Buod ng kumpanya

| Dragon Capital Buod ng Pagsusuri | |

| Itinatag | 2006 |

| Nakarehistrong Bansa/Rehiyon | Cyprus |

| Regulasyon | CySEC |

| Mga Produkto at Serbisyo | Serbisyong pang-invest, trading, payo sa investment, underwriting, custody, forex, derivatives |

| Demo Account | ❌ |

| Plataporma sa Trading | / |

| Minimum na Deposito | / |

| Suporta sa Customer | Telepono: +357 25 376 300 |

| Fax: +357 25 376 301 | |

| Email: svitlana.rusakova@dragon-capital.com | |

Impormasyon Tungkol sa Dragon Capital

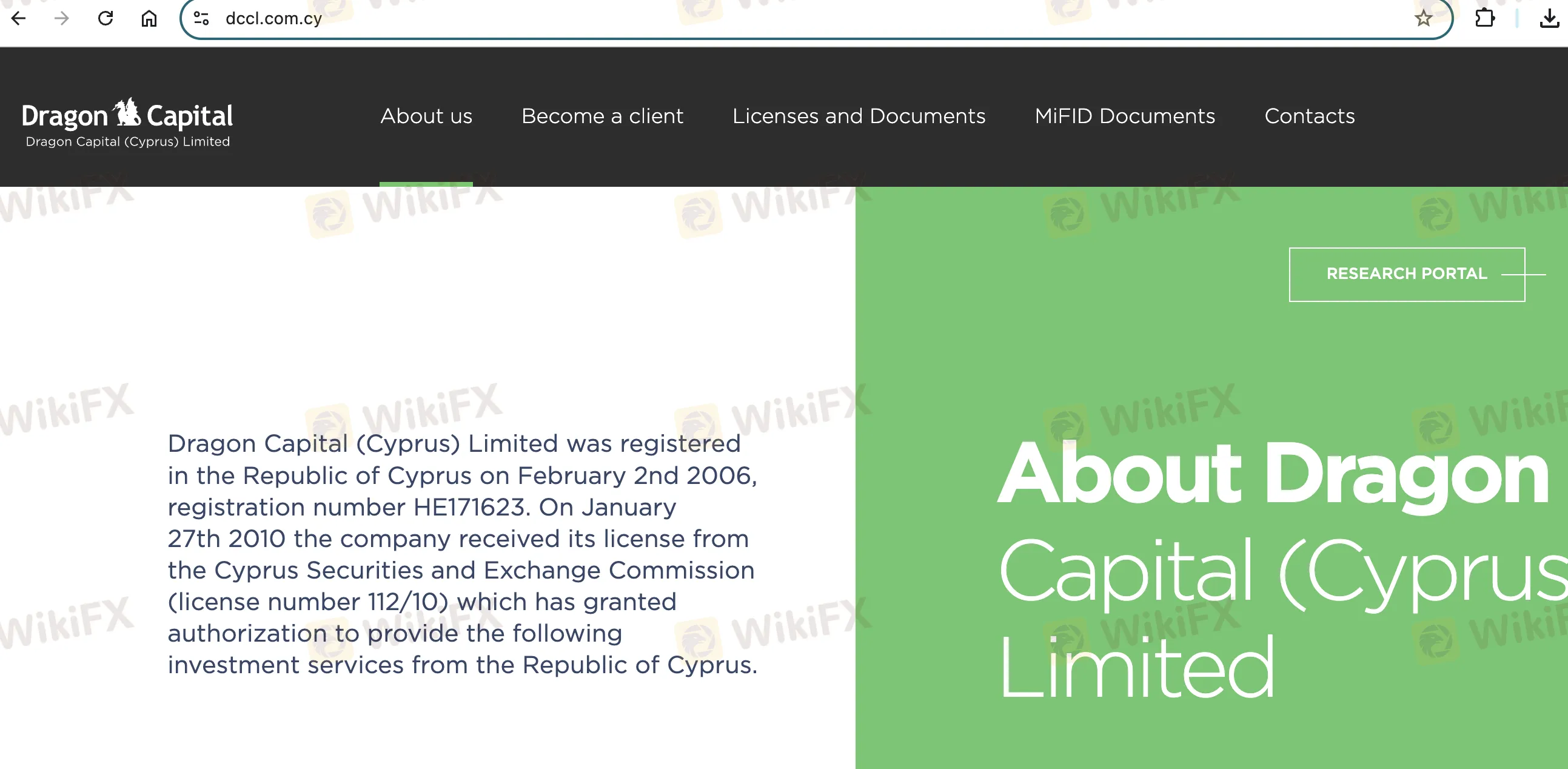

Ang Dragon Capital (Cyprus) Ltd ay isang lisensyadong kumpanya sa investment sa Cyprus na itinatag noong 2006 at nireregula ng CySEC sa ilalim ng lisensya 112/10. Ang kumpanya ay nagbibigay ng iba't ibang serbisyong pang-invest, kabilang ang pag-eexecute ng order, trading sa sariling account, custody, at payo sa investment, para sa iba't ibang financial instruments.

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

| Regulated by CySEC | Ang ilang bayarin (tulad ng Ukrainian bond services) ay mas mataas kaysa sa mga internasyonal na katapat |

| Nag-aalok ng malawak na hanay ng financial instruments at serbisyo | Walang demo accounts |

| Kumpletong investment at custody solutions | Walang detalye ng plataporma |

Tunay ba ang Dragon Capital?

Ang Dragon Capital (Cyprus) Ltd ay isang lisensyadong at regulated entity sa ilalim ng Cyprus Securities and Exchange Commission (CySEC) na may lisensyang 112/10, na nag-ooperate bilang Market Maker (MM).

Mga Produkto at Serbisyo

Nag-aalok ang Dragon Capital (Cyprus) Ltd ng kumpletong hanay ng serbisyo sa investment at kaugnay na serbisyo, tulad ng pag-eexecute ng mga order, trading sa sariling account, pagbibigay ng payo sa investment, underwriting, at custody services. Saklaw ng mga serbisyong ito ang malawak na hanay ng financial instruments, kabilang ang mga stocks, derivatives, at money market instruments.

| Mga Produkto & Serbisyo | Supported |

| Securities (stocks, bonds) | ✔ |

| Derivatives & CFDs | ✔ |

| Investment Advice | ✔ |

| Underwriting & Placement | ✔ |

| Custody Services | ✔ |

| Margin & Credit Services | ✔ |

| Forex (linked to investment) | ✔ |

| Investment Research | ✔ |

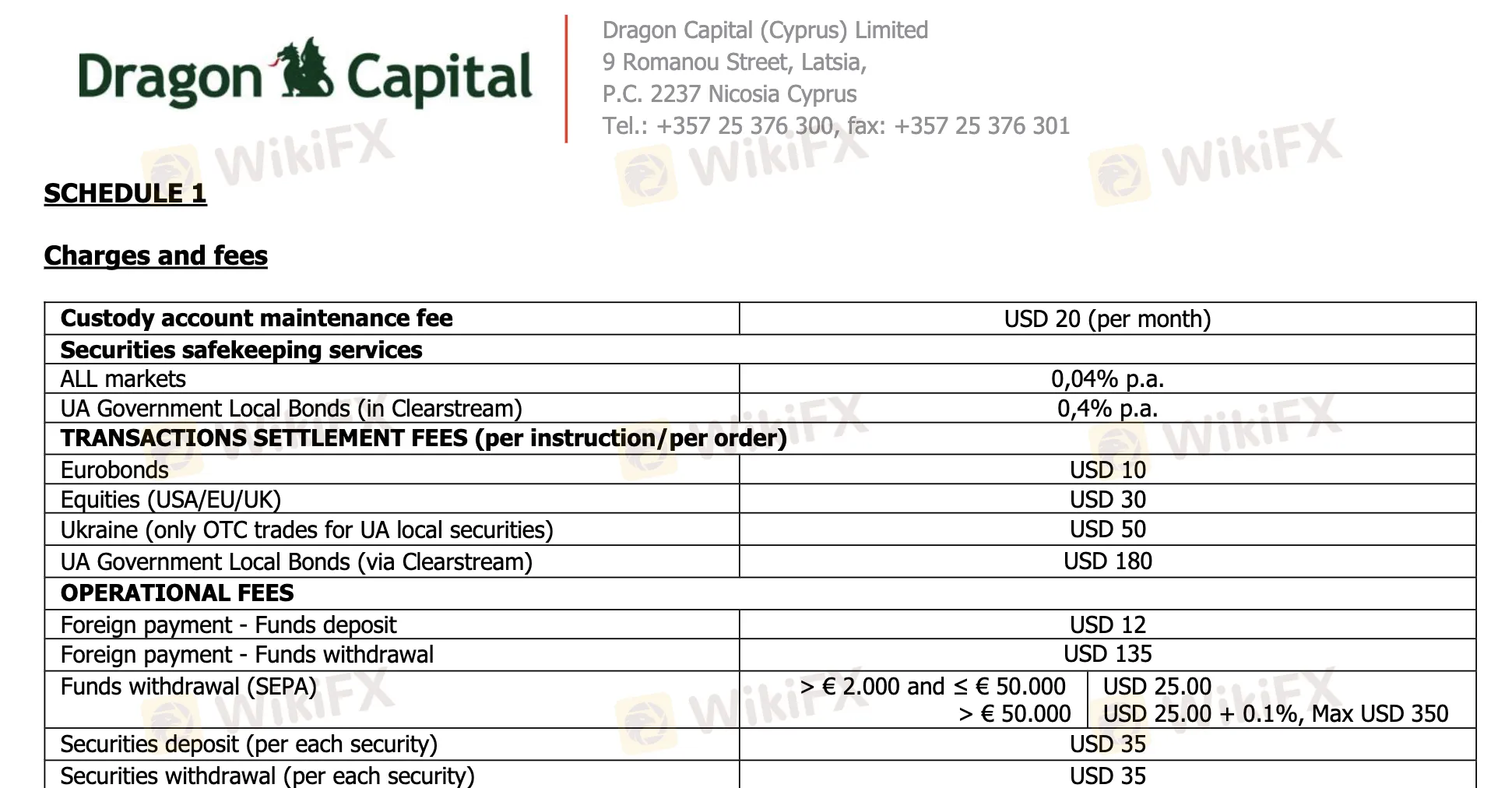

Mga Bayarin ng Dragon Capital

Ang mga bayad ni Dragon Capital ay karamihang katulad ng mga iba pang internasyonal na kumpanya ng pamumuhunan. Gayunpaman, maaaring magkaroon ng karagdagang bayad para sa ilang espesyalisadong serbisyo, tulad ng mga Ukrainian local bonds, corporate actions, at foreign withdrawals.

| Uri ng Bayad | Halaga |

| Pananatili ng Custody Account | USD 20 bawat buwan |

| Pag-iingat ng Securities (lahat ng merkado) | 0.04% bawat taon |

| UA Gov Local Bonds (Clearstream) | 0.4% bawat taon |

| Eurobond Settlement | USD 10 bawat order |

| Equities (USA/EU/UK) Settlement | USD 30 bawat order |

| UA Local Securities (OTC) Settlement | USD 50 bawat order |

| UA Gov Bonds (Clearstream) Settlement | USD 180 bawat order |

Mga Bayad sa Hindi Pangkalakalan

| Mga Bayad sa Hindi Pangkalakalan | Halaga |

| Dayuhang Pagbabayad (Deposit) | USD 12 |

| Dayuhang Pagbabayad (Withdrawal) | USD 135 |

| SEPA Withdrawal > €2,000–50,000 | USD 25 |

| SEPA Withdrawal > €50,000 | USD 25 + 0.1% (max USD 350) |

| Securities Deposit / Withdrawal | USD 35 bawat seguridad |

| Koleksyon ng Kita sa Dividendo (UA lamang) | 0.2% (min USD 15, max USD 300) |

| Kredito ng Kita sa Dividendo (UA lamang) | USD 20 |

| Buong Proxy Voting | USD 100–200 + mga panlabas na gastos |

| Buy Back (UA local) | USD 100 + mga panlabas na gastos |

| FX Operations EU Banks | 0.1% (min USD 20) |

| FX Operations UA Banks | 0.2% (min USD 40) |

| DR Conversion, Audit Requests, etc. | USD 20–100 + mga bayad mula sa ikatlong partido |