Pangunahing impormasyon

Ehipto

Ehipto

Kalidad

Ehipto

|

5-10 taon

|

Ehipto

|

5-10 taon

| https://www.vantagesb.com/default.aspx

Website

Marka ng Indeks

Impluwensiya

D

Index ng impluwensya NO.1

Ehipto 2.70

Ehipto 2.70 Mga Lisensya

Mga LisensyaWalang wastong impormasyon sa regulasyon, mangyaring magkaroon ng kamalayan ng panganib!

Ehipto

Ehipto vantagesb.com

vantagesb.com Ehipto

Ehipto| VANTAGE Buod ng Pagsusuri | |

| Itinatag | 1991 |

| Rehistradong Bansa/Rehiyon | Egypt |

| Regulasyon | Hindi nireregula |

| Mga Instrumento sa Merkado | Mga stock sa iba't ibang industriya at mga seguridad |

| Demo Account | / |

| Plataforma ng Pagtitingi | Web, Mist WS at mobile app |

| Min Deposit | 0 |

| Customer Support | Tel: +20 22560 4072, +20 22560 4073 |

| Whatsapp: 01025000896 | |

| Address: St. No. 28; Building No. 170; fourth floor, flat No. 9; Fifth District Building, Fifth Settlement, New Cairo | |

Itinatag ni VANTAGE ni Vantage Securities Brokerage noong 1991 sa Egypt. Nag-aalok ito ng kalakalan sa iba't ibang stock portfolios at mga seguridad. Maaaring magkalakal ang mga trader sa pamamagitan ng Web, Mist WS at mobile apps. Bagaman walang kinakailangang minimum na deposito, ito ay hindi nireregula.

| Mga Kalamangan | Mga Disadvantage |

| May karanasan | Walang regulasyon |

| Malinaw na istraktura ng bayad | Bayad sa paglipat para sa ilang mga bangko |

| Maramihang mga plataporma ng pagtitingi | |

| Walang kinakailangang minimum na deposito |

Hindi, ang VANTAGE ay hindi nireregula ng anumang mga awtoridad sa pananalapi. Dapat mag-ingat ang mga trader sa pagkalakal.

| Mga Ikalakal na Instrumento | Supported |

| Mga Stocks | ✔ |

| Mga Securities | ✔ |

| Forex | ❌ |

| Mga Komoditi | ❌ |

| Mga Indeks | ❌ |

| Mga Stocks | ❌ |

| Mga Cryptocurrency | ❌ |

Walang komisyon para sa pagbubukas ng account sa VANTAGE.

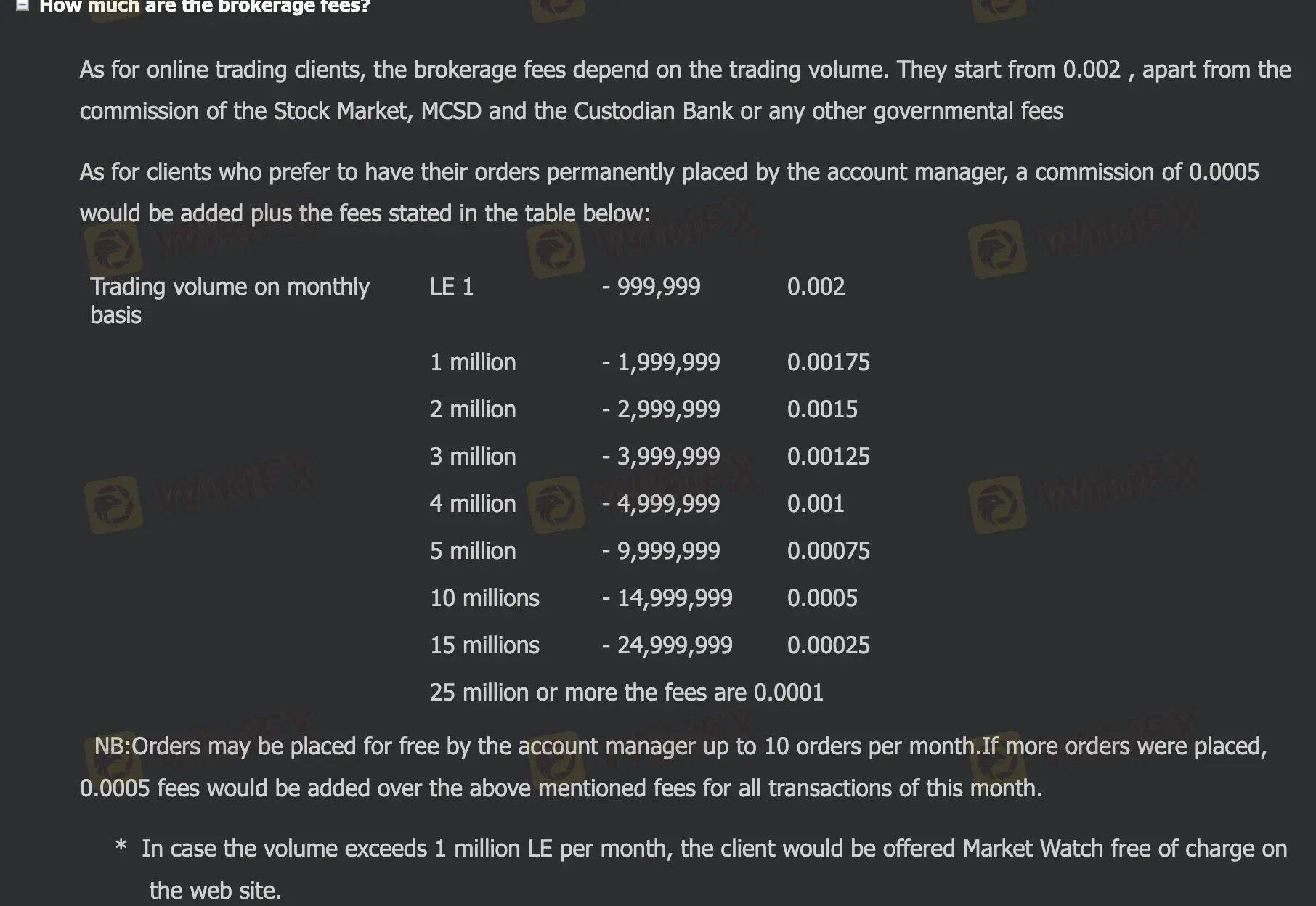

Ang mga bayad sa brokerage ng VANTAGE ay depende sa dami ng kalakalan. Nag-uumpisa ito mula sa 0.002, bukod sa komisyon ng Stock Market, MCSD at ang Custodian Bank o anumang iba pang mga bayarin ng pamahalaan.

Ang mga mangangalakal ay gusto na ang kanilang mga order ay magkakaroon ng permanente na komisyon na 0.0005 na idaragdag pati na rin ang mga bayarin na nakasaad sa talahanayan sa ibaba. Bukod dito, ang mga mangangalakal ay maaaring maglagay ng 10 libreng mga order, kung higit pa, ang mga bayarin na 0.0005 ay idaragdag sa mga nabanggit na bayarin para sa lahat ng transaksyon ng buwang ito.

| Trading Volume on a Monthly Basis | Mga Bayarin |

| LE 1-999999 | 0.002 |

| 1 milyon-1999999 | 0.00175 |

| 2 milyon- 2999999 | 0.0015 |

| 3 milyon- 3999999 | 0.00125 |

| 4 milyon- 4999999 | 0.001 |

| 5 milyon- 9999999 | 0.00075 |

| 10 milyon- 14999999 | 0.0005 |

| 15 milyon- 24999999 | 0.00025 |

| 25 milyon o higit pang mga bayarin | 0.0001 |

| Plataporma ng Pagkalakalan | Supported | Available Devices | Suitable for |

| Web | ✔ | Web | Mga karanasan na mangangalakal |

| Mist WS | ✔ | Web | Mga karanasan na mangangalakal |

| Mobile app | ✔ | Mobile | Mga karanasan na mangangalakal |

Ang mga mangangalakal ay maaaring magdeposito sa pamamagitan ng bank transfer with cash.

May dalawang paraan para mag-withdraw: bank transfer at isang saradong tseke na inisyu sa pangalan ng kliyente.

Walang mga bayad sa paglipat sakaling maglipat sa mga sumusunod na bangko: Arab African International Bank, CIB, Ahli United Bank, Banque Misr, NBK. Kung ibang mga bangko, ang mga bayad sa paglipat na 0.001 ay ibabawas na may minimum na EGP 25 at hanggang EGP 50, plus EGP 20 na mga bayad sa swift.

In my experience as a trader, understanding the commission structure of a broker is crucial before committing any funds. For VANTAGE, after thoroughly reviewing their available information, I noted that their fees are primarily based on trading volume rather than a fixed commission model per lot as found with many ECN or raw spread accounts at other brokers. Specifically, VANTAGE does not mention charging a standard commission for each trade or "lot" traded. Instead, their fee schedule is tiered according to the total monthly trading volume, starting from 0.002 for lower volumes and decreasing as the volume increases. There are some additional fees if you exceed a certain number of free orders in a month or choose to keep orders open permanently, but these are distinct from per-lot commissions. It’s also important to emphasize that VANTAGE is not regulated by any financial authority, which significantly raises the risk associated with using their services. From a risk management perspective, this lack of regulation is an important factor to consider, especially in a market where regulatory oversight is meant to enhance trader protection. For me, transparency and regulatory standing matter just as much as cost structure. While the absence of per-lot commissions may initially seem inviting, the unregulated status should not be overlooked when making a decision about where to trade.

From my professional perspective as an independent trader focusing on broker transparency and risk, I did not find any mention of an Islamic (swap-free) account option being available at VANTAGE. Based on the information I reviewed, VANTAGE mainly provides access to Egyptian stocks and securities through web and mobile platforms, and their account features and fee structure appear to be relatively straightforward. However, particulars such as swap-free accommodations—which are essential for many traders seeking to comply with Islamic finance principles—are not specified or advertised as part of their offerings. A lack of clear regulatory oversight at VANTAGE—since the broker is not regulated by any recognized authority—requires traders like myself to approach its services with extra caution. This extends especially to important account features, such as swap-free accounts, which are usually highlighted by reputable and regulated brokers due to their significance for certain client groups. My experience tells me that if this option was available, it would likely be stated directly given its importance for Muslim traders. Without any reference to an Islamic account option, I cannot assume VANTAGE provides one, and I would strongly recommend prospective clients directly confirm this with the broker before opening an account, especially if swap-related fees would conflict with their personal or religious requirements.

From my experience and thorough review of VANTAGE, one of the standout features is that there is no minimum deposit requirement to fund a live trading account. For me, this certainly lowers the barrier to entry, which could initially appeal to traders who want to start small or test the platform without committing significant capital. However, I need to stress the importance of looking beyond just deposit requirements when considering a broker. The lack of a minimum deposit might seem convenient, but I have learned over the years that regulation and safety of funds should be the primary concern—especially with brokers. VANTAGE is not regulated by any recognized financial authorities, which, in my experience, means there is a higher risk compared to trading with regulated entities. This absence of oversight means that even if starting with a small amount is possible, recovering any funds or resolving disputes could be much more difficult. For me, trading with unregulated brokers always prompts extra caution, regardless of attractive entry conditions. In summary, while you technically don't need any minimum amount to fund a live account at VANTAGE, it's vital to consider whether this flexibility outweighs the risks involved. Personally, I always prioritize the security and legitimacy of a broker before making any funding decisions.

Based on my careful review of VANTAGE, I found that trading individual assets like Gold (XAU/USD) and Crude Oil is not possible with this broker. For me, this is a significant limitation, especially as a trader who often diversifies across asset classes. VANTAGE currently supports trading only in stocks and securities; there is no mention of forex, commodities, indices, or cryptocurrencies being offered. This absence means that if, like me, you value access to metals or energy products for hedging or speculation, VANTAGE does not meet those needs. I always prioritize clarity on available trading instruments before opening an account, as access to key markets such as gold and oil is part of my risk management and opportunity-seeking strategies. Understanding why a broker restricts its product offering is important; in VANTAGE’s case, I noticed the business model is locally focused and unregulated, which could explain a more limited scope. For traders interested specifically in gold, oil, or other commodities, I would caution that VANTAGE’s platform is unsuitable for those objectives. In my experience, proper due diligence—and ensuring a broker’s product range aligns with your trading plan—is absolutely critical, especially in environments with higher potential risk or less oversight.

Mangyaring Ipasok...

TOP

TOP

Chrome

Extension ng Chrome

Pandaigdigang Forex Broker Regulatory Inquiry

I-browse ang mga website ng forex broker at tumpak na tukuyin ang mga legit at pandaraya na broker

I-install Ngayon