Profil perusahaan

| VANTAGERingkasan Ulasan | |

| Didirikan | 1991 |

| Negara/Daerah Terdaftar | Mesir |

| Regulasi | Tidak diatur |

| Instrumen Pasar | Saham di berbagai industri dan surat berharga |

| Akun Demo | / |

| Platform Perdagangan | Web, Mist WS, dan aplikasi seluler |

| Deposit Minimum | 0 |

| Dukungan Pelanggan | Tel: +20 22560 4072, +20 22560 4073 |

| Whatsapp: 01025000896 | |

| Alamat: St. No. 28; Gedung No. 170; lantai keempat, flat No. 9; Gedung Distrik Kelima, Fifth Settlement, New Cairo | |

VANTAGE didirikan oleh Vantage Securities Brokerage pada tahun 1991 di Mesir. Ini menawarkan perdagangan dalam berbagai portofolio saham dan surat berharga. Para trader dapat melakukan perdagangan melalui Web, Mist WS, dan aplikasi seluler. Meskipun tidak memiliki persyaratan deposit minimum, tidak diatur.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Berpengalaman | Tidak diatur |

| Struktur biaya yang jelas | Biaya transfer untuk beberapa bank |

| Beberapa platform perdagangan | |

| Tidak ada deposit minimum |

Apakah VANTAGE Legal?

Tidak, VANTAGE tidak diatur oleh otoritas keuangan manapun. Para trader harus berhati-hati saat melakukan perdagangan.

Apa yang Bisa Saya Perdagangkan di VANTAGE?

| Instrumen Perdagangan | Didukung |

| Saham | ✔ |

| Surat Berharga | ✔ |

| Forex | ❌ |

| Komoditas | ❌ |

| Indeks | ❌ |

| Saham | ❌ |

| Kriptocurrency | ❌ |

Komisi

Tidak ada komisi untuk membuka akun di VANTAGE.

Biaya Lainnya

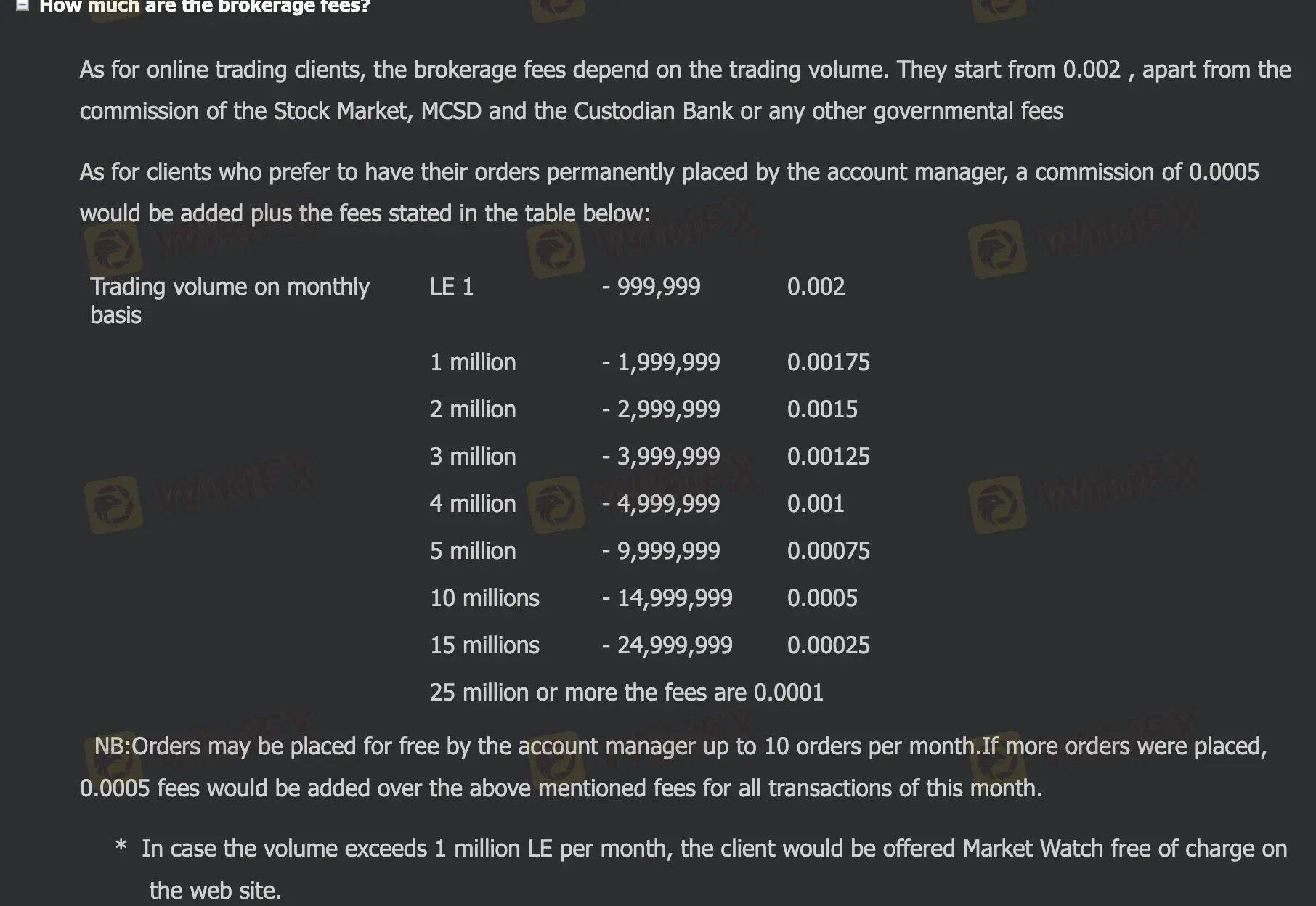

Biaya pialang VANTAGE bergantung pada volume perdagangan. Dimulai dari 0.002, selain komisi Pasar Saham, MCSD, dan Bank Penyimpan atau biaya pemerintah lainnya.

Para trader suka memiliki pesanan mereka secara permanen akan dikenakan komisi sebesar 0,0005 ditambah biaya yang tercantum dalam tabel di bawah ini. Selain itu, trader dapat menempatkan 10 pesanan gratis, jika lebih, biaya 0,0005 akan ditambahkan di atas biaya yang disebutkan di atas untuk semua transaksi bulan ini.

| Volume Perdagangan Bulanan | Biaya |

| LE 1-999999 | 0,002 |

| 1 juta-1999999 | 0,00175 |

| 2 juta- 2999999 | 0,0015 |

| 3 juta- 3999999 | 0,00125 |

| 4 juta- 4999999 | 0,001 |

| 5 juta- 9999999 | 0,00075 |

| 10 juta- 14999999 | 0,0005 |

| 15 juta- 24999999 | 0,00025 |

| 25 juta atau lebih | 0,0001 |

Platform Perdagangan

| Platform Perdagangan | Didukung | Perangkat yang Tersedia | Cocok untuk |

| Web | ✔ | Web | Trader berpengalaman |

| Mist WS | ✔ | Web | Trader berpengalaman |

| Aplikasi Mobile | ✔ | Mobile | Trader berpengalaman |

Deposit dan Penarikan

Trader dapat melakukan deposit melalui transfer bank dengan tunai.

Ada dua cara untuk menarik: transfer bank dan cek tertutup yang diterbitkan atas nama klien.

Tidak ada biaya transfer jika mentransfer ke bank-bank berikut: Arab African International Bank, CIB, Ahli United Bank, Banque Misr, NBK. Jika bank lain, biaya transfer sebesar 0,001 akan dikurangkan dengan minimum EGP 25 dan maksimum EGP 50, ditambah biaya swift EGP 20.