Unternehmensprofil

| VANTAGEÜberprüfungszusammenfassung | |

| Gegründet | 1991 |

| Registriertes Land/Region | Ägypten |

| Regulierung | Nicht reguliert |

| Marktinstrumente | Aktien in verschiedenen Branchen und Wertpapiere |

| Demokonto | / |

| Handelsplattform | Web, Mist WS und mobile App |

| Mindesteinzahlung | 0 |

| Kundensupport | Tel: +20 22560 4072, +20 22560 4073 |

| Whatsapp: 01025000896 | |

| Adresse: St. Nr. 28; Gebäude Nr. 170; vierte Etage, Wohnung Nr. 9; Fünfter Bezirk Gebäude, Fünfte Ansiedlung, Neues Kairo | |

VANTAGE wurde 1991 von Vantage Securities Brokerage in Ägypten gegründet. Es bietet den Handel mit verschiedenen Aktienportfolios und Wertpapieren an. Trader können über Web, Mist WS und mobile Apps handeln. Obwohl keine Mindesteinzahlung erforderlich ist, ist es nicht reguliert.

Vor- und Nachteile

| Vorteile | Nachteile |

| Erfahren | Keine Regulierung |

| Klare Gebührenstruktur | Überweisungsgebühr für einige Banken |

| Mehrere Handelsplattformen | |

| Keine Mindesteinzahlung |

Ist VANTAGE seriös?

Nein, VANTAGE wird von keiner Finanzbehörde reguliert. Trader sollten beim Handel vorsichtig sein.

Was kann ich bei VANTAGE handeln?

| Handelbare Instrumente | Unterstützt |

| Aktien | ✔ |

| Wertpapiere | ✔ |

| Forex | ❌ |

| Waren | ❌ |

| Indizes | ❌ |

| Aktien | ❌ |

| Kryptowährungen | ❌ |

Provision

Es gibt keine Provision für die Kontoeröffnung auf VANTAGE.

Andere Gebühren

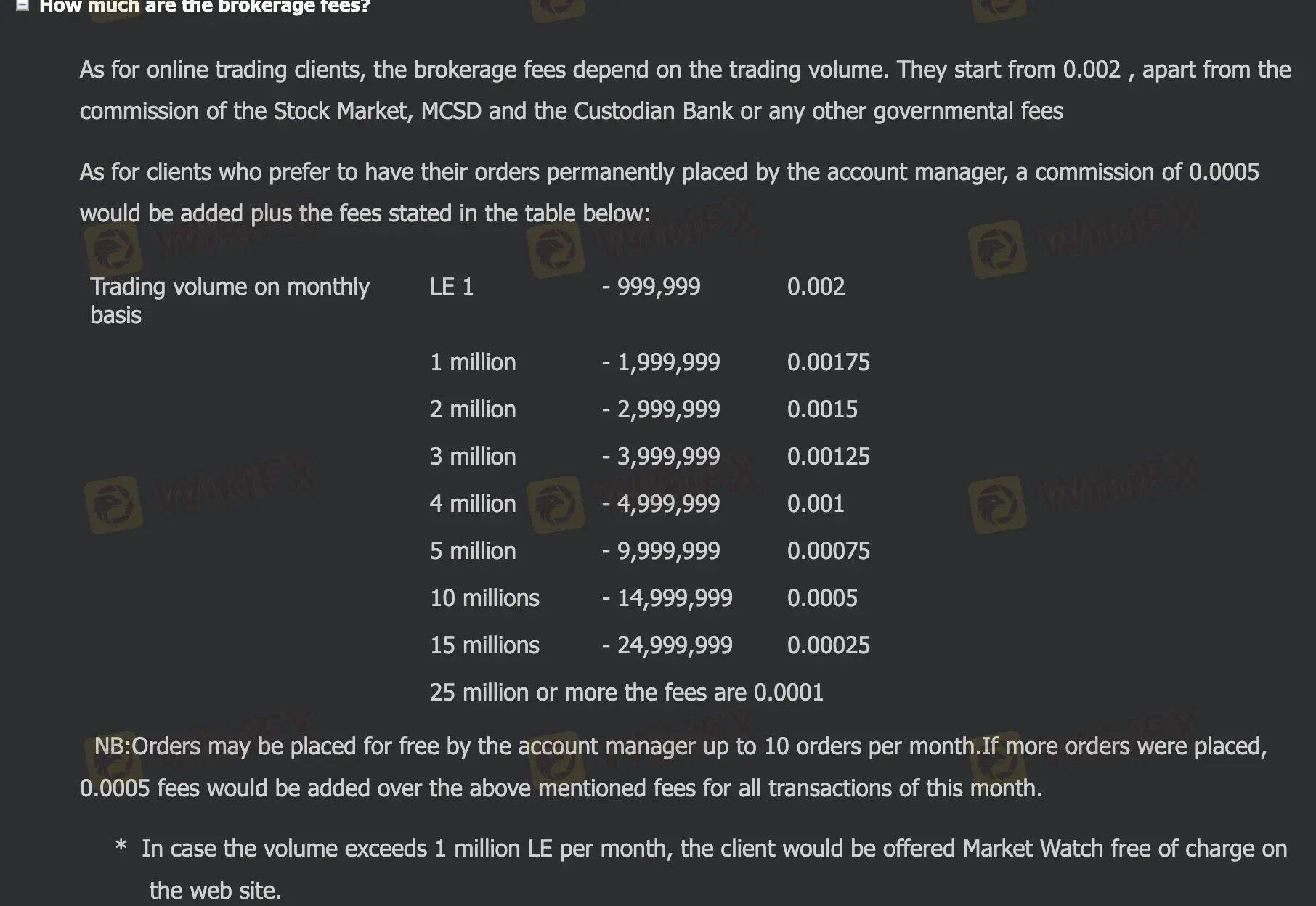

Die Maklergebühren von VANTAGE hängen vom Handelsvolumen ab. Es beginnt ab 0,002, abgesehen von der Provision der Börse, MCSD und der Depotbank oder anderen staatlichen Gebühren.

Händler möchten ihre Aufträge dauerhaft haben, es wird eine Provision von 0,0005 hinzugefügt, zuzüglich der Gebühren, die in der untenstehenden Tabelle angegeben sind. Darüber hinaus können Händler 10 kostenlose Aufträge platzieren, bei mehreren Aufträgen werden zusätzlich zu den oben genannten Gebühren für alle Transaktionen dieses Monats 0,0005 Gebühren erhoben.

| Handelsvolumen auf monatlicher Basis | Gebühren |

| LE 1-999999 | 0,002 |

| 1 Million-1999999 | 0,00175 |

| 2 Millionen- 2999999 | 0,0015 |

| 3 Millionen- 3999999 | 0,00125 |

| 4 Millionen- 4999999 | 0,001 |

| 5 Millionen- 9999999 | 0,00075 |

| 10 Millionen- 14999999 | 0,0005 |

| 15 Millionen- 24999999 | 0,00025 |

| 25 Millionen oder mehr Gebühren | 0,0001 |

Handelsplattform

| Handelsplattform | Unterstützt | Verfügbare Geräte | Geeignet für |

| Web | ✔ | Web | Erfahrene Händler |

| Mist WS | ✔ | Web | Erfahrene Händler |

| Mobile App | ✔ | Mobile | Erfahrene Händler |

Ein- und Auszahlung

Händler können über Bargeldüberweisung auf das Bankkonto einzahlen.

Es gibt zwei Möglichkeiten zur Auszahlung: Banküberweisung und ein geschlossener Scheck, der auf den Namen des Kunden ausgestellt ist.

Es fallen keine Überweisungsgebühren an, wenn an folgende Banken überwiesen wird: Arab African International Bank, CIB, Ahli United Bank, Banque Misr, NBK. Bei anderen Banken werden 0,001 Überweisungsgebühren abgezogen, mindestens jedoch EGP 25 und maximal EGP 50, zuzüglich EGP 20 Swift-Gebühren.