Buod ng kumpanya

| RUIDA FUTURES Buod ng Pagsusuri | |

| Itinatag | 1993 |

| Rehistradong Bansa/Rehiyon | China |

| Regulasyon | CFFEX |

| Mga Produkto at Serbisyo | Commodity & financial futures brokerage, investment consulting, asset & fund management, fintech, at international risk services |

| Platform/APP | Jinshida, Midas Touch, Flagship App, Boyi Master & APP, Polestar V9.3/V9.5, Express Terminal V2/V3, Infinite Easy (Ez/Pro), Caishun, SP Trader, Trading Pioneer/TBQuant, Wenhua, Tonghuashun |

| Suporta sa Customer | Telepono: 4008-8787-66 |

Impormasyon Tungkol sa RUIDA FUTURES

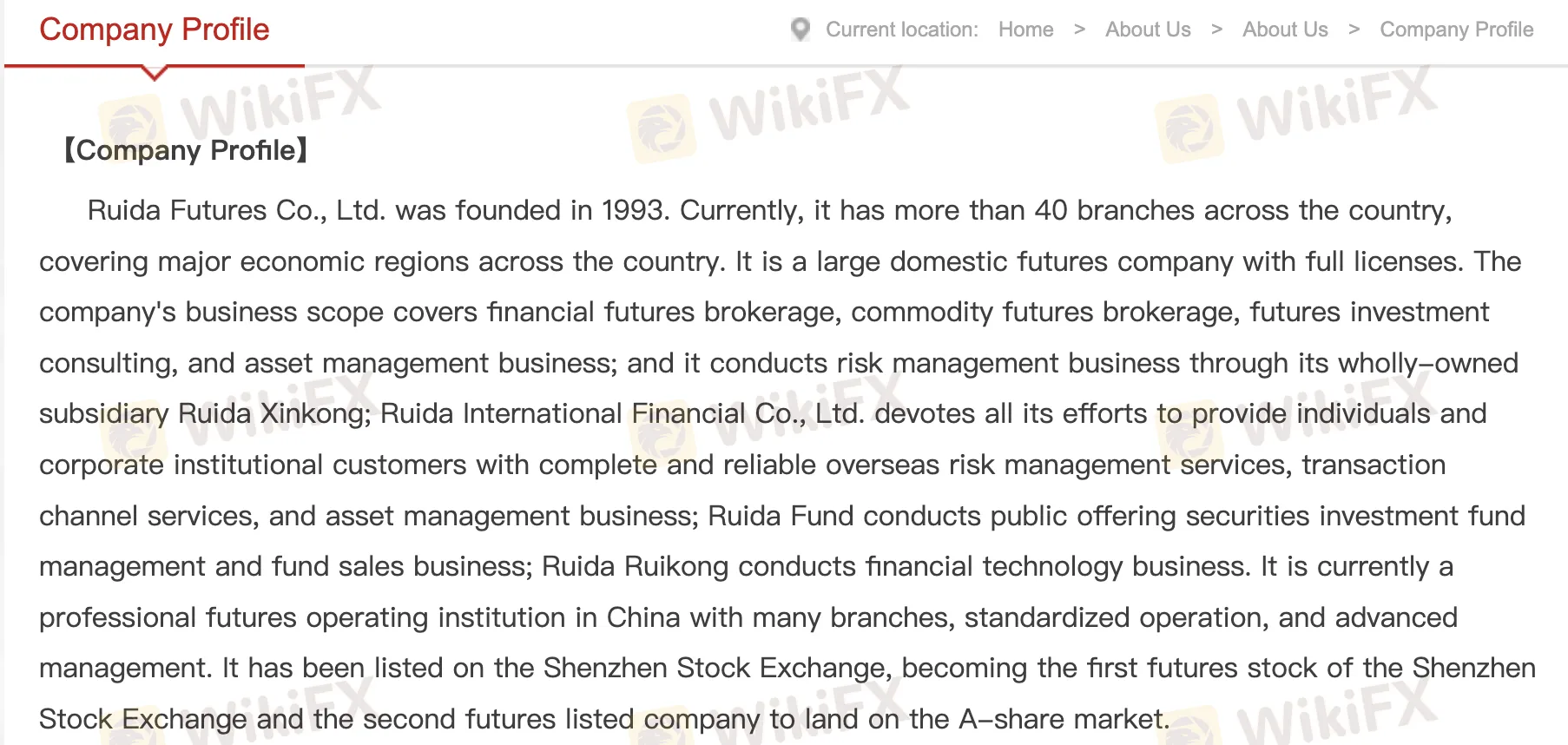

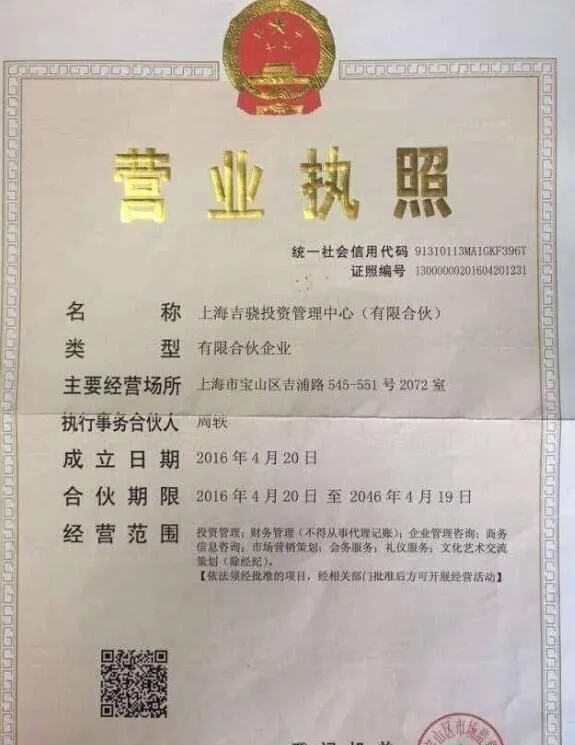

Ang Ruida Futures Co., Ltd., na itinatag noong 1993, ay isang lisensyadong kumpanya sa hinaharap ng Tsina na isinasailalim sa regulasyon ng China Financial Futures Exchange. Nag-aalok ito ng buong hanay ng mga serbisyo kabilang ang commodity at financial futures brokerage, investment consulting, asset management, at international risk management sa pamamagitan ng mga sangay nito.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Isinasailalim sa regulasyon ng CFFEX | May ilang mga plataporma na maaaring masyadong kumplikado para sa mga nagsisimula |

| Nag-aalok ng buong hanay ng futures at asset management services | Margin requirement 5% mas mataas kaysa sa base ng exchange |

| Maraming mga plataporma sa trading (desktop & mobile) |

Tunay ba ang RUIDA FUTURES?

Ang Ruida Futures Co., Ltd. (瑞达期货股份有限公司) ay isang lehitimong at isinasailalim sa regulasyon na institusyon sa pananalapi sa Tsina. Mayroon itong bisa na Futures License (License No. 0170) na inisyu ng China Financial Futures Exchange (CFFEX).

Mga Produkto at Serbisyo

Sa Tsina, nagbibigay ang Ruida Futures Co., Ltd. ng kumpletong hanay ng lisensyadong mga serbisyong pinansiyal, tulad ng brokerage para sa kalakal at pinansiyal na mga hinaharap, investment advising, at asset management. Bukod dito, nag-aalok ang kanilang mga kumpanya ng offshore risk management, fund management, at fintech services.

| Mga Produkto at Serbisyo | Supported |

| Commodity Futures Brokerage | ✔ |

| Financial Futures Brokerage | ✔ |

| Futures Investment Consulting | ✔ |

| Asset Management | ✔ |

| Overseas Risk Management (via Ruida Intl.) | ✔ |

| Transaction Channel Services (International) | ✔ |

| Public Fund Management (via Ruida Fund) | ✔ |

| Fund Sales Business | ✔ |

| Fintech Services (via Ruida Ruikong) | ✔ |

| Stock Trading | ✘ |

| Cryptocurrency Trading | ✘ |

RUIDA FUTURES Fees

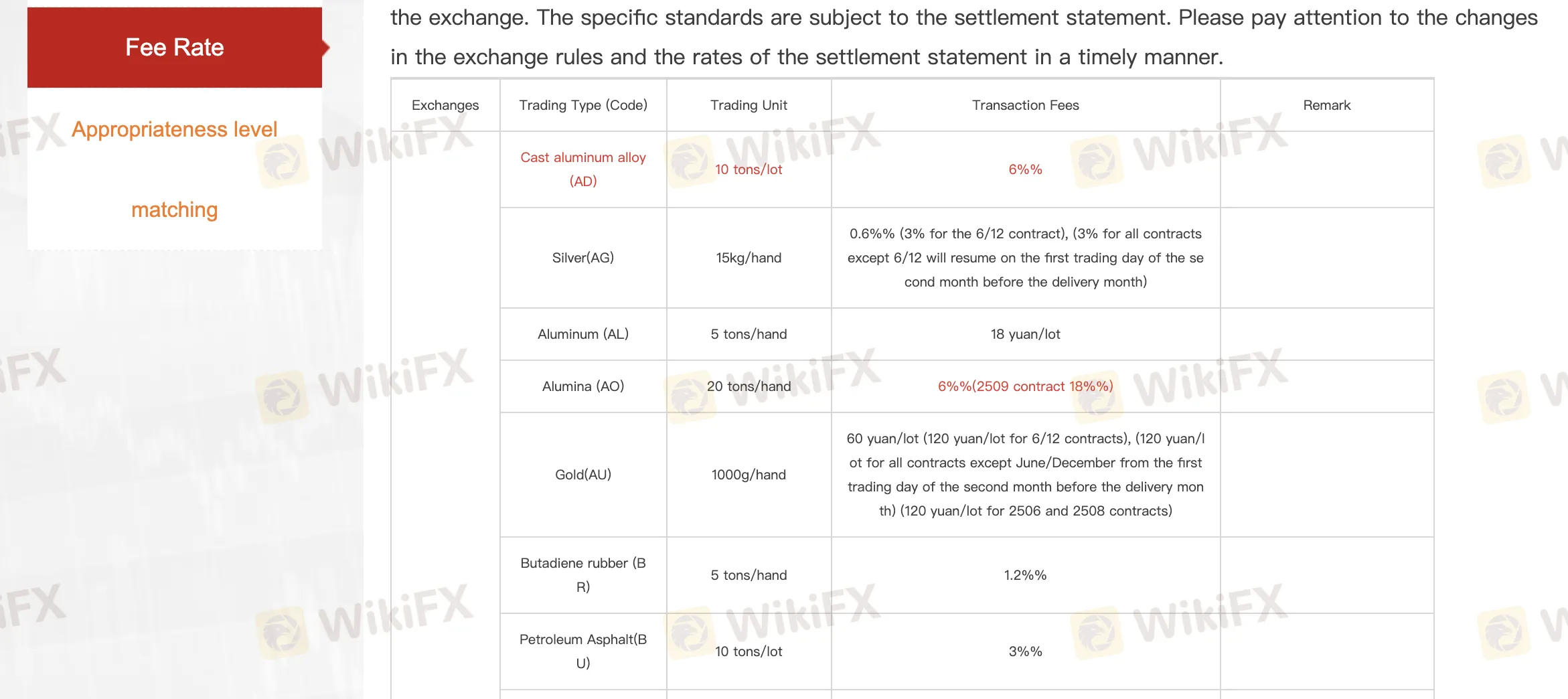

Ang mga bayad ng Ruida Futures ay karaniwang industry-standard, mayroong 5% na margin premium sa itaas ng mga kinakailangan ng palitan. Ang mga gastos sa pag-trade ay nag-iiba depende sa produkto—mayroong iba na singilin kada lot (e.g. ¥18/lot), samantalang ang iba naman ay sa pamamagitan ng porsyento (e.g. 3%). Ang mga trades na ginawa sa parehong araw at mga opsyon ay maaaring magdulot ng mas mataas o karagdagang bayad.

| Palitan | Major na Produkto | Karaniwang Bayad (kada lot) | Intraday Surcharge | Mga Puna |

| SHFE | Ginto, Pilak, Tanso, Rebar, Goma | 6–60 RMB o 0.6%–6% | Iba't ibang produkto 2× | Nag-iiba ang bayad depende sa buwan ng kontrata; maaaring tumaas ang margin malapit sa delivery |

| DCE | Soybeans, Mais, Iron Ore, PE, PP | 6–36 RMB o 0.6%–9% | Karaniwan para sa iron ore, coking coal | Iba't ibang presyo sa buwan ng delivery; mga pagkakaiba sa soy oil, mais |

| CZCE | Methanol, PTA, Rapeseed Meal, Glass | 6–180 RMB o 0.6%–12% | Oo, para sa mga kontrata tulad ng PTA, methanol | Mayroong mga produkto na may minimum na opening volume |

| CFFEX | CSI 300, SSE 50, CGB Futures | 18–90 RMB o 1.38% + 1 RMB/order | Oo (13.8%) | Naaplikahan sa stock index & bond futures; kasama ang mga opsyon |

| INE | Langis ng Krudo, Tanso, Langis ng Fuel | 60–120 RMB o 0.6%–3% | Oo (e.g., EC hanggang 72%) | Ang EC/SC ay may mataas na margin sa buwan ng delivery |

| GFEX | Lithium Carbonate, Silicon | 4.8%–6% o 12–18 RMB | Walang espesyal na intraday rates | Mga bagong kontrata; medyo mas mababang volume |

Platform/APP

| Platform/APP | Supported | Available Devices | Suitable For |

| Jinshida Trading System | ✔ | Desktop | Kumprehensibong futures trading |

| Midas Touch | ✔ | Desktop | Mabilis na pag-execute, panoramic order view |

| Ruida Futures Flagship App | ✔ | Mobile (iOS/Android) | One-stop account opening + trading |

| Boyi Master (5 & 7) | ✔ | Desktop | Market analysis, integrated “Lightning Hand” |

| Boyi APP | ✔ | Mobile | Mobile futures & options trading |

| Polestar V9.3 / V9.5 | ✔ | Desktop | Mabilis na trading, malalim na market analysis |

| Express Trading Terminal (V2/V3) | ✔ | Desktop | Real-time account data at mabilis na order functions |

| Infinite Easy (Ez & Pro) | ✔ | Desktop | Options trading, Excel export, custom strategies |

| Caishun | ✔ | Desktop | Arbitrage & long-term historical analysis |

| SP Trader (Lightning Trading) | ✔ | Desktop | Global futures with real-time quotes |

| Trading Pioneer / TBQuant | ✔ | Desktop | Systematic trading, multi-account management |

| Wenhua Yingshun / Wenhua Travel | ✔ | Desktop / Mobile | Technical analysis & intelligent trading |

| Tonghuashun Futures | ✔ | Desktop / Mobile | Futures quotes and trading |

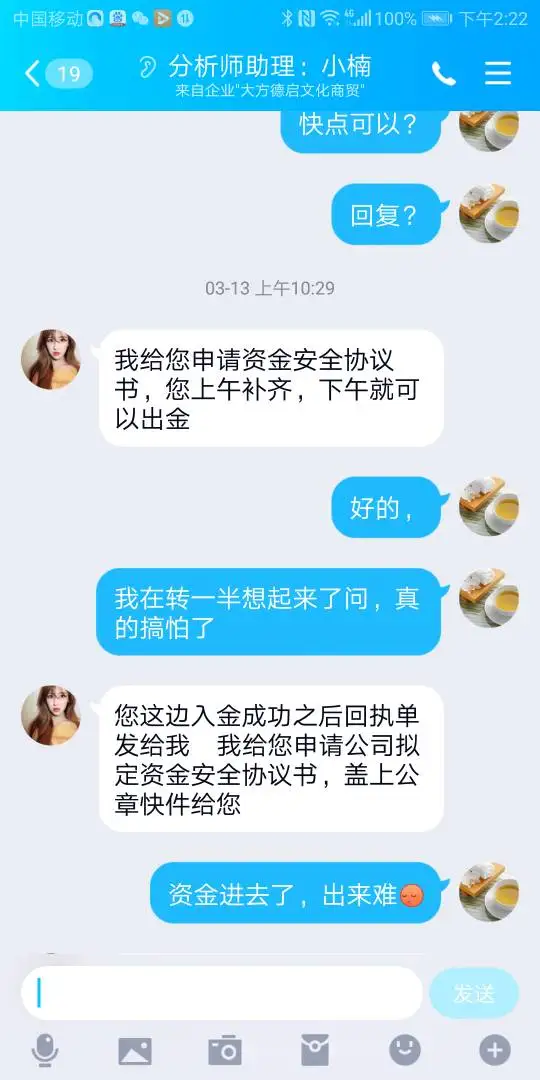

薇11六1四3零2七1

Hong Kong

2019年9月,我被拉入一个股票交流群,群里有金盈老师推荐了几只股票,都是连续拉涨停,还天天开直播介绍炒股技巧和介绍好票。再接下来就说股票行情不好挣钱太慢,做股指期货才能更快赚钱,于是在直播间让大家找经理开护、入金,并且每天在直播间晒图,跟进的群友轻轻松松就赚了几千美金。还有就是在股市里赔的钱,现在的行情是不可能挣回来的,只有通过炒指数分分钟就可以让你回本。 这些蛊惑让我动心了,觉得我也有时间,又有老师指导能在短时间内挣点钱,把股市亏本的钱挣回来就行。于是我开护了。我开护后,观察了几天,也问了群里的其他人出入金都能做,夸老师厉害!跟着老师吃肉之类的!又看到不少人已经开始操作赚钱了。就跟着老师操作。没想到一个星期就亏了42万,才觉得可能是骗局!

Paglalahad

FX6775882262

Hong Kong

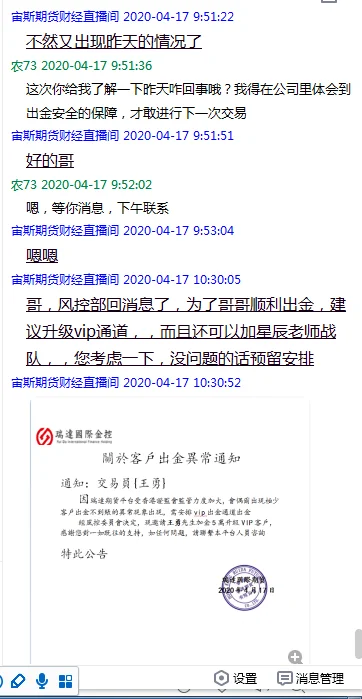

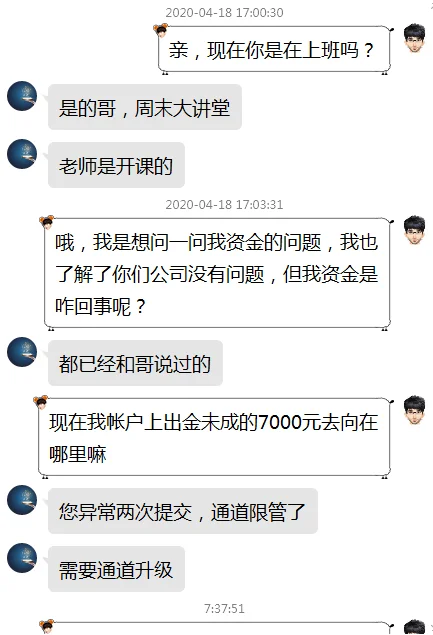

公司利用直播间诱导客户,周末都坚持讲授技术,客户联系助理出金不成后反应未果

Paglalahad

卿21224

Hong Kong

多次入金了,现在想出金不给出金,找助理所有的助理都是说要加金结果入金了后都不理,到现在都不给出金

Paglalahad

顺遂

Hong Kong

Iniloko ka nila sa pagdedeposito sa pamamagitan ng live na silid sa pamamagitan ng mababang bayad sa serbisyo at bonus. Pagkatapos sinabi sa iyo na kailangan mong mag-deposito upang mag-withdraw. Ngunit sa huli, hindi ka talaga makakabawi. Ang mga guro ay: Robin, JinShan, Zoe, GaoMing, TianYa, DongFang. Isang gang ng mga pandaraya. Papalitan nila ang kanilang sala at magpapatuloy sa pag-scam sa bawat ibang oras.

Paglalahad

李纯涛

Hong Kong

Isang serye ng mga traps. Mga sapilitan na deposito. Hindi makaatras pagkatapos.

Paglalahad

FX3688361241

Iraq

Nakita ko ang pagkakalantad mula kay Dawanshang at galit na galit ako. Naranasan ko ang parehong scam. Nagbayad ako ng ¥ 200,000 para sa iba't ibang bayarin. Ngunit sa huli, hindi ako makakaatras! Sana makasama tayo. Ang mga katulong na binanggit ni Dawanshang ay nakipag-ugnay din sa akin. Malas sila. Alam nila na hindi namin kayang ibigay ang aming pinaghirapang pera kaya't hinimok nila kami na magbayad ng iba't ibang bayarin. Iminumungkahi pa nila sa akin ang paghiram ng pera sa usurer. Ang parehong pagtatapos. Hindi maibalik ang pera. Mangyaring mag-isip ng isang paraan upang magsama.

Paglalahad

FX3688361241

Iraq

Maraming beses akong niloko: Una ang bayad tungkol sa paglipat ng account. Hindi raw nila natanggap ang pera. Kaya kailangan kong bayaran ulit. Pagkatapos ang bayad sa VIP, halos sampu-sampung libo ng yuan. Pagkatapos sinabi nila na ang impormasyon ng aking account ay mali, isa pang 180,000. Dapat tayong magkasama upang sila ay makulong!

Paglalahad

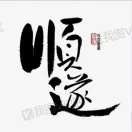

FX1926873034

Hong Kong

Isinampa ko na lang ang kaso. Niloko ako. Sa firdt, nagdeposito ako ng higit sa 100,000. Pagkatapos ay sumali ako sa isang aktibidad na tinatawag na plano ng operator, kumikita sa 950,000. Kailangan kong magbayad ng komisyon na 380,000. Magbayad ng komisyon na 200,000, makakakuha kami ng 300,000. Pagkatapos bayaran ang natitirang komisyon na 180,000, maaari naming bawiin ang lahat ng mga pondo. Kahapon, nagbayad ako ng 200,000 na komisyon ngunit hindi ako makaatras. Napagtanto kong niloko ako. Tumawag ako sa pulis.

Paglalahad

大晚上

Hong Kong

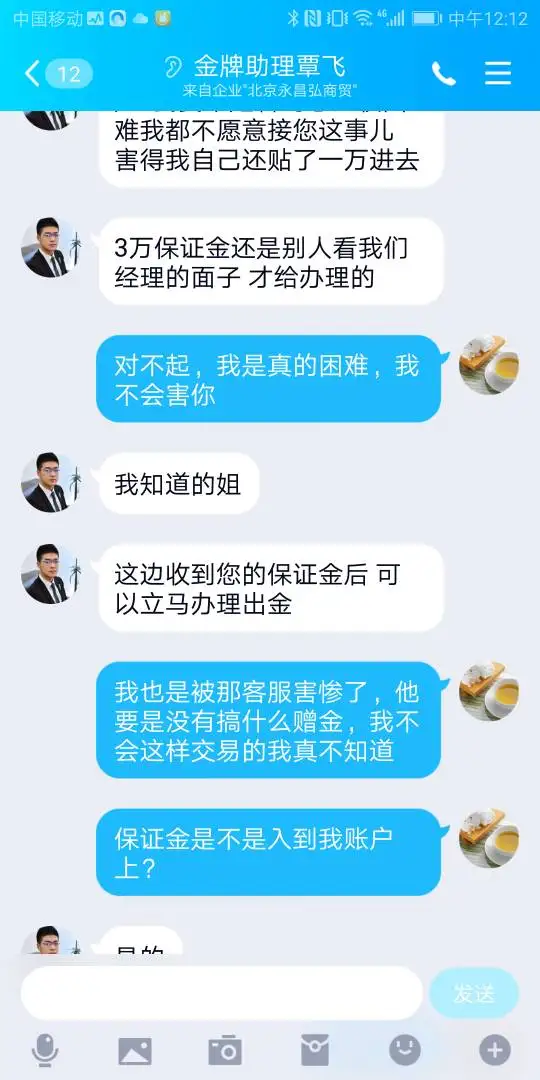

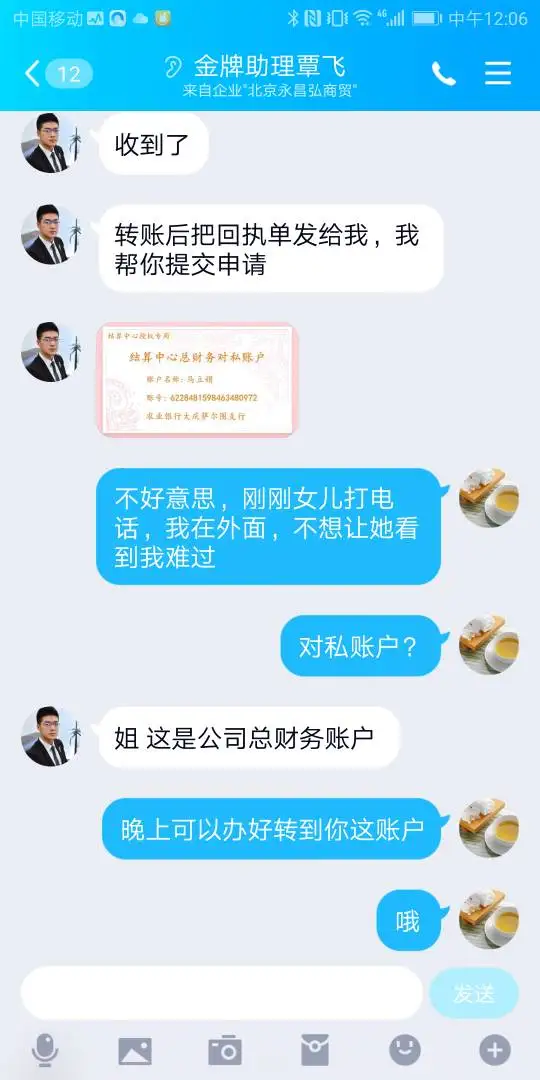

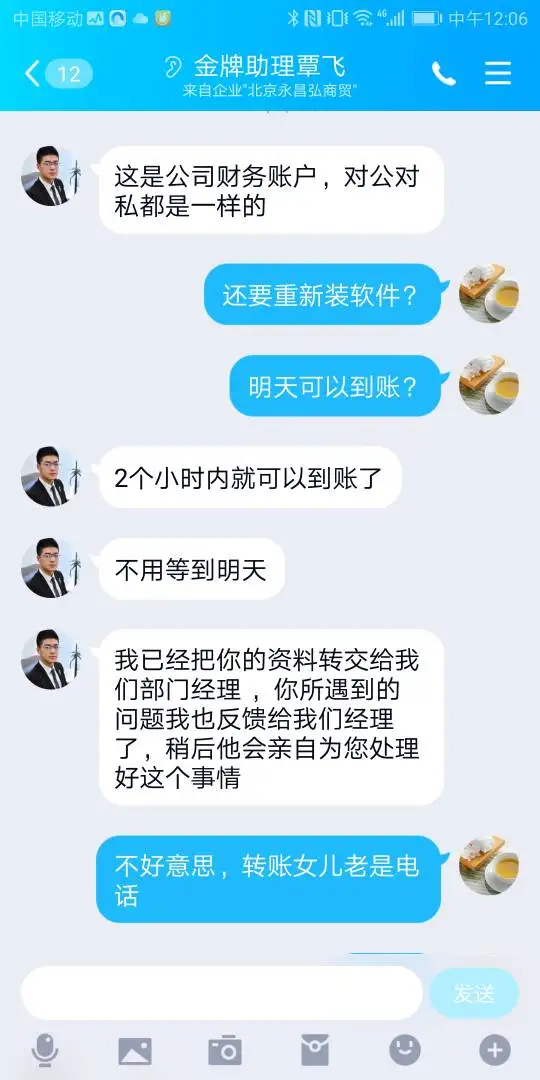

Isang clone ngRUIDA FUTURES . Nagsimula akong mamuhunan dito mula noong Mayo. At mawalan ng higit sa 50,000. Gusto kong mag-atras ngunit ang aking mga aplikasyon ay tinanggihan na may iba't ibang mga kadahilanan. Pagkatapos ay tinanong akong magbayad ng higit sa 20,000 upang mag-withdraw. Matapos kong magbayad, hiniling nila sa akin na bayaran ulit ito, ngunit hindi pa rin ako makaatras. Ang iba pang katulong, na tinatawag na Nana, ay niloko ako ng higit sa 70,000. Nang maglaon, sinabi sa akin ng Direktor ng Mga Operasyon na magbayad ng 10,000 upang mabawi ang lahat ng aking pondo. Sa wakas, ang tinaguriang pinuno ngRUIDA FUTURES sinabi sa akin na magbayad ng 7,000 bilang isang bayarin sa kaligtasan. Pinagtutuya ka nila ng pera

Paglalahad

86245

Hong Kong

Iudyok ako na magdeposito ngunit hindi ako maaaring mag-withdraw. SA una, sinabi nila na may hinala ako sa money laundering. Pagkatapos ay sinabi sa akin na ang aking halaga ng pangangalakal ay hindi sapat. Ngayon ay naiinip na sila.

Paglalahad

张勇7998

Hong Kong

Ang serbisyo ay hindi nagbigay ng pag-alis sa pag-alis ng dahilan ng error sa pagpopondo ng channel. Pagkatapos ay palagi itong binabalot sa akin, sinasabing sinusuri ito para sa akin. Panloloko!

Paglalahad

FX3327602342

Hong Kong

Ang kumpanya na ito ay kasalukuyang nagdaraya sa mga customer sa pagdeposito sa pamamagitan ng pagbubukas ng account. Kapag binubuksan ang isang account, doble akong nag-check sa serbisyo ng customer upang kumpirmahin na walang limitasyong limitasyon ng threshold. Ang pag-alis ng bonus ay may kondisyon sa laki ng laki, na makatuwiran. Ang mga capitals at kita ng kliyente ay maaaring malayang mai-deposito o iatras kahit papaano, na kung saan ay isang pamantayan sa buong industriya para sa isang regular na platform. Gayunpaman, nabigo akong mag-alis sa susunod na araw! Ano ang higit na hindi makatwiran na hindi ko matingnan ang aking account! Ipinaliwanag ng serbisyo sa customer na ito ay para sa kaligtasan ng mga pondo. Hindi ma-aktibo ang aking account nang hindi maabot ang deposit threshold! Ang palitan ay nakakita ng mataas na peligro! Anong kalokohan! Nakilala ko na ang mga kondisyon ng pagbubukas ng margin na nagpapahintulot sa akin na magbukas ng mga posisyon nang walang karagdagang deposito. Ngunit sa huli, kailangan kong magdeposito ng isa pang CNY 50,000 upang mag-alis! Pinipilit kong linlangin ako! Ang pag-aalis ay ang pinakamahalaga. Ang anumang dahilan para sa pagtanggi sa pag-alis ay walang katuturang! Tanging ang mga pandaraya lamang ang makakaya ng ganito! Maging maingat!

Paglalahad

留香

Hong Kong

Ang pandaraya inveigled mga kliyente na magdeposito ng pondo at nagbigay ng hindi pagtanggi sa pagbabawas ng panganib ng pondo, na humihiling sa akin na magdagdag ng pondo.

Paglalahad

薇11六1四3零2七1

Hong Kong

今年9月份的时候,我于机缘巧合之下被人拉进了直播间,里面有四个老师讲课,老师们开始讲股票还会推荐股票,讲的好推荐的也准,我跟着买了几次都有小赚。就一直去听课,听了一段时间老师推荐的股票亏了之后,老师说现在股票行情不好,收益低,还是做股指、期货赚钱,可以带大家到瑞达期货做股指、期货一起发财,说着还晒出自己盈利的账户。我刚开始的时候打算考虑考虑在做,后来看到群里赚的人越来越多,有点经不住诱惑找到开户专员投了56万,可没想到不到两个星期直接亏光了,当时我都懵了,老师我去问老师老师要就不回我消息要就找各种借口说什么投资本来就有风险,群也把我踢了。

Paglalahad