Unternehmensprofil

| SOCIETE GENERALE Überprüfungszusammenfassung | |

| Gegründet | 2000 |

| Registriertes Land/Region | China |

| Regulierung | Keine Regulierung |

| Handelsprodukte | Aktien, Aktienderivate, Währungen |

| Demokonto | / |

| Hebel | / |

| Spread | / |

| Handelsplattform | / |

| Mindesteinzahlung | / |

| Kundenbetreuung | Soziale Medien: LinkedIn, Twitter, YouTube |

| Adresse: 29 Boulevard Haussmann, 75009 Paris, Frankreich | |

SOCIETE GENERALE Informationen

SOCIETE GENERALE wurde im Jahr 2000 gegründet und in China registriert. Es bietet eine breite Palette von Wertpapierdienstleistungen an, einschließlich Aktien und Derivate, Festverzinsliche und Devisen, Clearing-Dienstleistungen, Verwahrungsdienste und Liquiditätsmanagement.

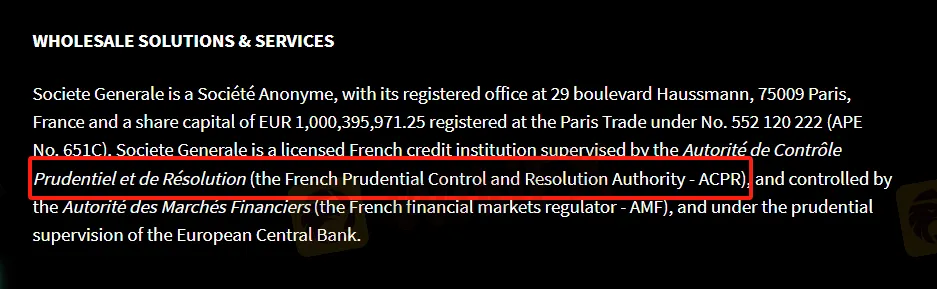

Obwohl es angibt, von der französischen ACPR reguliert zu werden, ist es nicht reguliert. Anleger sollten in Bezug auf die Sicherheit und Transparenz der Fonds vorsichtig sein. Das Unternehmen interagiert mit Kunden über verschiedene Kanäle, einschließlich LinkedIn, Twitter und YouTube, bietet jedoch keine ausführlichen Erklärungen zu Einzahlungen, Abhebungen und anderen wichtigen Informationen.

Vor- und Nachteile

| Vorteile | Nachteile |

| Angebot von mehreren Produkten und Dienstleistungen | Keine Regulierung |

| Unklare Gebührenstruktur | |

| Keine Informationen zu Einzahlungen und Abhebungen | |

| Kein direkter Kontaktkanal |

Ist SOCIETE GENERALE legitim?

Obwohl SOCIETE GENERALE angibt, von der ACPR reguliert zu werden, ist es nicht reguliert. Händler sollten beim Handel Vorsicht walten lassen.

Produkte und Dienstleistungen

SOCIETE GENERALE bietet umfassende Wertpapierdienstleistungen für Aktien & Aktienderivate, Festverzinsliche Wertpapiere und Währungen, Prime Services & Clearing, Quantitative Anlagestrategien, Bernstein Cash Equity Trading & Aktienforschung, Cross-Asset-Forschung, Cross-Asset-Lösungen, Positive Impact Finance, SG Markets, Clearing-Services, Verwahr- und Treuhanddienstleistungen, Einzelverwahrungsdienste, Liquiditätsmanagement, Fondsverwaltung, Vermögensverwaltung, Fondsvertrieb, Globale Emittentendienste.

| Produkte | Verfügbar |

| Aktien | ✔ |

| Aktienderivate | ✔ |

| Währungen | ✔ |

| Waren | ❌ |

| Indizes | ❌ |

| Kryptowährungen | ❌ |

| Anleihen | ❌ |

| Optionen | ❌ |

| ETFs | ❌ |