Unternehmensprofil

| Turing Überprüfungszusammenfassung | |

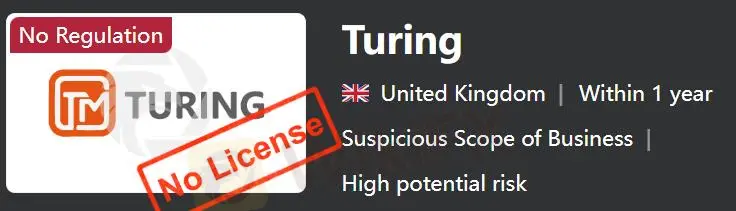

| Gegründet | 1996 |

| Registriertes Land/Region | Vereinigtes Königreich |

| Regulierung | Nicht reguliert |

| Handelsinstrumente | Devisen, Metalle und Kryptowährungen |

| Demokonto | Ja |

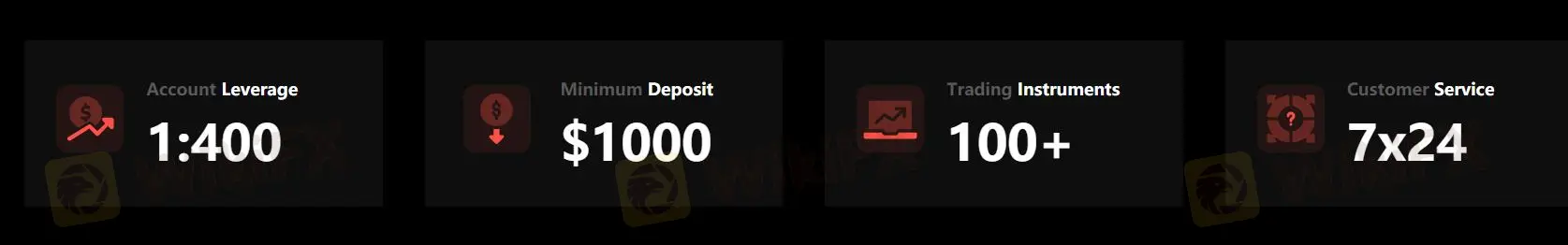

| Hebelwirkung | Bis zu 1:400 |

| Spread | Ab 0,0 Pips |

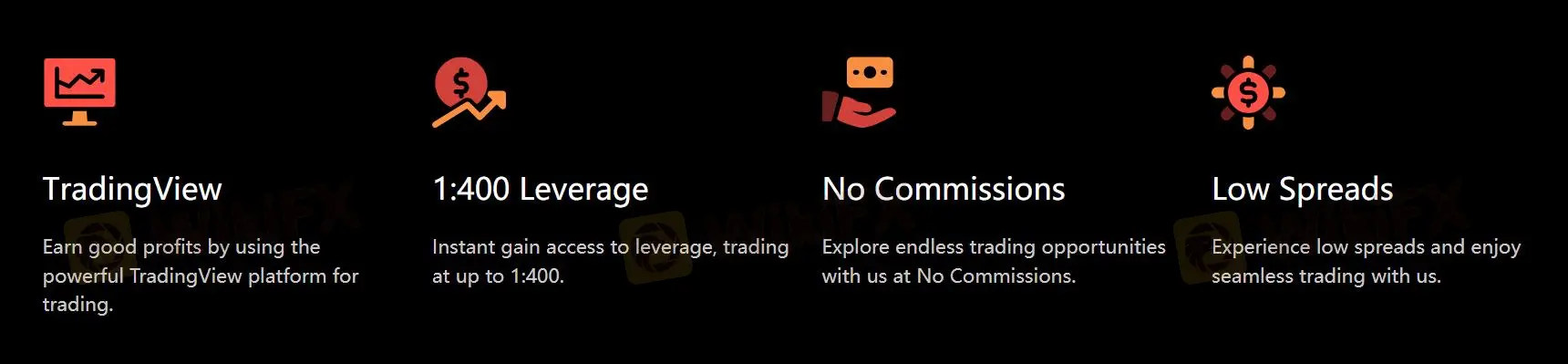

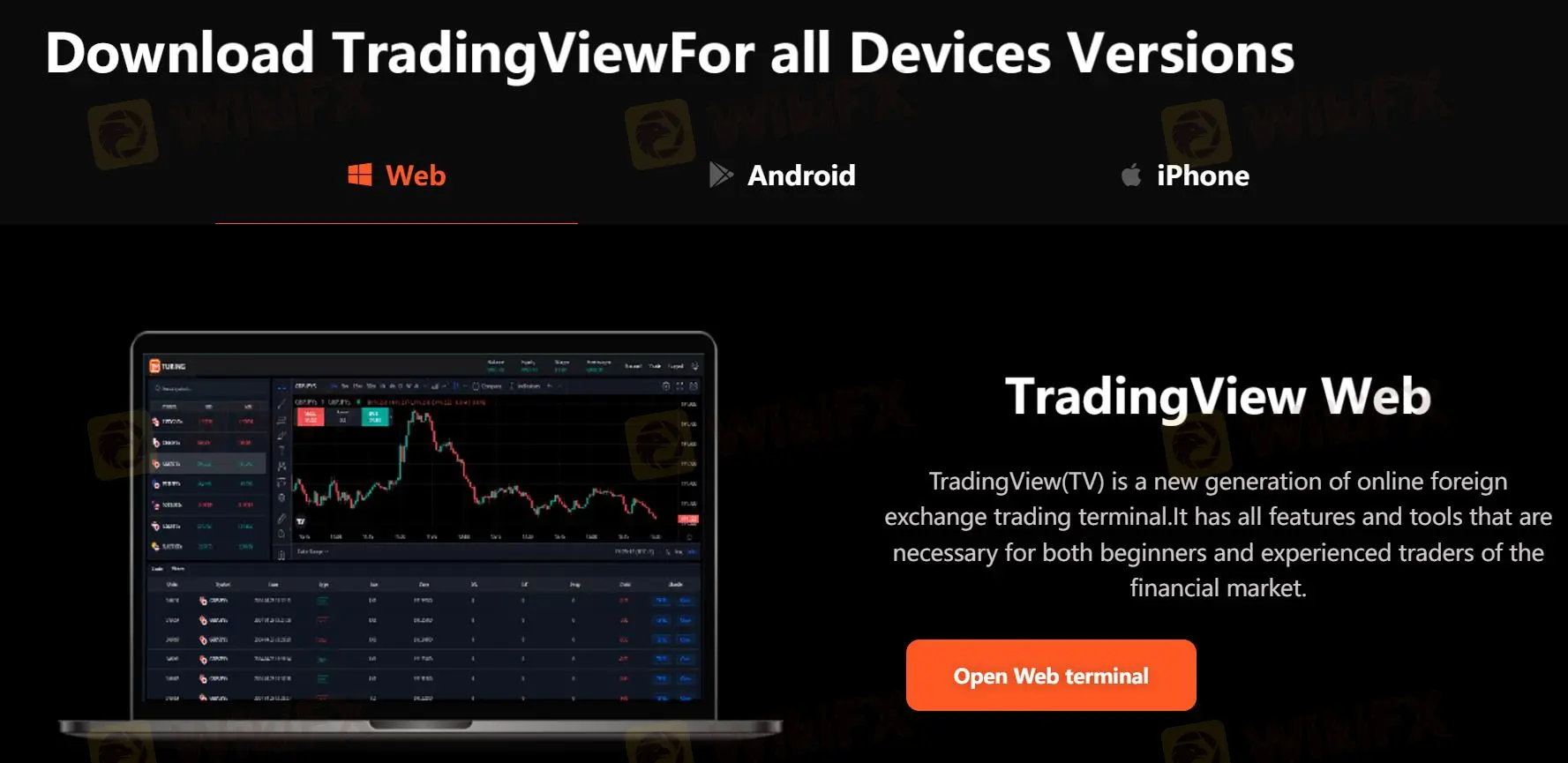

| Handelsplattform | TradingView |

| Mindesteinzahlung | $1000 |

| Kundensupport | support@turingfx.pro |

| 24/7 Live-Chat-Support | |

Turing Informationen

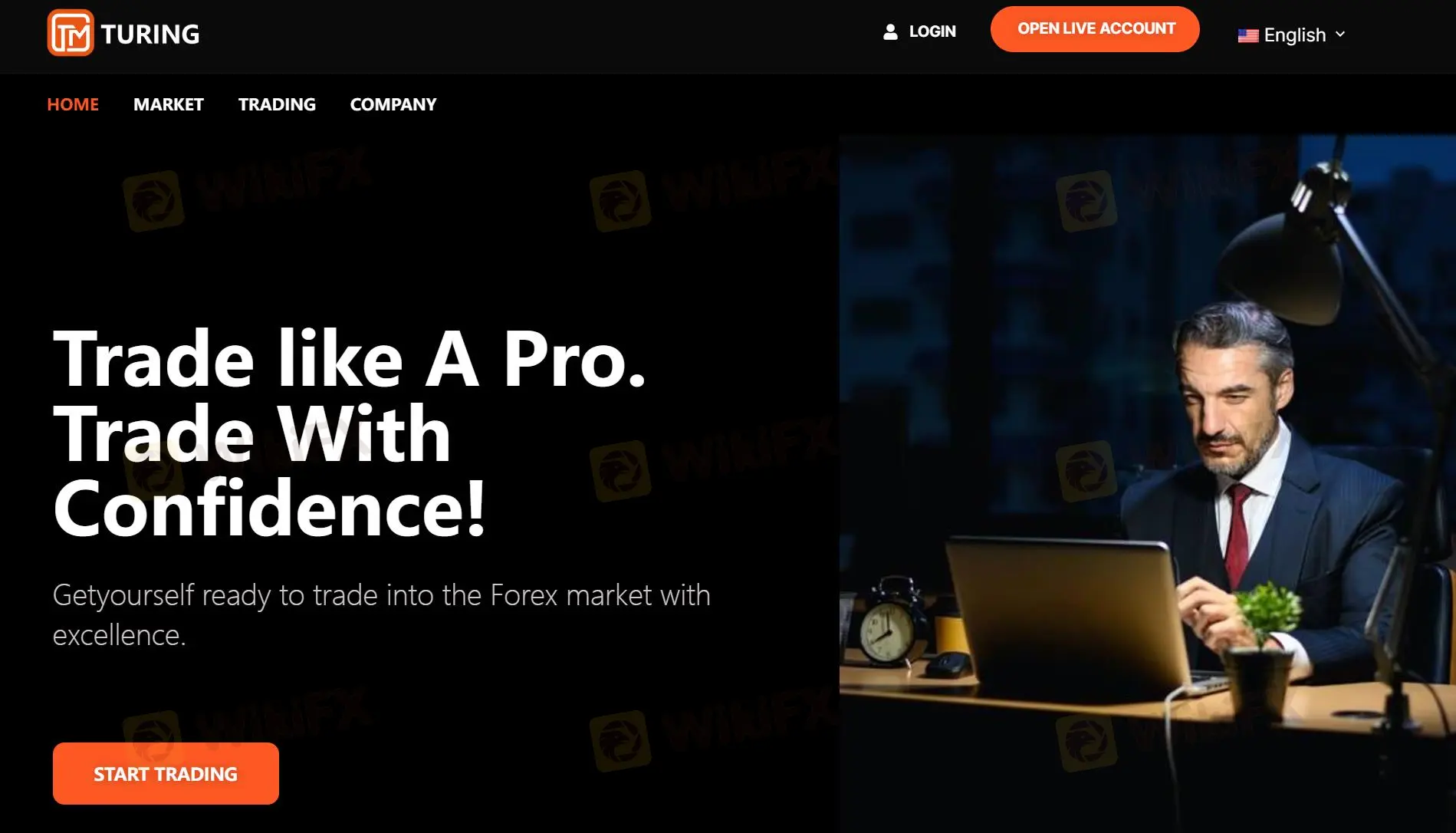

Turing ist eine Online-Handelsplattform, die über 100 Handelsinstrumente, einschließlich Devisen, Metalle und Kryptowährungen, anbietet. Turing bietet geringe Spreads und eine hohe Hebelwirkung von bis zu 1:400 ohne Provisionen über die TradingView-Plattform. Es erfordert jedoch eine hohe Mindesteinzahlung von $1000.

Vor- und Nachteile

| Vorteile | Nachteile |

|

|

|

|

|

|

Ist Turing seriös?

Turing ist nicht reguliert.

Was kann ich auf Turing handeln?

Turing bietet über 100 Handelsinstrumente an, hauptsächlich Devisen, Metalle und Kryptowährungen.

| Handelbare Instrumente | Unterstützt |

| Devisen | ✔ |

| Kryptowährungen | ✔ |

| Metalle | ✔ |

| Indizes | ❌ |

| Rohstoffe | ❌ |

| Aktien | ❌ |

Turing Gebühren

Turing bietet niedrige Spreads und hohe Hebelwirkung von bis zu 1:400 ohne Provisionen.

Handelsplattform

| Handelsplattform | Unterstützt | Verfügbare Geräte | Geeignet für |

| TradingView | ✔ | PC und Mobilgeräte | Investoren aller Erfahrungsstufen |

Ein- und Auszahlung

Turing erfordert eine hohe Mindesteinzahlung von $1000.