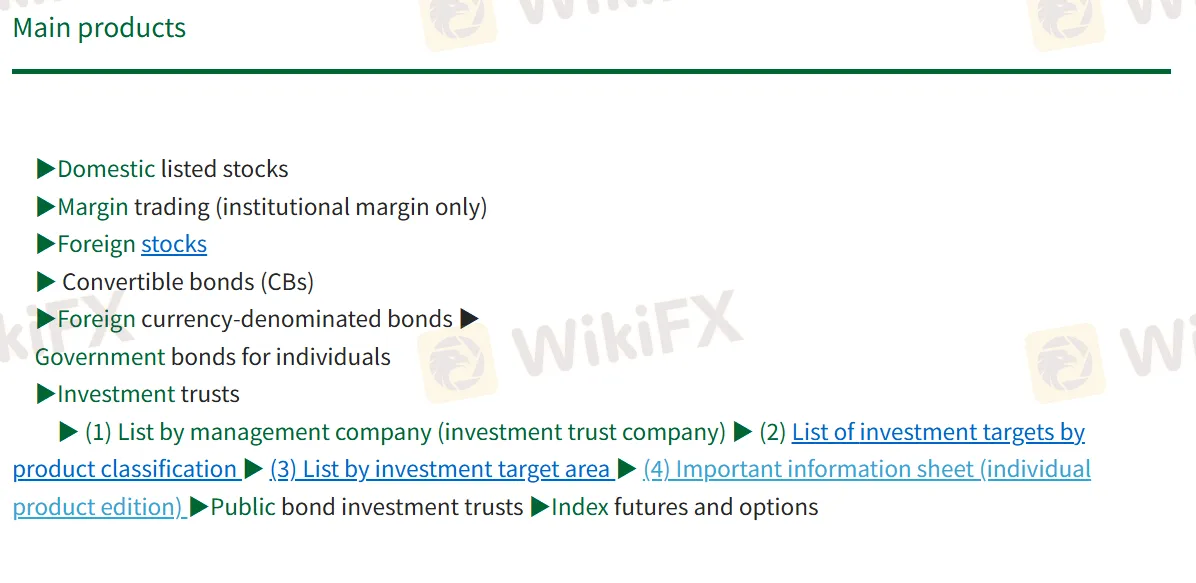

Productos

Los productos de Tobu-sec incluyen diversos valores como acciones nacionales y extranjeras, varios tipos de bonos, fondos de inversión y derivados como futuros de índices y opciones, junto con operaciones de margen institucional.

| Productos | Soportados |

| Acciones | ✔ |

| Bonos | ✔ |

| Fondos de Inversión | ✔ |

| Futuros | ✔ |

| Opciones | ✔ |

| Forex | ❌ |

| Productos Básicos | ❌ |

| Índices | ❌ |

| Criptomonedas | ❌ |

| ETFs | ❌ |

Comisiones

Estructura de Comisión de Corretaje de Acciones - Tarifa Básica de Comisión de Acciones

| Monto del Contrato | Comisión (incl. 10% de impuestos) |

| Menos de 1 millón de yenes | 1.265% del precio del contrato (Mín. 2,750 yenes) |

| De 1M a 3M yenes | 0.935% del precio del contrato + 3,300 yenes |

| De 3M a 5M yenes | 0.880% del precio del contrato + 4,840 yenes |

| De 5M a 10M yenes | 0.660% del precio del contrato + 15,840 yenes |

| De 10M a 30M yenes | 0.550% del precio del contrato + 26,840 yenes |

| De 30M a 50M yenes | 0.330% del precio del contrato + 92,840 yenes |

| Más de 50 millones de yenes | 257,840 yenes |

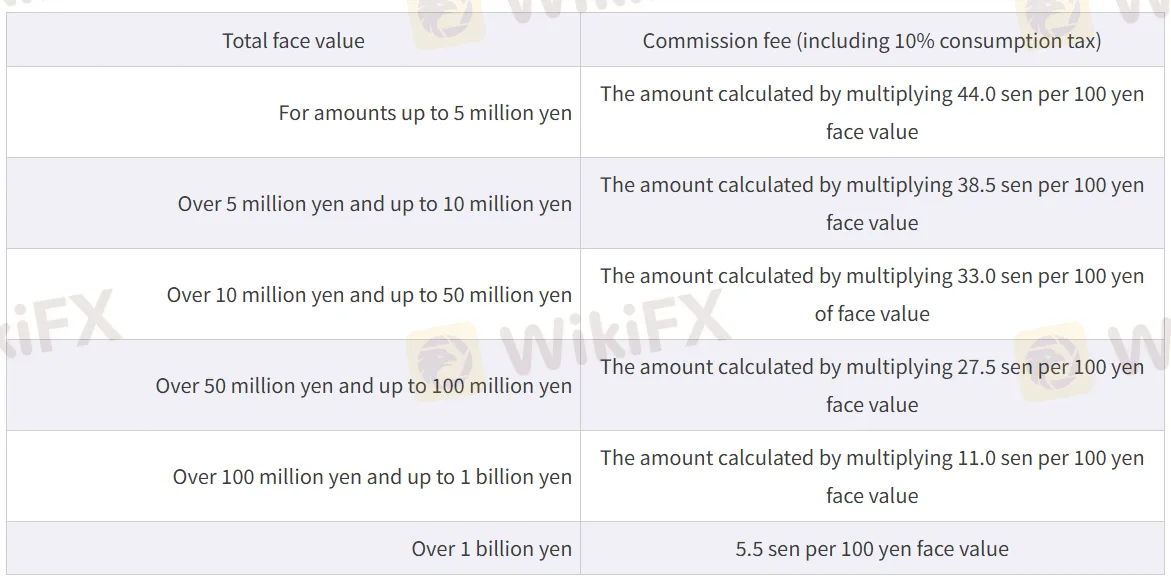

Tarifas de Comisión de Corretaje de Bonos - Bonos del Gobierno

| Valor Nominal Total | Comisión (incl. 10% de impuestos) |

| Hasta 5 millones de yenes | 44.0 sen por cada 100 yenes de valor nominal |

| De más de 5M a 10M yenes | 38.5 sen por cada 100 yenes de valor nominal |

| De más de 10M a 50M yenes | 33.0 sen por cada 100 yenes de valor nominal |

| De más de 50M a 100M yenes | 27.5 sen por cada 100 yenes de valor nominal |

| De más de 100M yenes a 1 mil millones de yenes | 11.0 sen por cada 100 yenes de valor nominal |

| Más de 1 mil millones de yenes | 5.5 sen por cada 100 yenes de valor nominal |

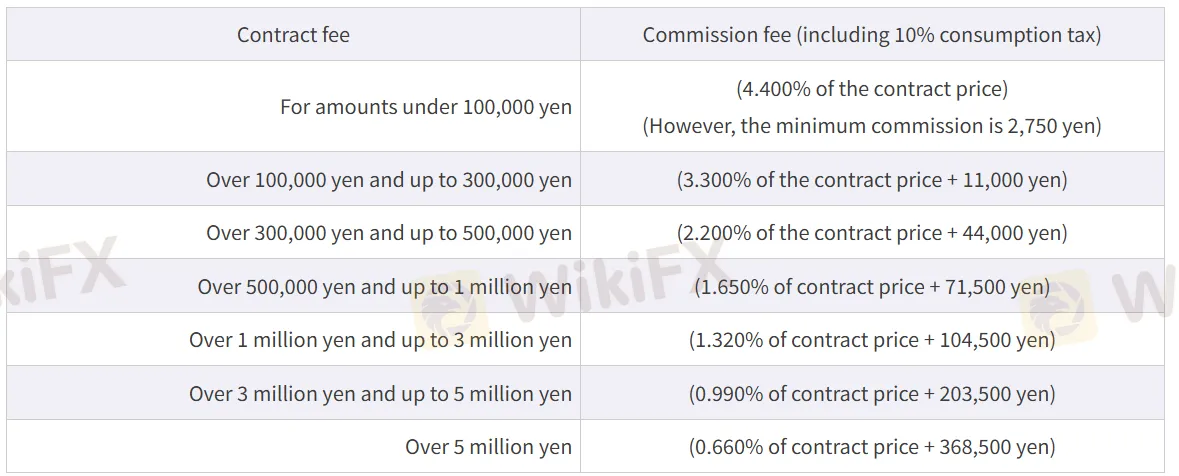

Comisión de Tarifas de la Comisión de Comercio de Opciones de Valores

| Monto del Contrato | Comisión (incl. 10% de impuestos) |

| Menos de 100,000 yenes | 4.400% del precio del contrato (Mín. 2,750 yenes) |

| 100,000 a 300,000 yenes | 3.300% del precio del contrato + 11,000 yenes |

| 300,000 a 500,000 yenes | 2.200% del precio del contrato + 44,000 yenes |

| 500,000 a 1M yenes | 1.650% del precio del contrato + 71,500 yenes |

| 1M a 3M yenes | 1.320% del precio del contrato + 104,500 yenes |

| 3M a 5M yenes | 0.990% del precio del contrato + 203,500 yenes |

| Más de 5 millones de yenes | 0.660% del precio del contrato + 368,500 yenes |