公司简介

| SOCIETE GENERALE 评论摘要 | |

| 成立时间 | 2000 |

| 注册国家/地区 | 中国 |

| 监管 | 无监管 |

| 交易产品 | 股票、股票衍生品、货币 |

| 模拟账户 | / |

| 杠杆 | / |

| 点差 | / |

| 交易平台 | / |

| 最低存款 | / |

| 客户支持 | 社交媒体:LinkedIn、Twitter、YouTube |

| 地址:法国巴黎哈乌斯曼大道29号,75009 | |

SOCIETE GENERALE 信息

SOCIETE GENERALE 成立于2000年,注册地为中国。提供包括股票和衍生品、固定收益和外汇交易所、结算服务、托管服务和流动性管理在内的广泛证券服务。

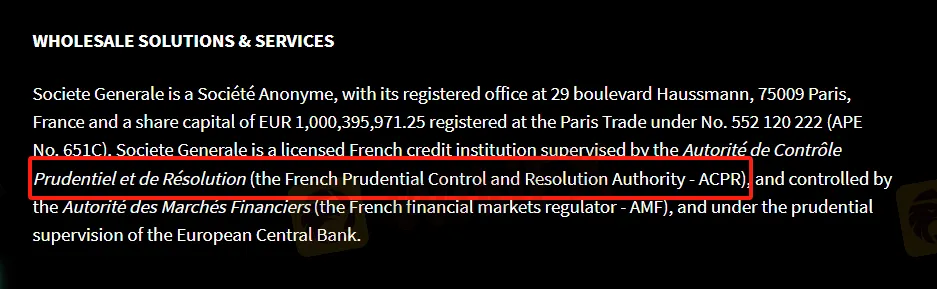

尽管声称受法国ACPR监管,但实际上并未受到监管。投资者在资金安全和透明度方面应保持谨慎。该公司通过LinkedIn、Twitter和YouTube等多个渠道与客户互动,但缺乏有关存款、取款等关键信息的详细解释。

优缺点

| 优点 | 缺点 |

| 提供多种产品和服务 | 无监管 |

| 费用结构不清晰 | |

| 没有存取款信息 | |

| 没有直接联系渠道 |

SOCIETE GENERALE 是否合法?

尽管SOCIETE GENERALE声称受ACPR监管,但实际上未受监管。交易者在交易时应保持谨慎。

产品和服务

SOCIETE GENERALE 提供全面的证券服务,涵盖股票和股票衍生品、固定收益和货币、首席服务和清算、量化投资策略、伯恩斯坦现金股票交易和股票研究、跨资产研究、跨资产解决方案、积极影响金融、SG市场、清算服务、托管和受托人服务、零售托管服务、流动性管理、基金管理、资产服务、基金分销、全球发行人服务。

| 产品 | 可用 |

| 股票 | ✔ |

| 股票衍生品 | ✔ |

| 货币 | ✔ |

| 大宗商品 | ❌ |

| 指数 | ❌ |

| 加密货币 | ❌ |

| 债券 | ❌ |

| 期权 | ❌ |

| 交易所交易基金 | ❌ |