Buod ng kumpanya

| BLUEMOUNT Buod ng Pagsusuri | ||

| Itinatag | 1996 | |

| Rehistradong Bansa/Rehiyon | China Hong Kong | |

| Regulasyon | SFC (Nalampasan) | |

| Mga Instrumento sa Merkado | Mga Securities, Mga Shares | |

| Platform ng Paggawa ng Kalakalan | Suporta sa Customer | Hotline: +852 2137 2688 |

| Fax: + 852 2137 2628 | ||

| Email: cs@bluemount.com | ||

Impormasyon Tungkol sa BLUEMOUNT

BLUEMOUNT ay isang kumpanya ng securities na nakabase sa China, Hong Kong, na nagbibigay ng mga serbisyong pangkalakalan ng securities para sa parehong merkado ng Hong Kong at Global. Ang BLUE ay nag-aalok din ng iba't ibang mga serbisyo, kabilang ang pagkolekta ng mga serbisyong pangangasiwa ng account, cash dividends, bonus shares/warrants, bagong shares subscription, shares subscription, pagsasanay ng mga warrants, at stock consolidation/splitting, atbp. Sa kasalukuyan, ito ay nag-ooperate nang walang regulasyon.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Transparent fee structure | Nalampasan ang Lisensya ng SFC |

| Nag-aalok ng mga Indibidwal at Joint accounts | Demo accounts hindi available |

| Mahabang oras ng operasyon | Limitadong mga instrumento sa merkado |

| Limitadong mga pagpipilian sa pagbabayad |

Tunay ba ang BLUEMOUNT?

Hindi, ang BLUEMOUNT ay may nalampasang lisensya mula sa Securities and Futures Commission (SFC) ng Hong Kong, na nangangahulugang ang kasalukuyang mga aktibidad nito ay ginaganap nang walang pagsusuri mula sa regulasyon.

| Regulated Country | Regulated Authority | Regulatory Status | Regulated Entity | License Type | License Number |

| Securities and Futures Commission of Hong Kong (SFC) | Nalampasan | Bluemount Securities Limited | Pakikitungo sa mga securities | BHR496 |

Ano ang Maaari Kong Kalakalan sa BLUEMOUNT?

Ang mga mangangalakal sa BLUEMOUNT ay may access sa mga shares at securities (cash at margin).

| Trading Asset | Available |

| securities | ✔ |

| shares | ✔ |

| forex | ❌ |

| commodities | ❌ |

| indices | ❌ |

| cryptocurrencies | ❌ |

| bonds | ❌ |

| options | ❌ |

| funds | ❌ |

| ETFs | ❌ |

Uri ng Account

Pinapayagan ang mga mangangalakal na magbukas ng individual accounts at joint accounts sa platapormang ito.

Bukod dito, nag-aalok ang platapormang ito ng Discretionary Account Services, na tumutukoy sa mga serbisyong pangangasiwa sa pamumuhunan kung saan binibigyan ng kapangyarihan ang isang financial advisor o portfolio manager na gumawa ng mga desisyon sa pamumuhunan para sa isang kliyente nang hindi kinakailangang humingi ng pahintulot para sa bawat transaksyon.

Mga Bayarin

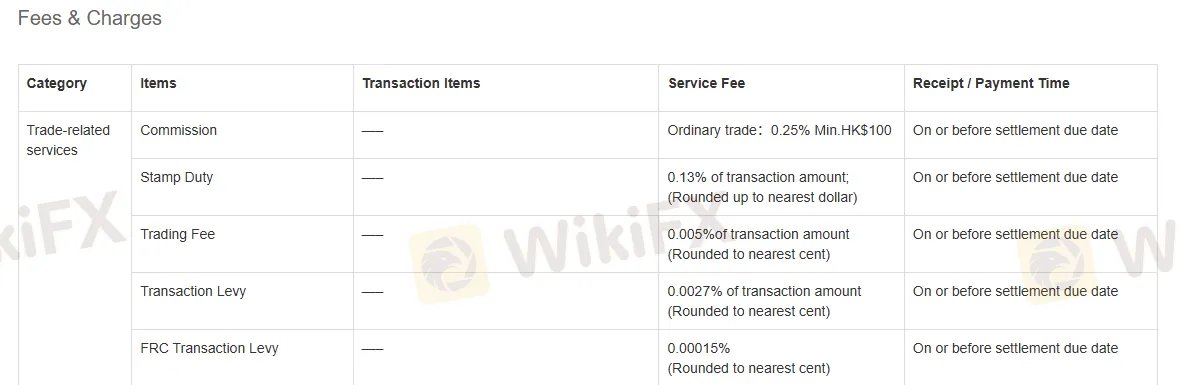

Nagbibigay ang BLUEMOUNT ng malinaw na istraktura ng bayarin sa mga mangangalakal, na naglalarawan ng mga singil nito para sa bawat serbisyo. Halimbawa, naniningil ang BLUEMOUNT ng komisyon na 0.25%, at ang minimum na halaga ay HK$ $100.

Para sa karagdagang impormasyon tungkol sa mga bayarin sa platapormang ito, pumunta sa https://www.bluemount.com/fees-charges?lang=en.

Narito ang iba't ibang bayarin kaugnay ng transaksyon, kasama ang kanilang mga patakaran sa pagkalkula at mga timeline ng pagbabayad.

| Items | Service Fee | Receipt/Payment Time |

| Commission | Karaniwang kalakal: 0.25%; Min. HK$100 | Sa o bago ang petsa ng pagtutuos |

| Stamp Duty | 0.13% ng halaga ng transaksyon; (Itinatama sa pinakamalapit na dolyar) | |

| Trading Fee | 0.005% ng halaga ng transaksyon (Itinatama sa pinakamalapit na sentabo) | |

| Transaction Levy | 0.0027% ng halaga ng transaksyon (Itinatama sa pinakamalapit na sentabo) | |

| FRC Transaction Levy | 0.00015% (Itinatama sa pinakamalapit na sentabo) |

Plataporma ng Paggagalaw

Nag-aalok ang BLUEMOUNT ng isang trading app na maaaring ma-access sa parehong Google Play at App Store.

| Plataporma ng Paggagalaw | Supported | Available Devices |

| BLUEMOUNT APP | ✔ | Mobile |

Deposito at Pag-Wiwithdraw

Proseso ng Pagdedeposito:

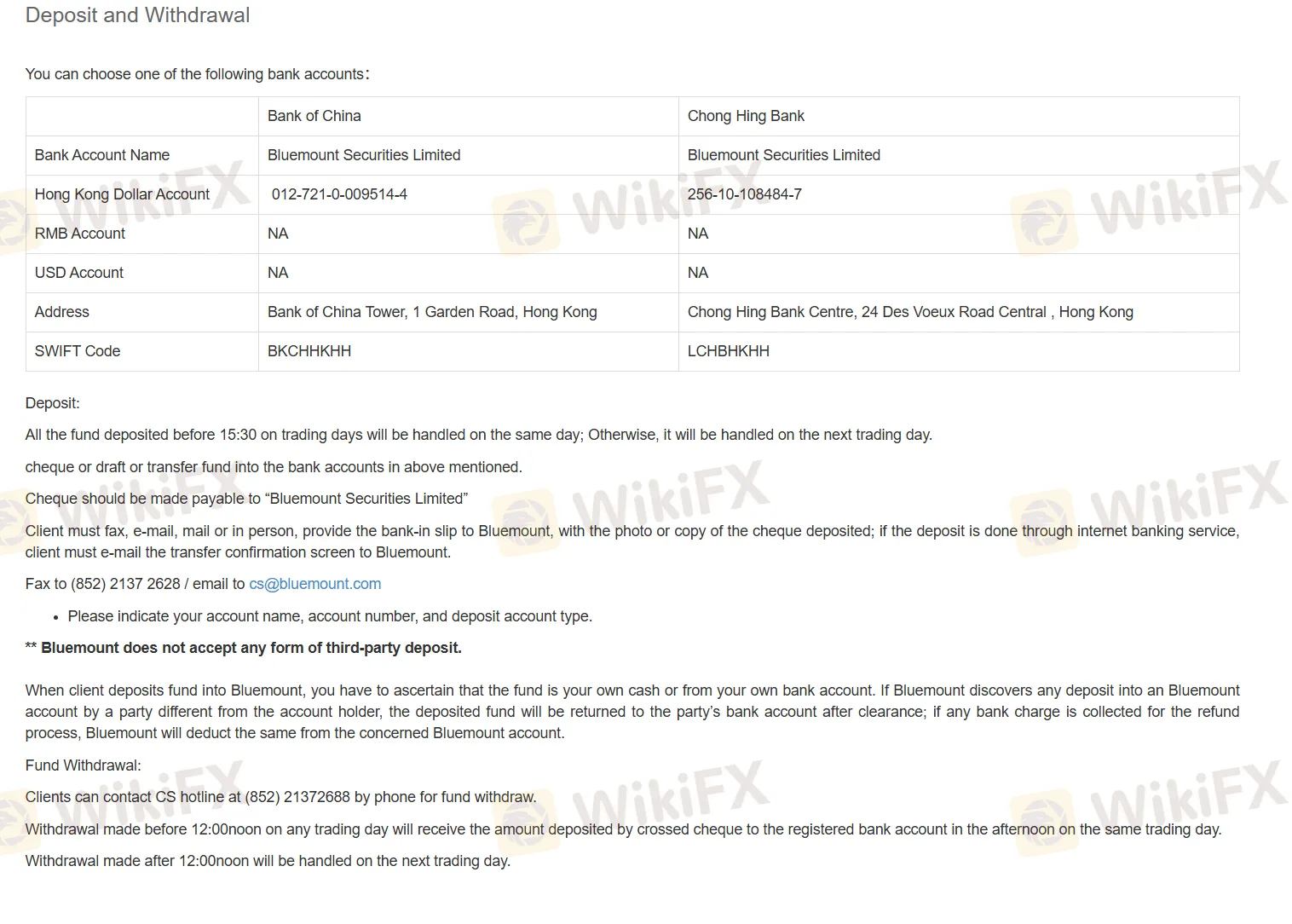

- Mga Bank Account para sa Pagdedeposito:

- Maaari kang magdepos ito ng pondo sa mga account ng Bluemounts sa Bank of China o Chong Hing Bank. Kasama sa mga uri ng account ang Hong Kong Dollar Accounts, ngunit walang RMB o USD accounts. Ang mga SWIFT Codes at mga address ay ibinigay para sa bawat bangko.

- Oras ng Pagdedeposito:

- Bago mag 15:30 sa mga araw ng kalakalan: Naiproseso sa parehong araw. Pagkatapos ng 15:30: Naiproseso sa susunod na araw ng kalakalan.

- Mga Paraan ng Pagdedeposito:

- Cheque/Draft/Bank Transfer: Gawing payable sa Bluemount Securities Limited. Kung magdedeposito gamit ang cheque, dapat mong magbigay ng bank-in slip, larawan o kopya ng cheque, o kumpirmasyon ng transfer.

Mahalagang Mga Tanda: Hindi tinatanggap ang mga deposito mula sa ikatlong partido. Lahat ng mga deposito ay dapat manggaling sa iyong account. Kung makikilala ng Bluemount ang isang deposito mula sa ikatlong partido, ibabalik nito ang pondo sa account ng nagpadala (kasama ang anumang bayad ng bangko na bawas).

Proseso ng Pagwiwithdraw:

- Papaano Magwithdraw:

- Maaari kang tumawag sa Customer Service (CS) sa (852) 2137 2688 upang humiling ng withdrawal.

- Oras ng Pagwiwithdraw:

- Bago mag 12:00 PM: Ang mga withdrawal ay naiproseso sa hapon at ide-deposito sa pamamagitan ng crossed cheque sa iyong rehistradong bank account sa parehong araw ng kalakalan. Pagkatapos ng 12:00 PM: Ang mga withdrawal ay naiproseso sa susunod na araw ng kalakalan.