Perfil de la compañía

| United Trust BankResumen de revisión | |

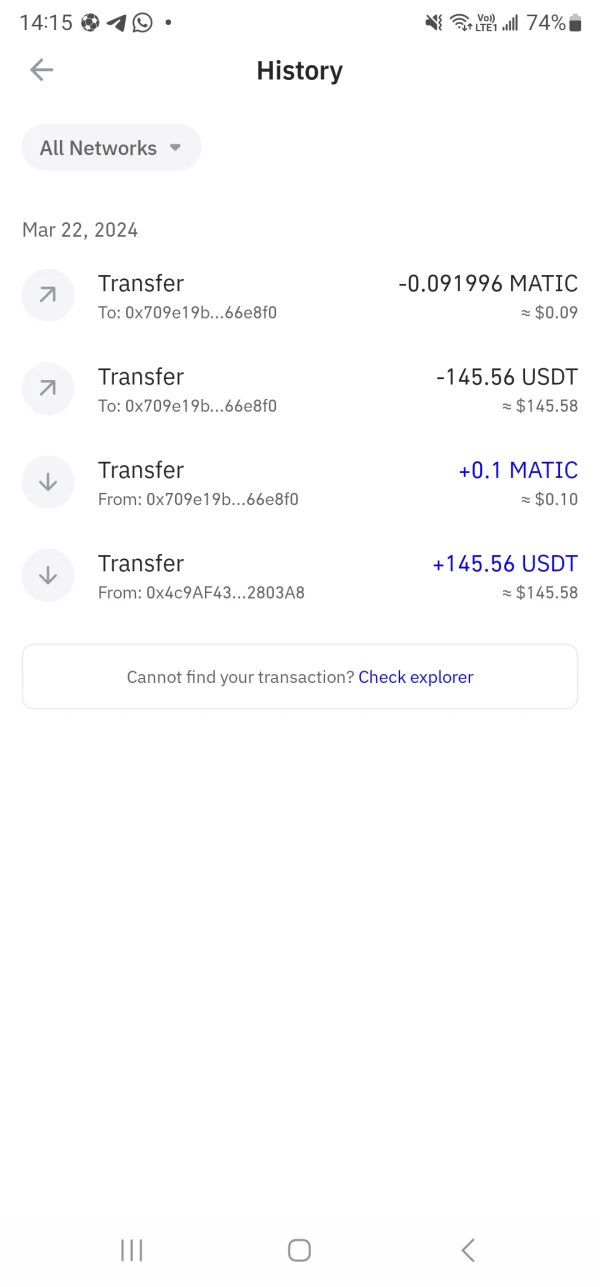

| Fundado | 1999-10-08 |

| País/Región registrado | Reino Unido |

| Regulación | No regulado |

| Servicios | Ahorros y depósitos/préstamos |

| Soporte al cliente | Email: hello@utbank.co.uk |

| Teléfono: 020 7190 5555 | |

Información de United Trust Bank

United Trust Bank se originó como un prestamista especializado que proporciona financiamiento para el desarrollo principalmente a constructores de viviendas pequeñas y medianas, fue adquirido por el banco anglo-holandés Insinger de Beaufort en 2001 y se transformó en un banco especializado en 2004. El banco se dedica a construir relaciones sólidas, ofrecer soluciones personalizadas y brindar el apoyo que necesitan nuestros clientes y socios corredores. United Trust Bank también ofrece servicios de ahorro, depósitos y préstamos.

¿Es United Trust Bank legítimo?

United Trust Bank está autorizado y regulado por la Autoridad de Conducta Financiera con la licencia No.204463, lo que lo hace más seguro que los corredores regulados.

¿Qué servicios ofrece United Trust Bank?

Ahorros y depósitos: United Trust Bank ofrece acceso a cuentas personales a tasas fijas y variables, cuentas ISA que hacen crecer los ahorros individuales libres de impuestos, cuentas comerciales con soluciones simples y seguras para empresas, autónomos, fondos de pensiones, fideicomisos, proveedores de educación, cooperativas de crédito, clubes y sociedades, y cuentas de caridad para organizaciones benéficas y escuelas. También ofrece productos personalizados y soluciones de depósito para clientes con £1 millón o más.

Préstamos: Incluyen financiamiento puente, desarrollo de propiedades, financiamiento estructurado de propiedades, financiamiento de activos e hipotecas. Soluciones de financiamiento a medida y ayuda para hacer crecer los negocios o inversiones de los clientes.

Opciones de soporte al cliente

Los traders pueden mantenerse en contacto con United Trust Bank por correo electrónico y teléfono.

| Opciones de contacto | Detalles |

| Correo electrónico | hello@utbank.co.uk |

| Teléfono | 020 7190 5555 |

| Idioma admitido | Inglés |

| Idioma del sitio web | Inglés |

| Dirección física | United Trust Bank Limited, 1 Ropemaker Street, Londres, EC2Y 9AW |