회사 소개

| VANTAGE리뷰 요약 | |

| 설립 | 1991 |

| 등록 국가/지역 | 이집트 |

| 규제 | 규제되지 않음 |

| 시장 기구 | 다양한 산업과 증권의 주식 |

| 데모 계정 | / |

| 거래 플랫폼 | 웹, Mist WS 및 모바일 앱 |

| 최소 입금액 | 0 |

| 고객 지원 | 전화: +20 22560 4072, +20 22560 4073 |

| Whatsapp: 01025000896 | |

| 주소: St. No. 28; Building No. 170; fourth floor, flat No. 9; Fifth District Building, Fifth Settlement, New Cairo | |

VANTAGE은 1991년에 Vantage Securities Brokerage에 의해 이집트에서 설립되었습니다. 다양한 주식 포트폴리오와 증권 거래를 제공합니다. 트레이더는 웹, Mist WS 및 모바일 앱을 통해 거래할 수 있습니다. 최소 입금 요건은 없지만 규제되지 않았습니다.

장단점

| 장점 | 단점 |

| 경험 많음 | 규제 없음 |

| 명확한 수수료 구조 | 일부 은행의 이체 수수료 |

| 다양한 거래 플랫폼 | |

| 최소 입금액 없음 |

VANTAGE은 신뢰할 수 있나요?

아니요, VANTAGE은 어떠한 금융 당국에도 규제되지 않았습니다. 트레이더는 거래할 때 주의해야 합니다.

VANTAGE에서 무엇을 거래할 수 있나요?

| 거래 가능한 기구 | 지원됨 |

| 주식 | ✔ |

| 증권 | ✔ |

| 외환 | ❌ |

| 상품 | ❌ |

| 지수 | ❌ |

| 주식 | ❌ |

| 암호화폐 | ❌ |

수수료

VANTAGE에서 계정 개설에는 수수료가 없습니다.

기타 수수료

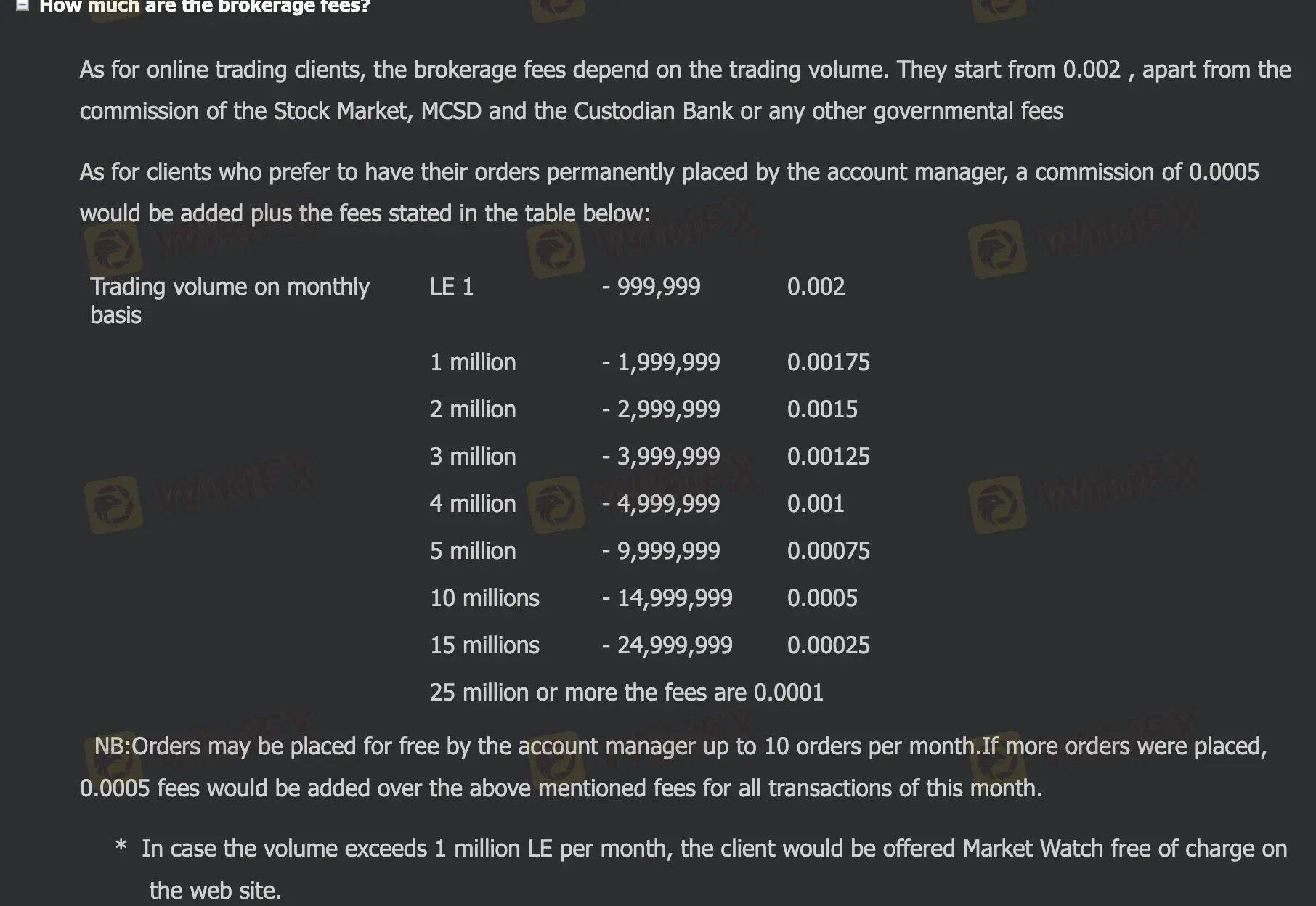

VANTAGE의 중개 수수료는 거래량에 따라 다릅니다. 주식 시장, MCSD 및 예탁 은행의 수수료 외에도 0.002부터 시작됩니다.

트레이더들은 주문을 영구적으로 유지하고 싶어합니다. 이 경우 수수료 0.0005가 추가되며 아래 표에 명시된 수수료도 추가됩니다. 또한, 트레이더들은 10개의 무료 주문을 할 수 있으며, 그 이상의 주문은 이번 달의 모든 거래에 위에서 언급한 수수료에 0.0005의 수수료가 추가됩니다.

| 월별 거래량 | 수수료 |

| LE 1-999999 | 0.002 |

| 100만-1999999 | 0.00175 |

| 200만- 2999999 | 0.0015 |

| 300만- 3999999 | 0.00125 |

| 400만- 4999999 | 0.001 |

| 500만- 9999999 | 0.00075 |

| 1000만- 14999999 | 0.0005 |

| 1500만- 24999999 | 0.00025 |

| 2500만 이상 수수료 | 0.0001 |

거래 플랫폼

| 거래 플랫폼 | 지원 | 사용 가능한 기기 | 적합한 대상 |

| 웹 | ✔ | 웹 | 경험 있는 트레이더 |

| Mist WS | ✔ | 웹 | 경험 있는 트레이더 |

| 모바일 앱 | ✔ | 모바일 | 경험 있는 트레이더 |

입출금

트레이더들은 현금으로 은행 송금을 통해 입금할 수 있습니다.

출금은 은행 송금과 클라이언트 이름으로 발행된 닫힌 수표로 이루어집니다.

다음 은행으로 송금하는 경우 수수료가 없습니다: Arab African International Bank, CIB, Ahli United Bank, Banque Misr, NBK. 다른 은행의 경우, 최소 25 EGP에서 최대 50 EGP까지 0.001의 송금 수수료와 20 EGP의 스위프트 수수료가 공제됩니다.