Buod ng kumpanya

| Axis Bank Buod ng Pagsusuri | |

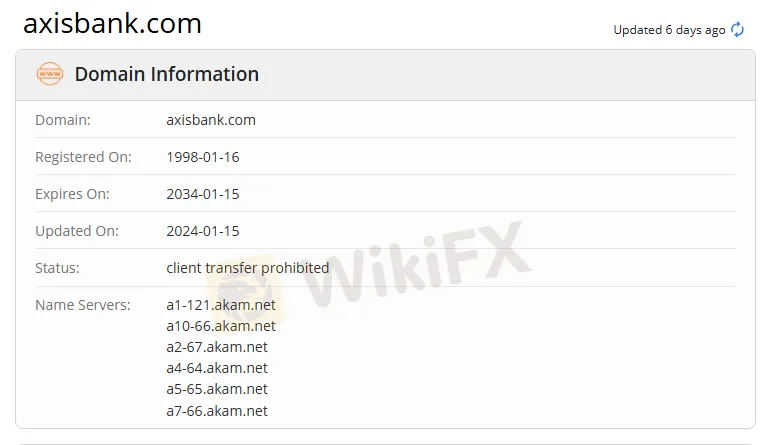

| Itinatag | 1998 |

| Rehistradong Bansa/Rehiyon | India |

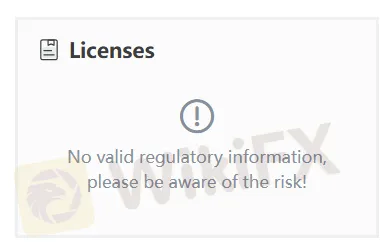

| Regulasyon | Walang Regulasyon |

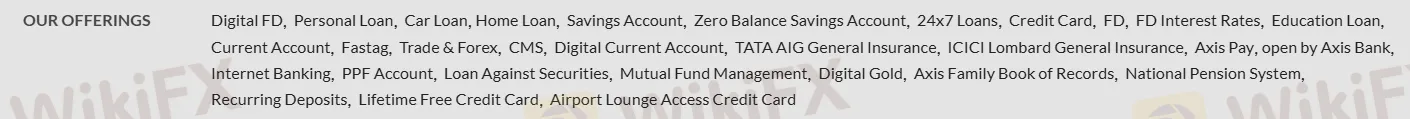

| Mga Produkto at Serbisyo | Pautang, forex, insurance, Mutual Fund Management, Digital Gold, at iba pa. |

| Platform/APP | Axis Bank App |

| Suporta sa Customer | Telepono: +91-79-66306161 |

| Email: PNO@axisbank.com | |

| Social Media: Facebook, LinkedIn, Twitter, YouTube, Instagram | |

| Address: Axis Bank Limited, Trishul 3rd Floor, Opp. Samartheshwar Temple, Near Law Garden, Ellisbridge. Ahmedabad-380 006 | |

Impormasyon Tungkol sa Axis Bank

Itinatag ang Axis Bank noong 1998 at rehistrado sa India. Nag-aalok ito ng iba't ibang mga produkto at serbisyo sa pinansyal, kabilang ang pautang, forex, insurance, Mutual Fund Management, Digital Gold, at iba pa.

Gayunpaman, ang kumpanya ay hindi regulado sa kasalukuyan. Dapat mag-ingat ang mga mamumuhunan sa kaligtasan ng kanilang pondo.

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

| Iba't ibang mga produkto at serbisyo | Walang regulasyon |

| Maraming uri ng account |

Tunay ba ang Axis Bank?

Sa kasalukuyan, ang Axis Bank ay walang mga wastong regulasyon. Mangyaring maging maingat sa panganib!

Mga Produkto at Serbisyo

Nag-aalok ang Axis Bank ng malawak na hanay ng mga produkto at serbisyo, kabilang ang pautang, forex, insurance, Mutual Fund Management, Digital Gold, at iba pa.

Uri ng Account

Ang Axis Bank ay sumusuporta sa mga transaksyon sa pamamagitan ng kanilang sariling Axis Bank App.

| Platform/APP | Supported | Available Devices |

| Axis Bank App | ✔ | Desktop, Mobile, Web |