Buod ng kumpanya

| JIA Securities Buod ng Pagsusuri | |

| Itinatag | 2021 |

| Rehistradong Bansa/Rehiyon | Hapon |

| Regulasyon | FSA |

| Mga Instrumento sa Merkado | Bonds, stocks, investment trusts, Index Futures, Japan Operating Lease Investment Products, JIA Fund, Unlisted Company Funds, at Real Estate Small-Lot Investment Products |

| Demo Account | ❌ |

| Platform ng Pagtitingin | / |

| Minimum na Deposit | / |

| Suporta sa Customer | 24/5 suporta, form ng pakikipag-ugnayan |

| Telepono: 0120-69-1424 | |

| Address: 〒104-0033 1-5-17 Shinkawa, Chuo-ku, Tokyo Eiha Shinkawa 6F | |

Impormasyon Tungkol sa JIA Securities

JIA Securities ay isang broker. Kasama sa mga maaaring i-trade na instrumento ang bonds, stocks, investment trusts, Index Futures, Japan Operating Lease Investment Products, JIA Fund, Unlisted Company Funds, at Real Estate Small-Lot Investment Products. Bagaman ang JIA Securities ay regulado ng FSA, hindi maaaring lubusang iwasan ang mga panganib.

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

| Regulado ng FSA | Limitadong mga paraan ng pagbabayad |

| Iba't ibang mga maaaring i-trade na produkto | Limitadong transparency ng impormasyon |

| Malinaw na istraktura ng bayad | |

| 24/5 suporta sa customer |

Tunay ba ang JIA Securities?

Ang JIA Securities ay regulado ng FSA na may Retail Forex License, na ginagawang mas ligtas kaysa sa mga hindi reguladong broker.

| Otoridad na Regulado | Kasalukuyang Kalagayan | Lisensiyadong Entidad | Regulado na Bansa | Uri ng Lisensya | Numero ng Lisensya |

| Financial Services Agency (FSA) | Regulado | JIA証券株式会社 | Japan | Retial Forex License | 関東財務局長(金商)第2444号 |

Ano ang Maaari Kong I-trade sa JIA Securities?

JIA Securities ay nag-aalok ng malawak na hanay ng mga instrumento sa merkado, kabilang ang mga bond, stocks, investment trusts, Index Futures, Japan Operating Lease Investment Products, JIA Fund, Unlisted Company Funds, at Real Estate Small-Lot Investment Products.

| Maaaring I-Trade | Supported |

| Bonds | ✔ |

| Investment Trusts | ✔ |

| Stocks | ✔ |

| Index Futures | ✔ |

| Japan Operating Lease Investment Products | ✔ |

| JIA Fund | ✔ |

| Unlisted Company Funds | ✔ |

| Real Estate Small-Lot Investment Products | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

| ETFs | ❌ |

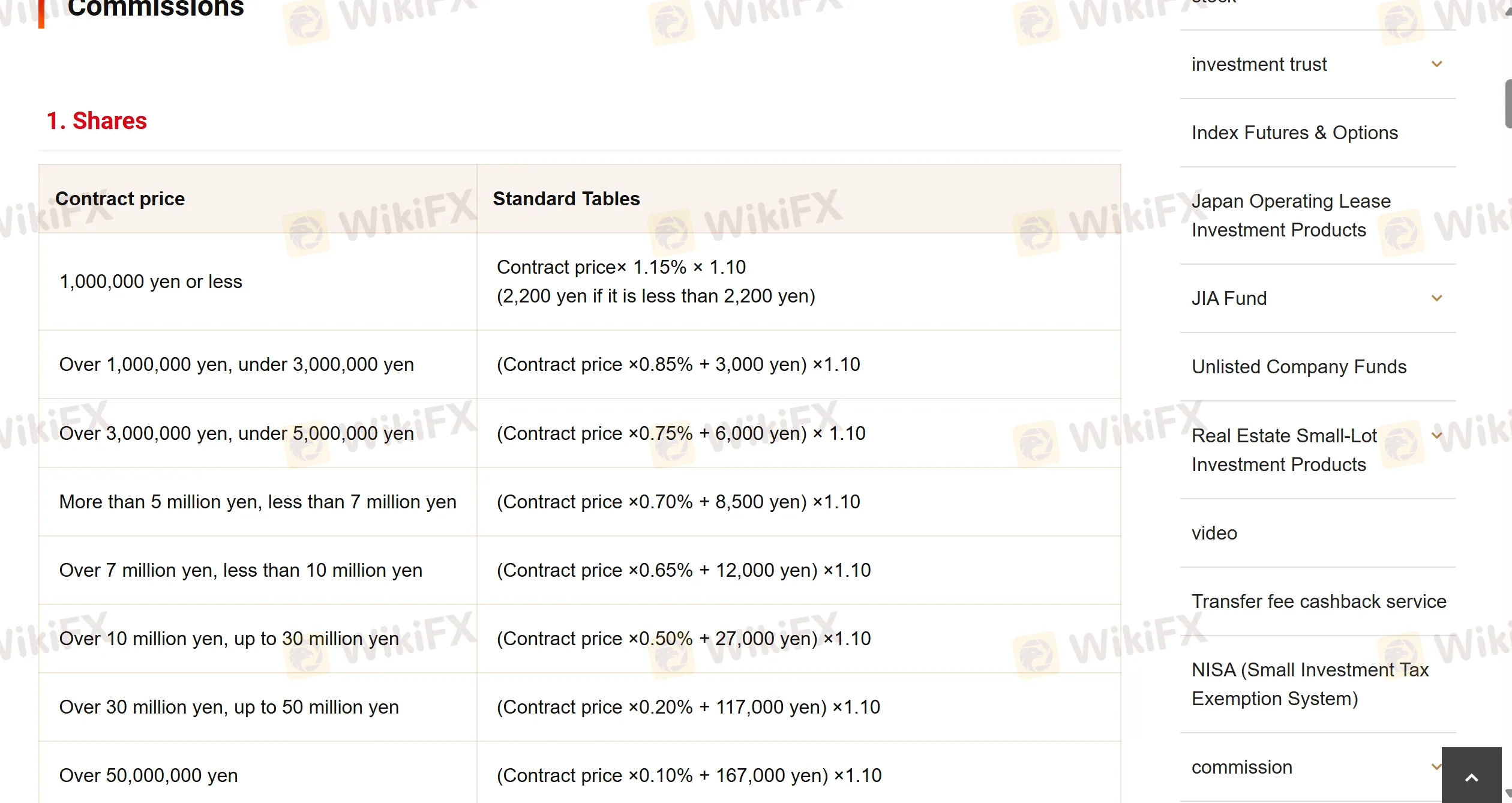

Mga Bayarin ng JIA Securities

| Shares (Halaga ng Kontrata) | Bayarin |

| 1,000,000 yen o mas mababa | Halaga ng kontrata × 1.15% × 1.10; (2,200 yen kung ito ay mas mababa sa 2,200 yen) |

| Higit sa 1,000,000 yen, mababa sa 3,000,000 yen | (Halaga ng kontrata × 0.85% + 3,000 yen) × 1.10 |

| Higit sa 3,000,000 yen, mababa sa 5,000,000 yen | (Halaga ng kontrata × 0.75% + 6,000 yen) × 1.10 |

| Higit sa 5 milyong yen, mas mababa sa 7 milyong yen | (Halaga ng kontrata × 0.70% + 8,500 yen) × 1.10 |

| Higit sa 7 milyong yen, mas mababa sa 10 milyong yen | (Halaga ng kontrata × 0.65% + 12,000 yen) × 1.10 |

| Bonds (Halaga ng Kontrata) | Bayarin |

| 1,000,000 yen o mas mababa | Halaga ng kontrata × 1.00% × 1.10; (2,200 yen kung ito ay mas mababa sa 2,200 yen) |

| Higit sa 1,000,000 yen, mababa sa 3,000,000 yen | (Halaga ng kontrata × 0.85% + 1,500 yen) × 1.10 |

| Higit sa 3,000,000 yen, mababa sa 5,000,000 yen | (Halaga ng kontrata × 0.75% + 4,500 yen) × 1.10 |

| Higit sa 5 milyon yen, mas mababa sa 7 milyon yen | (Halaga ng kontrata × 0.70% + 7,000 yen)× 1.10 |

| Higit sa 7 milyon yen, mas mababa sa 10 milyon yen | (Halaga ng kontrata × 0.65% + 10,500 yen) × 1.10 |

| Dayuhang Shares (Halaga ng Kontrata) | Bayarin |

| 1,000,000 yen o mas mababa | Halaga ng Trading × 1.25% × 1.10 |

| Higit sa 1,000,000 yen, mababa sa 3,000,000 yen | (Halaga ng Trading × 1.20% + 500 yen) × 1.10 |

| Higit sa 3,000,000 yen, mababa sa 5,000,000 yen | (Halaga ng Trading × 1.00% + 6,500 yen) × 1.10 |

| Higit sa 5 milyon yen, mas mababa sa 10 milyon yen | (Halaga ng Trading × 0.80% + 16,500 yen) × 1.10 |

| Higit sa 10 milyon yen, hanggang sa 30 milyon yen | (Halaga ng Trading × 0.60% + 36,500 JPY) × 1.10 |

Deposito at Pag-Wiwithdraw

Mga Paggawa ng Banko (domestic Japanese banks) ay inirerekomenda para sa mga pagbili ng real estate at bond, ngunit hindi naka-lista ang mga partikular na paraan ng pagbabayad. Sa kaso ng mga shares, maaaring mag-withdraw 2 araw na negosyo pagkatapos ng petsa ng pagbenta (petsa ng paghahatid). Sa kaso ng mga dayuhang bond, maaaring mag-withdraw mula sa 3 araw na negosyo (petsa ng paghahatid).