Buod ng kumpanya

| CGSCIMB Buod ng Pagsusuri | |

| Itinatag | 2018 |

| Rehistradong Bansa/Rehiyon | Thailand |

| Regulasyon | Walang regulasyon |

| Mga Instrumento sa Merkado | Forex, Equities, Derivatives, Mutual Funds, Bonds |

| Demo Account | / |

| Levage | / |

| Spread | / |

| Platform ng Paggagalaw | WebTrader, Mobile App |

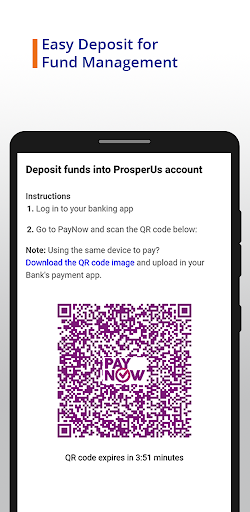

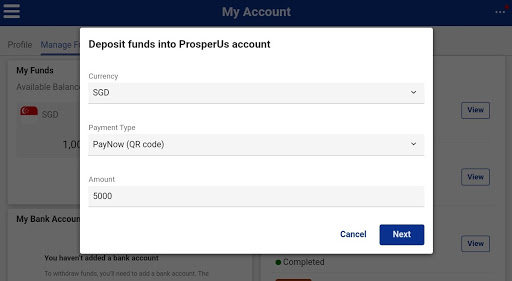

| Minimum na Deposito | / |

| Suporta sa Customer | Tel: 02-846-8689 |

| Email: bk.etrade@cgsi.com | |

| Social media: Line, YouTube, Facebook | |

| Address: 130-132 Sindhorn Tower 2, 2nd, 3rd Floor and Sindhorn Tower 3, 12th Floor Wireless Road, Lumpini, Pathumwan, Bangkok 10330 | |

Impormasyon Tungkol sa CGSCIMB

Ang CGSCIMB ay isang broker na nakabase sa Thailand na itinatag noong 2018, na walang regulasyon. Nag-aalok ito ng iba't ibang uri ng mga instrumento sa merkado, kabilang ang Forex, Equities, Derivatives, Mutual Funds, at Bonds.

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

| Iba't ibang mga aset sa pagtitingi | Walang regulasyon |

| Mga promosyon na inaalok | Limitadong impormasyon sa mga kondisyon ng pagtitingi |

| Walang MT4/MT5 | |

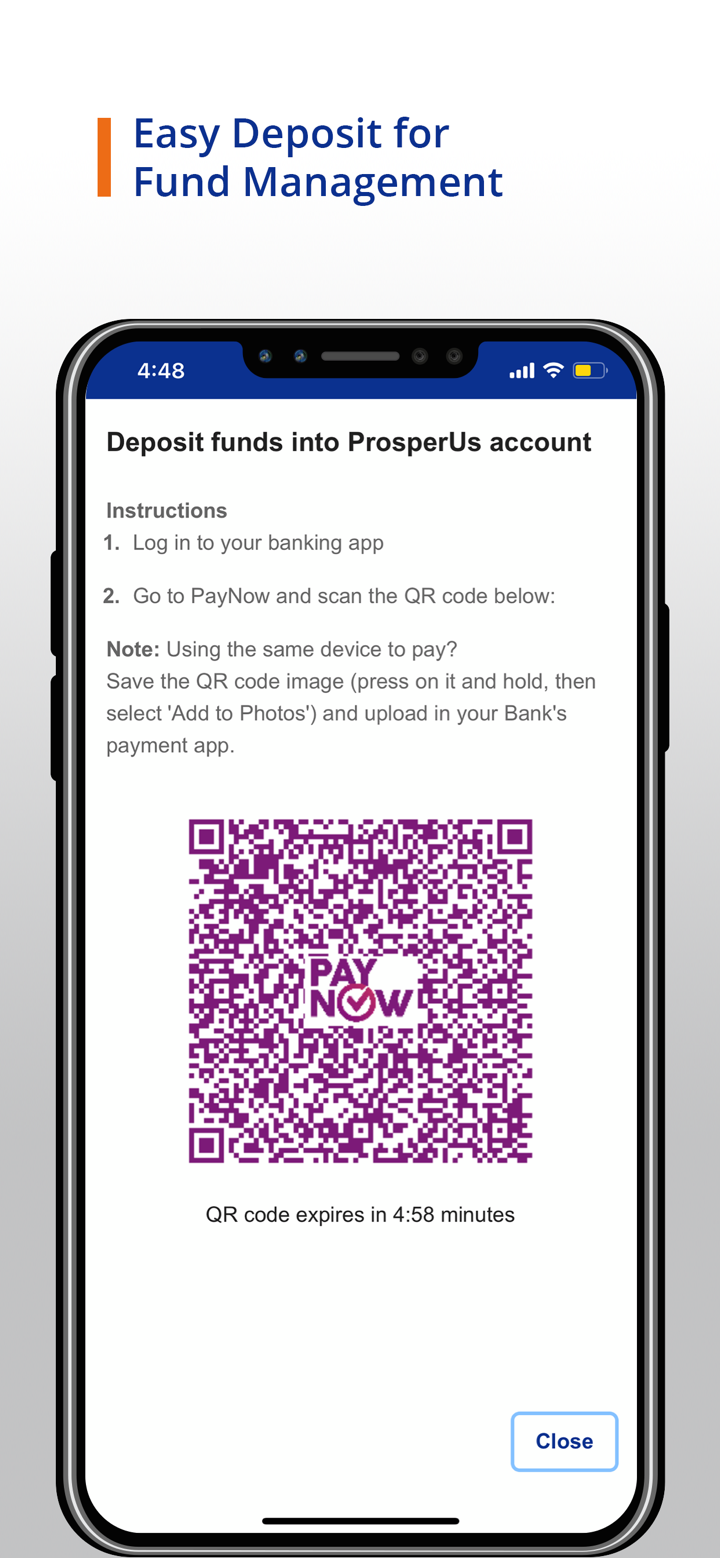

| Walang impormasyon sa pagdedeposito at pagwiwithdraw |

Tunay ba ang CGSCIMB?

CGSCIMB sa ngayon ay walang mga wastong regulasyon. Mangyaring maging maingat sa panganib!

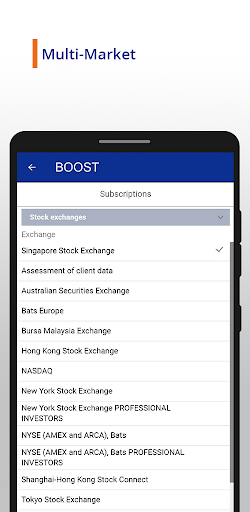

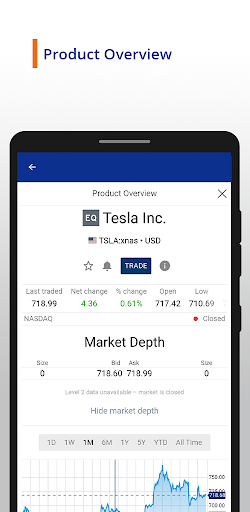

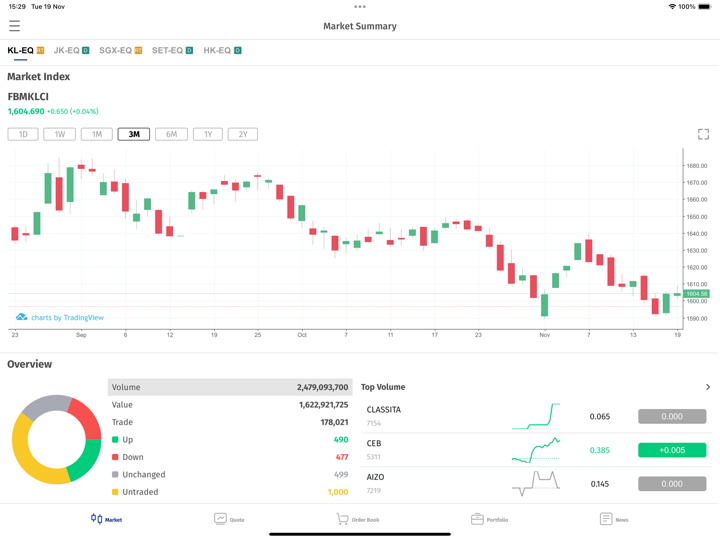

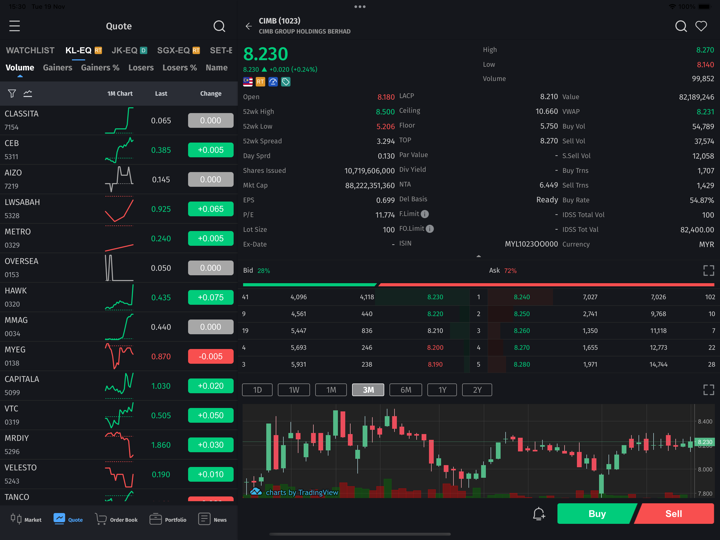

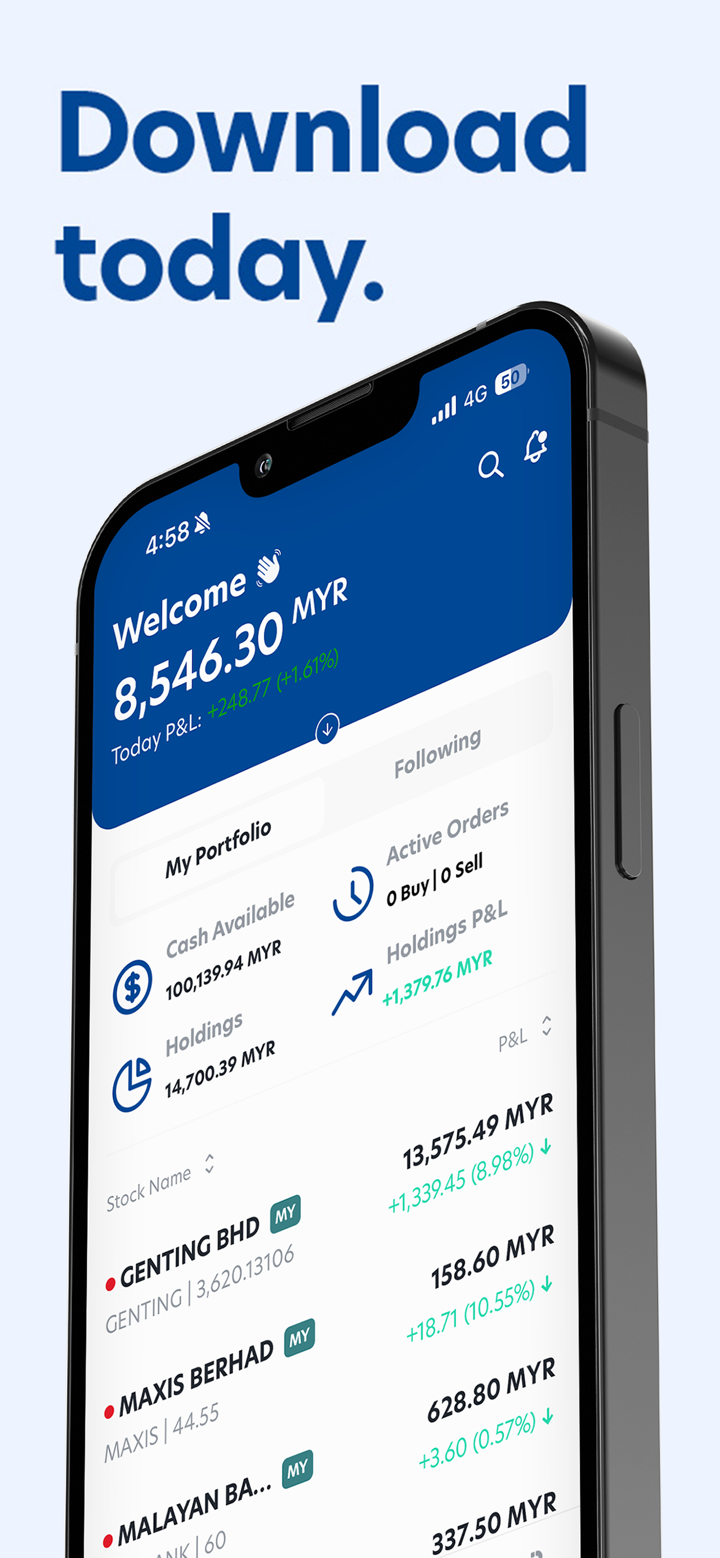

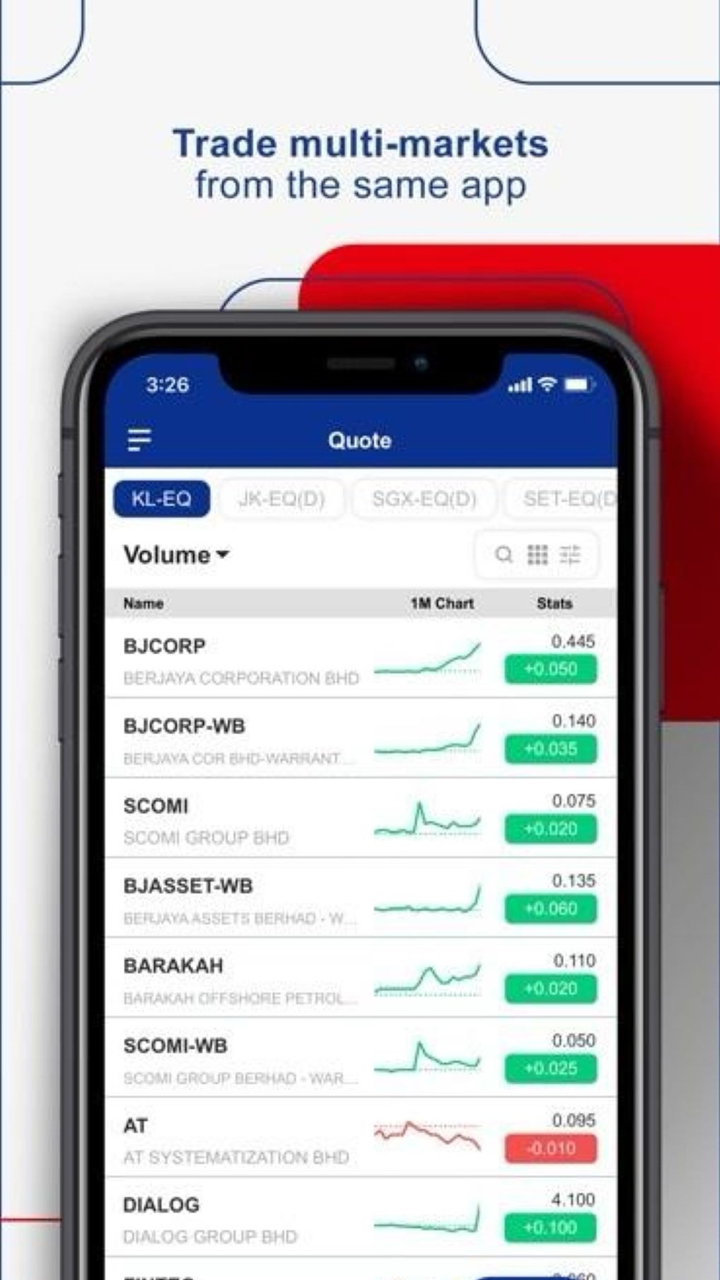

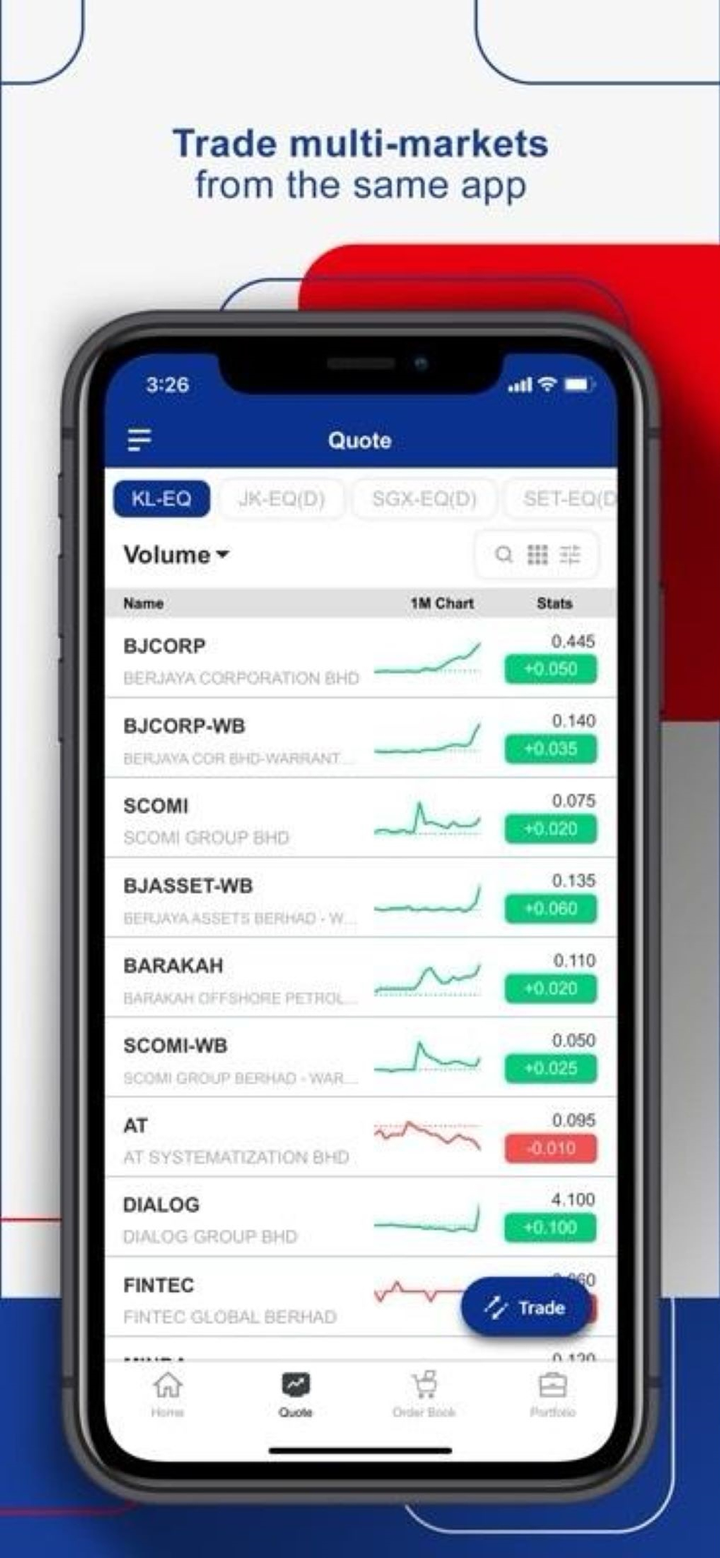

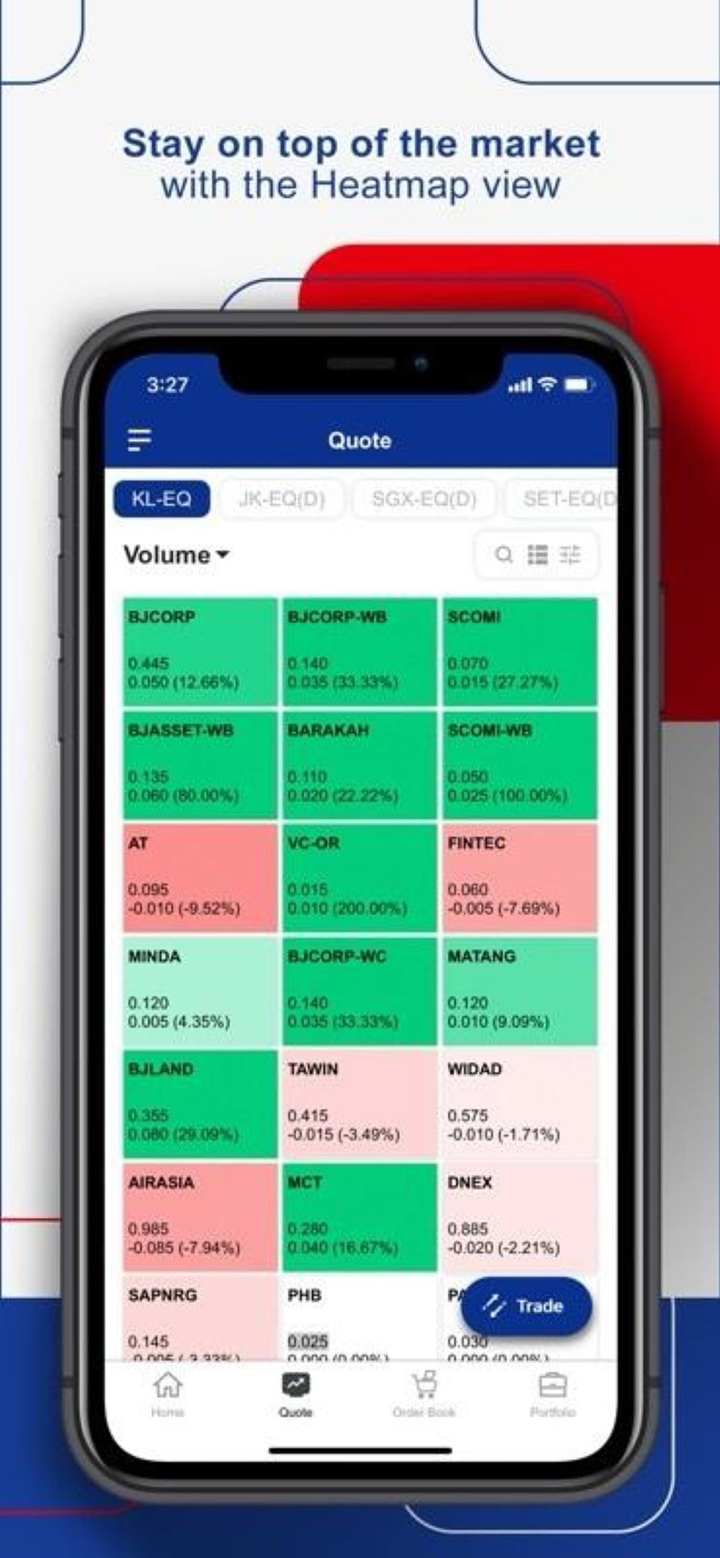

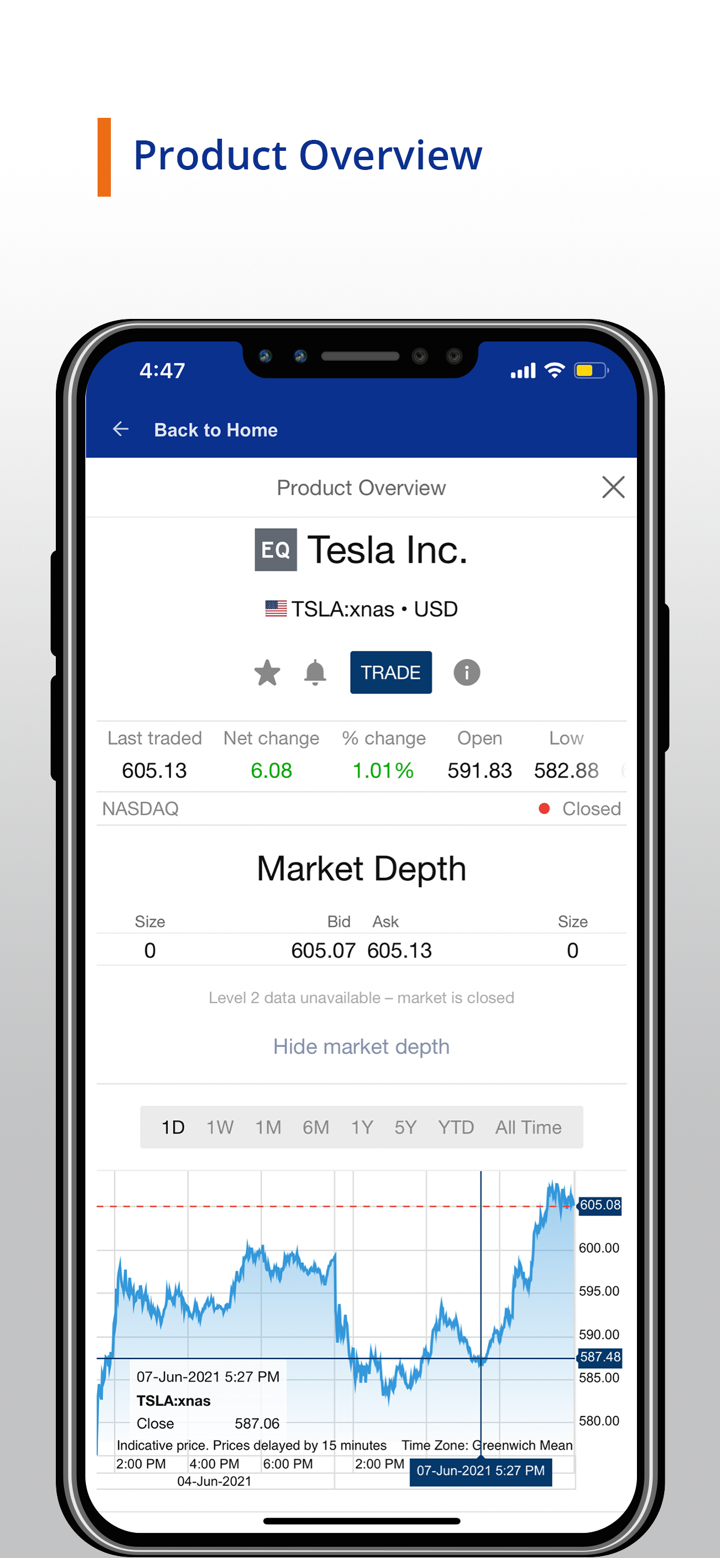

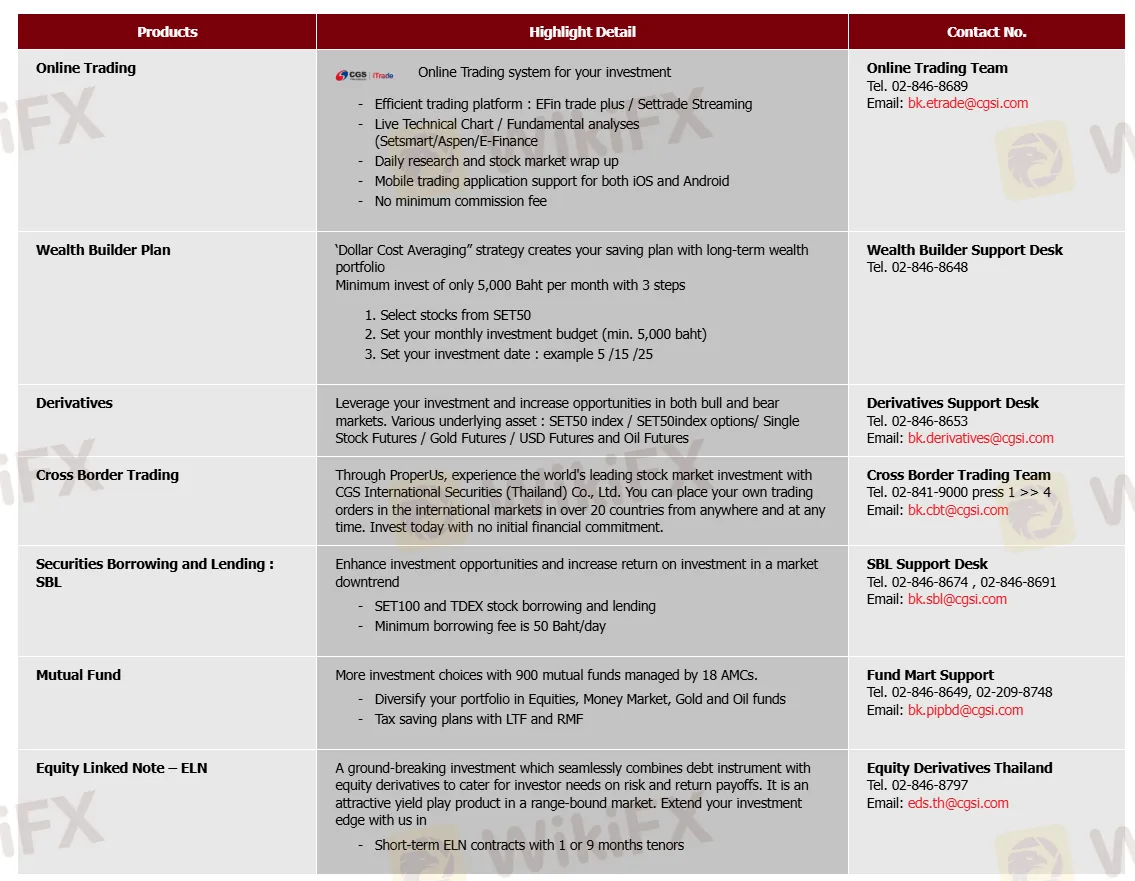

Ano ang Maaari Kong I-Trade sa CGSCIMB?

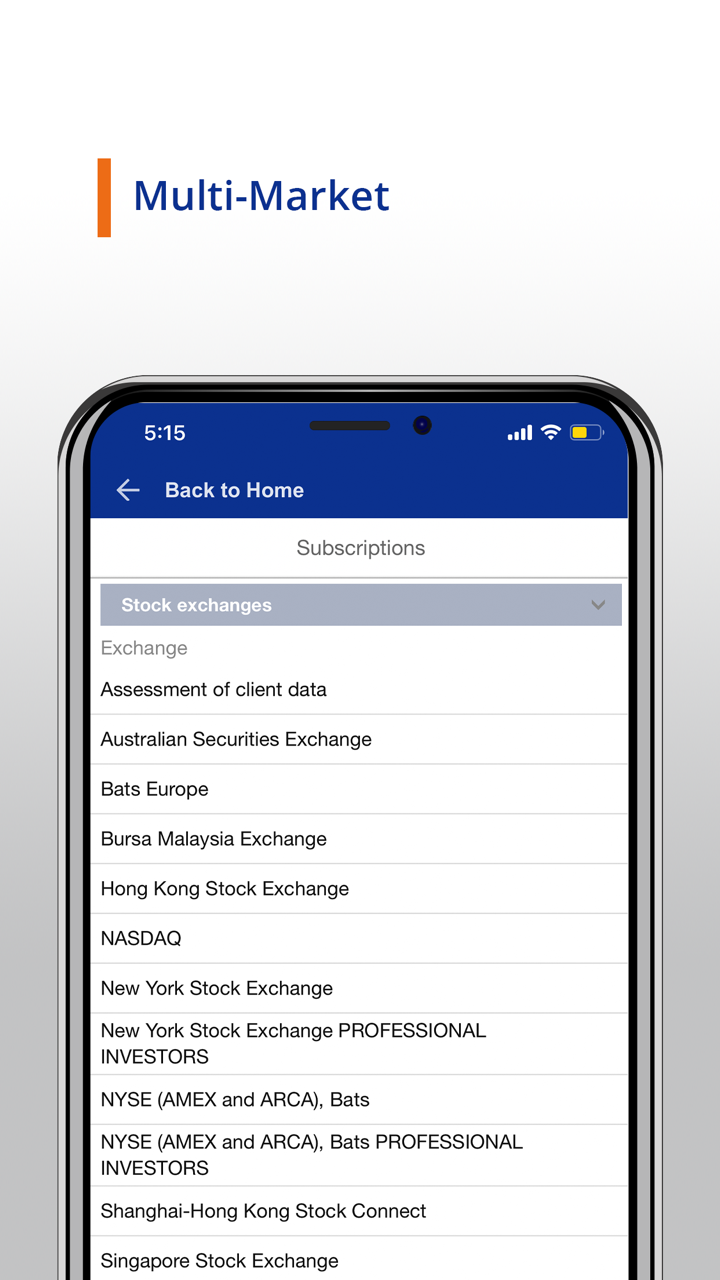

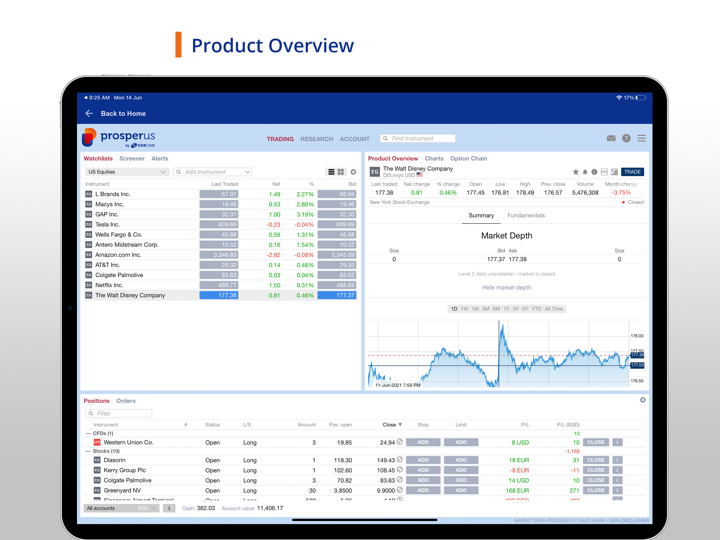

| Mga Tradable na Kasangkapan | Supported |

| Forex | ✔ |

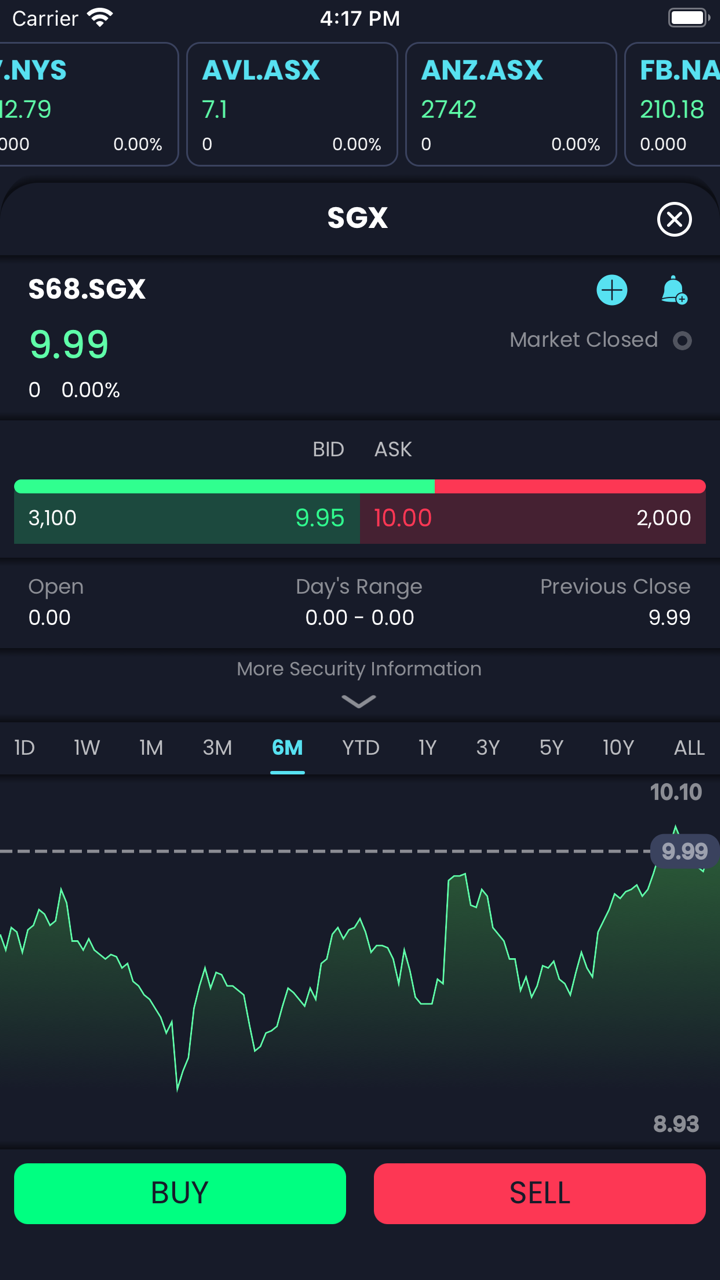

| Equities | ✔ |

| Derivatives | ✔ |

| Mutual Funds | ✔ |

| Bonds | ✔ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

| ETFs | ❌ |

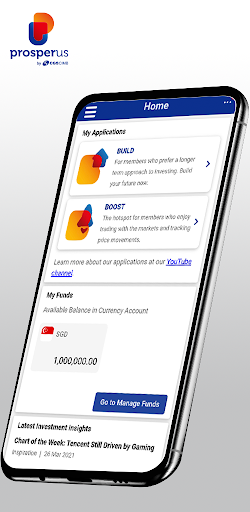

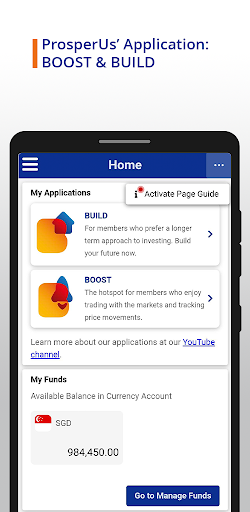

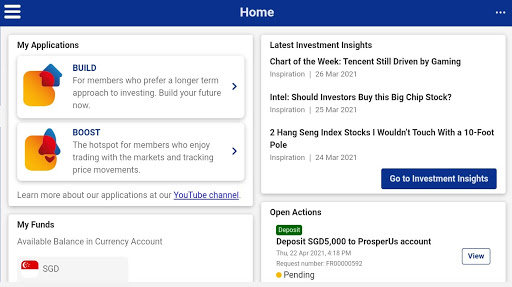

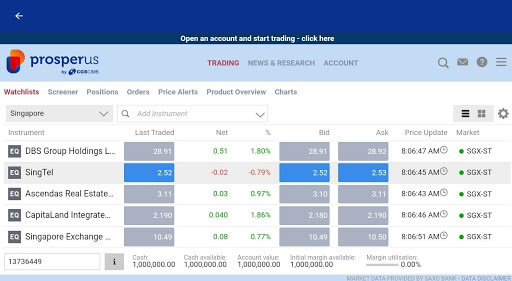

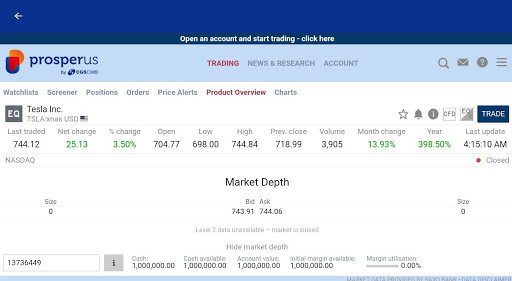

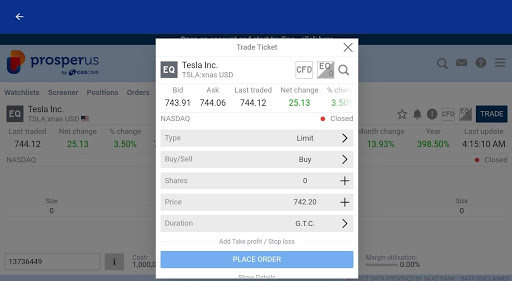

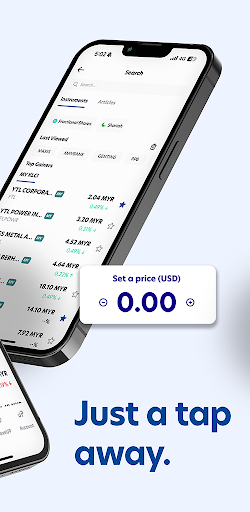

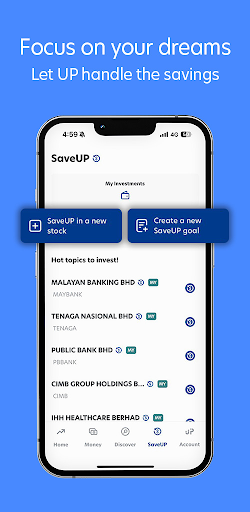

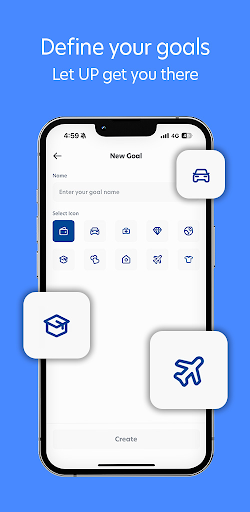

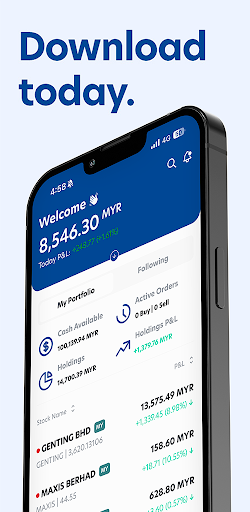

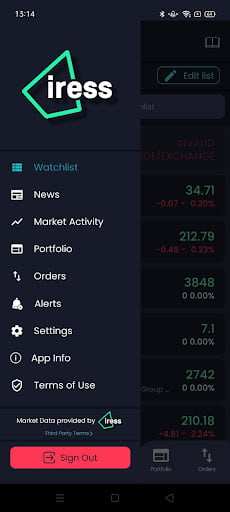

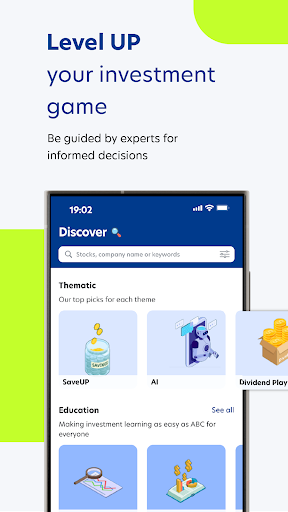

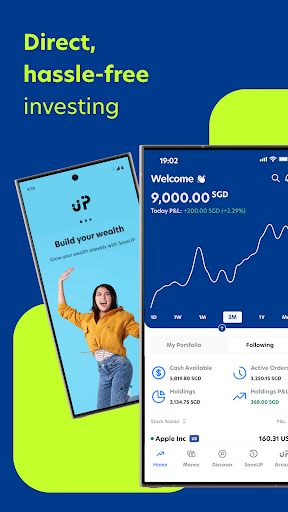

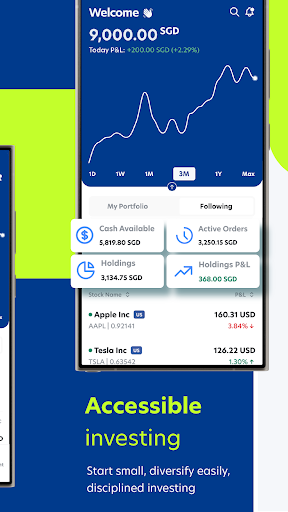

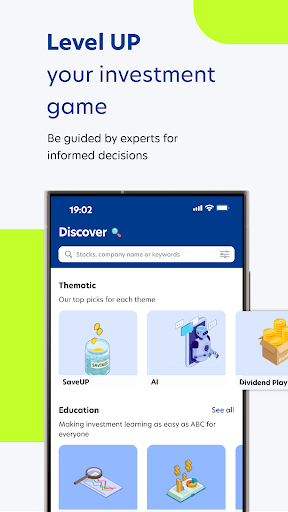

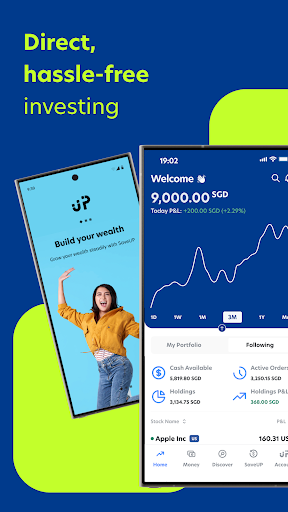

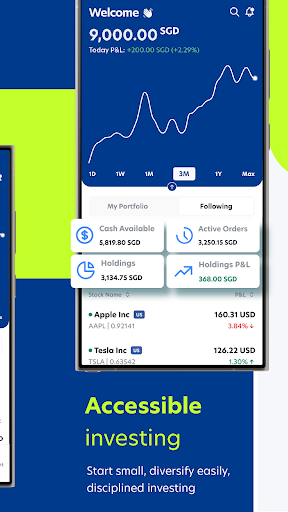

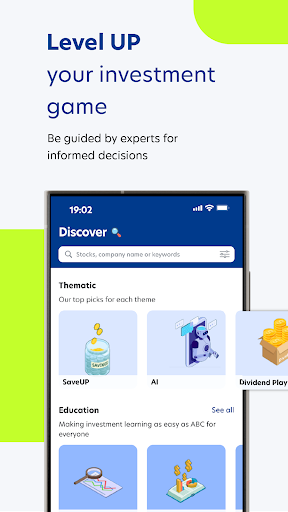

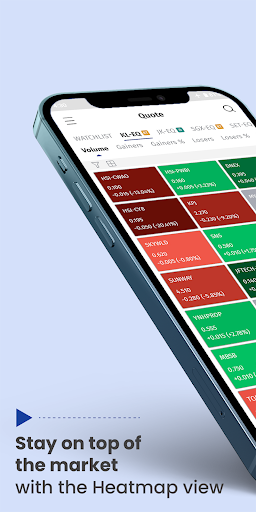

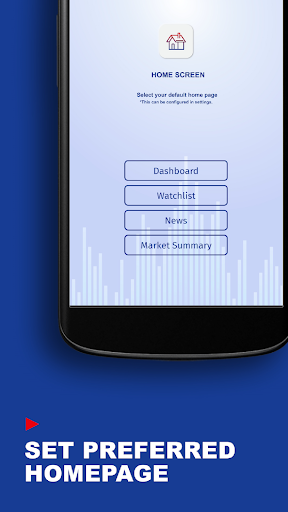

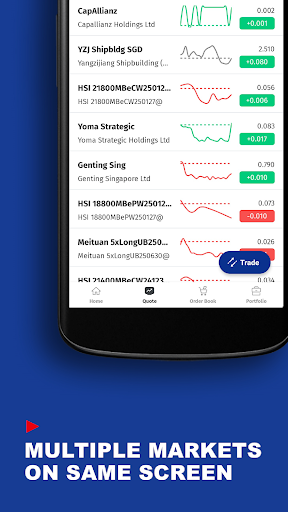

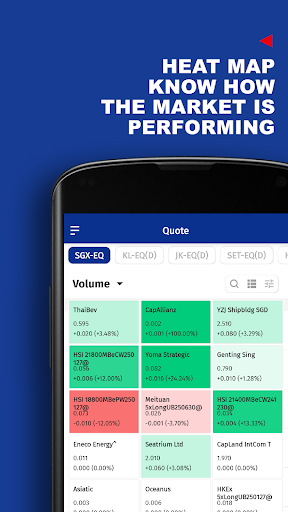

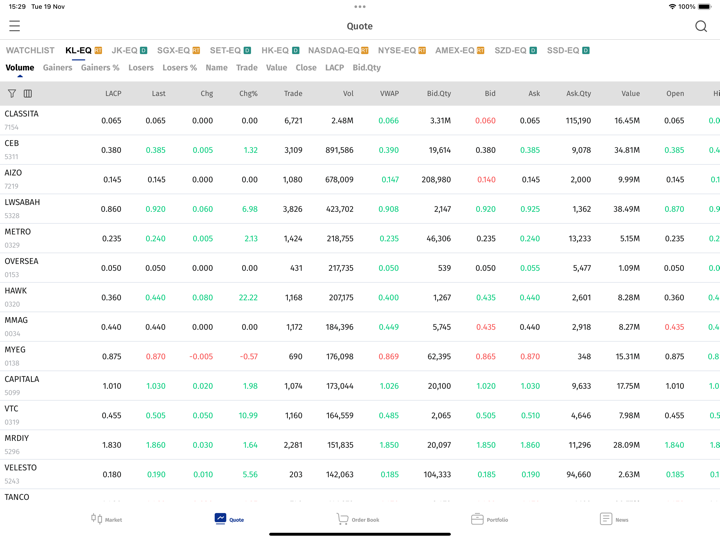

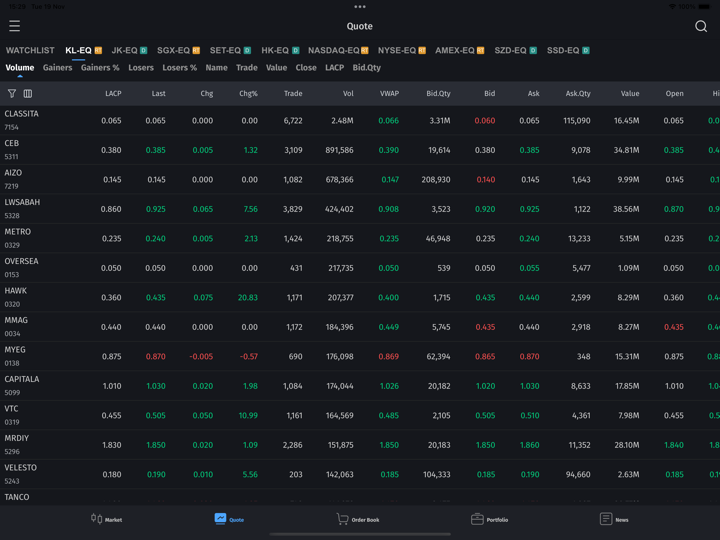

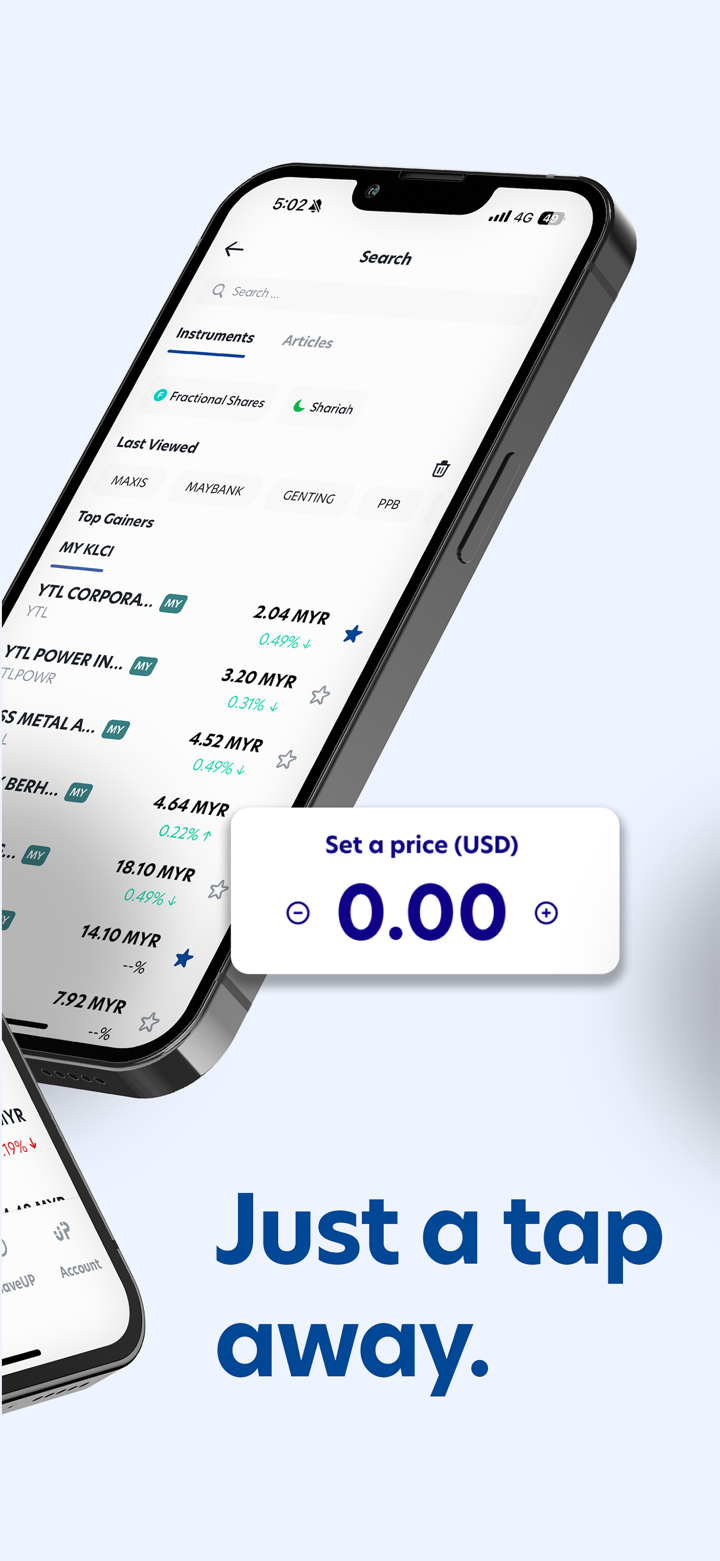

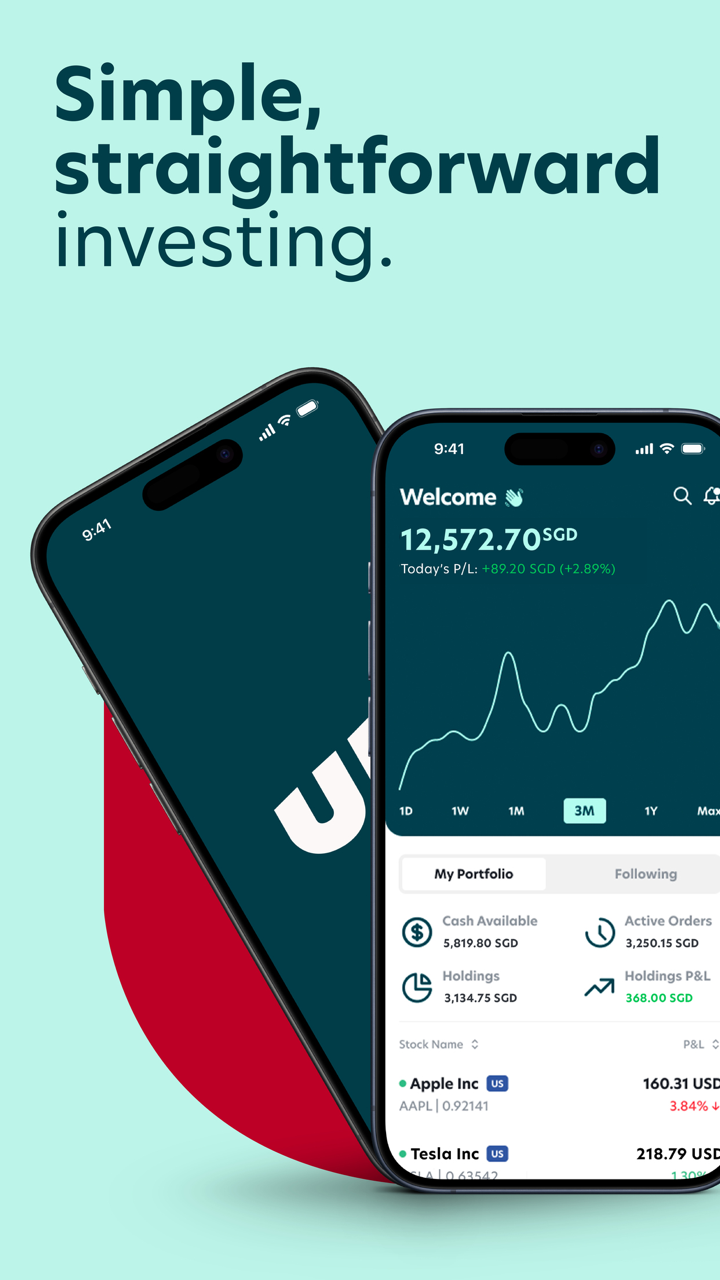

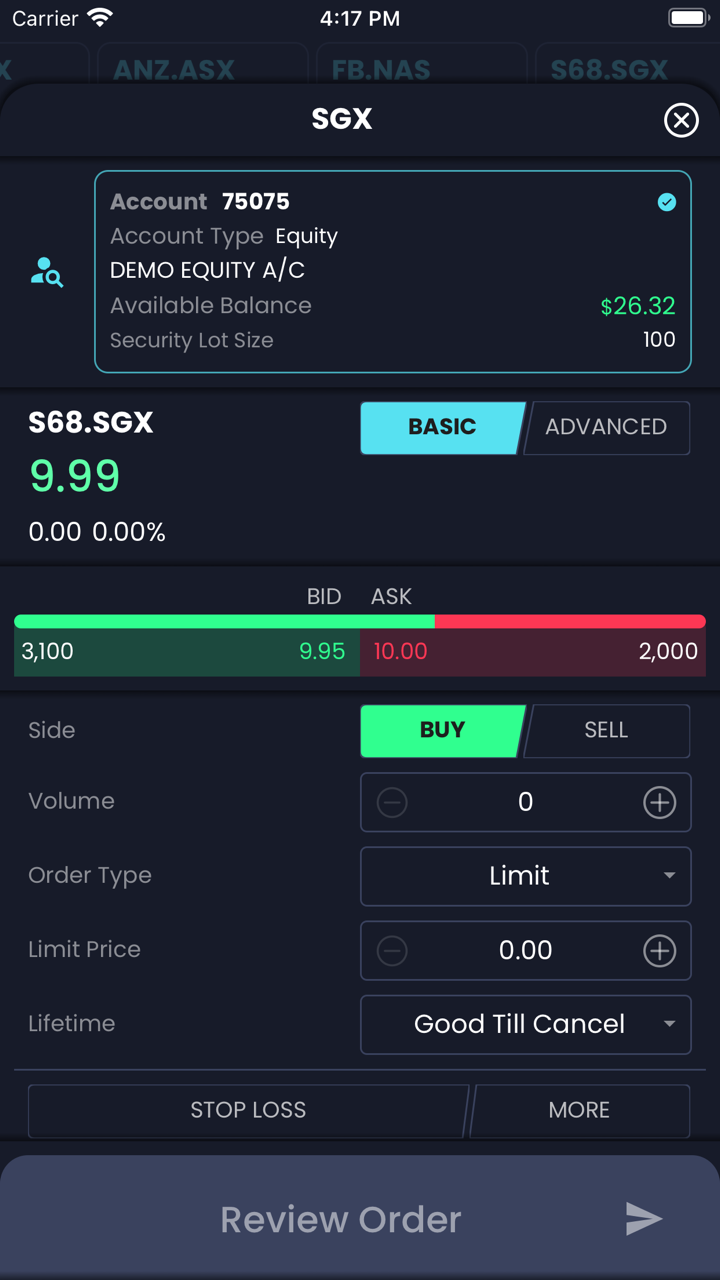

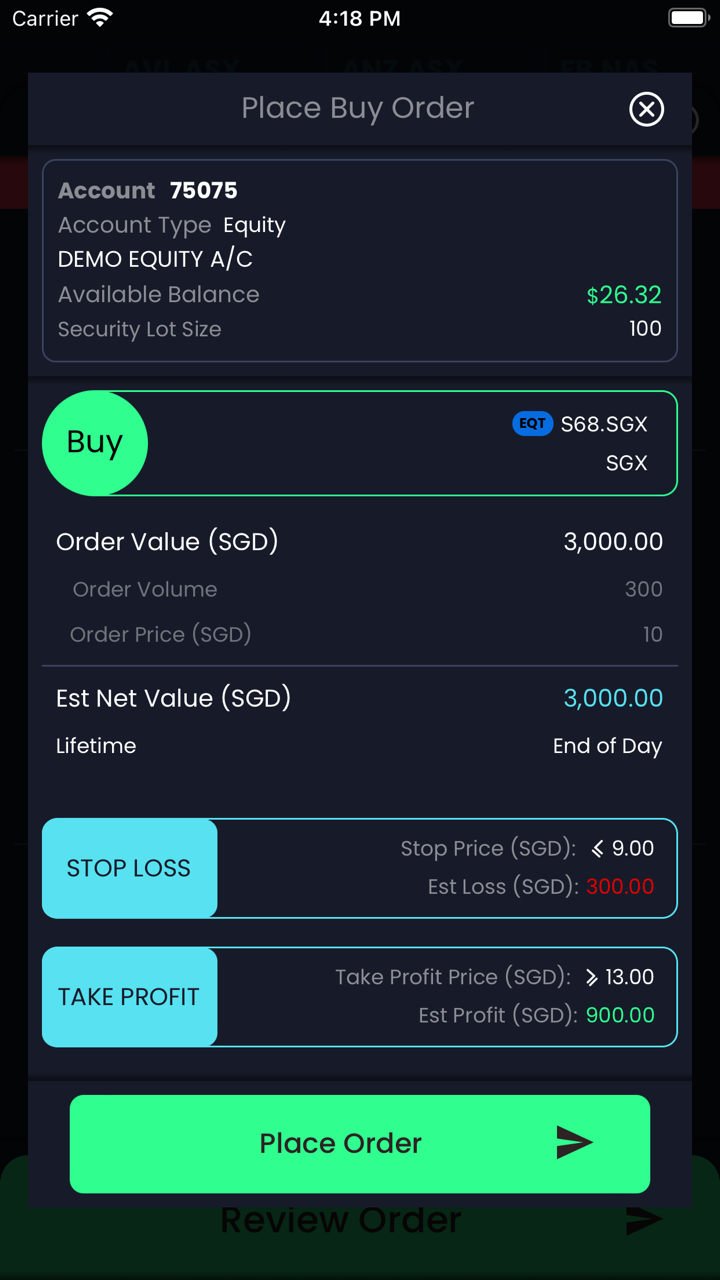

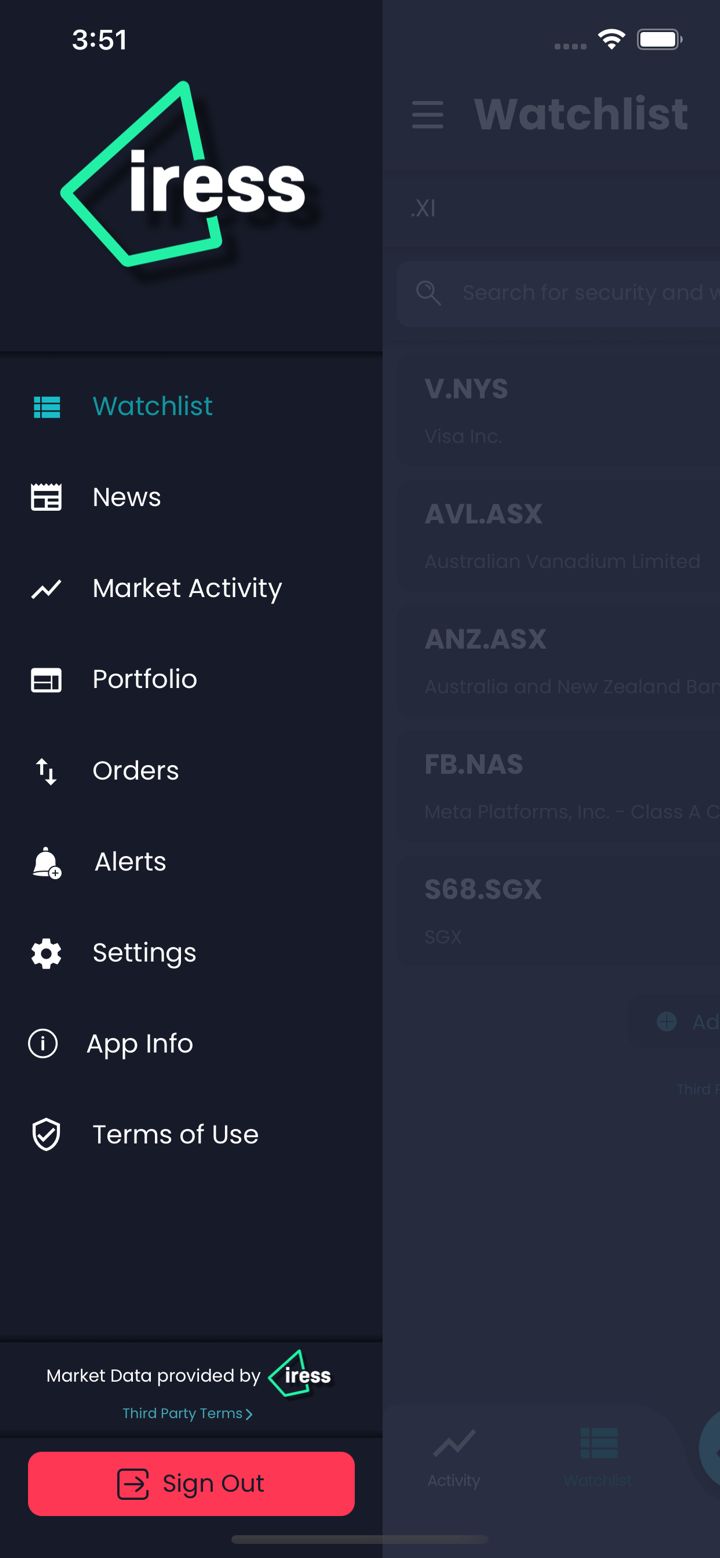

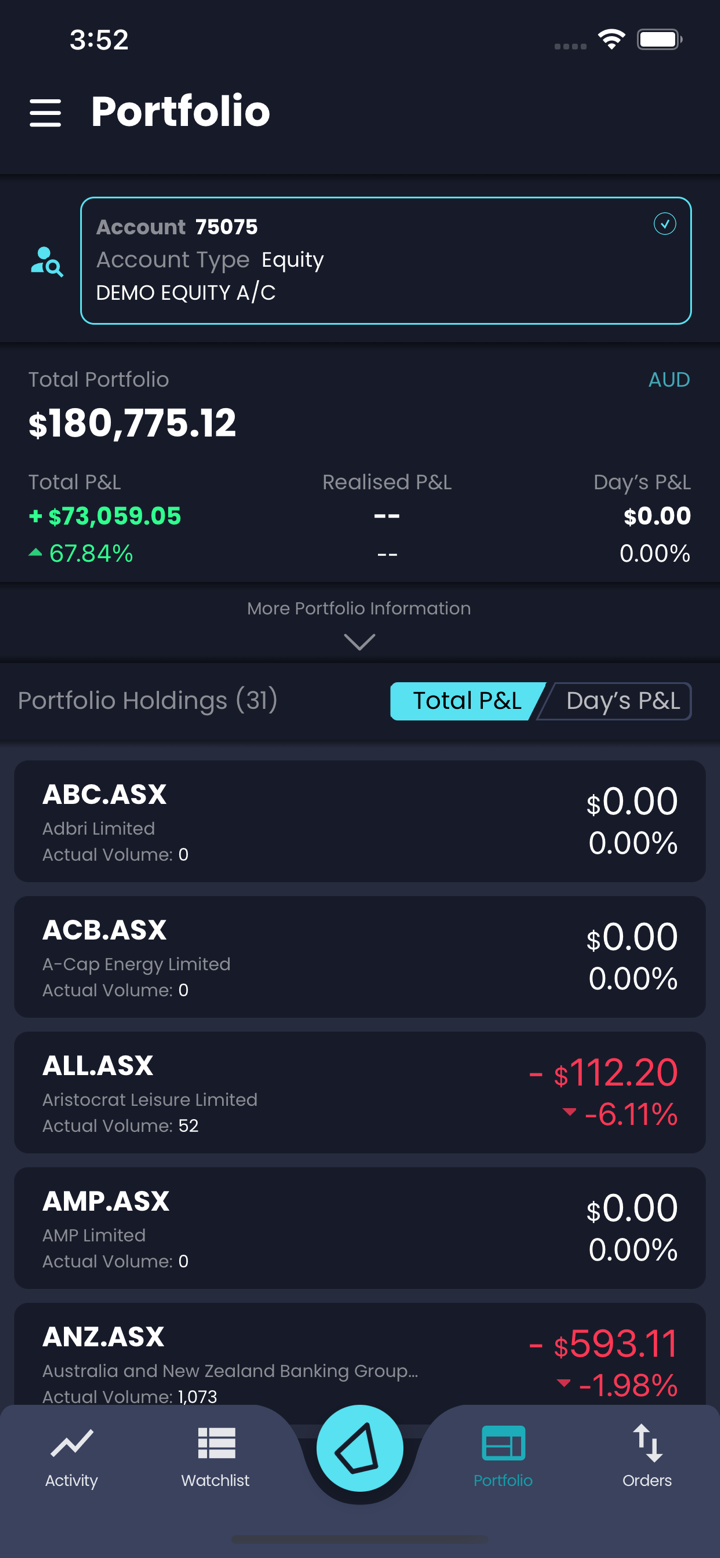

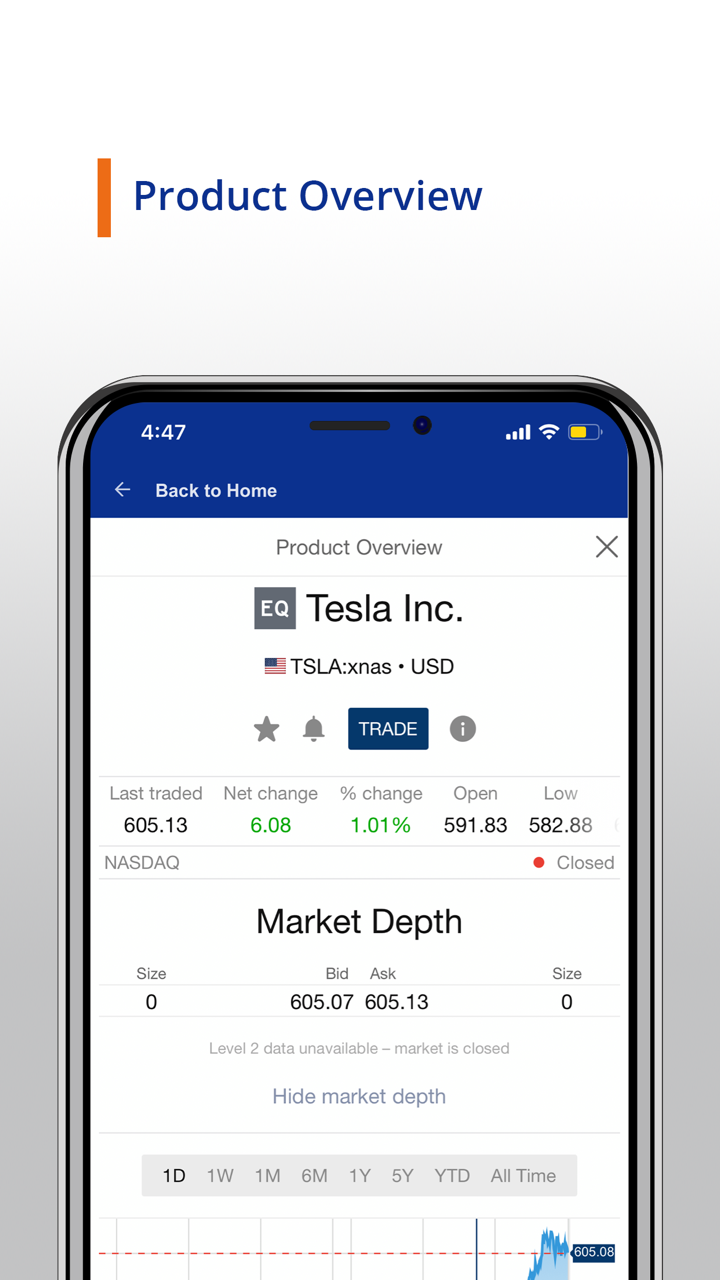

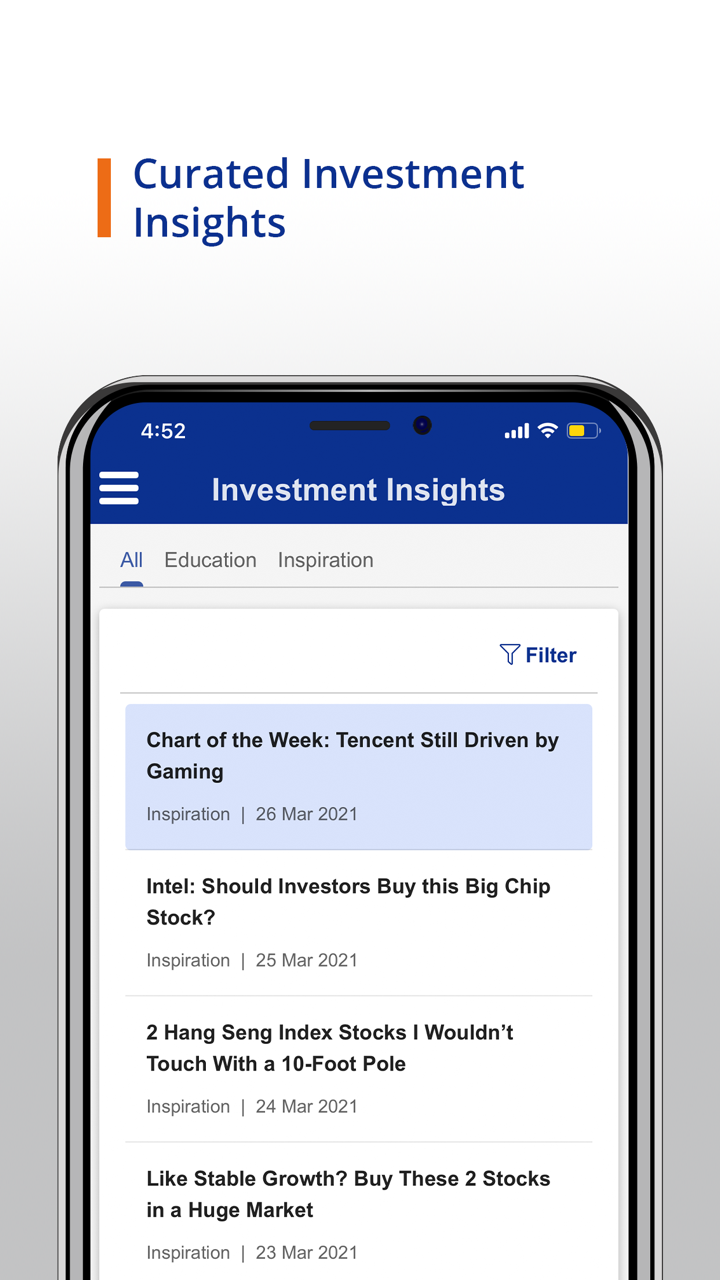

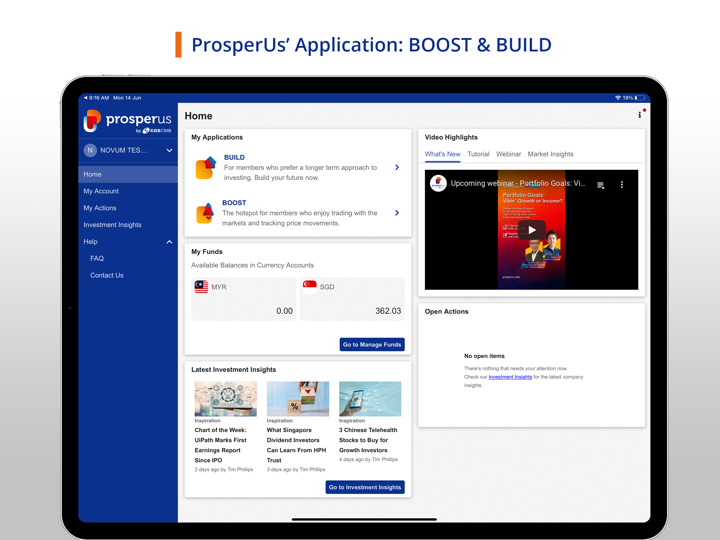

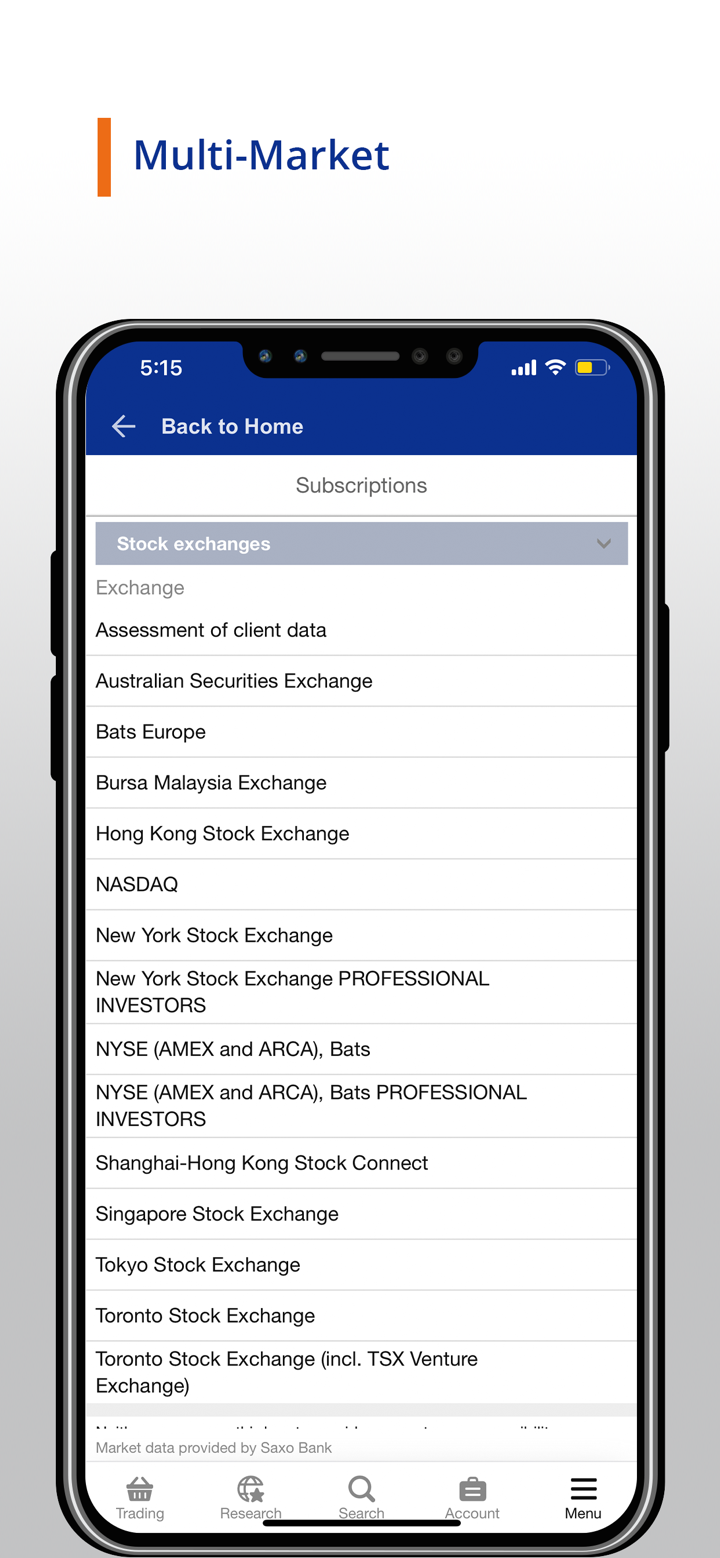

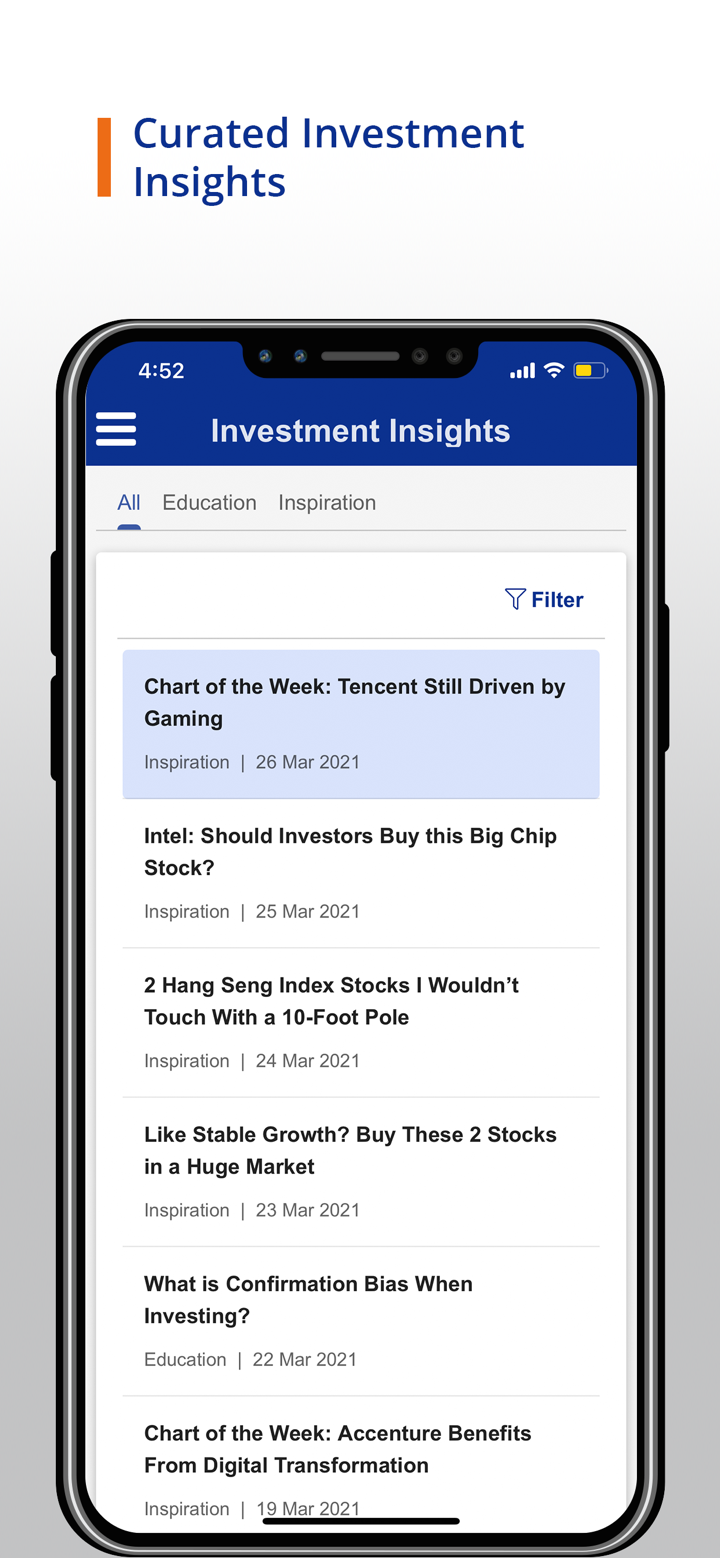

Platform ng Paggawa ng Kalakalan

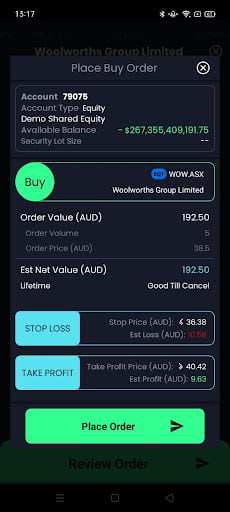

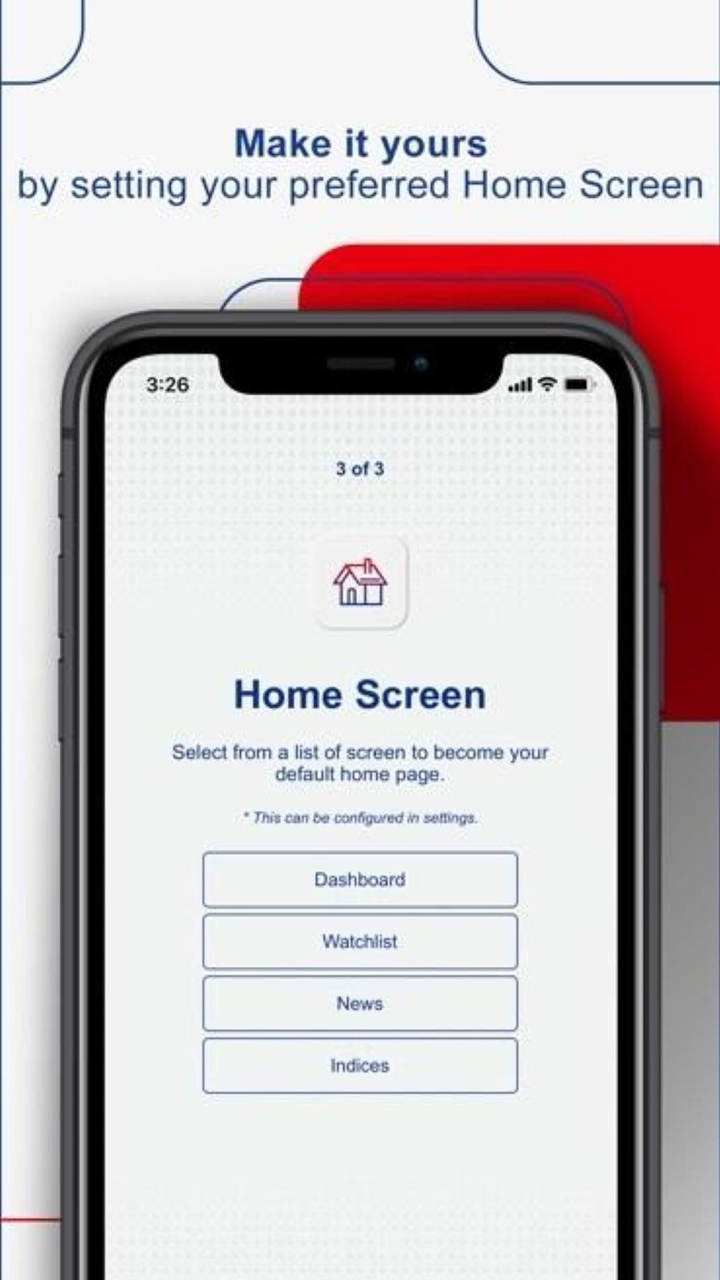

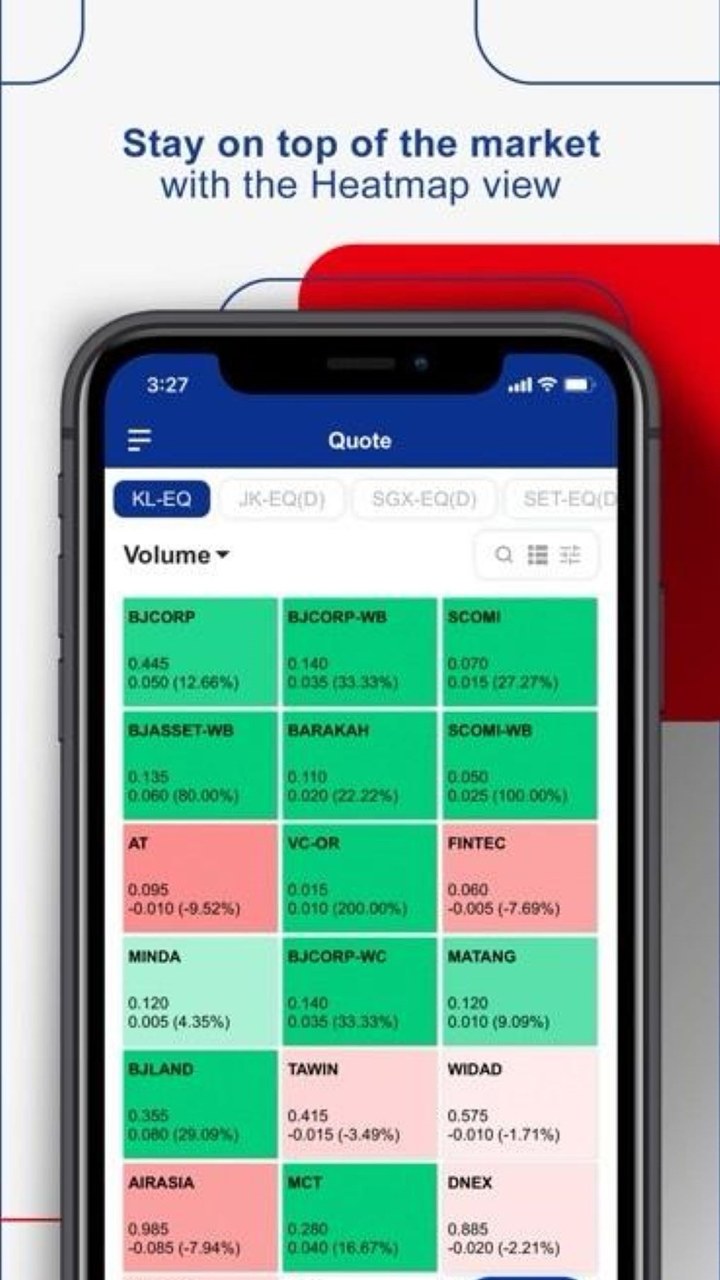

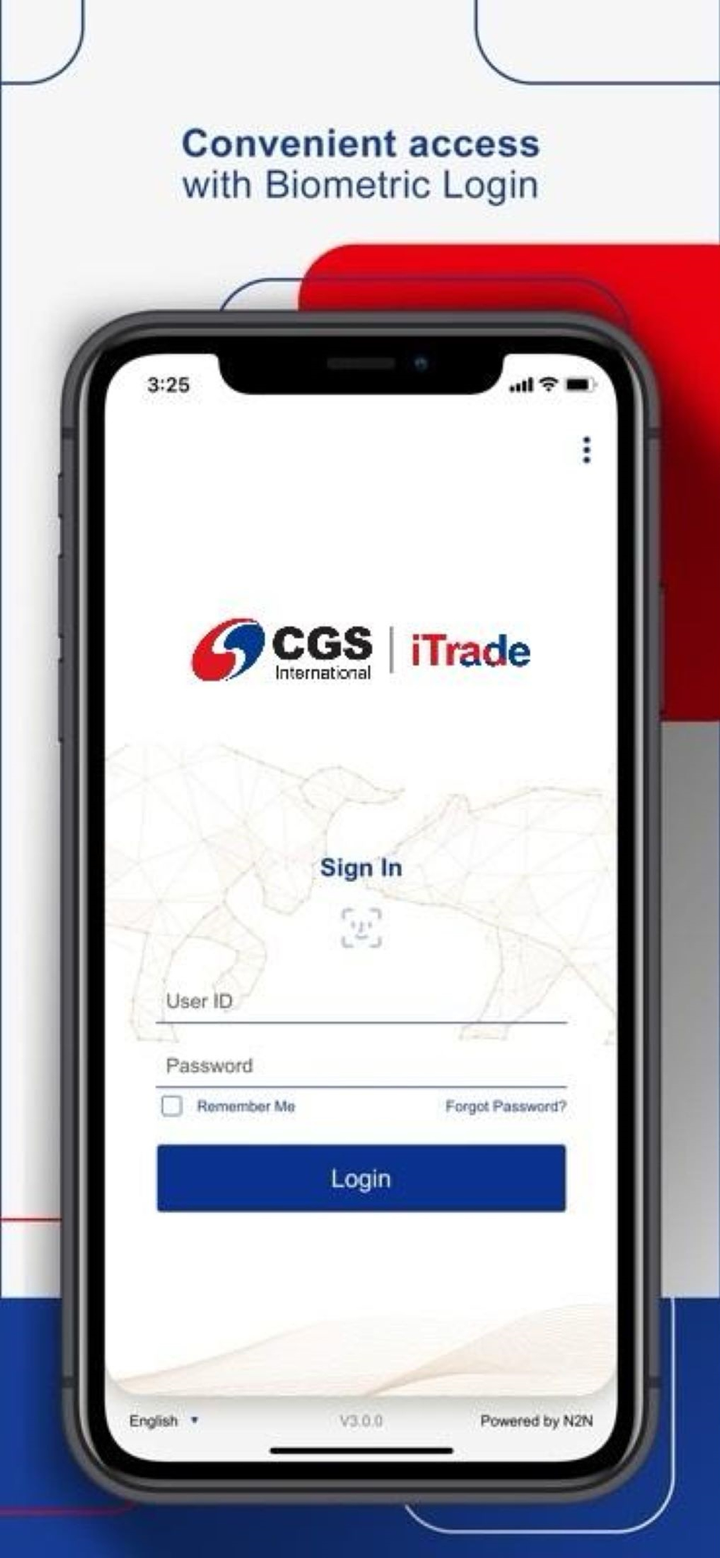

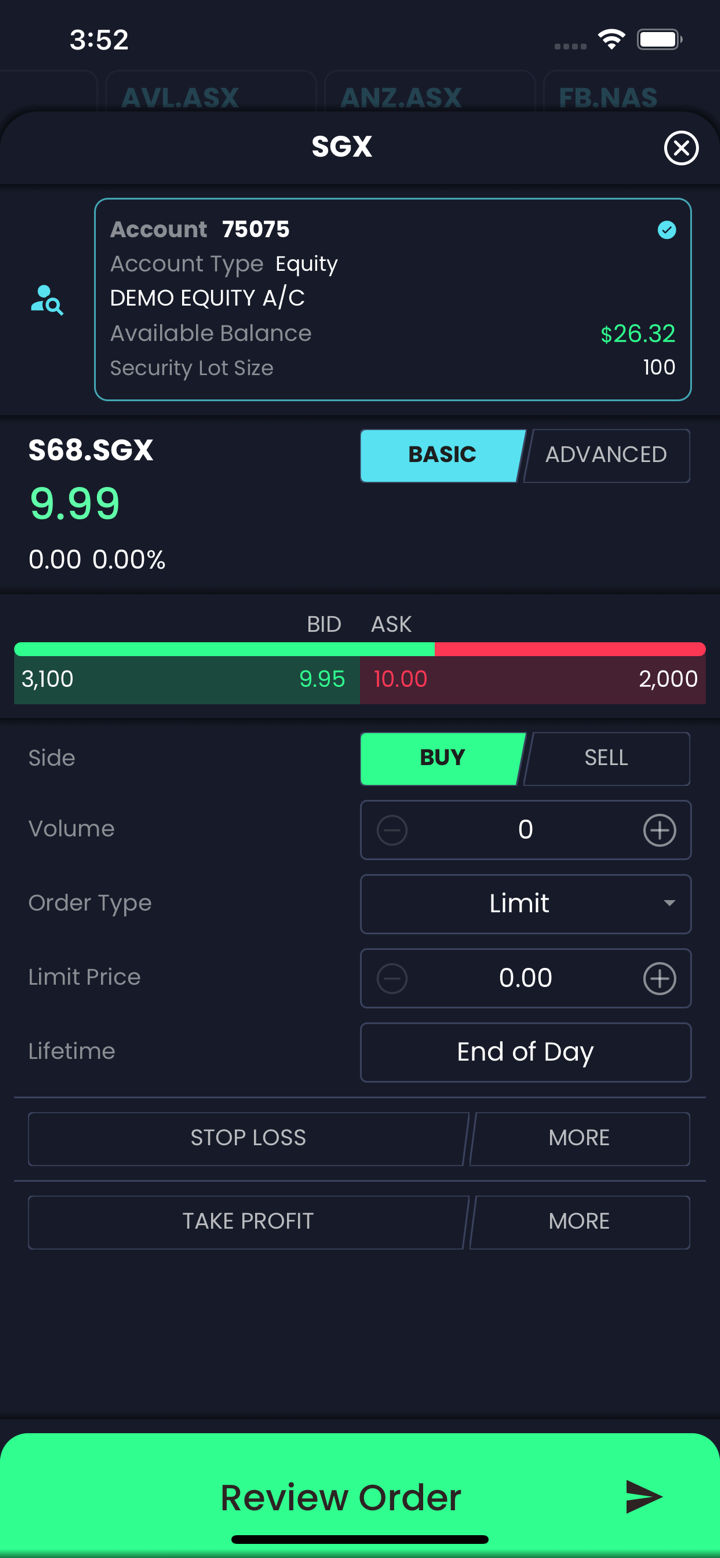

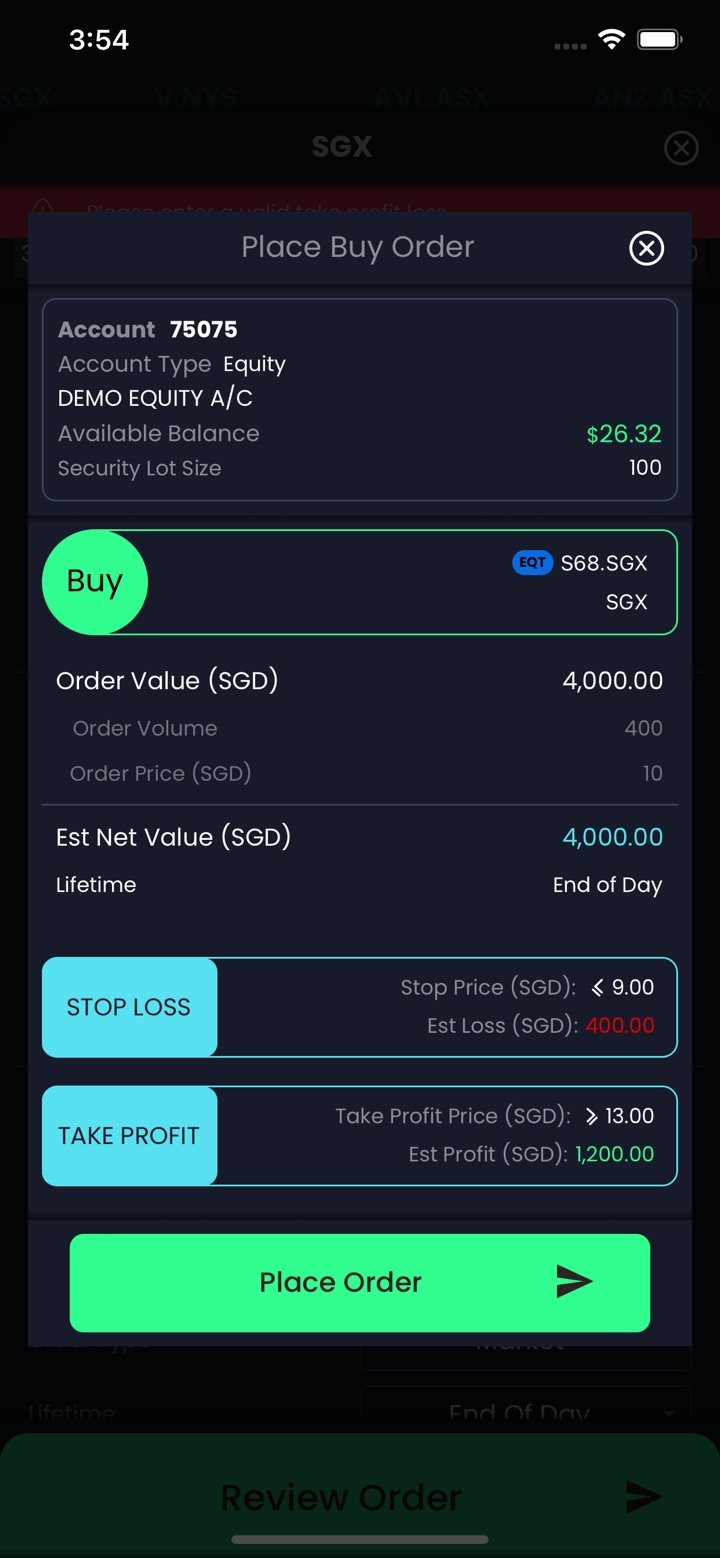

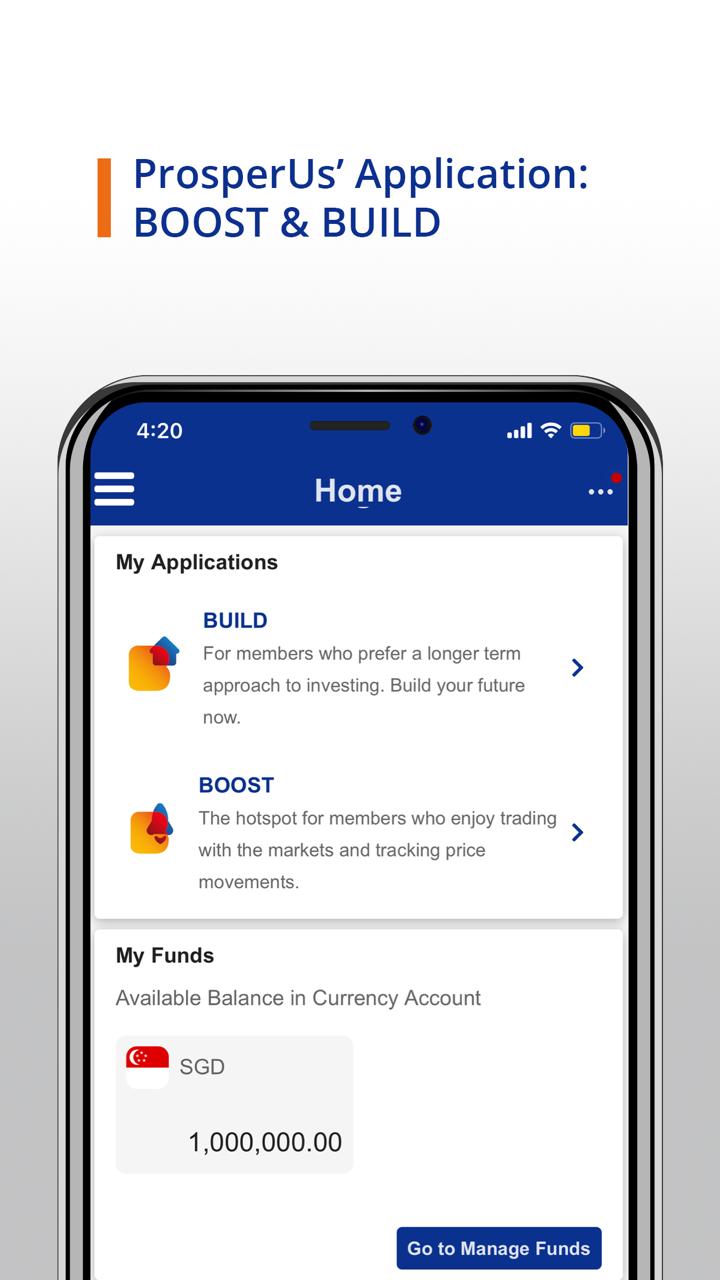

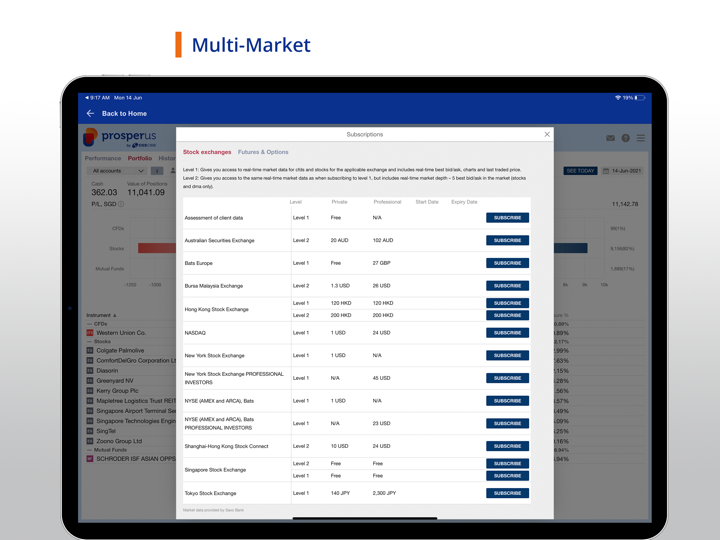

| Platform ng Paggawa ng Kalakalan | Supported | Available Devices | Angkop para sa |

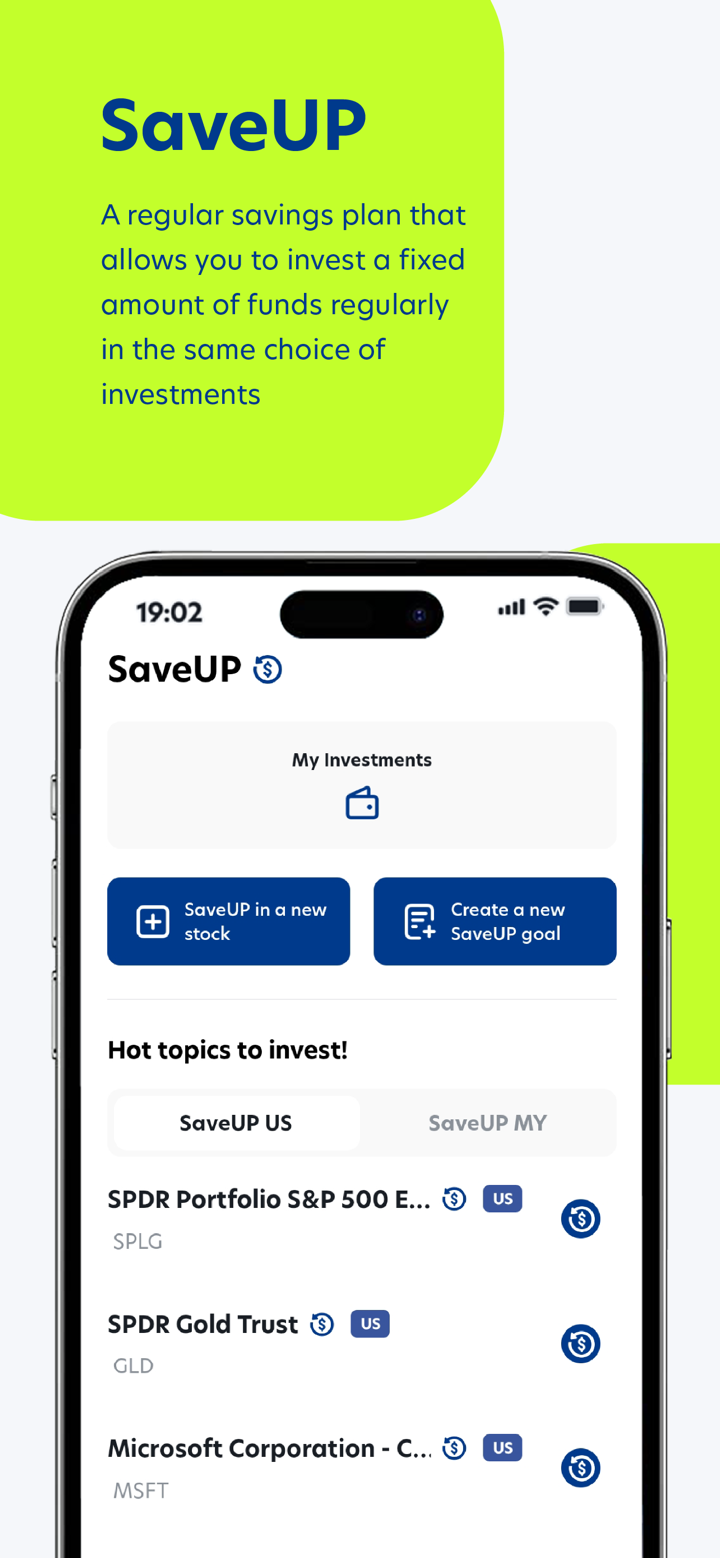

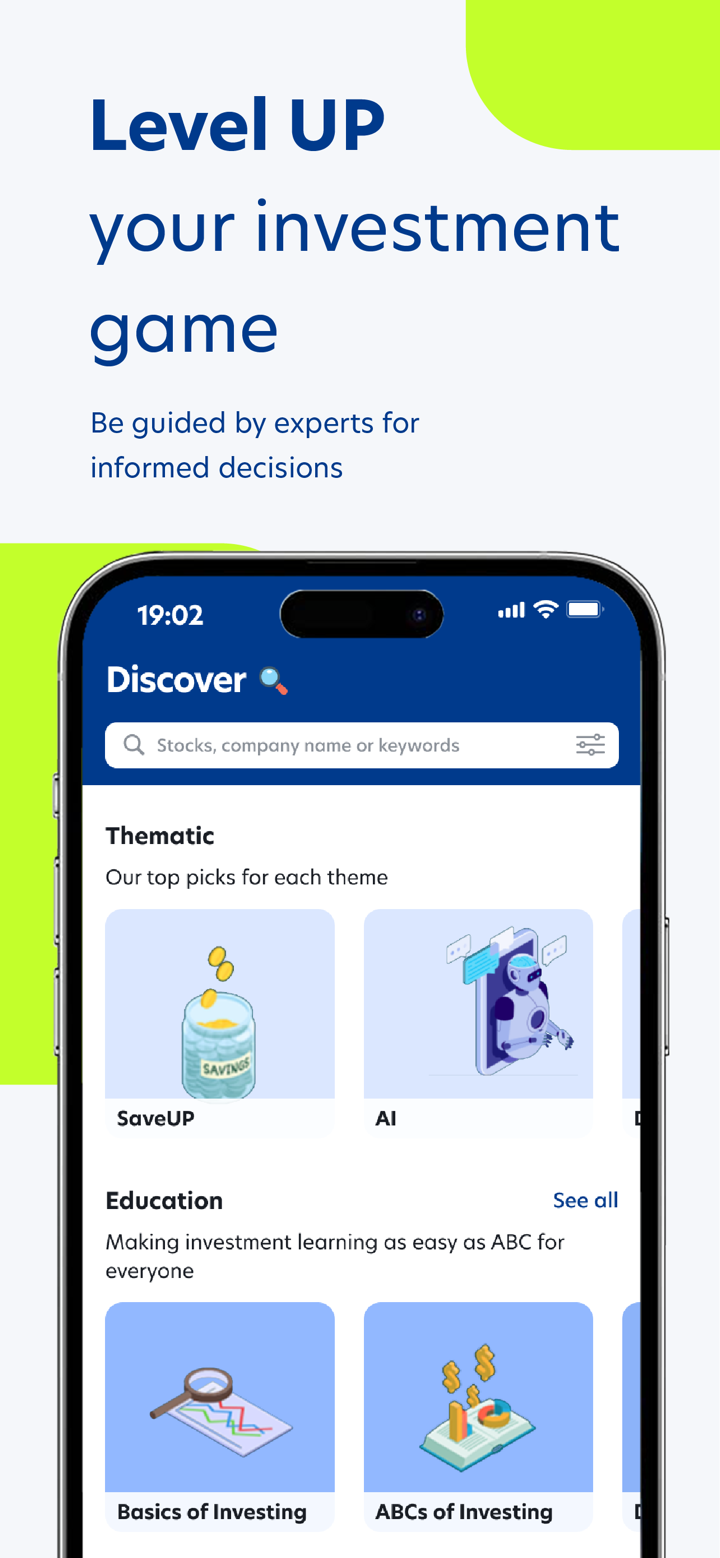

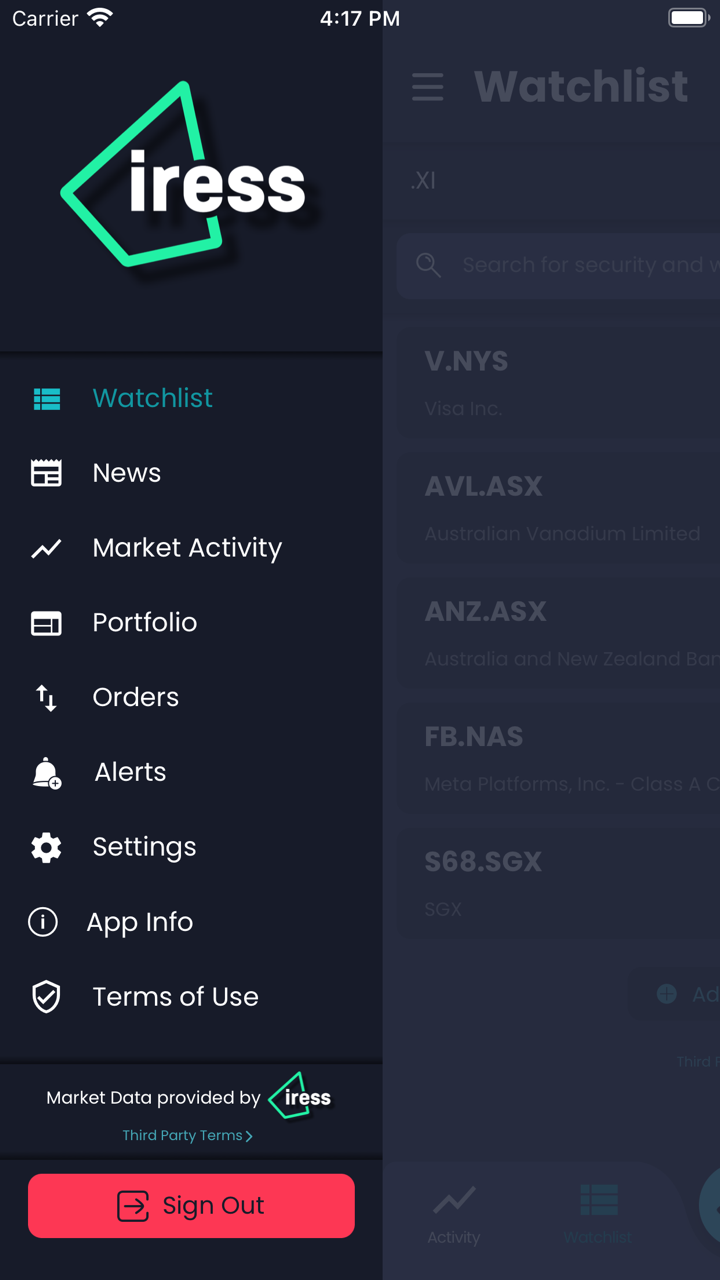

| WebTrader | ✔ | Web Browser, MacOS, Windows | / |

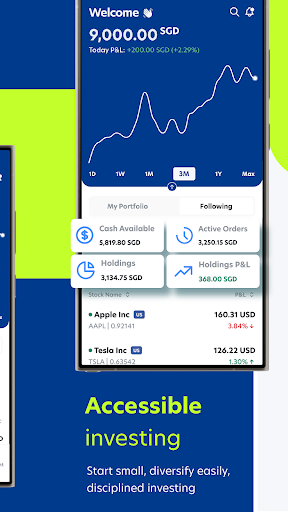

| Mobile App | ✔ | iOS, Android | / |

| MT4 | ❌ | / | Mga Baguhan |

| MT5 | ❌ | / | Mga Dalubhasa sa kalakalan |

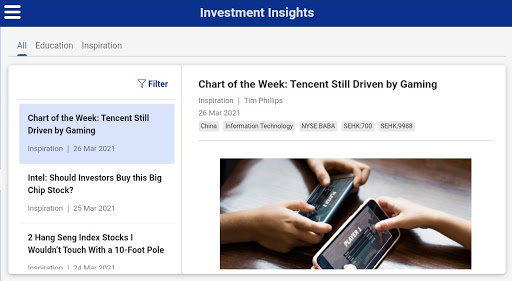

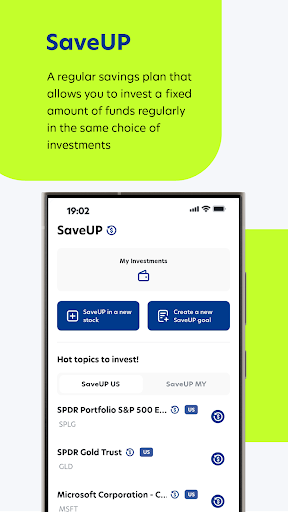

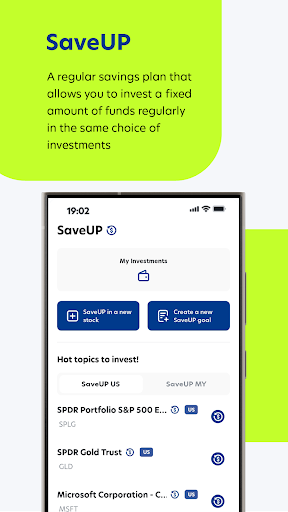

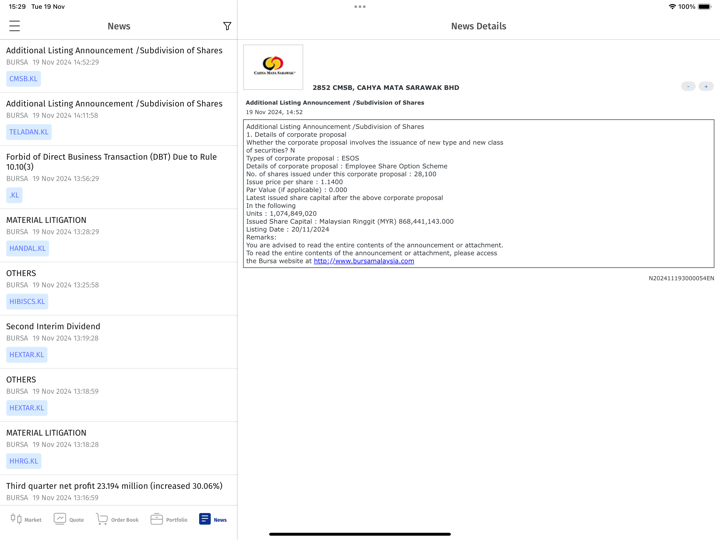

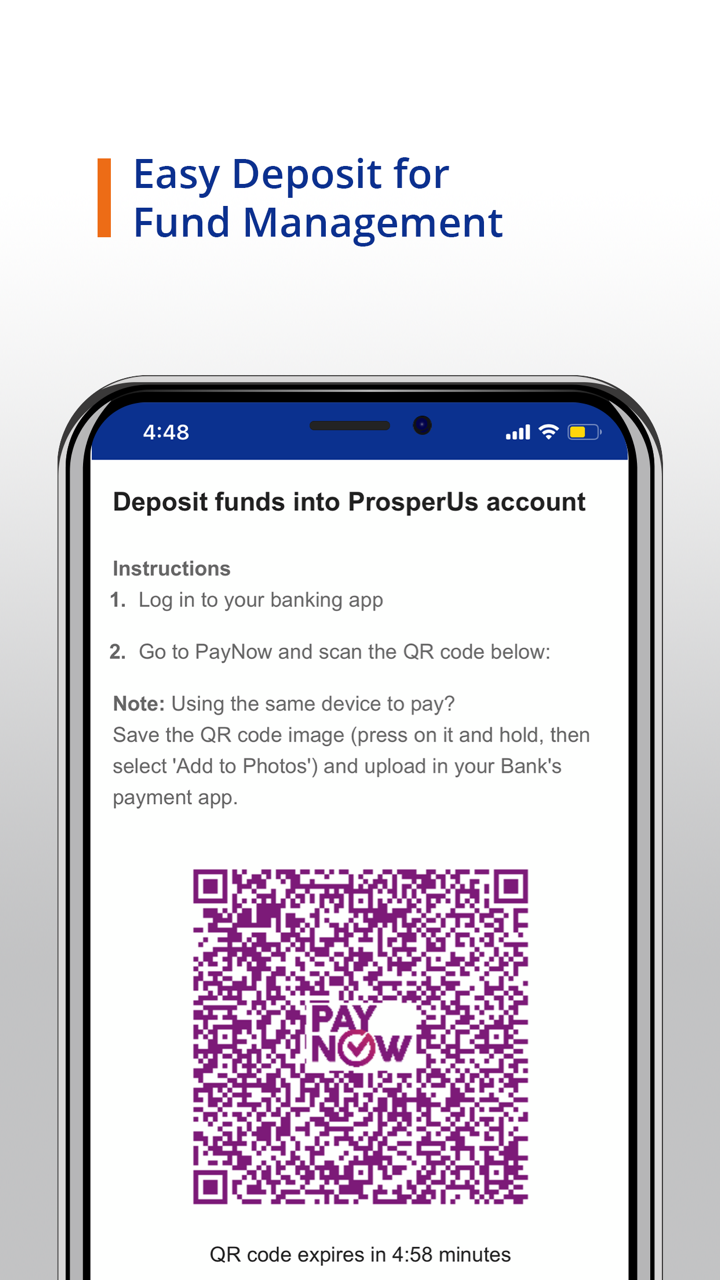

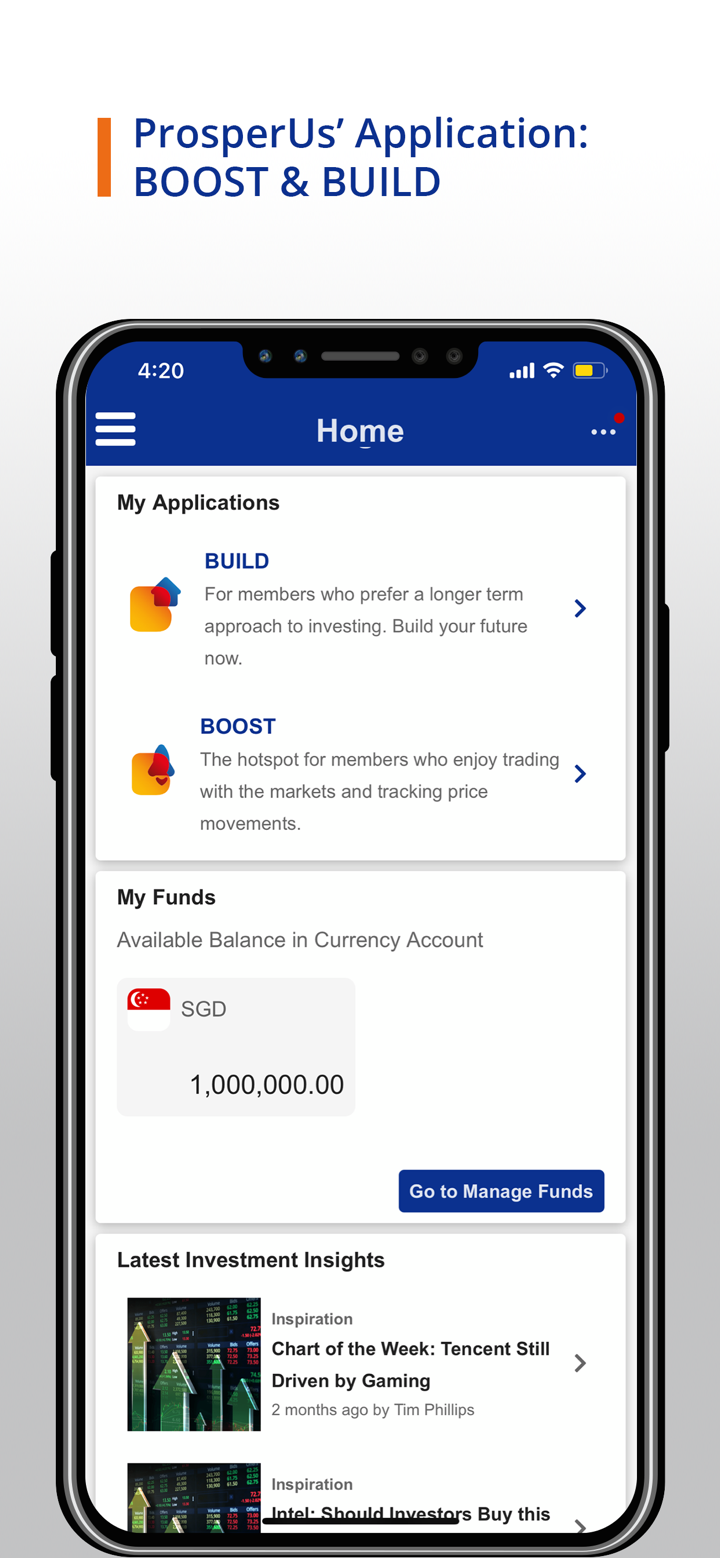

Promosyon

Nag-aalok si CGSCIMB ng iba't ibang mga aktibidad sa pagsusulong para sa mga customer na pumili. Sa ngayon, maaaring makakuha ang mga customer ng Starbucks e-voucher kung magbubukas sila ng account.