Company Summary

| Hana BankReview Summary | |

| Founded | 2013-02-08 |

| Registered Country/Region | South Korea |

| Regulation | Unregulated |

| Products and Services | commercial banking, investment banking, asset management, and insurance |

| Customer Support | 分行写 每种写一行 比如电话一行 邮箱一行等 可见别的兼职写的文章 |

Hana Bank Information

KEB Hana Bank is one of the major financial institutions in South Korea, belonging to the Hana Financial Group. Its business covers multiple fields such as commercial banking, investment banking, asset management, and insurance. Headquartered in Seoul, South Korea, the bank has a global service network, providing multilingual support (Korean, English, Japanese, Chinese, Vietnamese, etc.), and launching various financial products and promotional activities through its official website and mobile platforms.

Pros and Cons

| Pros | Cons |

| Multilingual support and globalized services | Unregulated |

| Abundant promotional activities | Insufficient transparency in core business information |

| Interactivity and investor benefits | Ambiguous activity details |

| Various trading products | Lack of detailed support for international users |

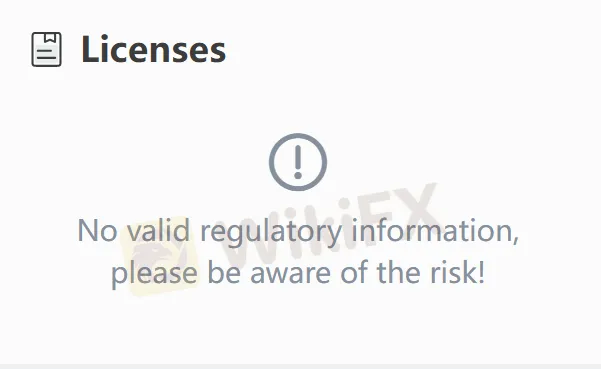

Is Hana Bank Legit?

Hana Bank has not displayed a regulatory license, making it unable to prove its regulated status. As a bank under a major South Korean financial group, Hana Bank claims to be a legitimate financial institution regulated by South Korean financial authorities such as the Financial Supervisory Service (FSS) and holds formal banking qualifications.

Investors can verify service information through official channels (such as the official website or customer service hotline 1599-6111) to ensure transaction security.

What Can I Trade on Hana Bank?

The promotional activities on Hana Bank's official website mainly focus on deposits, currency exchange, lucky draws, and interactive games. It does not explicitly list tradable financial products such as foreign exchange, stocks, and futures.

Deposit and Withdrawal

Hana Bank supports bank transfers, cash deposits, and annuity transfers (such as IRP accounts receiving funds from other institutions). Withdrawals can be made via ATMs, over the counter, or through transfers. For international money transfers, an overseas customer service hotline is provided: 82-42-520-2500 (press 8 for extension).

Bonus

| Activity Type | Activity Name/Time | Reward Details |

| Deposit Incentive | IRP Account Deposit | Earn “하나머니” (points or cash rewards) |

| Lucky Draw | HANA DAY (1st, 11th, 21st of each month) | 100% winning rate with prizes, including1~11,111 하나머니, Coffee coupons, and Gas coupons |

| Exchange Discount | Incheon Airport Currency Exchange | 30% coupon via Smart Tax-Free APP |

| Interactive Game Reward | 리워드 팡팡! (Reward Pang!) | Earn cash rewards through gameplay |

| 물주기 꾹! (Watering Activity) | Earn cash rewards by watering virtual plants |