회사 소개

| Fulbright Financial Group 리뷰 요약 | |

| 설립 연도 | 1999 |

| 등록 지역 | 홍콩 |

| 규제 | SFC |

| 시장 상품 | 증권, 선물, 옵션 (HK, 미국, 글로벌) |

| 데모 계정 | ❌ |

| 거래 플랫폼 | Fulbright App (모바일), Fulbright Terminal (PC), Fulbright Web Platform, Fulbright Pro Terminal, Fulbright Speed Trader |

| 고객 지원 | 전화: +852 3108 3333, 4001-200-899 (중국 본토) |

| 이메일: cis@fulbright.com.hk | |

| Wechat: hkfuchang | |

Fulbright Financial Group 정보

Fulbright Financial Group은 1999년에 설립되어 홍콩을 본부로 하는 금융기관으로 홍콩 증권 및 선물위원회에 의해 규제를 받고 있으며 현재 선물 거래 회사만 라이선스를 보유하고 있습니다. 홍콩, 미국 및 기타 글로벌 시장에서 증권, 선물 및 옵션 거래를 제공하며 다양한 거래 플랫폼을 제공하지만 데모 계정이나 명확한 최소 입금 안내가 없습니다.

장단점

| 장점 | 단점 |

| 홍콩 SFC 규제 | 데모 계정 미제공 |

| 다중 시장 접근 제공 | 최소 입금 내역 미투명 |

| 다양한 거래 플랫폼 | 계정 유형에 대한 제한된 정보 |

Fulbright Financial Group은 신뢰할 만한가요?

네, Fulbright Financial Group은 라이선스를 보유한 기관입니다. 그러나 현재 홍콩 SFC로부터 활성화(규제)된 선물 계약 거래 라이선스를 유지하고 있는 것은 Fulbright Futures Limited 뿐입니다. 다른 두 업체의 라이선스는 만료되어 더 이상 유효하지 않습니다.

| 라이선스 보유 업체 | 라이선스 유형 | 라이선스 번호 | 유효 날짜 | 현재 상태 | 규제 기관 |

| Fulbright Futures Limited | 선물 계약 거래 | AME963 | 2005/12/5 | 규제됨 | 홍콩 SFC |

| Fulbright Securities Limited | 증권 거래 | AFB820 | 2004/11/30 | 만료됨 | 홍콩 SFC |

| Fulbright Asset Management Limited | 자산 관리 | AYQ254 | 2012/3/22 | 만료됨 | 홍콩 SFC |

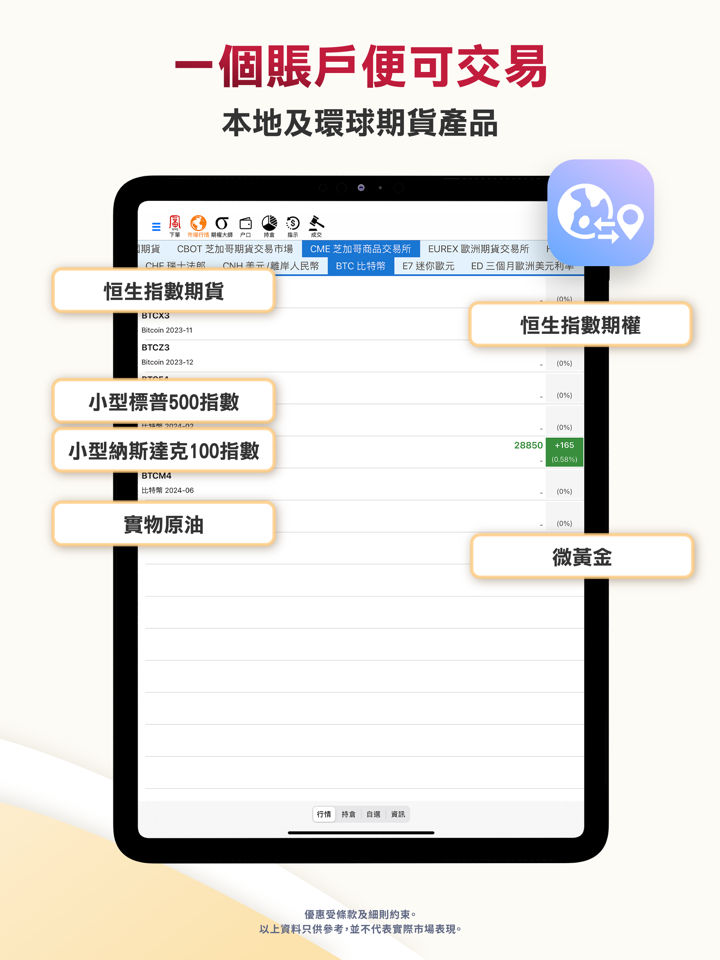

Fulbright Financial Group에서 무엇을 거래할 수 있나요?

Fulbright Financial Group은 홍콩 및 전 세계에서 증권, 선물 및 옵션 거래를 포함한 다양한 금융 서비스를 제공합니다.

| 거래 상품 | 지원 |

| 증권 | ✔ |

| 선물 | ✔ |

| 옵션 | ✔ |

| 외환 | ❌ |

| 상품 | ❌ |

| 지수 | ❌ |

| 주식 | ❌ |

| 암호화폐 | ❌ |

| 채권 | ❌ |

| ETFs | ❌ |

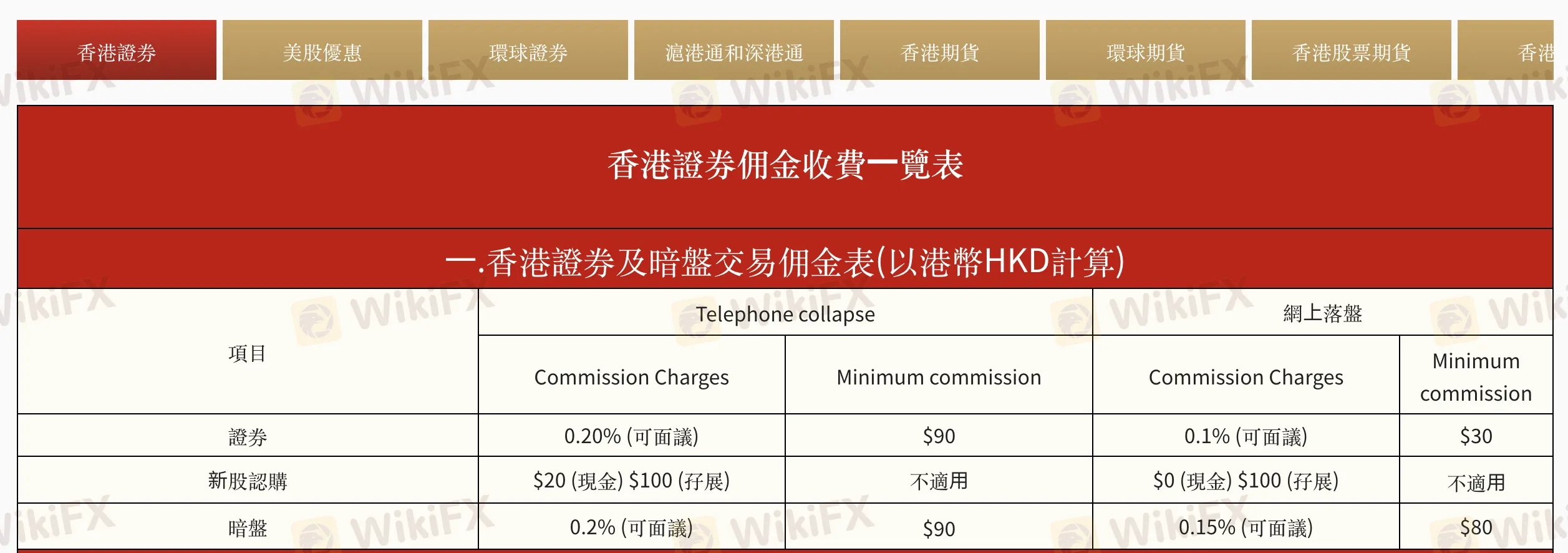

Fulbright Financial Group 수수료

Fulbright Financial Group은 업계 표준에 비해 온라인 거래를 위해 약간 더 낮은 비용을 부과합니다. 일부 요금은 처리 수수료 및 금융 이자와 같이 고객 프로필에 따라 다르며, 협상 가능하며, 이는 일반적인 비즈니스 관행입니다.

| 카테고리 | 서비스/항목 | 수수료 (HKD) | 비고 |

| 거래 수수료 | 홍콩 증권 (전화) | 0.20% (최소 $90) | 협상 가능 |

| 홍콩 증권 (온라인) | 0.10% (최소 $30) | 협상 가능 | |

| IPO 구독 (현금/마진) | $20 / $100 | 온라인 현금: 무료 | |

| 그레이 마켓 (전화/온라인) | 0.20% / 0.15% (최소 $90 / $80) | ||

| 규제 수수료 | 스탬프 세금 | 0.10% | 최소 $1 |

| SFC 거래 수수료 | 0.00% | ||

| 거래소 수수료 (HKEx) | 0.01% | ||

| 청산 수수료 (HKSCC) | 0.005% (최소 $5, 최대 $200) | ||

| FRC 거래 수수료 | 0.00% | ||

| 이자 비용 | 마진 계좌 / 현금 계좌 이자 | P+1.8% 또는 ~7.05% | HSBC Prime Rate 기준 |

| 보관 및 에이전트 서비스 | 주식 이체 (SI/ISI) | 무료 (입금), $5/lot (인출, 최소 $500) | HKSCC 수수료 적용 |

| 주식 인출 (물리적) | $5/lot | $3.5 HKSCC 수수료 포함 | |

| 배당금 수령 | 0.5% (최소 $20, 최대 $10,000) | HKSCC 수수료 0.12% 포함 | |

| 보너스 주식 / 권리 구독 | 무료 / $100 + $0.80/lot | 최대 $10,000 | |

| IPO 처리 (현금/마진) | $20 / $100 | ||

| 기타 수수료 | 월간 명세서 재발행 / 우편 | $50/월 각각 | 2023년 9월부터 우편 요금 적용 |

| SFO 섹션 329 요청 | 케이스 당 $4,000 |

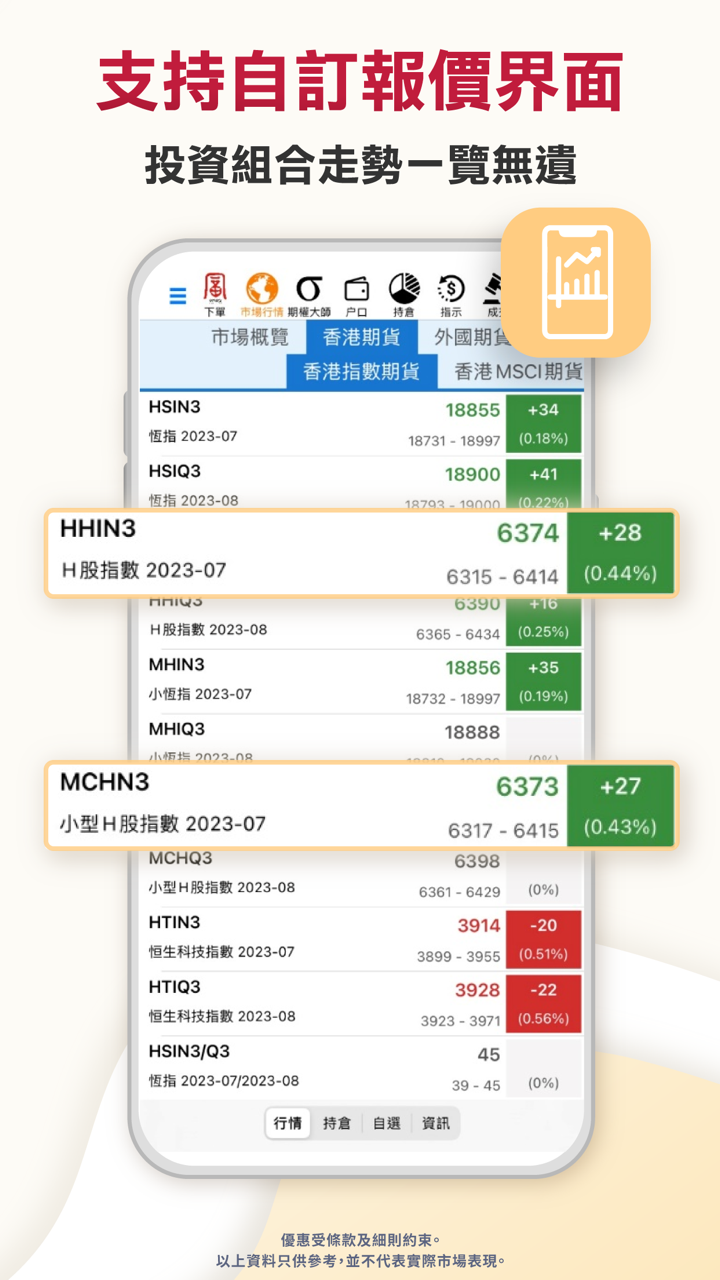

거래 플랫폼

| 플랫폼 이름 | 지원 | 사용 가능한 장치 | 적합 대상 |

| Fulbright App (모바일) | ✔ | 모바일 | 초급자부터 중급 트레이더 |

| Fulbright Terminal (PC) | ✔ | PC | 중급 트레이더 |

| Fulbright Web Platform | ✔ | 웹 브라우저 | 중급 트레이더 |

| Fulbright Pro Terminal | ✔ | 데스크톱 다운로드 | 전문 트레이더 |

| Fulbright Speed Trader | ✔ | 데스크톱 다운로드 | HK 하이 프리퀀시 트레이더 |

입출금

Fulbright Financial Group은 입금 또는 출금에 대해 어떠한 수수료도 부과하지 않지만, 은행은 사용한 방법에 따라 요금을 부과할 수 있습니다. 최소 입금 금액에 대해 언급하지 않았습니다.

입금 옵션

| 입금 방법 | 입금 수수료 | 입금 시간 |

| eDDA 빠른 입금 | ❌ | 즉시 |

| FPS (빠른 지불 시스템) | ~2 시간 (거래일 9:00 – 17:00)* | |

| 온라인 은행 송금 | 1–3 영업일 | |

| 수표 또는 캐셔즈 어더 | 2+ 영업일 |

출금 옵션

| 출금 방법 | 출금 수수료 | 출금 시간 |

| 은행 송금 | ❌ | 9:00–13:00에 제출된 경우 같은 날 처리; 그렇지 않으면 다음 영업일 |

| 수표 | 처리 시간 내에 제출된 경우 같은 날 발행 |