Buod ng kumpanya

| CommSec Buod ng Pagsusuri | |

| Itinatag | 1995 |

| Rehistradong Bansa | Australia |

| Regulasyon | ASIC |

| Mga Produkto sa Paghahalal | Mga Bahagi, Mga Opsyon, ETFs |

| Demo Account | ❌ |

| Platform sa Paghahalal | CommSec Plataporma sa Web, CommSec Mobile App |

| Minimum na Deposito | 0 |

| Suporta sa Customer | Telepono: 13 15 19 (sa loob ng Australia) |

| Telepono: +61 2 8397 1206 (sa labas ng Australia) | |

Impormasyon Tungkol sa CommSec

Ang Commonwealth Securities Limited ay pinapatakbo ang CommSec, na nasa paligid na mula noong 1995 at isa sa pinakamahusay na online na mga broker sa Australia. Mayroon itong maraming iba't ibang produkto, tulad ng mga Australian at internasyonal na mga stocks, ETFs, mga opsyon, mga pautang sa margin, at mga tool sa micro-investing tulad ng CommSec Pocket. Ito ay isang mabuting pagpipilian para sa mga baguhan at mga may karanasan na mamumuhunan.

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

| Malawak na hanay ng mga produkto at serbisyo | Ang internasyonal at telepono na kalakalan ay mahal |

| Matibay na suporta sa regulasyon (ASIC) | Walang mga demo account na magagamit |

| Madaling gamitin na mga plataporma sa web at mobile |

Tunay ba ang CommSec?

Oo, ang CommSec ay nairegulate. Ito ay gumagana sa ilalim ng lisensiyadong kumpanya Commonwealth Securities Limited, na binabantayan ng Australia Securities & Investment Commission (ASIC). Ang ASIC ang namamahala sa mga patakaran, at ang uri ng lisensya ay Market Maker (MM). Ang numero ng lisensya ay 000238814.

Ano ang Maaari Kong Itrade sa CommSec?

Ang CommSec ay may malawak na hanay ng mga kalakal at serbisyo, tulad ng mga Australian at dayuhang mga shares, ETFs, mga opsyon, at iba pa. Ito ay isang mabuting pagpipilian para sa mga baguhan at mga may karanasan na mamumuhunan. Mayroon din itong mga tool tulad ng mga pautang sa margin, pamamahala ng SMSF, at maging mga alternatibong pamumuhunan para sa mga kabataan at maliit na mamumuhunan.

| Mga Kasangkapan sa Paghahalal | Supported |

| Shares | ✓ |

| Opsyon | ✓ |

| ETFs | ✓ |

| Forex | × |

| Mga Kalakal | × |

| Mga Indeks | × |

| Mga Cryptocurrency | × |

| Mga Bond | × |

Mga Bayad sa CommSec

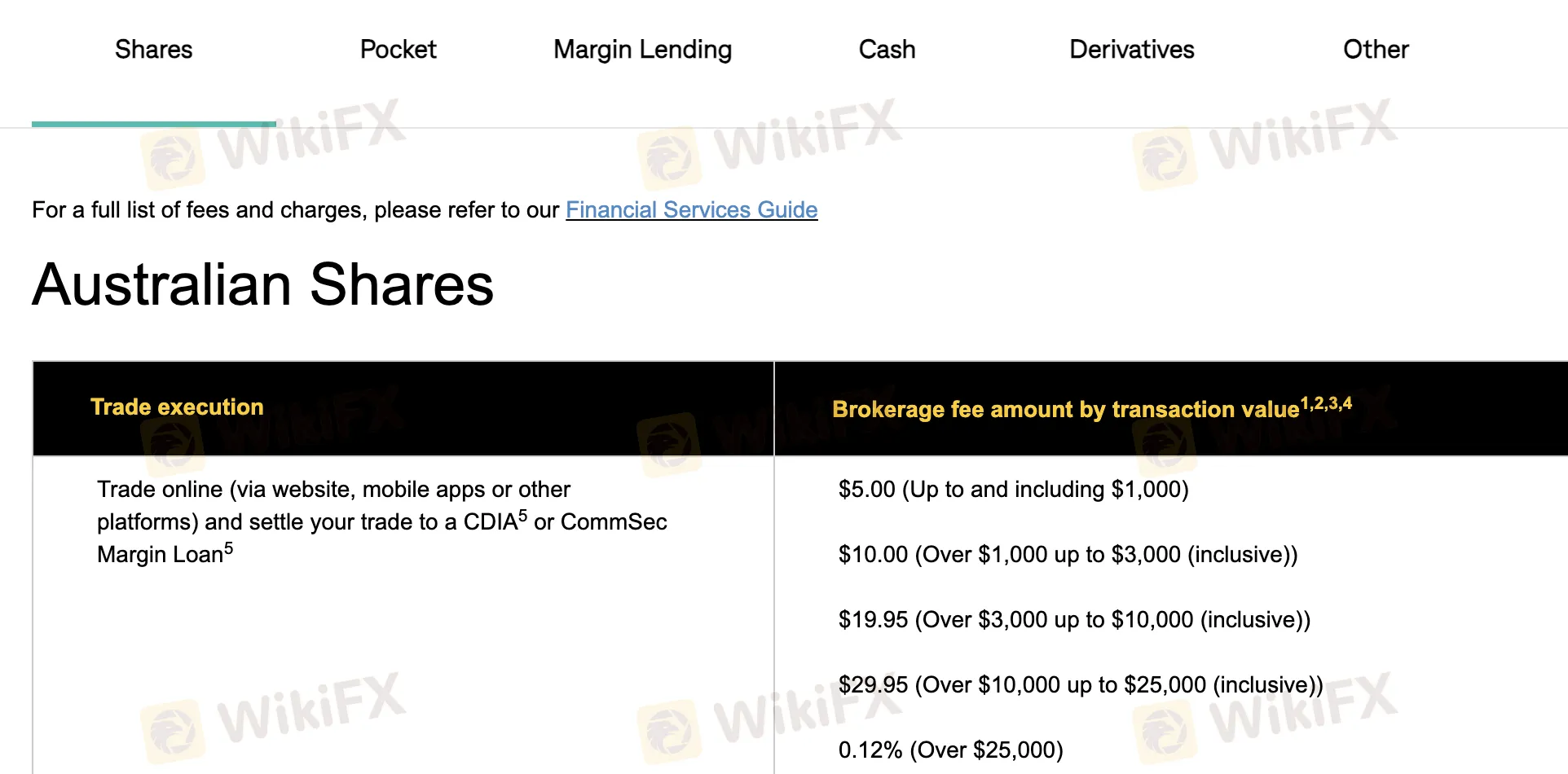

Ang mga presyo ng CommSec ay karaniwang makatarungan at makatwiran kumpara sa iba pang mga broker, lalo na para sa online trading sa loob ng Australia. Gayunpaman, ang mga kalakal sa ibang bansa at sa telepono ay maaaring mas mahal. Para sa mga mababang kalakal sa Australia, nagsisimula ang bayad sa $5. Para sa dayuhang kalakalan at trading sa mga opsyon, mayroong minimum na bayarin sa dolyar o porsyento.

| Uri | Mga Detalye ng Bayad |

| Australian Shares (online via CDIA) | $5 (≤$1,000), $10 (>$1,000–$3,000), $19.95 (>$3,000–$10,000), $29.95 (>$10,000–$25,000), 0.12% (>$25,000) |

| Australian Shares (online, non-CDIA settlement) | $29.95 (≤$9,999.99), 0.31% (≥$10,000) |

| Phone Trades | $59.95 (≤$10,000), 0.52% (>$10,000–$25,000), 0.49% (>$25,000–$1M), 0.11% (>$1M) |

| CommSec Pocket App | $2 (≤$1,000), 0.20% (>$1,000) |

| International Shares (basic account) | US: $5 or 0.12%; Canada: C$40 or 0.40%; Europe: €12 or 0.40%; Hong Kong: HK$130 or 0.40%; UK: £12 or 0.40% |

| Foreign Exchange Conversion Fee | 0.55% bawat conversion ng currency |

| Mga Rate ng Margin Lending (variable) | ~9.15% kada taon (buwanan), fixed rates (1–5 taon: ~7.49–7.69% kada taon) |

| Exchange-Traded Options (online) | $34.95 (≤$10,000), 0.35% (>$10,000) |

| Exchange-Traded Options (phone) | $54.60 (≤$10,000), 0.54% (>$10,000) |

| Mga Bayad sa ETO Contract | Equity options: $0.13 bawat kontrata (open/close), $0.05 (exercise); Index options: $0.45 (open/close), $0.35 (exercise) |

Mga Singil na Hindi Kaugnay sa Paghahalal

| Mga Singil na Hindi Kaugnay sa Paghahalal | Halaga | |

| Bayad sa Aplikasyon (indiibidwal/kumpanya) | $0 | |

| Bayad sa Pagsisiyasat ng Trust Deed | Minimum $200 | |

| Bayad sa PPSR Registration (bayad ng pamahalaan) | Bayad ng pamahalaan (kung kailangan) | |

| Bayad sa Pagpapanatili ng Account | $0 | |

| Printed Contract Notes (sa pamamagitan ng koreo) | $1.95 | |

| Dishonour Fee | $30 | |

| Rebooking Fee | $25 | |

| Bayad sa Paglipat sa Labas ng Merkado | $54 | |

| Mga Buwis/Responsibilidad ng Pamahalaan | Ibinababa sa halaga | |

| Bayad sa Pagsara ng Account (maagang pagbabayad ng utang) | Deposito/Pag-atras (mga account ng CDIA) | Walang limitasyong libreng pag-atras sa elektroniko; pinapayagan ang buwanang libreng pag-atras ng SMSF CDIA |

| Bayad sa Pagpapalit ng Huli (Bumili/Mag-short Sell) | $100 | |

| SRN Query o Bayad sa Pag-rebook | $25 | |

| Market Data (live snapshots) | $1 USD libre kada buwan, pagkatapos $0.01 bawat quote ng US equity, $0.03 para sa iba | |

| Bayad sa U.S. Tax Form | $0 | |

| Bayad sa Pagtanggi ng Pagsalin ng Pondo | $0 | |

| Instant Buying Power | $0 | |

| U.S. ACATS Transfers In/Out | $0 | |

| U.S. DRS Transfers In | $25 bawat natapos na transaksyon; mga tinanggihan na transaksyon $100 | |

| Canada DRS Transfers In | $30 CAD bawat natapos na transaksyon plus mga bayad mula sa ikatlong partido | |

| U.S. DRS Transfers Out | $5 bawat natapos na transaksyon |

Platform ng Paghahalal

| Platform ng Paghahalal | Supported | Available Devices | Akma para sa |

| CommSec Web Platform | ✔ | Web browser (desktop, laptop) | Mga aktibong mamumuhunan, mga tagapamahala ng portfolio |

| CommSec Mobile App | ✔ | iOS, Android | Mga naglalakbay, mga gumagamit ng mobile |