公司簡介

| SOCIETE GENERALE 評論摘要 | |

| 成立年份 | 2000 |

| 註冊國家/地區 | 中國 |

| 監管 | 無監管 |

| 交易產品 | 股票、股票衍生品、貨幣 |

| 模擬帳戶 | / |

| 槓桿 | / |

| 點差 | / |

| 交易平台 | / |

| 最低存款 | / |

| 客戶支援 | 社交媒體:LinkedIn、Twitter、YouTube |

| 地址:法國巴黎75009號29大道豪斯曼 | |

SOCIETE GENERALE 資訊

SOCIETE GENERALE 成立於2000年,並在中國註冊。提供廣泛的證券服務,包括股票和衍生品、固定收益和外匯、結算服務、托管服務和流動性管理。

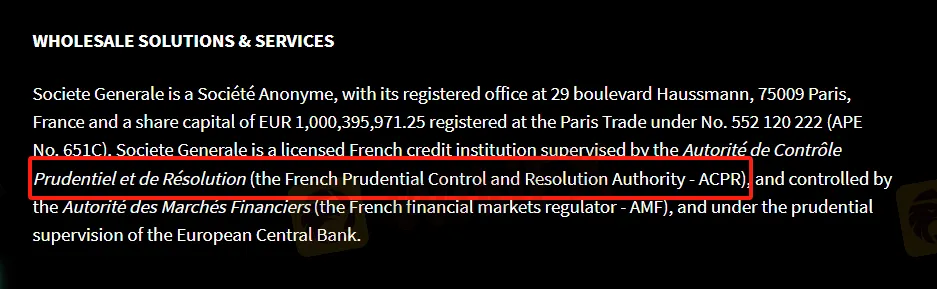

儘管聲稱受法國ACPR監管,但實際上並未受到監管。投資者應對基金安全和透明度保持警惕。該公司通過多個渠道與客戶互動,包括LinkedIn、Twitter和YouTube,但缺乏有關存款、提款和其他重要信息的詳細說明。

優缺點

| 優點 | 缺點 |

| 提供多種產品和服務 | 無監管 |

| 收費結構不清晰 | |

| 沒有存款和提款信息 | |

| 沒有直接聯絡渠道 |

SOCIETE GENERALE 是否合法?

儘管 SOCIETE GENERALE 聲稱受ACPR監管,但實際上並未受到監管。交易者在交易時應保持警惕。

產品和服務

SOCIETE GENERALE 提供全面的證券服務,涵蓋股票和股票衍生品、固定收益和貨幣、首席服務和結算、量化投資策略、伯恩斯坦現金股票交易和股票研究、跨資產研究、跨資產解決方案、積極影響金融、SG市場、結算服務、托管和受託服務、零售托管服務、流動性管理、基金管理、資產服務、基金分銷、全球發行人服務。

| 產品 | 可用 |

| 股票 | ✔ |

| 股票衍生品 | ✔ |

| 貨幣 | ✔ |

| 大宗商品 | ❌ |

| 指數 | ❌ |

| 加密貨幣 | ❌ |

| 債券 | ❌ |

| 期權 | ❌ |

| ETFs | ❌ |