Présentation de l'entreprise

| VANTAGERésumé de l'examen | |

| Fondé | 1991 |

| Pays/Région enregistré | Égypte |

| Réglementation | Non réglementé |

| Instruments de marché | Actions dans diverses industries et titres |

| Compte de démonstration | / |

| Plateforme de trading | Web, Mist WS et application mobile |

| Dépôt minimum | 0 |

| Assistance clientèle | Tél : +20 22560 4072, +20 22560 4073 |

| Whatsapp : 01025000896 | |

| Adresse : St. No. 28 ; Building No. 170 ; quatrième étage, appartement No. 9 ; Fifth District Building, Fifth Settlement, New Cairo | |

VANTAGE a été fondé par Vantage Securities Brokerage en 1991 en Égypte. Il propose des transactions sur divers portefeuilles d'actions et titres. Les traders peuvent effectuer des transactions via Web, Mist WS et des applications mobiles. Bien qu'il n'y ait pas d'exigence de dépôt minimum, il n'est pas réglementé.

Avantages et inconvénients

| Avantages | Inconvénients |

| Expérimenté | Non réglementé |

| Structure de frais claire | Frais de transfert pour certaines banques |

| Plusieurs plateformes de trading | |

| Pas de dépôt minimum |

VANTAGE est-il légitime ?

Non, VANTAGE n'est pas réglementé par les autorités financières. Les traders doivent être prudents lorsqu'ils effectuent des transactions.

Que puis-je trader sur VANTAGE ?

| Instruments négociables | Pris en charge |

| Actions | ✔ |

| Titres | ✔ |

| Forex | ❌ |

| Matériaux premiers | ❌ |

| Indices | ❌ |

| Actions | ❌ |

| Cryptomonnaies | ❌ |

Commission

Il n'y a pas de commission pour l'ouverture de compte sur VANTAGE.

Autres frais

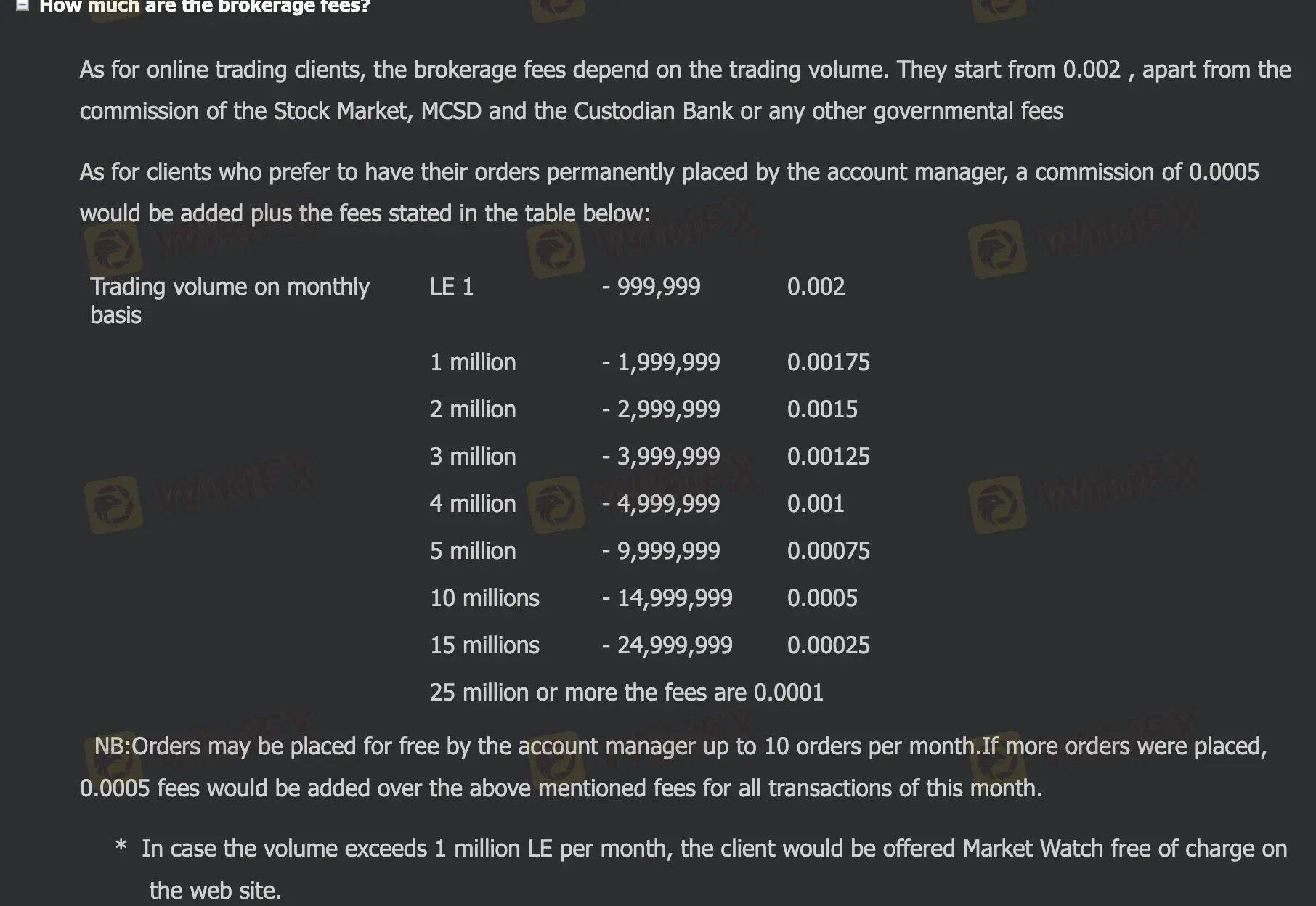

Les frais de courtage de VANTAGE dépendent du volume des transactions. Ils commencent à partir de 0,002, en plus de la commission de la Bourse, du MCSD et de la banque dépositaire ou de tout autre frais gouvernemental.

Les traders qui souhaitent avoir leurs ordres en permanence auront une commission de 0,0005 qui sera ajoutée aux frais indiqués dans le tableau ci-dessous. De plus, les traders peuvent passer 10 ordres gratuits, si plus, des frais de 0,0005 seront ajoutés aux frais mentionnés ci-dessus pour toutes les transactions de ce mois.

| Volume de trading sur une base mensuelle | Frais |

| LE 1-999999 | 0,002 |

| 1 million-1999999 | 0,00175 |

| 2 million- 2999999 | 0,0015 |

| 3 million- 3999999 | 0,00125 |

| 4 million- 4999999 | 0,001 |

| 5 million- 9999999 | 0,00075 |

| 10 millions- 14999999 | 0,0005 |

| 15 millions- 24999999 | 0,00025 |

| 25 millions ou plus de frais | 0,0001 |

Plateforme de trading

| Plateforme de trading | Pris en charge | Appareils disponibles | Convient pour |

| Web | ✔ | Web | Traders expérimentés |

| Mist WS | ✔ | Web | Traders expérimentés |

| Application mobile | ✔ | Mobile | Traders expérimentés |

Dépôt et retrait

Les traders peuvent effectuer des dépôts par virement bancaire en espèces.

Il existe deux façons de retirer de l'argent : le virement bancaire et un chèque fermé émis au nom du client.

Il n'y a pas de frais de transfert en cas de transfert vers les banques suivantes : Arab African International Bank, CIB, Ahli United Bank, Banque Misr, NBK. Si d'autres banques, des frais de transfert de 0,001 seront déduits avec un minimum de 25 EGP et jusqu'à 50 EGP, plus des frais de virement de 20 EGP.