Perfil de la compañía

| CloudfuturesResumen de la revisión | |

| Establecido | 2019 |

| País/Región Registrada | China |

| Regulación | CFFE |

| Instrumentos de Mercado | Futuros |

| Cuenta Demo | ❌ |

| Plataforma de Trading | Edición de Trading en la Nube Boyi (Versión 7.0), Edición de Transacciones en la Nube Boyi (Edición Confidencial Comercial), Edición de Trading en la Nube Boyi, Edición Especial de Riqueza en la Nube Panlifang, Versión V2 de Emisión Rápida (Versión Confidencial Comercial), Versión V3 de Emisión Rápida (Versión Confidencial Comercial), V2 de Emisión Rápida, V3 de Emisión Rápida, etc. |

| Soporte al Cliente | Tel: 4001119992 |

| Email: YCFQH@cloudfutures.cn | |

Información de Cloudfutures

Cloudfutures es un broker regulado que ofrece servicios de trading en futuros en diversas plataformas de trading. El broker no ofrece cuentas demo y proporciona poca información sobre las condiciones de trading. Debido a la escasa información proporcionada, hay una falta de transparencia en el sitio web.

Pros y Contras

| Pros | Contras |

| Diversas plataformas de trading | Sin cuentas demo |

| Bien regulado | Pocos canales de contacto |

| Falta de transparencia |

¿Es Cloudfutures Legítimo?

Sí. Cloudfutures está autorizado por CFFEX para ofrecer servicios.

| País Regulado | Regulador | Estado Actual | Entidad Regulada | Tipo de Licencia | Número de Licencia |

| Bolsa de Futuros Financieros de China | Regulado | 云财富期货有限公司 | Licencia de Futuros | 0240 |

¿Qué puedo negociar en Cloudfutures?

Cloudfutures ofrece trading en futuros.

| Instrumentos Negociables | Soportado |

| Futuros | ✔ |

| Forex | ❌ |

| Productos Básicos | ❌ |

| Índices | ❌ |

| Acciones | ❌ |

| Criptomonedas | ❌ |

| Bonos | ❌ |

| Opciones | ❌ |

| ETFs | ❌ |

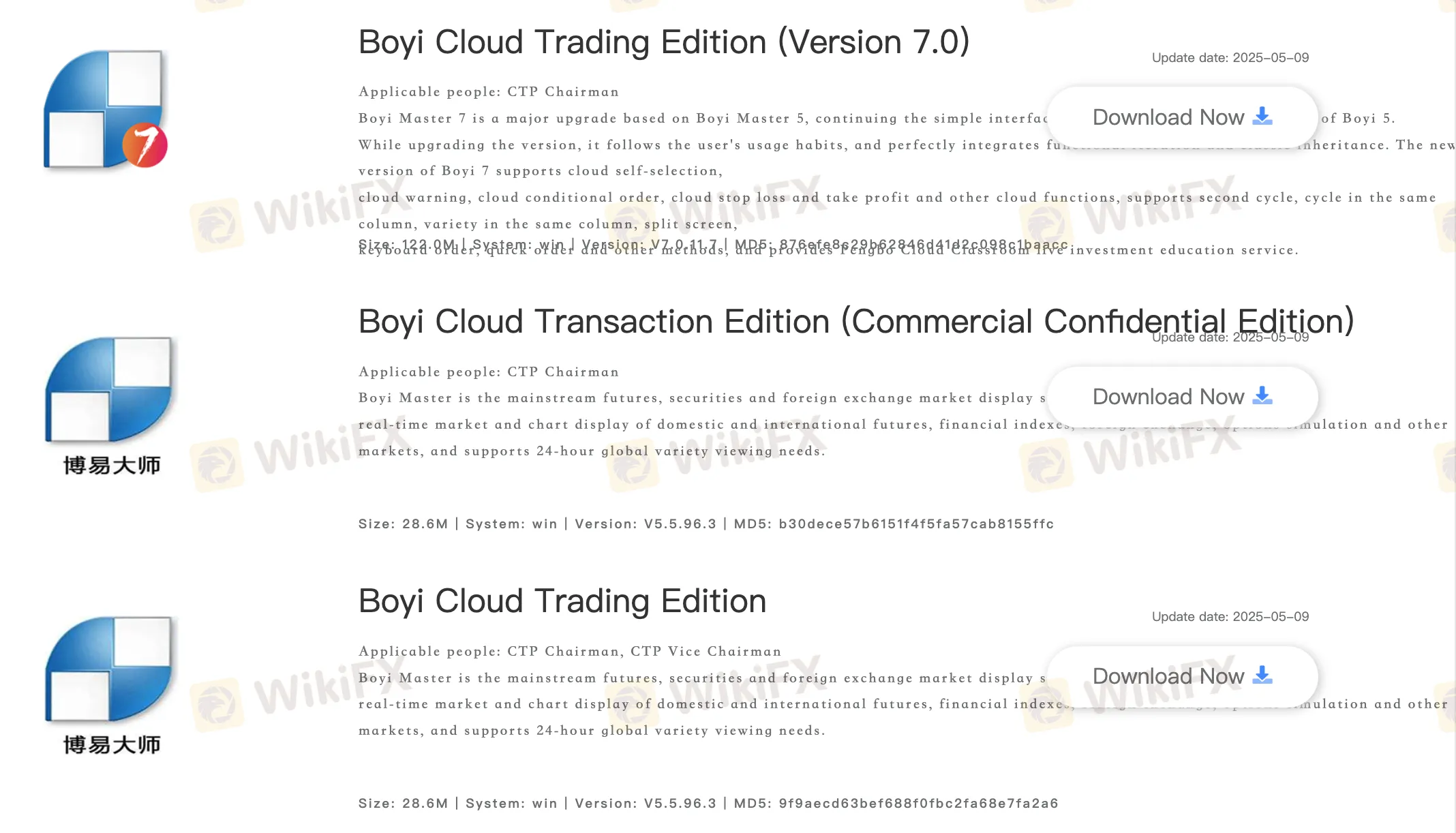

Plataforma de Trading

El bróker ofrece varias plataformas de trading, incluyendo Boyi Cloud Trading Edition (Versión 7.0), Boyi Cloud Transaction Edition (Edición Comercial Confidencial), Boyi Cloud Trading Edition, Panlifang Cloud Wealth Special Edition, Quick Issue V2 (Versión Comercial Confidencial), Quick Issue V3 (Versión Comercial Confidencial), Fast Issue V2, Quick Issue V3, Fast Issue V2, Quick Issue V3, Winshun Cloud Trading Software (wh6), Cloud Wealth Futures, Travel, Disk Cube, Cloud Wealth Polestar 9.5, Cloud Wealth Polestar 9.5 MacOS, Cloud Wealth Polestar 8.5, Infinite Easy y Simulation Boyi Master.

Dispositivos disponibles: escritorio y móvil.

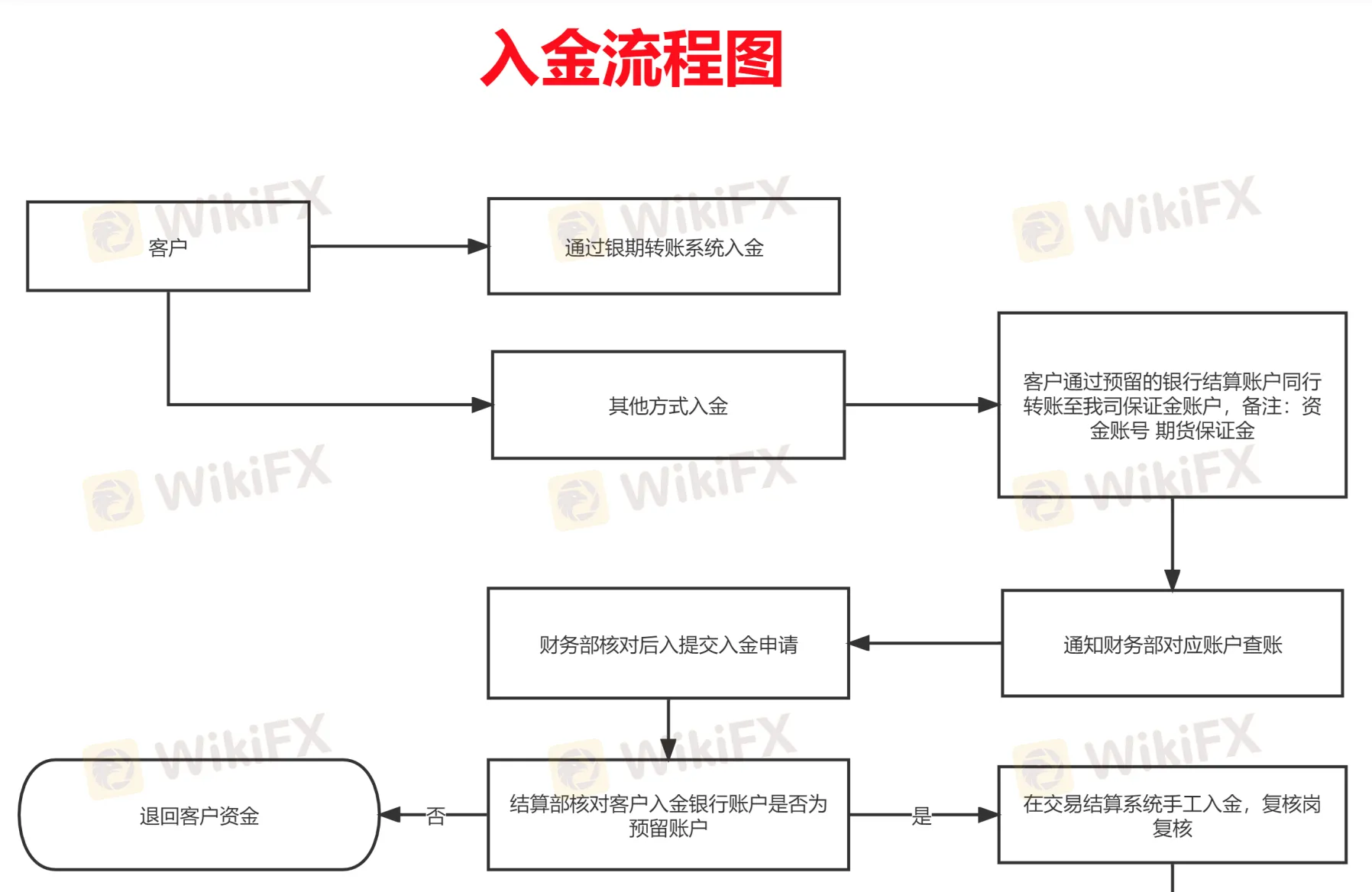

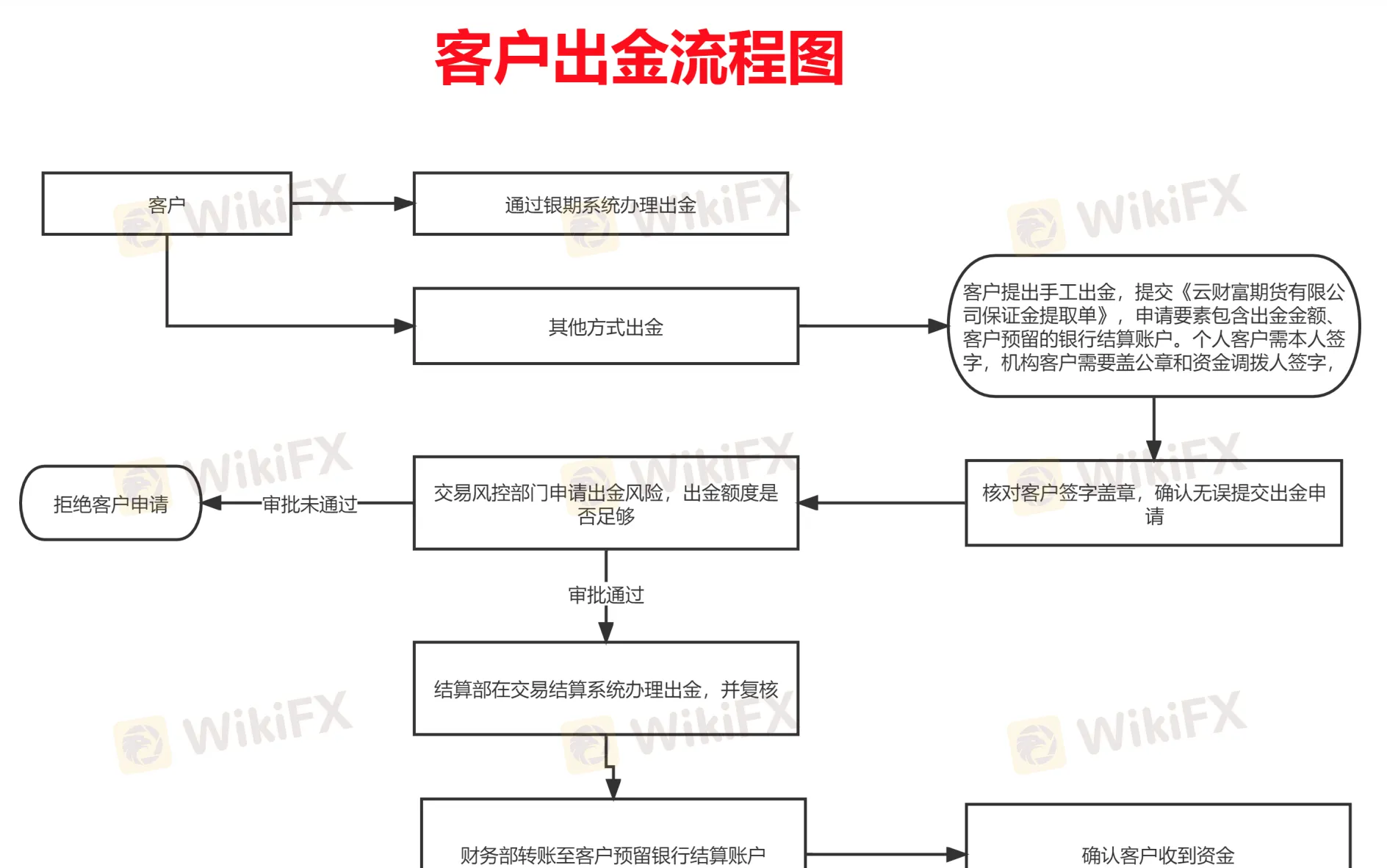

Depósito y Retiro

No se ha definido un monto mínimo de depósito o retiro y no se especifican tarifas o cargos. El sitio web solo muestra un proceso de depósito y retiro.