Resumo da empresa

| VANTAGEResumo da Revisão | |

| Fundado | 1991 |

| País/Região Registrado | Egito |

| Regulação | Não regulamentado |

| Instrumentos de Mercado | Ações em várias indústrias e títulos |

| Conta Demonstração | / |

| Plataforma de Negociação | Web, Mist WS e aplicativo móvel |

| Depósito Mínimo | 0 |

| Suporte ao Cliente | Tel: +20 22560 4072, +20 22560 4073 |

| Whatsapp: 01025000896 | |

| Endereço: Rua nº 28; Edifício nº 170; quarto andar, apartamento nº 9; Edifício do Quinto Distrito, Quinto Assentamento, Nova Cairo | |

VANTAGE foi fundada por Vantage Securities Brokerage em 1991 no Egito. Oferece negociação em várias carteiras de ações e títulos. Os traders podem negociar através da Web, Mist WS e aplicativos móveis. Embora não tenha requisito de depósito mínimo, não é regulamentado.

Prós e Contras

| Prós | Contras |

| Experiente | Sem regulação |

| Estrutura de taxas clara | Taxa de transferência para alguns bancos |

| Múltiplas plataformas de negociação | |

| Sem depósito mínimo |

VANTAGE é Legítimo?

Não, VANTAGE não é regulamentado por nenhuma autoridade financeira. Os traders devem ter cuidado ao negociar.

O que posso negociar na VANTAGE?

| Instrumentos Negociáveis | Suportado |

| Ações | ✔ |

| Títulos | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Índices | ❌ |

| Ações | ❌ |

| Criptomoedas | ❌ |

Comissão

Não há comissão para abrir conta na VANTAGE.

Outras Taxas

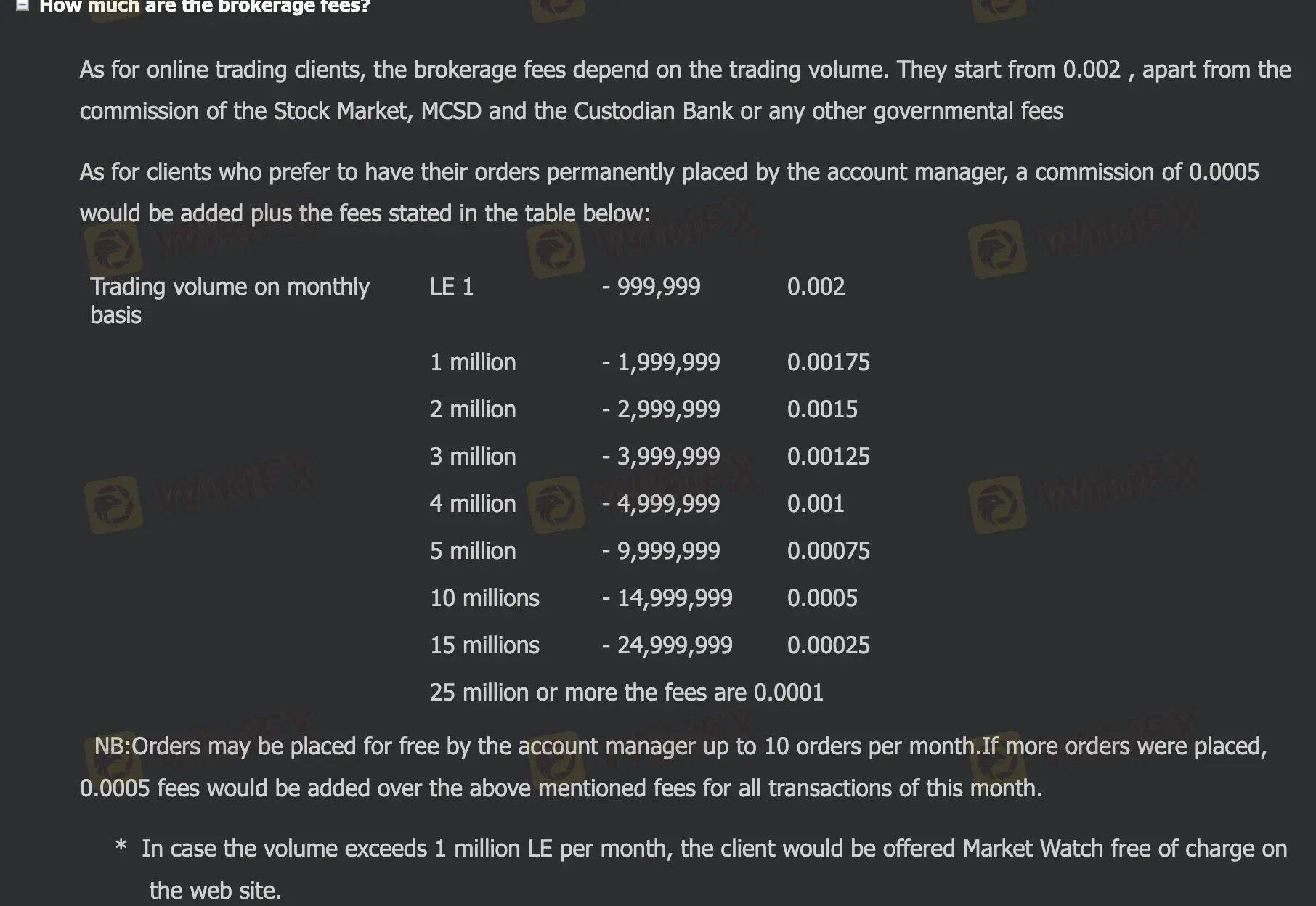

As taxas de corretagem da VANTAGE dependem do volume de negociação. Começa a partir de 0.002, além da comissão da Bolsa de Valores, MCSD e do Banco Custodiante ou quaisquer outras taxas governamentais.

Os traders que desejam ter suas ordens permanentemente terão uma comissão de 0,0005 adicionada, além das taxas mencionadas na tabela abaixo. Além disso, os traders podem fazer 10 pedidos gratuitos, se fizerem mais, será adicionada uma taxa de 0,0005 sobre as taxas mencionadas acima para todas as transações deste mês.

| Volume de Negociação em Base Mensal | Taxas |

| LE 1-999999 | 0,002 |

| 1 milhão-1999999 | 0,00175 |

| 2 milhões- 2999999 | 0,0015 |

| 3 milhões- 3999999 | 0,00125 |

| 4 milhões- 4999999 | 0,001 |

| 5 milhões- 9999999 | 0,00075 |

| 10 milhões- 14999999 | 0,0005 |

| 15 milhões- 24999999 | 0,00025 |

| 25 milhões ou mais taxas | 0,0001 |

Plataforma de Negociação

| Plataforma de Negociação | Suportada | Dispositivos Disponíveis | Adequado para |

| Web | ✔ | Web | Traders experientes |

| Mist WS | ✔ | Web | Traders experientes |

| Aplicativo móvel | ✔ | Móvel | Traders experientes |

Depósito e Retirada

Os traders podem depositar por meio de transferência bancária com dinheiro.

Existem duas formas de retirada: transferência bancária e um cheque fechado emitido em nome do cliente.

Não há taxas de transferência no caso de transferência para os seguintes bancos: Arab African International Bank, CIB, Ahli United Bank, Banque Misr, NBK. Se for para outros bancos, será deduzida uma taxa de transferência de 0,001, com um mínimo de EGP 25 e até EGP 50, mais taxas de swift de EGP 20.