회사 소개

| SOCIETE GENERALE 리뷰 요약 | |

| 설립 연도 | 2000 |

| 등록 국가/지역 | 중국 |

| 규제 | 규제 없음 |

| 거래 상품 | 주식, 주식 파생상품, 통화 |

| 데모 계정 | / |

| 레버리지 | / |

| 스프레드 | / |

| 거래 플랫폼 | / |

| 최소 입금액 | / |

| 고객 지원 | 소셜 미디어: LinkedIn, Twitter, YouTube |

| 주소: 프랑스 파리 75009번지 29번길 | |

SOCIETE GENERALE 정보

SOCIETE GENERALE은 2000년에 설립되어 중국에 등록되었습니다. 주식 및 파생상품, 고정 소득 및 외환, 청산 서비스, 보관 서비스 및 유동성 관리를 포함한 다양한 증권 서비스를 제공합니다.

프랑스 ACPR에 의해 규제되었다고 주장하지만 실제로 규제를 받지 않고 있습니다. 투자자는 자금 안전 및 투명성에 대해 주의를 기울여야 합니다. 회사는 LinkedIn, Twitter 및 YouTube를 통해 다양한 채널을 통해 고객과 상호 작용하지만 입출금 및 기타 주요 정보에 대한 상세한 설명이 부족합니다.

장단점

| 장점 | 단점 |

| 다양한 제품 및 서비스 제공 | 규제 없음 |

| 수수료 구조 불명확 | |

| 입출금 정보 없음 | |

| 직접 연락 채널 없음 |

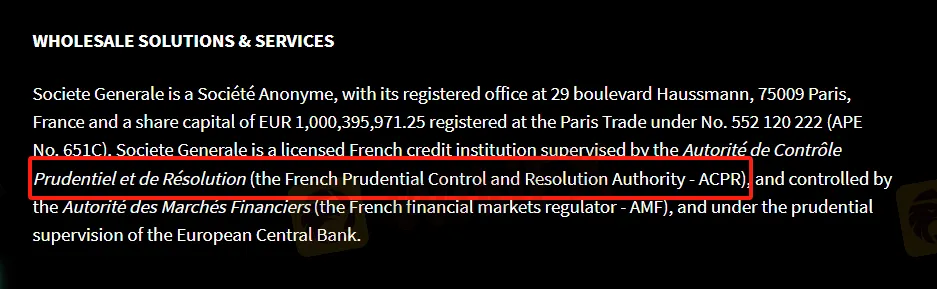

SOCIETE GENERALE 합법성

SOCIETE GENERALE은 ACPR에 의해 규제되었다고 주장하지만 규제를 받지 않고 있습니다. 트레이더들은 거래 시 주의를 기울여야 합니다.

제품 및 서비스

SOCIETE GENERALE은(는) 주식 및 주식 파생상품, 고정 소득 및 통화, 프라임 서비스 및 청산, 양적 투자 전략, 버넷스틴 현금 주식 거래 및 주식 연구, 크로스 자산 연구, 크로스 자산 솔루션, 긍정적인 영향 금융, SG Markets, 청산 서비스, 보관 및 수탁 서비스, 소매 보관 서비스, 유동성 관리, 펀드 관리, 자산 서비스, 펀드 유통, 글로벌 발행인 서비스를 포함한 포괄적인 증권 서비스를 제공합니다.

| 제품 | 제공 여부 |

| 주식 | ✔ |

| 주식 파생상품 | ✔ |

| 통화 | ✔ |

| 상품 | ❌ |

| 지수 | ❌ |

| 암호화폐 | ❌ |

| 채권 | ❌ |

| 옵션 | ❌ |

| ETFs | ❌ |