Buod ng kumpanya

| SOCIETE GENERALE Buod ng Pagsusuri | |

| Itinatag | 2000 |

| Rehistradong Bansa/Rehiyon | China |

| Regulasyon | Walang Regulasyon |

| Mga Produkto sa Kalakalan | Mga Ekitya, equity derivatives, currencies |

| Demo Account | / |

| Leverage | / |

| Spread | / |

| Plataforma ng Kalakalan | / |

| Minimum na Deposito | / |

| Suporta sa Customer | Social Media: LinkedIn, Twitter, YouTube |

| Address: 29 Boulevard Haussmann, 75009 Paris, France | |

Impormasyon Tungkol sa SOCIETE GENERALE

Ang SOCIETE GENERALE ay itinatag noong 2000 at rehistrado sa China. Nag-aalok ito ng malawak na hanay ng mga serbisyong pang-seguridad, kabilang ang mga stocks at derivatives, fixed income at foreign exchange, clearing services, custody services, at liquidity management.

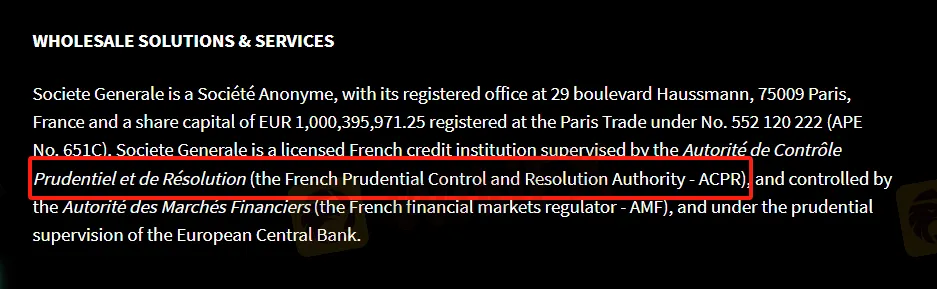

Bagaman ito ay nagmamalaki na ito ay nireregula ng French ACPR, hindi ito regulado. Dapat mag-ingat ang mga mamumuhunan pagdating sa kaligtasan at transparensya ng pondo. Nakikipag-ugnayan ang kumpanya sa mga customer sa pamamagitan ng iba't ibang mga channel, kabilang ang LinkedIn, Twitter, at YouTube, ngunit kulang sa detalyadong paliwanag ng mga deposito, withdrawals, at iba pang mahahalagang impormasyon.

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

| Iba't ibang mga produkto at serbisyo ang inaalok | Walang regulasyon |

| Unclear fee structure | |

| Walang impormasyon sa deposito at withdrawal | |

| Walang direktang channel ng contact |

Tunay ba ang SOCIETE GENERALE?

Bagaman ang SOCIETE GENERALE ay nagmamalaki na ito ay nireregula ng ACPR, ito ay hindi regulado. Dapat mag-ingat ang mga mangangalakal sa pagtitingin-tinging mag-trade.

Mga Produkto at Serbisyo

SOCIETE GENERALE nag-aalok ng kumprehensibong mga serbisyong pang-seguridad na sumasaklaw sa mga Ekwalidad at Deribatibong Ekwalidad, Fixed Income at Salapi, Prime Services at Clearing, Quantitative Investment Strategies, Bernstein Cash Equity Trading at Equity Research, Cross Asset Research, Cross Asset Solutions, Positive Impact Finance, SG Markets, Clearing Services, Custody at Trustee Services, Retail Custody Services, Liquidity Management, Fund Administration, Asset Servicing, Fund Distribution, Global Issuer Services.

| Mga Produkto | Magagamit |

| Ekwalidad | ✔ |

| Deribatibong Ekwalidad | ✔ |

| Salapi | ✔ |

| Mga Kalakal | ❌ |

| Mga Indise | ❌ |

| Mga Cryptocurrency | ❌ |

| Mga Obligasyon | ❌ |

| Mga Opsyon | ❌ |

| Mga ETF | ❌ |