Unternehmensprofil

| Currency Solutions Überprüfungszusammenfassung | |

| Gegründet | 2003 |

| Registriertes Land/Region | Vereinigtes Königreich |

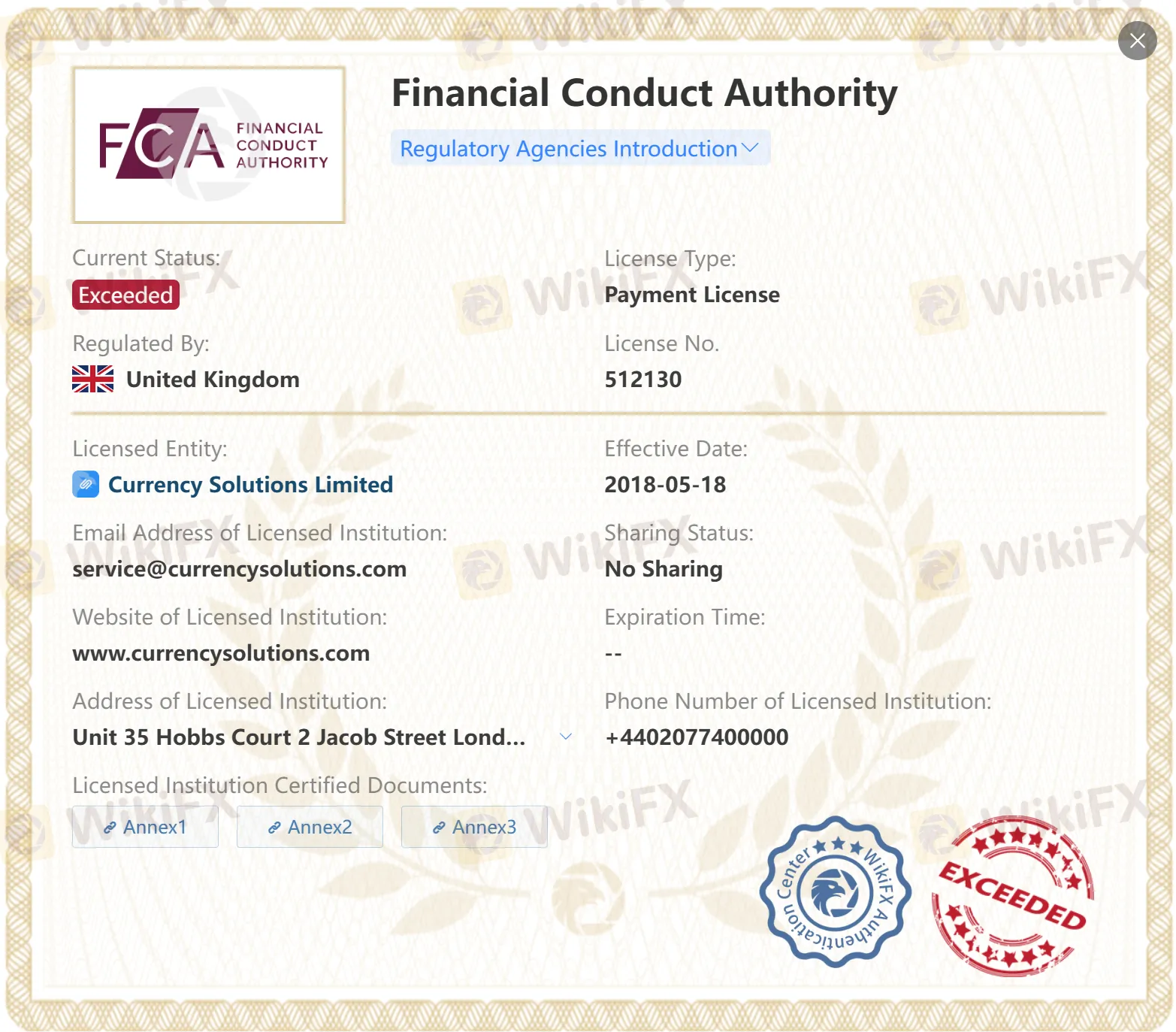

| Regulierung | FCA: Durchlaufverarbeitung (STP) (reguliert), Zahlungslizenz (überschritten) |

| Dienstleistungen | Devisen (FX) und internationale Zahlungsdienste |

| Demo-Konto | ❌ |

| Hebel | / |

| Spread | / |

| Handelsplattform | / |

| Mindesteinzahlung | / |

| Kundenbetreuung | Telefon: +44 2077400000 |

| X, Linkedin, Instagram | |

| Adresse: 4. Stock Hobbs Court, 2 Jacob Street, London, SE1 2BG | |

Im Jahr 2003 in Großbritannien gegründet, bietet Currency Solutions Devisen (FX) und internationale Zahlungsdienste an und ermöglicht den Zugang zu über 170 Währungspaaren. Das Unternehmen ist von der Financial Conduct Authority (FCA) für die Durchlaufverarbeitung (STP) autorisiert und reguliert. Allerdings wurde ihre Zahlungslizenz (Nummer 512130) überschritten. Darüber hinaus sind Informationen zu Handelsplattformen, Spreads, Hebeln und Mindesteinzahlungen nicht leicht verfügbar, und derzeit werden keine Demo-Konten angeboten.

Vor- und Nachteile

| Vorteile | Nachteile |

| Reguliert durch FCA | Überschrittene Lizenz |

| Begrenzte Informationen zu Handelsgebühren | |

| Keine Demo-Konten | |

| Mangel an Informationen zu Handelsplattformen |

Ist Currency Solutions legitim?

Currency Solutions besitzt derzeit zwei Lizenzen unter der FCA. Eine ist eine Straight Through Processing (STP)-Lizenz, die reguliert ist. Die andere ist eine Zahlungslizenz, die überschritten wurde.

| Reguliertes Land | Regulierungsbehörde | Reguliertes Unternehmen | Aktueller Status | Lizenztyp | Lizenznummer |

| Financial Conduct Authority (FCA) | Currency Solutions Limited | Reguliert | Straight Through Processing (STP) | 602082 |

| Financial Conduct Authority (FCA) | Currency Solutions Limited | Überschritten | Zahlungslizenz | 512130 |

Dienstleistungen

Currency Solutions bietet mehr als 170 Währungspaare, Devisen (FX) und internationale Zahlungsdienste an.

Ein- und Auszahlung

Currency Solutions unterstützt Zahlungsmethoden über Visa- und Mastercard-Debitkarten sowie Banküberweisung.