Profil perusahaan

| Hana BankRingkasan Ulasan | |

| Didirikan | 2013-02-08 |

| Negara/Daerah Terdaftar | Korea Selatan |

| Regulasi | Tidak Diatur |

| Produk dan Layanan | perbankan komersial, perbankan investasi, manajemen aset, dan asuransi |

| Dukungan Pelanggan | 分行写 每种写一行 比如电话一行 邮箱一行等 可见别的兼职写的文章 |

Hana Bank Informasi

KEB Hana Bank adalah salah satu lembaga keuangan utama di Korea Selatan, yang merupakan bagian dari Hana Financial Group. Bisnisnya mencakup berbagai bidang seperti perbankan komersial, perbankan investasi, manajemen aset, dan asuransi. Bermarkas di Seoul, Korea Selatan, bank ini memiliki jaringan layanan global, menyediakan dukungan multibahasa (Korea, Inggris, Jepang, Tiongkok, Vietnam, dll.), dan meluncurkan berbagai produk keuangan dan kegiatan promosi melalui situs web resmi dan platform seluler.

Pro dan Kontra

| Pro | Kontra |

| Dukungan multibahasa dan layanan global | Tidak Diatur |

| Kegiatan promosi yang melimpah | Ketidaktransparan informasi inti bisnis |

| Interaktivitas dan manfaat bagi investor | Detail kegiatan yang ambigu |

| Berbagai produk perdagangan | Kurangnya dukungan detail untuk pengguna internasional |

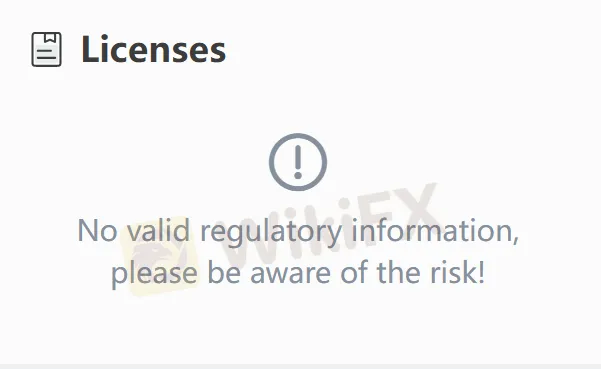

Apakah Hana Bank Legal?

Hana Bank belum menampilkan lisensi regulasi, sehingga tidak dapat membuktikan status teraturannya. Sebagai bank di bawah grup keuangan besar Korea Selatan, Hana Bank mengklaim sebagai lembaga keuangan yang sah yang diatur oleh otoritas keuangan Korea Selatan seperti Financial Supervisory Service (FSS) dan memiliki kualifikasi perbankan resmi.

Investor dapat memverifikasi informasi layanan melalui saluran resmi (seperti situs web resmi atau hotline layanan pelanggan 1599-6111) untuk memastikan keamanan transaksi.

Apa yang Dapat Saya Perdagangkan di Hana Bank?

Kegiatan promosi di situs web resmi Hana Bank terutama berfokus pada deposito, pertukaran mata uang, undian beruntung, dan permainan interaktif. Tidak secara eksplisit mencantumkan produk keuangan yang dapat diperdagangkan seperti valuta asing, saham, dan futures.

Deposit dan Penarikan

Hana Bank mendukung transfer bank, deposit tunai, dan transfer anuitas (seperti rekening IRP yang menerima dana dari lembaga lain). Penarikan dapat dilakukan melalui ATM, di meja layanan, atau melalui transfer. Untuk transfer uang internasional, hotline layanan pelanggan luar negeri disediakan: 82-42-520-2500 (tekan 8 untuk ekstensi).

Bonus

| Jenis Aktivitas | Nama/Waktu Aktivitas | Detail Hadiah |

| Insentif Deposit | Deposit Rekening IRP | Dapatkan "하나머니" (poin atau hadiah tunai) |

| Undian Beruntung | HARI HANA (setiap tanggal 1, 11, 21 setiap bulan) | Tingkat kemenangan 100% dengan hadiah, termasuk 1~11,111 하나머니, kupon kopi, dan kupon bensin |

| Diskon Tukar | Penukaran Mata Uang Bandara Incheon | Kupon 30% melalui Aplikasi Smart Tax-Free |

| Hadiah Permainan Interaktif | 리워드 팡팡! (Hadiah Pang!) | Dapatkan hadiah tunai melalui permainan |

| 물주기 꾹! (Aktivitas Penyiraman) | Dapatkan hadiah tunai dengan menyiram tanaman virtual |