Buod ng kumpanya

| Hana BankBuod ng Pagsusuri | |

| Itinatag | 2013-02-08 |

| Rehistradong Bansa/Rehiyon | Timog Korea |

| Regulasyon | Hindi Regulado |

| Mga Produkto at Serbisyo | komersyal na bangko, investment banking, asset management, at insurance |

| Suporta sa Customer | 分行写 每种写一行 比如电话一行 邮箱一行等 可见别的兼职写的文章 |

Hana Bank Impormasyon

Ang KEB Hana Bank ay isa sa mga pangunahing institusyon sa pananalapi sa Timog Korea, na kinabibilangan ng Hana Financial Group. Ang kanilang negosyo ay sumasaklaw sa iba't ibang larangan tulad ng komersyal na bangko, investment banking, asset management, at insurance. Batay sa Seoul, Timog Korea, ang bangko ay may global na network ng serbisyo, nagbibigay ng multilingual na suporta (Korean, English, Japanese, Chinese, Vietnamese, atbp.), at naglulunsad ng iba't ibang produkto at promotional activities sa pamamagitan ng kanilang opisyal na website at mobile platforms.

Mga Benepisyo at Kons

| Mga Benepisyo | Kons |

| Multilingual support at globalized services | Hindi Regulado |

| Abundant promotional activities | Kulang sa transparency sa core business information |

| Interactivity at investor benefits | Ambiguous activity details |

| Iba't ibang trading products | Kulang sa detalyadong suporta para sa international users |

Tunay ba ang Hana Bank?

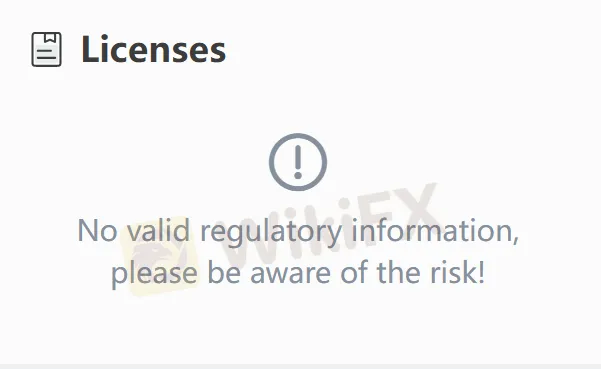

Ang Hana Bank ay hindi nagpakita ng regulatory license, kaya't hindi nito maipakita ang kanyang regulated status. Bilang isang bangko sa ilalim ng isang malaking financial group sa Timog Korea, iginiit ng Hana Bank na sila ay isang lehitimong institusyon sa pananalapi na nireregulate ng mga awtoridad sa pananalapi ng Timog Korea tulad ng Financial Supervisory Service (FSS) at may opisyal na banking qualifications.

Maaaring i-verify ng mga investors ang impormasyon sa serbisyo sa pamamagitan ng opisyal na mga channel (tulad ng opisyal na website o customer service hotline 1599-6111) upang tiyakin ang seguridad ng transaksyon.

Ano ang Maaari Kong I-trade sa Hana Bank?

Ang mga promotional activities sa opisyal na website ng Hana Bank ay pangunahing nakatuon sa deposits, currency exchange, lucky draws, at interactive games. Hindi ito eksplisitong naglalaman ng mga tradable financial products tulad ng foreign exchange, stocks, at futures.

Deposito at Pag-Wiwithdraw

Hana Bank suporta ang mga pagsasalin ng pera sa bangko, cash deposits, at mga pagsasalin ng annuity (tulad ng mga IRP account na tumatanggap ng pondo mula sa iba pang mga institusyon). Ang mga withdrawals ay maaaring gawin sa pamamagitan ng mga ATM, sa counter, o sa pamamagitan ng mga pagsasalin. Para sa mga internasyonal na pagsasalin ng pera, mayroong overseas customer service hotline na ibinibigay: 82-42-520-2500 (pindutin ang 8 para sa extension).

Bonus

| Uri ng Aktibidad | Pangalan/Oras ng Aktibidad | Mga Detalye ng Premyo |

| Deposit Incentive | IRP Account Deposit | Kumita ng "하나머니" (mga puntos o cash rewards) |

| Lucky Draw | HANA DAY (1st, 11th, 21st ng bawat buwan) | 100% rate ng panalo na may mga premyo, kabilang ang 1~11,111 하나머니, mga kupon ng kape, at mga kupon ng gas |

| Exchange Discount | Incheon Airport Currency Exchange | 30% kupon sa pamamagitan ng Smart Tax-Free APP |

| Interactive Game Reward | 리워드 팡팡! (Reward Pang!) | Kumita ng cash rewards sa pamamagitan ng gameplay |

| 물주기 꾹! (Watering Activity) | Kumita ng cash rewards sa pamamagitan ng pagdidilig sa mga virtual na halaman |