Buod ng kumpanya

| M&G Buod ng Pagsusuri | |

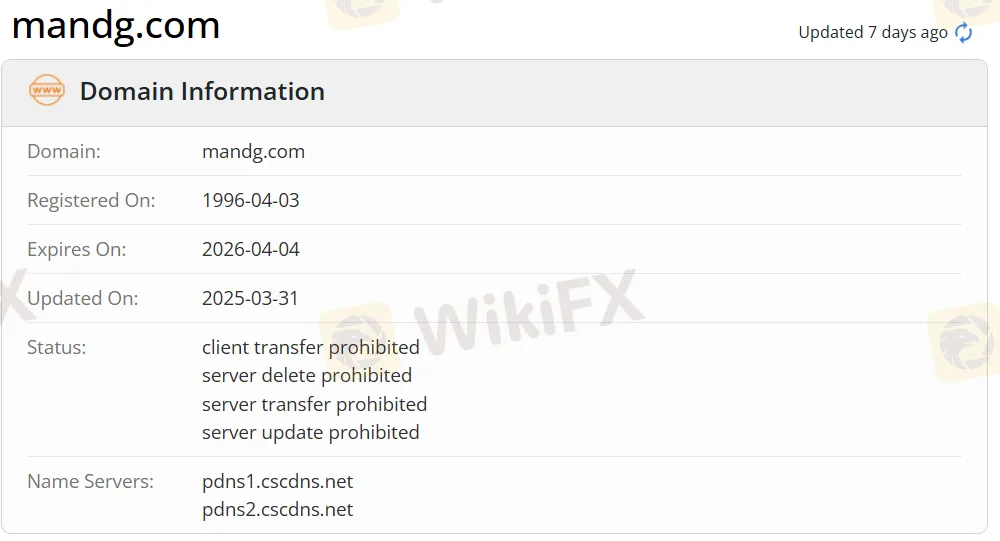

| Itinatag | 1996 |

| Rehistradong Bansa/Rehiyon | Ireland |

| Regulasyon | FCA (Nalampasan) |

| Mga Serbisyo | Asset management, investments at long-term savings |

| Plataforma ng Pagtitingin | aking M&G web |

| Minimum na Deposito | £1 |

| Suporta sa Customer | Tel: +44 (0)207 626 4588 |

| Email: info@mandg.co.uk | |

| Address: 10 Fenchurch Avenue LondonEC3M 5AG United Kingdom | |

| Instagram, LinkedIn | |

| Mga Paggan restriction | Mga merkado na may AUM na mas mababa sa £50m, at British overseas territories, crown dependencies at European microstates (maliban sa Malta) ay hindi kasama |

Impormasyon Tungkol sa M&G

Ang M&G ay isang tagapagbigay ng pangunahing brokerage at mga serbisyong pinansiyal, na itinatag sa Ireland noong 1996. Nag-aalok ito ng mga produkto at serbisyo para sa asset management, investments at long-term savings. Bukod dito, ang mga merkado na may AUM na mas mababa sa £50m, at British overseas territories, crown dependencies at European microstates (maliban sa Malta) ay hindi pinapayagan. Dagdag pa, dapat tandaan na ang lisensya ng FCA ng M&G ay nalampasan, na nangangahulugang maaaring may mga potensyal na panganib.

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

| Mahabang oras ng operasyon | Nalampasan ang lisensya ng FCA |

| Iba't ibang mga paraan ng pakikipag-ugnayan | Mga paggan restriction |

| Mababang minimum na deposito | Mga bayad sa komisyon |

| Iba't ibang mga pagpipilian sa pagbabayad |

Tunay ba ang M&G?

M&G ay lisensyado ng Financial Conduct Authority upang mag-alok ng mga serbisyo ngunit ang kasalukuyang kalagayan ay lumampas na. Ang numero ng lisensya nito ay 119328. Ang Financial Conduct Authority (FCA) ay isang ahensya ng regulasyon sa pinansyal sa United Kingdom, ngunit ito ay nag-ooperate nang independiyente mula sa Pamahalaan ng UK, at pinansiyahan sa pamamagitan ng pagpapataw ng bayad sa mga miyembro ng industriya ng mga serbisyong pinansyal.

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| Financial Conduct Authority (FCA) | Lumampas na | M&G Investment Management Limited | Investment Advisory License | 119328 |

Mga Serbisyo ng M&G

| Services | Supported |

| Asset management | ✔ |

| Investments | ✔ |

| Long-term savings | ✔ |

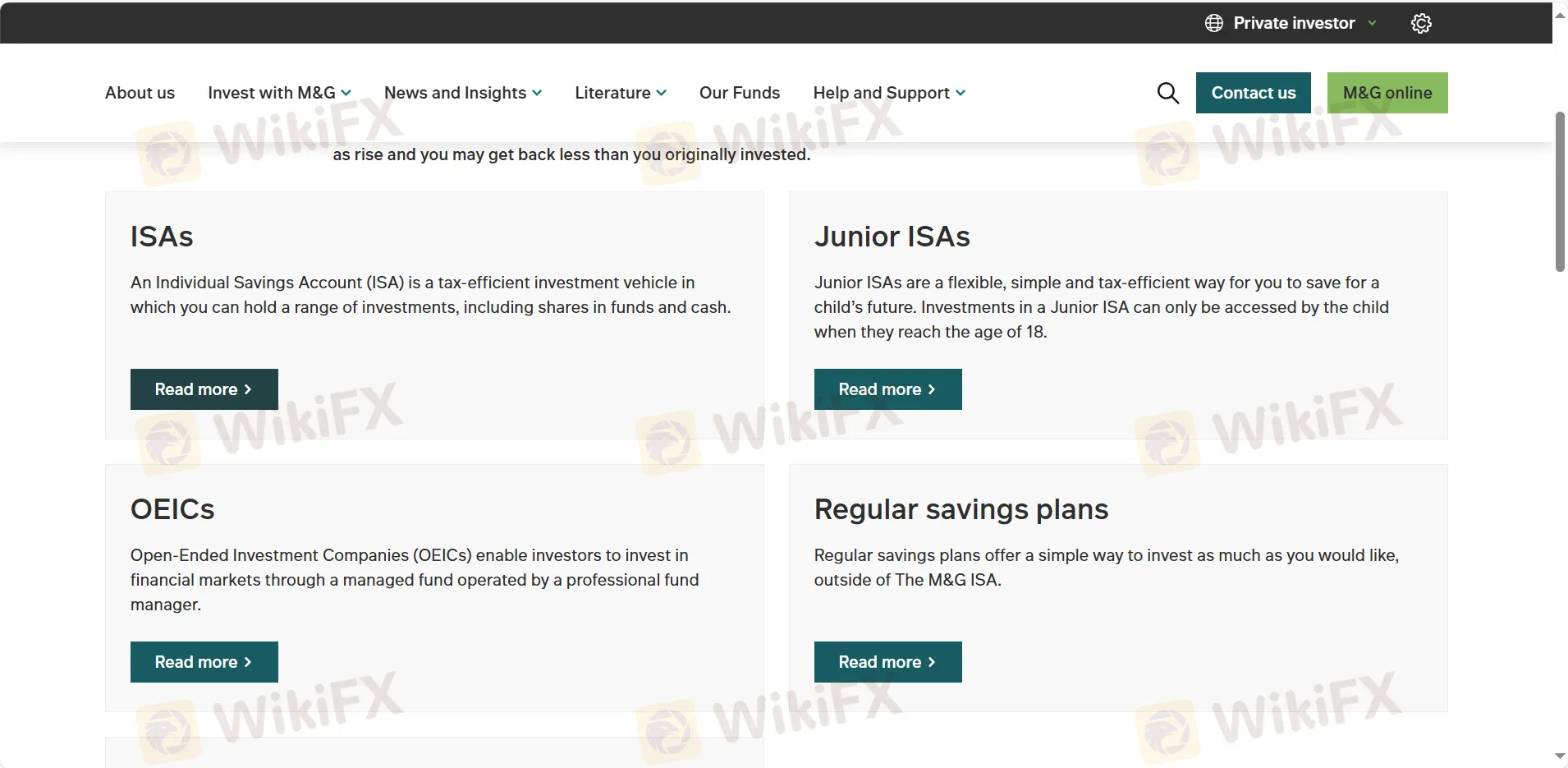

Uri ng Account

| Account Type | Minimum Deposit |

| ISAs | £1 |

| Junior ISAs | £1 |

| OEIC | £1 |

Mga Bayarin ng M&G

Ang mga bayarin ay nauugnay sa halaga ng pamumuhunan kaya't depende ito sa performance ng pondo. Ang mga singil ay kinukalkula taun-taon at kinukuha araw-araw. Ang mga detalye ay hindi binanggit.

Platform ng Paggawa ng Kalakalan

| Trading Platform | Supported | Available Devices | Suitable for |

| myM&G web | ✔ | PC, laptop, tablet | / |

Deposito at Pag-Atas

Ang broker ay tumatanggap ng mga pagbabayad gamit ang Maestro, MasterCard Debit, Visa Debit & Visa Delta debit cards. Ang minimum na deposito ay £1. Walang itinakdang minimum na halaga para sa pag-withdraw at walang mga bayarin o singil na nakasaad.

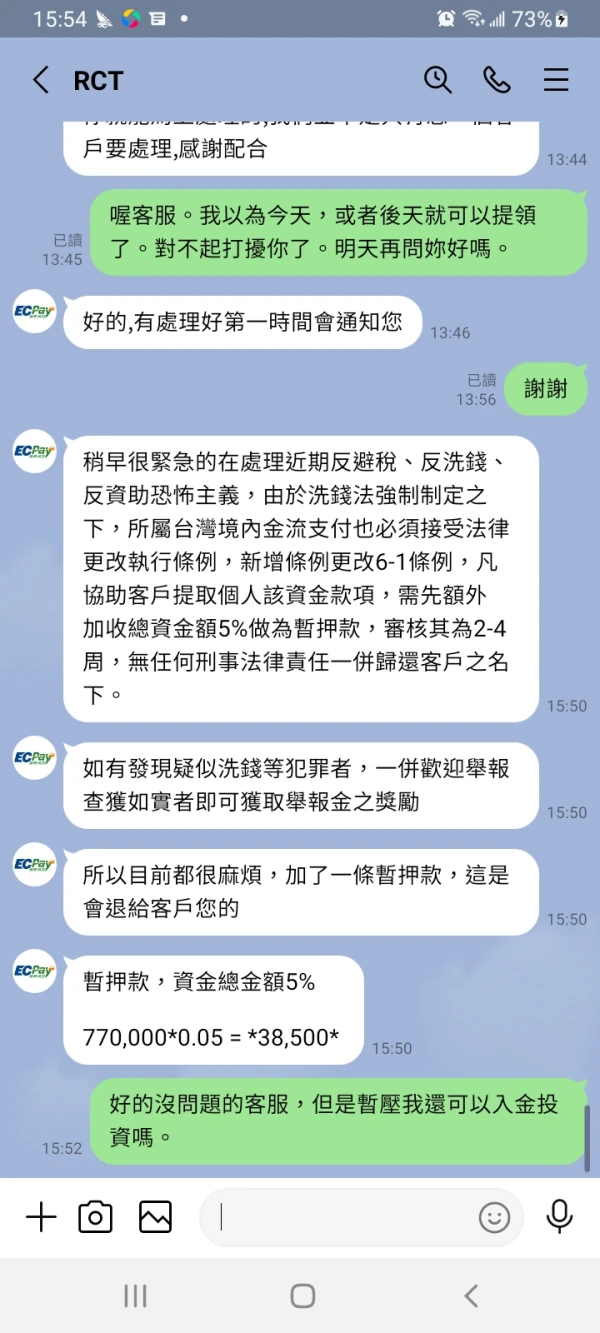

FX7068259962

Taiwan

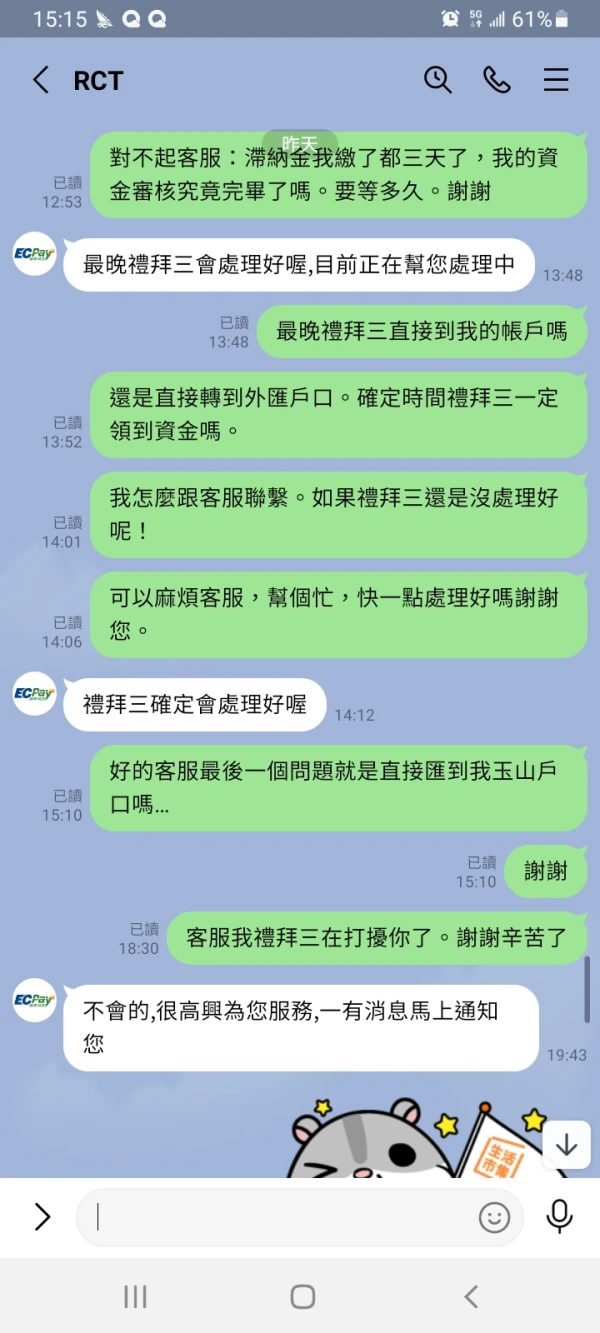

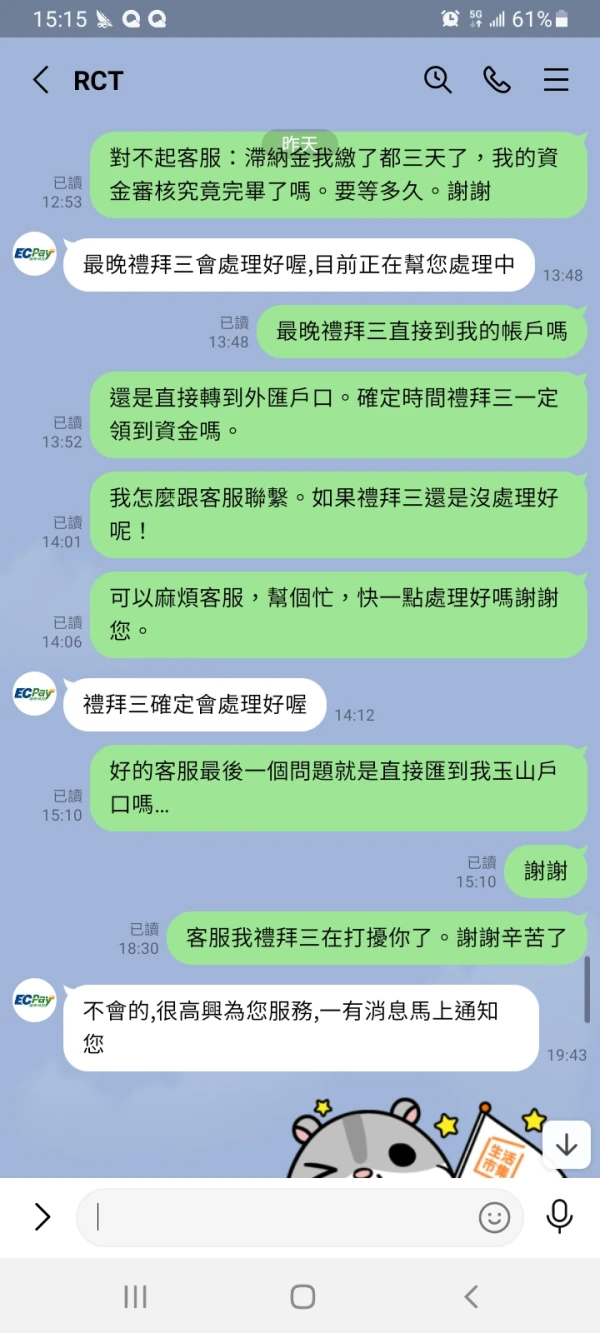

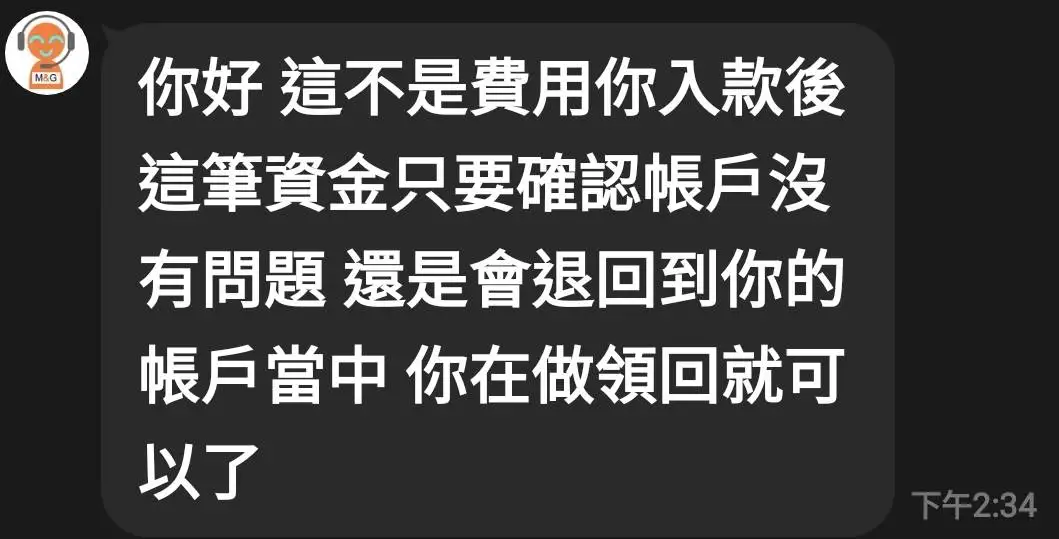

Nagbayad ako ng higit sa 100,000 sa lahat ng mga bayarin

Paglalahad

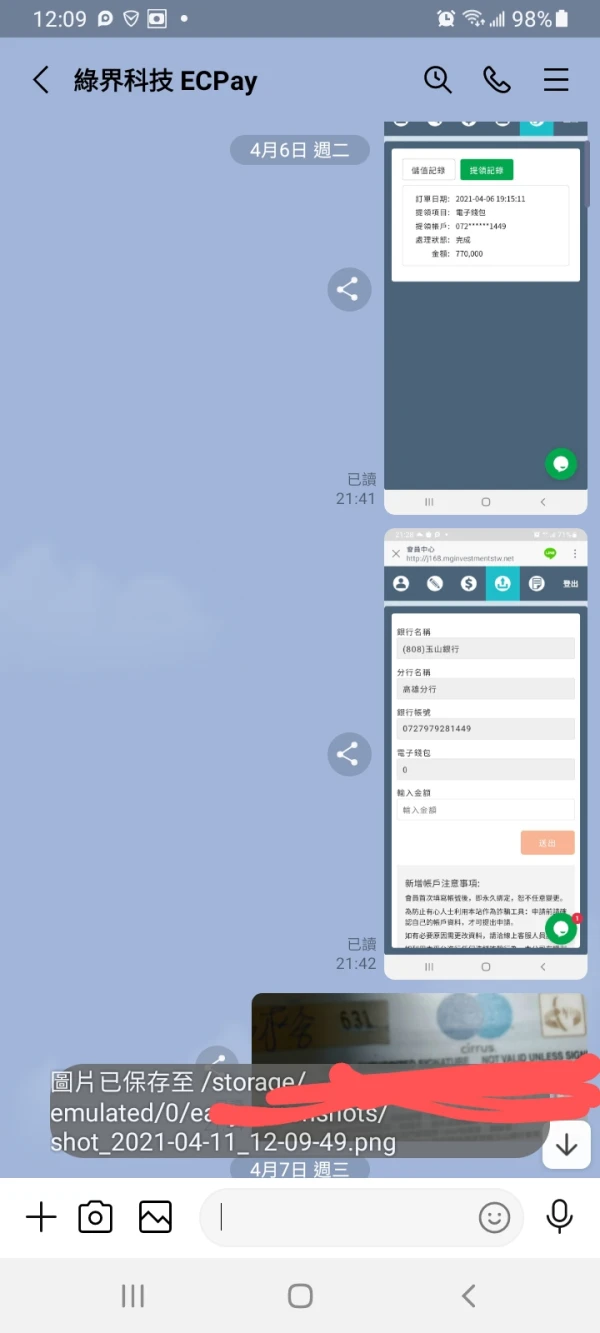

Hsuan天天

Taiwan

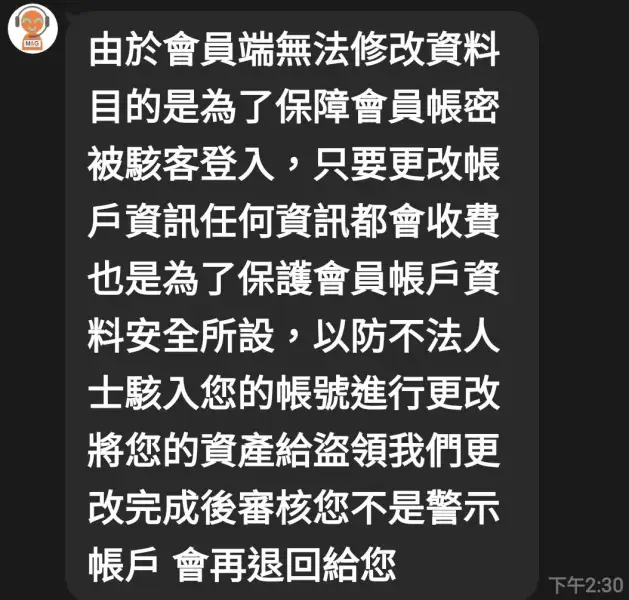

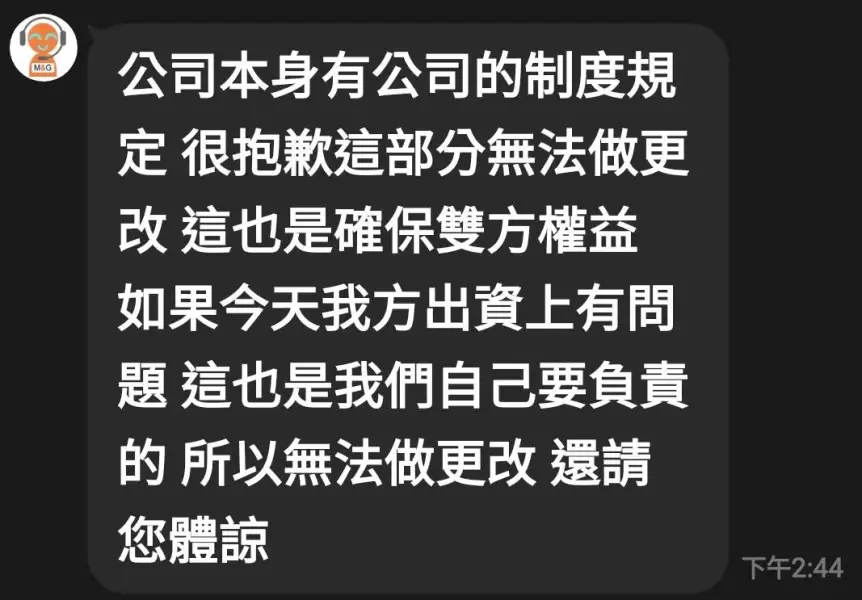

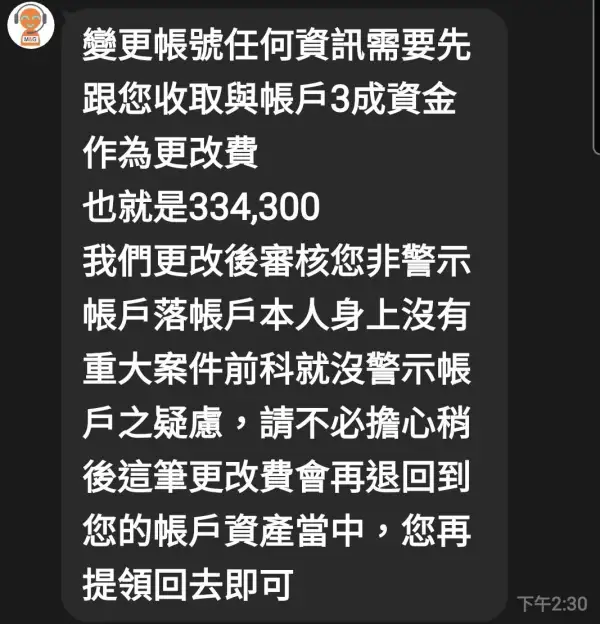

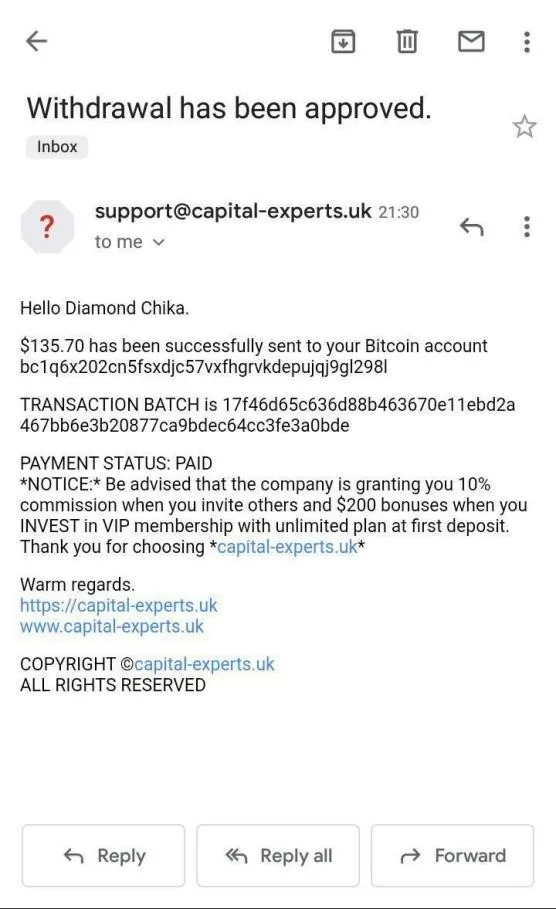

mginvestmentstw.net/. Kung mai-input mo ang totoong bank account, ipapakita nito sa iyo na mali ito. Kung nais mong baguhin ang impormasyon, dapat kang magbayad ng 30% ng iyong mga assets. Kung nakikita mo ang website, huwag mamuhunan

Paglalahad

FX4102010959

Argentina

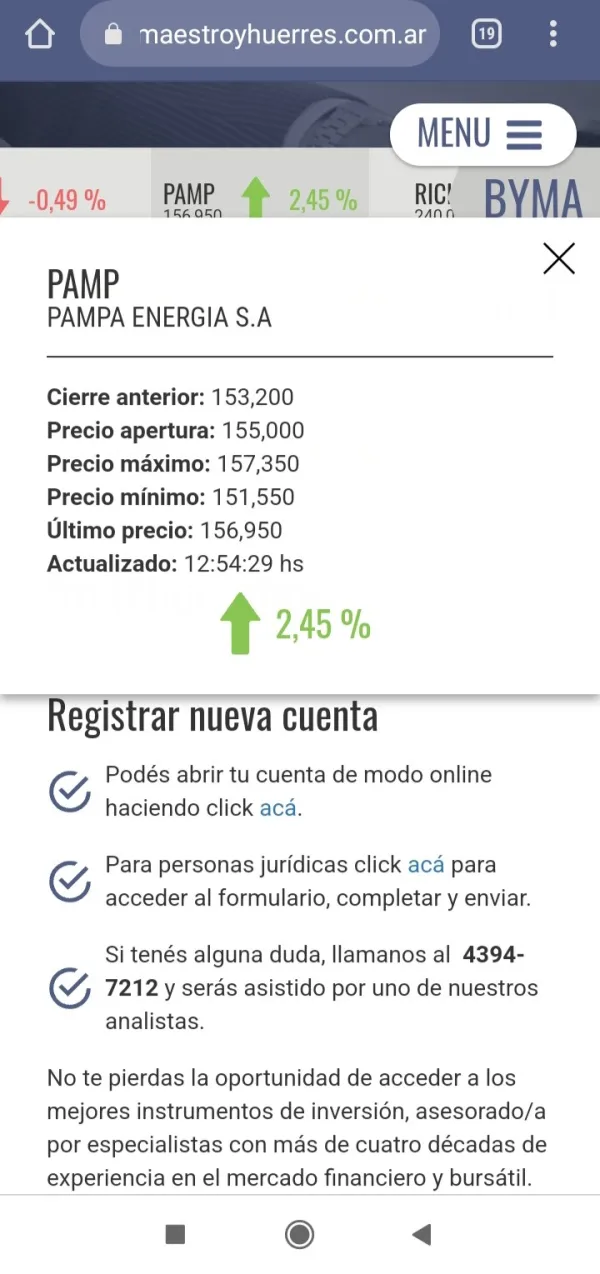

Binago nila ang impormasyon sa merkado. Nag-deposito ako ng 66,215 pesos at nawala ang lahat ng puhunan.

Paglalahad

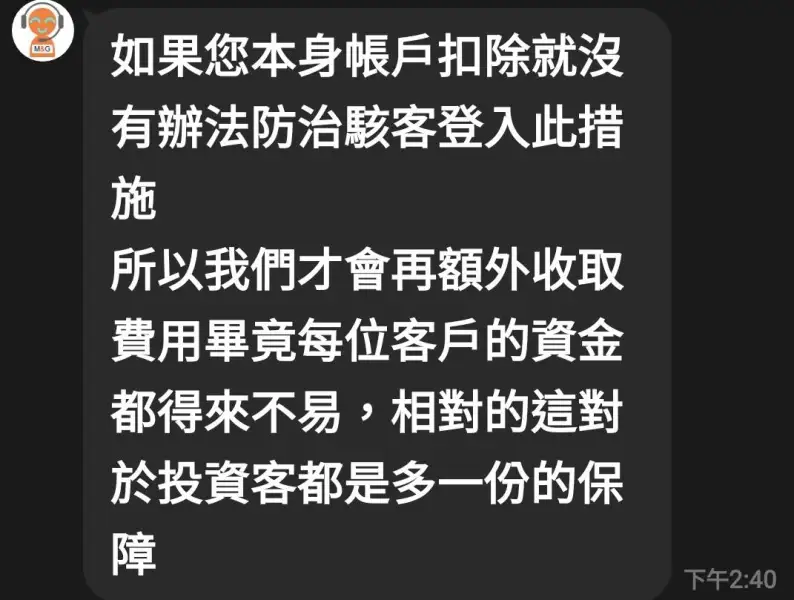

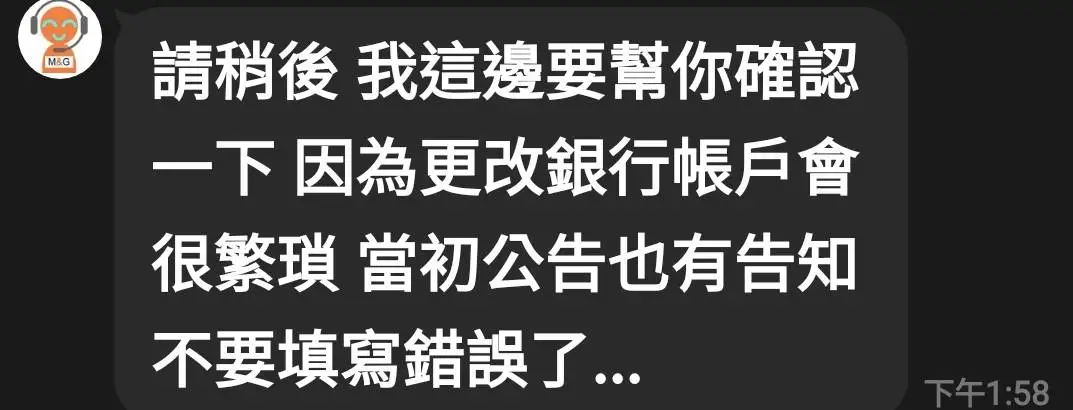

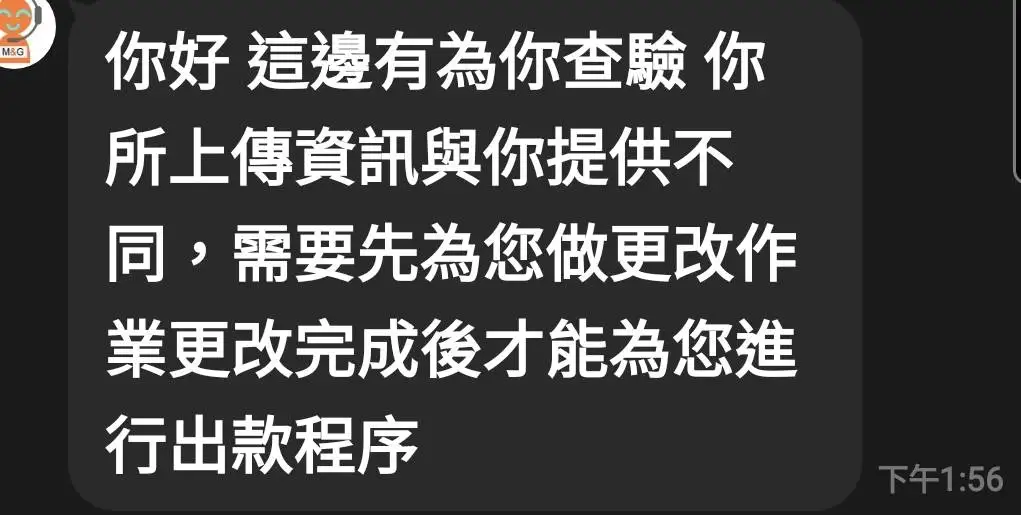

FX3308363627

Taiwan

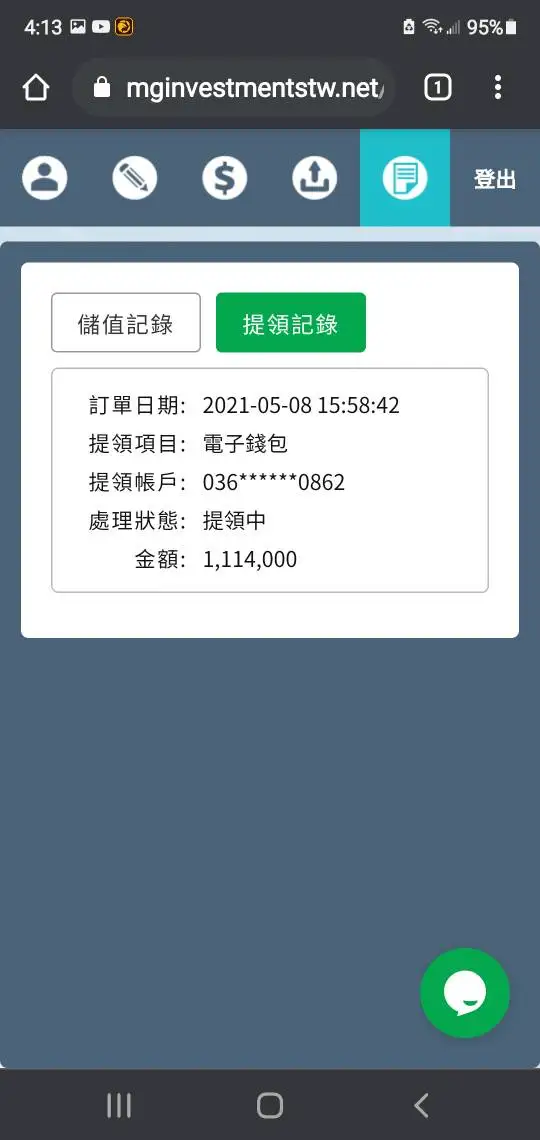

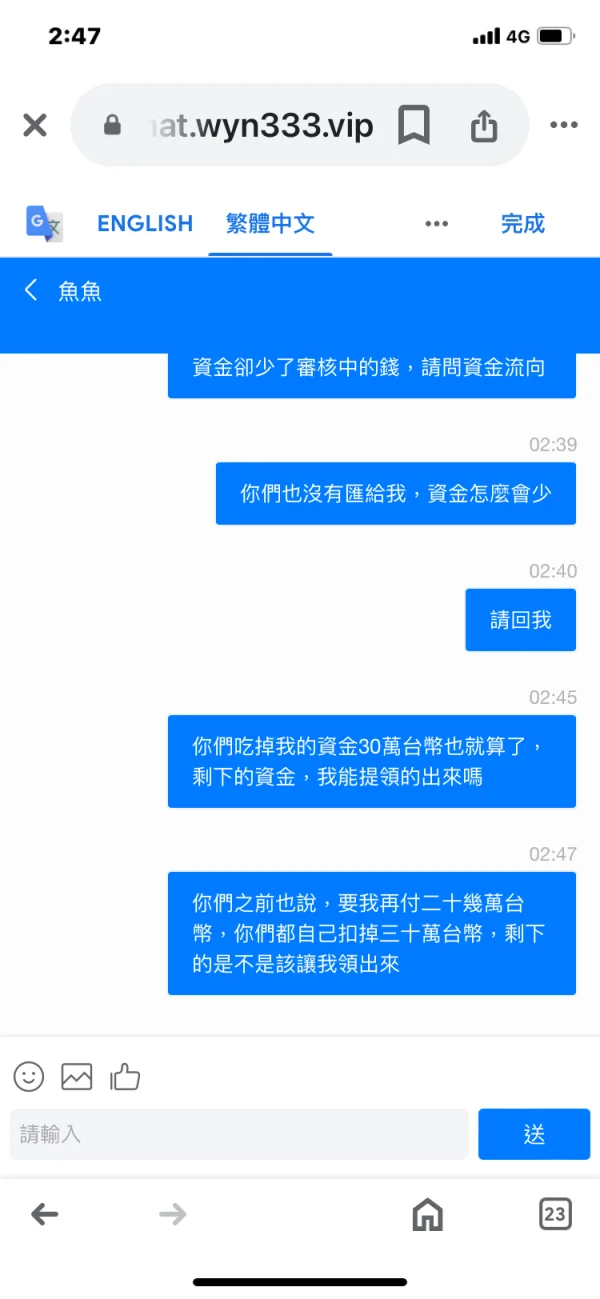

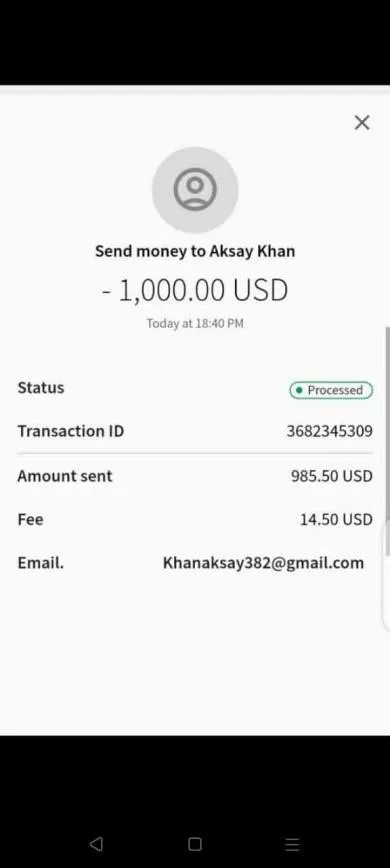

Nag-download ako ng app na ito nang makita ko ito sa internet na pwedeng kumita ng pera. Nagbibigay rin ng online remittance ang kanilang customer service. Nagpadala ako ng pera. Nang gusto kong i-withdraw ang pera, ito ay nasa ilalim pa rin ng pagsusuri. Tatlong beses akong nag-withdraw, bawat beses ay nag-withdraw ako ng 100,000 New Taiwan Dollars, pero wala akong natanggap. Maraming beses akong nagtanong sa customer service, pero hindi sila sumasagot. Nang mag-log in ako ulit sa platform na ito, nakita ko na nawala na ang perang ini-withdraw ko. Sa una, ito ay mahigit sa 1.9 milyon, pero ngayon ay naging mahigit lang sa 1.5 milyon. Ito ay malinaw na isang scam upang lokohin ang aking pera.

Paglalahad

วิทยา ประธานทรง

St. Barthelemy

Kumusta, Witthaya Prathantrong o M na negosyante.

Positibo

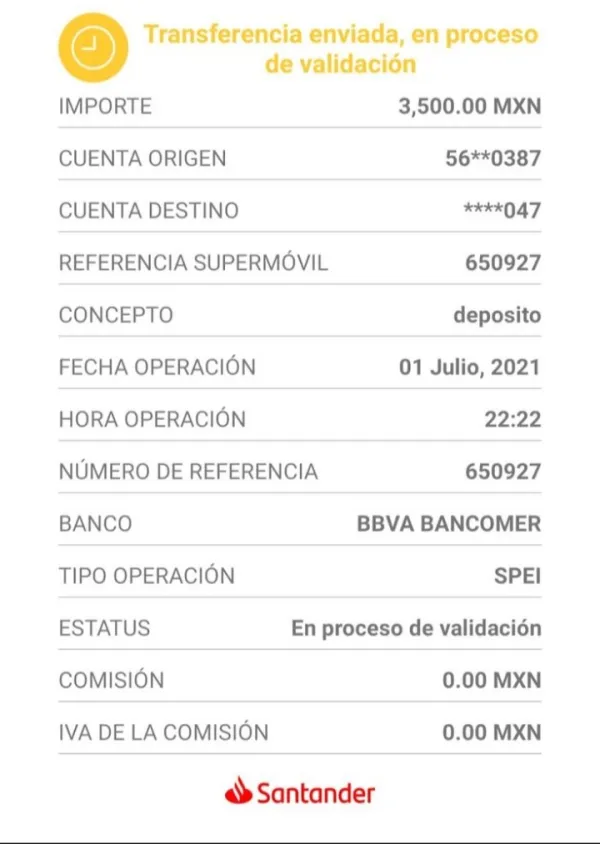

FX1828697794

Mexico

Nag-deposito ako ng $ 3500 at binawi ang $ 2300. Nagpakita ang aking board ng isang larawan at sinabi nilang may nangyari. Ang pera ay hindi pagmamay-ari. Ito ang pinakamasamang katotohanan.

Paglalahad

FX2046354843

Pilipinas

Iwasan ang kanilang M&V Investments. Kinuha ang isang pautang na £ 5000 dahil sapat na ang aking paniniwala upang paniwalaan ang kanilang ipinangako na ROI. Hindi ko rin maalala ang Na-advertise na ROI, ngunit ito ay nasa isang lugar sa saklaw na 5-7% bawat buwan. (Alin ang syempre mabuti.) Para sa unang dalawang linggo napaka-positibo (Kasama ko sila mula noong Agosto 2021) pagkatapos ay bumaba ang lahat mula roon. Kung nag-formulate ka ng isang graph ng balanse ng aking account magiging hitsura ito ng isang nagpapasya na hanay ng mga hagdan. Nagtatakda ako ngayon sa paligid ng £ 2900 mark (mula sa £ 5000) na may lumulutang na kita sa bukas na kalakalan ng - £ 600. Kaya upang bawiin ang natitirang balanse kakailanganin kong isara ang lahat ng mga bukas na kalakalan at maluwag din ang £ 600 na iyon. Gayunpaman mayroon silang isang kapaki-pakinabang at pangkalahatang tumutugong suporta sa customer. Tila sila rin ay tunay na nagsisikap.

Paglalahad