Company Summary

| XPO Markets Review Summary | |

| Founded | 2024 |

| Registered Country/Region | Comoros |

| Regulation | No regulation |

| Market Instruments | Forex, Metals, Cryptocurrencies, Energy, Stocks, Indices, Commodities |

| Demo Account | / |

| Leverage | Up to 1:2000 |

| Spread | 2.5 pips (Lite account) |

| Trading Platform | XPO Markets App |

| Minimum Deposit | $10 |

| Customer Support | Live chat, contact form |

| Email: hello@xpo.markets | |

| Company Address: Bonovo Road - Fomboni Island of Moheli, Union of Comoros | |

| Social Media: Facebook, Instagram, YouTube | |

| Regional Restrictions | Cuba, North Korea, Syria, Sudan, Zimbabwe, Israel, the Islamic Republic of Iran, Myanmar, Libya, Mali, Nicaragua, Central African Republic |

XPO Markets Information

XPO Markets is an unregulated brokerage firm registered in Comoros in 2024, offering trading across multiple asset classes, including Forex, Metals, Commodities, Cryptocurrencies, Energy, Stocks, and Indices. The platform provides three account tiers: Lite, Core, and Ultra. Notably, XPO Markets restricts service access for residents of numerous regions.

Pros & Cons

| Pros | Cons |

| Low Minimum Deposit | No Regulation |

| Three Account Types Available | Regional Restrictions |

| Live Chat Support | Demo Accounts Unavailable |

| Various Products Offered | Lack of Information about Deposit and Withdrawal |

| No MT4 or MT5 |

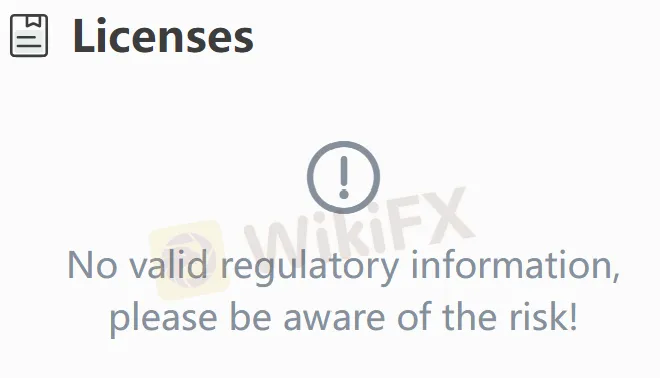

Is XPO Markets Legit?

XPO Markets is not regulated by any notable authorities, which means trading on this platform might involve risks.

What Can I Trade on XPO Markets?

XPO Markets offers a diverse trading portfolio across multiple asset classes, including Forex, Metals, Commodities, Cryptocurrencies, Energy, Stocks, and Indices. Available instruments vary depending on the trader's account tier.

| Trading Asset | Available |

| forex | ✔ |

| metals | ✔ |

| energy | ✔ |

| commodities | ✔ |

| indices | ✔ |

| stocks | ✔ |

| cryptocurrencies | ✔ |

| bonds | ❌ |

| options | ❌ |

| ETFs | ❌ |

Account Type & Fees

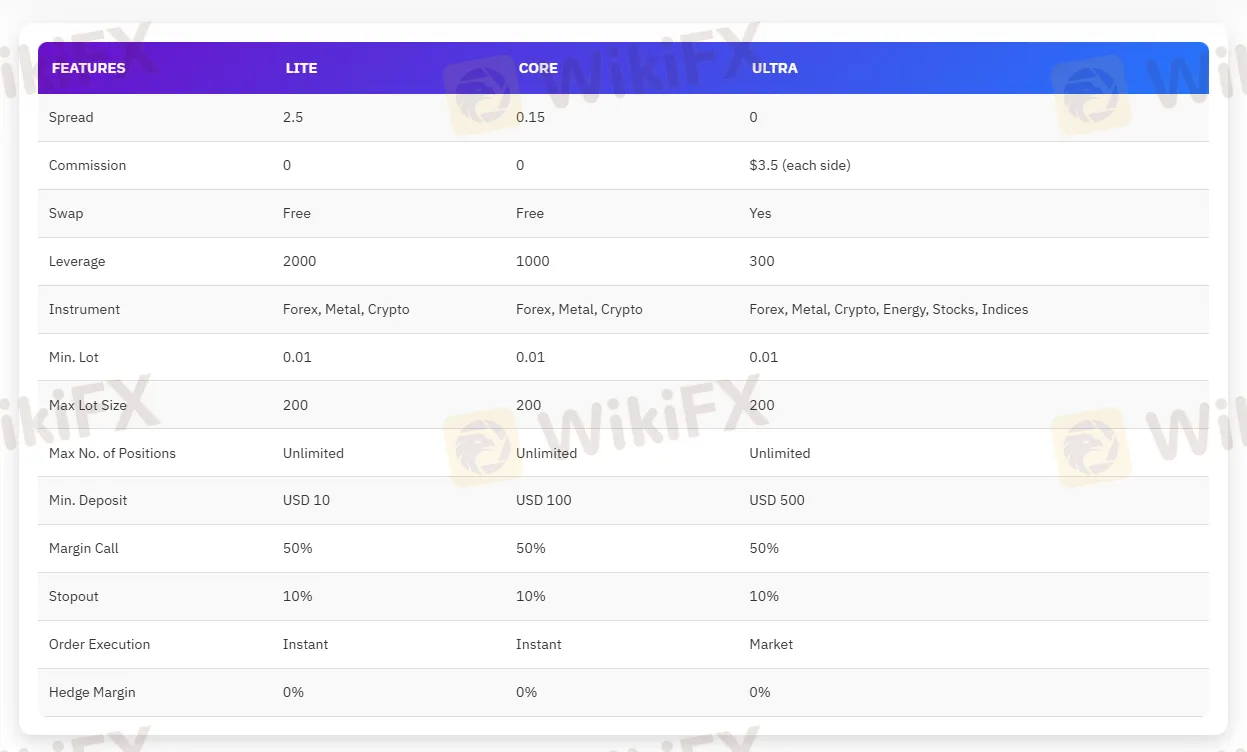

XPO Markets offers three types of trading accounts, catering to different types of traders.

Lite Account: Built for beginners, it offers user-friendly tools, lower spreads, and fast execution.

Core Account: With tight spreads, zero commissions, and flexible conditions, ideal for all types of traders.

Ultra Account: Designed for professionals, it provides raw spreads, deep liquidity, and direct market access.

Here is a breakdown of the details about each account type.

| Account Type | Lite | Core | Ultra |

| Spread | 2.5 pips | 0.15 pips | 0 pips |

| Commission | ❌ | ❌ | $3.5 (each side) |

| Swap | ❌ | ❌ | ✔ |

| Leverage | 1:2000 | 1:1000 | 1:300 |

| Market Instrument | Forex, Metals, Cryptos | Forex, Metals, Cryptos | Forex, Metals, Cryptos, Energy, Stocks, Indices |

| Minimum Lot | 0.01 | 0.01 | 0.01 |

| Maximum Lot Size | 200 | 200 | 200 |

| Maximum No. of Positions | Unlimited | Unlimited | Unlimited |

| Minimum Deposit | USD 10 | USD 100 | USD 500 |

| Margin Call | 50% | 50% | 50% |

| Stopout | 10% | 10% | 10% |

| Order Execution | Instant | Instant | Market |

| Hedge Margin | 0% | 0% | 0% |

Leverage

The leverage rate varies on this platform based on the account type levels. Leverage allows traders to control larger positions with a smaller amount of capital, increasing potential profits and losses.

| Account Type | Maximum Leverage |

| Lite | 1:2000 |

| Core | 1:1000 |

| Ultra | 1:300 |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| XPO Market app | ✔ | Desktop, Mobile, Web | / |

| MT5 | ❌ | / | Experienced traders |

| MT4 | ❌ | / | Beginners |

Deposit & Withdrawal

XPO Markets' website states that it offers fast withdrawals through multiple payment methods, but it provides no additional details about these services.