회사 소개

| Hana Bank리뷰 요약 | |

| 설립일 | 2013-02-08 |

| 등록 국가/지역 | 대한민국 |

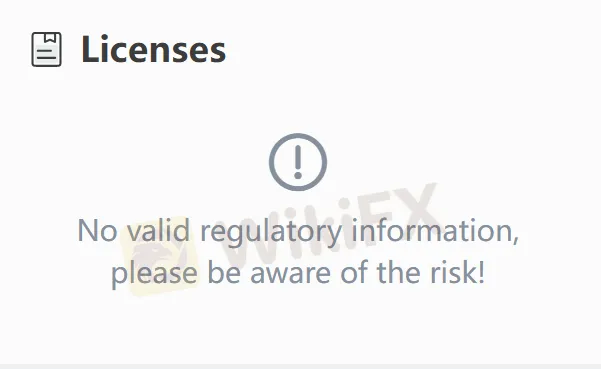

| 규제 | 규제되지 않음 |

| 제품 및 서비스 | 상업 은행, 투자 은행, 자산 관리 및 보험 |

| 고객 지원 | 분점 작성 각각 한 줄씩 작성 전화 한 줄, 이메일 한 줄 등 다른 파트타임 작성된 기사에서 확인 가능 |

Hana Bank 정보

KEB Hana Bank는 한국의 주요 금융 기관 중 하나로 하나금융그룹에 속합니다. 상업 은행, 투자 은행, 자산 관리 및 보험과 같은 다양한 분야를 사업으로 하고 있습니다. 대한민국 서울에 본사를 두고 있으며 글로벌 서비스 네트워크를 갖추고 있어 다국어 지원 (한국어, 영어, 일본어, 중국어, 베트남어 등)을 제공하며 공식 웹사이트와 모바일 플랫폼을 통해 다양한 금융 상품 및 프로모션 활동을 시작했습니다.

장단점

| 장점 | 단점 |

| 다국어 지원 및 글로벌화된 서비스 | 규제되지 않음 |

| 풍부한 프로모션 활동 | 핵심 비즈니스 정보의 불충분한 투명성 |

| 상호 작용 및 투자자 혜택 | 활동 세부 정보의 모호함 |

| 다양한 거래 상품 | 국제 사용자에 대한 상세한 지원 부족 |

Hana Bank 합법적인가요?

Hana Bank는 규제 라이선스를 표시하지 않아 규제 상태를 증명할 수 없습니다. 대한민국 주요 금융 그룹 소속 은행으로 Hana Bank는 금융감독원 (FSS)과 같은 대한민국 금융 당국에 의해 규제되는 합법적인 금융 기관임을 주장하며 공식 웹사이트나 고객 서비스 핫라인 1599-6111을 통해 서비스 정보를 확인할 수 있어 거래 보안을 보장할 수 있습니다.

Hana Bank에서 무엇을 거래할 수 있나요?

Hana Bank의 공식 웹사이트에서의 프로모션 활동은 주로 예금, 환전, 행운의 추첨 및 인터랙티브 게임에 초점을 맞추고 있습니다. 외환, 주식 및 선물과 같은 거래 가능한 금융 상품을 명시적으로 나열하지는 않습니다.

입출금

Hana Bank은(는) 은행 송금, 현금 입금 및 연금 이체(다른 기관으로부터 자금을 수령하는 IRP 계정과 같은)을 지원합니다. ATM, 계산대 또는 이체를 통해 인출할 수 있습니다. 국제 송금의 경우 해외 고객 서비스 핫라인이 제공됩니다: 82-42-520-2500 (내선 번호를 위해 8번을 누르세요).

보너스

| 활동 유형 | 활동 이름/시간 | 보상 세부 정보 |

| 입금 인센티브 | IRP 계정 입금 | "하나머니" (포인트 또는 현금 보상) 획득 |

| 럭키 드로우 | 하나데이 (매월 1일, 11일, 21일) | 상품 포함 1~11,111 하나머니, 커피 쿠폰 및 가스 쿠폰을 포함한 100% 당첨률 |

| 환전 할인 | 인천공항 환전소 | Smart Tax-Free APP을 통한 30% 할인 쿠폰 |

| 인터랙티브 게임 보상 | 리워드 팡팡! (리워드 팡!) | 게임을 플레이하여 현금 보상 획득 |

| 물주기 꾹! (물주기 활동) | 가상 식물에 물을 주어 현금 보상 획득 |