Unternehmensprofil

| Fulbright Financial Group Überprüfungszusammenfassung | |

| Gegründet | 1999 |

| Registrierte Region | Hongkong |

| Regulierung | SFC |

| Marktinstrumente | Wertpapiere, Futures, Optionen (HK, USA, Global) |

| Demo-Konto | ❌ |

| Handelsplattformen | Fulbright App (Mobile), Fulbright Terminal (PC), Fulbright Webplattform, Fulbright Pro Terminal, Fulbright Speed Trader |

| Kundensupport | Telefon: +852 3108 3333, 4001-200-899 (Festland) |

| E-Mail: cis@fulbright.com.hk | |

| Wechat: hkfuchang | |

Fulbright Financial Group Informationen

Fulbright Financial Group, gegründet im Jahr 1999 mit Hauptsitz in Hongkong, ist eine lizenzierte Finanzinstitution, die von der Hongkonger Wertpapier- und Terminbörse reguliert wird, wobei nur ihr Futures-Handelsunternehmen derzeit lizenziert ist. Es bietet Wertpapier-, Futures- und Optionsgeschäfte in Hongkong, den Vereinigten Staaten und anderen globalen Märkten an, sowie verschiedene Handelsplattformen, jedoch gibt es kein Demo-Konto oder klare Offenlegung der Mindesteinzahlung.

Vor- und Nachteile

| Vorteile | Nachteile |

| Reguliert durch die Hongkonger SFC | Keine Demo-Konten verfügbar |

| Bietet Zugang zu mehreren Märkten | Mindesteinzahlung nicht klar angegeben |

| Mehrere Handelsplattformen | Begrenzte Informationen zu Kontotypen |

Ist Fulbright Financial Group legitim?

Ja, Fulbright Financial Group ist eine lizenzierte Organisation. Allerdings unterhält nur Fulbright Futures Limited derzeit eine aktive (regulierte) Lizenz für den Handel mit Futures-Kontrakten von der Hongkonger SFC. Die Lizenzen der anderen beiden Einheiten sind abgelaufen und daher nicht mehr gültig.

| Lizenzierte Einheit | Lizenztyp | Lizenznummer | Wirksamkeitsdatum | Aktueller Status | Reguliert von |

| Fulbright Futures Limited | Handel mit Futures-Kontrakten | AME963 | 2005/12/5 | Reguliert | SFC Hongkong |

| Fulbright Securities Limited | Handel mit Wertpapieren | AFB820 | 2004/11/30 | Überschritten | SFC Hongkong |

| Fulbright Asset Management Limited | Vermögensverwaltung | AYQ254 | 2012/3/22 | Überschritten | SFC Hongkong |

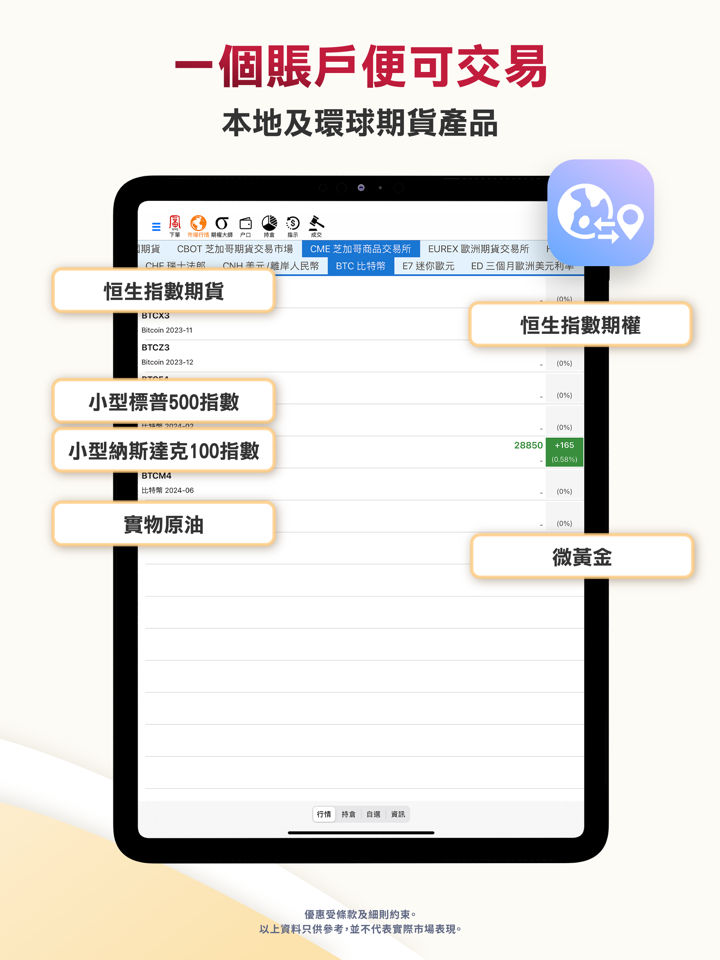

Was kann ich bei Fulbright Financial Group handeln?

Fulbright Financial Group bietet eine breite Palette von Finanzdienstleistungen, einschließlich Wertpapier-, Futures- und Options-Handel in Hongkong und weltweit an.

| Handelsinstrumente | Unterstützt |

| Wertpapiere | ✔ |

| Futures | ✔ |

| Optionen | ✔ |

| Forex | ❌ |

| Waren | ❌ |

| Indizes | ❌ |

| Aktien | ❌ |

| Kryptowährungen | ❌ |

| Anleihen | ❌ |

| ETFs | ❌ |

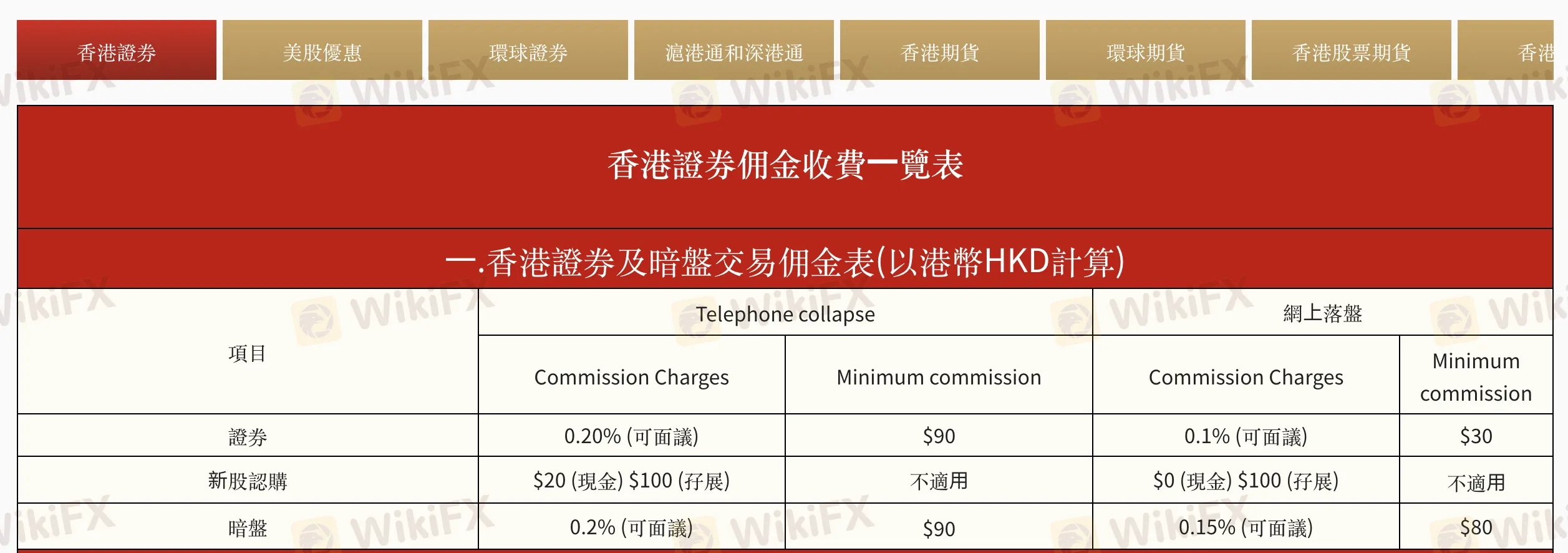

Gebühren bei Fulbright Financial Group

Fulbright Financial Group berechnet etwas niedrigere Kosten als die branchenübliche Norm, insbesondere für den Online-Handel. Einige Gebühren wie Bearbeitungsgebühren und Finanzierungszinsen variieren je nach Kundenprofil und sind verhandelbar, wie es in der Geschäftspraxis üblich ist.

| Kategorie | Dienstleistung/Artikel | Gebühr (HKD) | Bemerkungen |

| Handelsprovisionen | Hongkonger Wertpapiere (Telefon) | 0,20% (mind. 90 $) | Verhandelbar |

| Hongkonger Wertpapiere (Online) | 0,10% (mind. 30 $) | Verhandelbar | |

| IPO-Abonnement (Bargeld/Margin) | 20 $ / 100 $ | Online-Bargeld: Kostenlos | |

| Grauer Markt (Telefon/Online) | 0,20% / 0,15% (mind. 90 $ / 80 $) | ||

| Regulierungsgebühren | Stempelsteuer | 0,10% | mind. 1 $ |

| SFC-Transaktionsabgabe | 0,00% | ||

| Börsengebühr (HKEx) | 0,01% | ||

| Clearing-Gebühr (HKSCC) | 0,005% (mind. 5 $, max. 200 $) | ||

| FRC-Transaktionsabgabe | 0,00% | ||

| Zinsgebühren | Marginkonto / Barkonto Zinsen | P+1,8% oder ~7,05% | Basierend auf dem HSBC-Primeratensatz |

| Verwahrungs- und Agenturdienste | Wertpapierübertrag (SI/ISI) | Kostenlos (Einzahlung), 5 $/Los (Abhebung, mind. 500 $) | Gebühren der HKSCC gelten |

| Wertpapierabhebung (physisch) | 5 $/Los | Inkl. 3,5 $ HKSCC-Gebühr | |

| Dividendensammlung | 0,5% (mind. 20 $, max. 10.000 $) | Inkl. HKSCC-Gebühr 0,12% | |

| Bonusaktien / Bezugsrechtsabonnement | Kostenlos / 100 $ + 0,80/Los | Max. 10.000 $ | |

| IPO-Abwicklung (Bargeld/Margin) | 20 $ / 100 $ | ||

| Weitere Gebühren | Monatliche Kontoauszugsneuausstellung / Postversand | 50 $/Monat je | Postgebühr seit Sep 2023 wirksam |

| SFO-Abschnitt 329 Anfrage | 4.000 $ pro Fall |

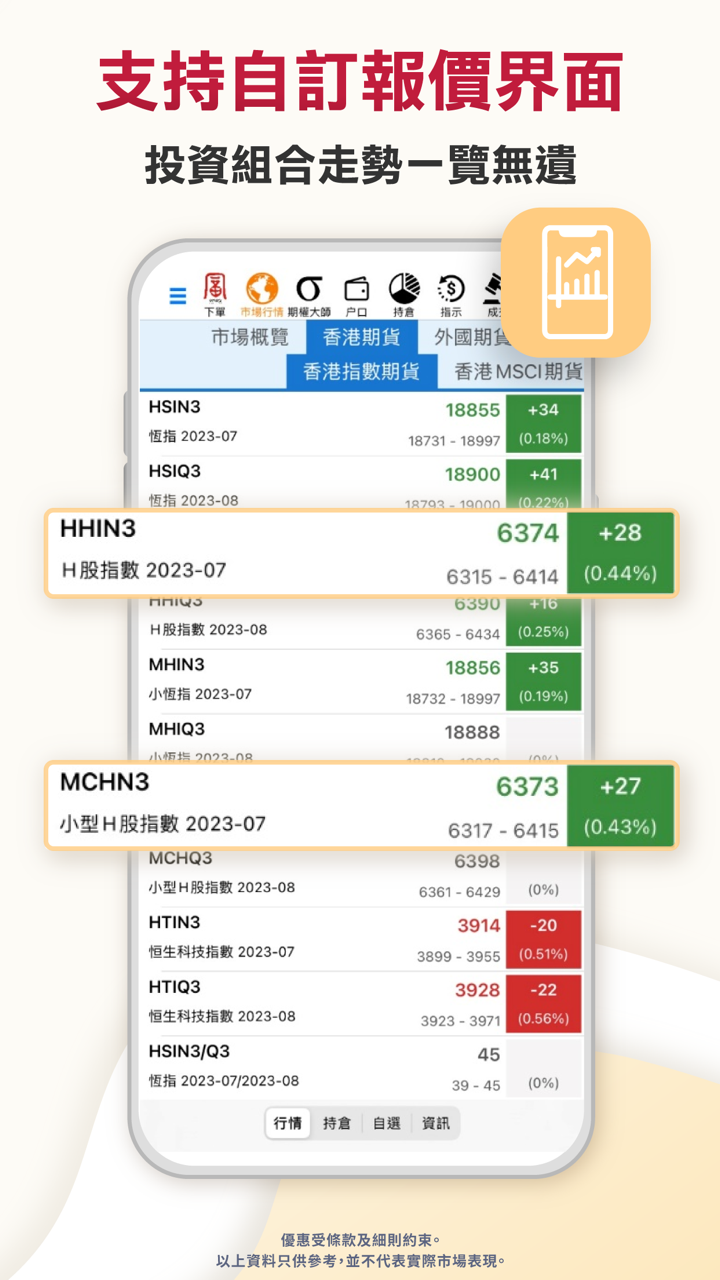

Handelsplattform

| Plattformname | Unterstützt | Verfügbare Geräte | Geeignet für |

| Fulbright App (Mobile) | ✔ | Mobilgerät | Anfänger bis Fortgeschrittene Trader |

| Fulbright Terminal (PC) | ✔ | PC | Fortgeschrittene Trader |

| Fulbright Web-Plattform | ✔ | Webbrowser | Fortgeschrittene Trader |

| Fulbright Pro Terminal | ✔ | Desktop-Download | Professionelle Trader |

| Fulbright Speed Trader | ✔ | Desktop-Download | HK High-Frequency Trader |

Ein- und Auszahlung

Fulbright Financial Group berechnet keine Gebühren für Einzahlungen oder Auszahlungen, obwohl Banken je nach verwendeter Methode Gebühren erheben können. Es wird kein Mindesteinzahlungsbetrag genannt.

Einzahlungsoptionen

| Einzahlungsmethode | Einzahlungsgebühren | Einzahlungszeit |

| eDDA Schnelleinzahlung | ❌ | Instant |

| FPS (Faster Payment System) | ~2 Stunden (9:00 – 17:00 an Handelstagen)* | |

| Online-Banküberweisung | 1–3 Werktage | |

| Scheck oder Verrechnungsscheck | 2+ Werktage |

Auszahlungsoptionen

| Auszahlungsmethode | Auszahlungsgebühren | Auszahlungszeit |

| Banküberweisung | ❌ | Noch am selben Tag bearbeitet, wenn bis 9:00–13:00 Uhr eingereicht; ansonsten am nächsten Werktag |

| Scheck | Noch am selben Tag ausgestellt, wenn innerhalb der Bearbeitungszeiten |