Buod ng kumpanya

| Fulbright Financial Group Buod ng Pagsusuri | |

| Itinatag | 1999 |

| Rehistradong Rehiyon | Hong Kong |

| Regulasyon | SFC |

| Mga Instrumento sa Merkado | Securities, Futures, Options (HK, US, Global) |

| Demo Account | ❌ |

| Mga Plataporma sa Paghahalal | Fulbright App (Mobile), Fulbright Terminal (PC), Fulbright Web Platform, Fulbright Pro Terminal, Fulbright Speed Trader |

| Suporta sa Customer | Telepono: +852 3108 3333, 4001-200-899 (Mainland) |

| Email: cis@fulbright.com.hk | |

| Wechat: hkfuchang | |

Impormasyon Tungkol sa Fulbright Financial Group

Fulbright Financial Group, itinatag noong 1999 at may punong tanggapan sa Hong Kong, ay isang lisensyadong institusyon sa pinansyal na regulado ng Hong Kong Securities and Futures Commission, kung saan ang kumpanya nito sa pagtangkilik ng hinaharap lamang ang may lisensya. Nag-aalok ito ng securities, futures, at options trading sa Hong Kong, Estados Unidos, at iba pang global na merkado, pati na rin iba't ibang mga plataporma sa pagtangkilik, gayunpaman walang demo account o malinaw na pahayag sa minimum deposit.

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

| Regulado ng Hong Kong SFC | Walang available na demo accounts |

| Nag-aalok ng multi-market access | Minimum deposit hindi malinaw na naitala |

| Maraming plataporma sa pagtangkilik | Limitadong impormasyon tungkol sa uri ng account |

Tunay ba ang Fulbright Financial Group?

Oo, ang Fulbright Financial Group ay isang lisensyadong organisasyon. Gayunpaman, ang Fulbright Futures Limited lamang ang may aktibong (regulated) futures contract trading license mula sa Hong Kong SFC. Ang lisensya ng dalawang iba pang entidad ay nag-expire, kaya't hindi na mga bago.

| Lisensyadong Entidad | Uri ng Lisensya | Numero ng Lisensya | Epektibong Petsa | Kasalukuyang Kalagayan | Regulado ng |

| Fulbright Futures Limited | Naglalakad sa mga kontrata ng hinaharap | AME963 | 2005/12/5 | Regulado | SFC Hong Kong |

| Fulbright Securities Limited | Naglalakad sa securities | AFB820 | 2004/11/30 | Nag-expire | SFC Hong Kong |

| Fulbright Asset Management Limited | Pamamahala ng asset | AYQ254 | 2012/3/22 | Nag-expire | SFC Hong Kong |

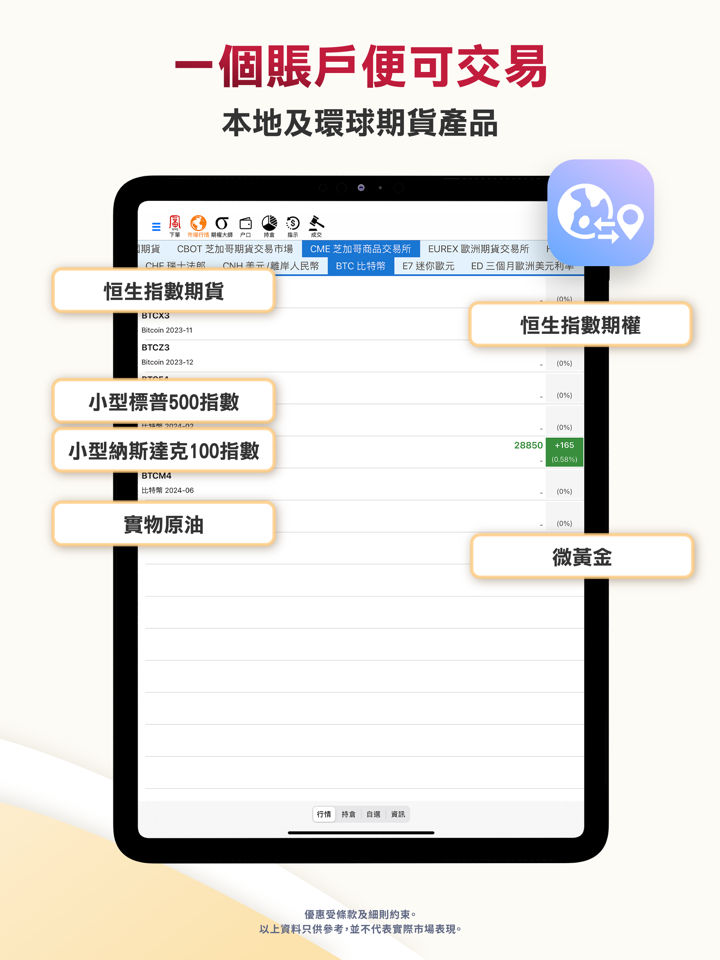

Ano ang Maaari Kong I-trade sa Fulbright Financial Group?

Fulbright Financial Group ay nag-aalok ng malawak na hanay ng mga serbisyong pinansiyal, kabilang ang securities, futures, at options trading sa Hong Kong at sa buong mundo.

| Mga Kasangkapan sa Paghahalal | Supported |

| Securities | ✔ |

| Futures | ✔ |

| Options | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Stocks | ❌ |

| Cryptos | ❌ |

| Bonds | ❌ |

| ETFs | ❌ |

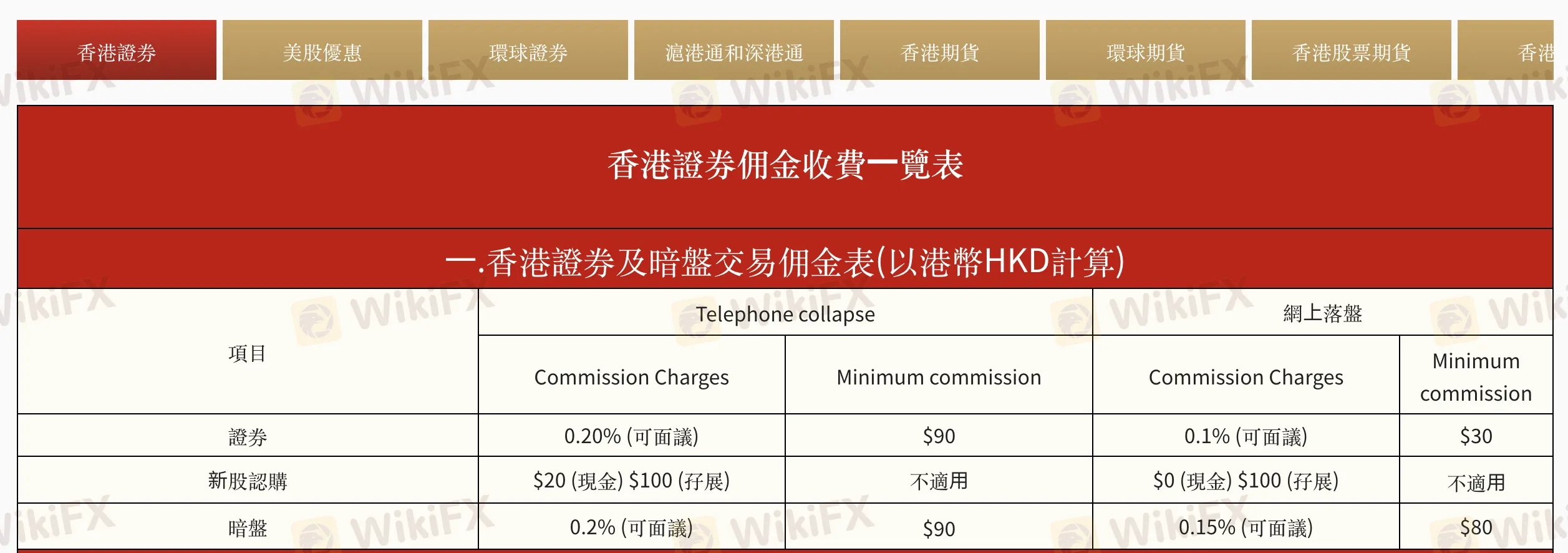

Mga Bayad sa Fulbright Financial Group

Fulbright Financial Group singil ng bahagyang mas mababang gastos kaysa sa karaniwang industriya, lalo na para sa online trading. Ang ilang bayarin, tulad ng handling fees at financing interest, ay nag-iiba depende sa profile ng kliyente at maaaring pag-usapan, tulad ng karaniwang gawain sa negosyo.

| Kategorya | Serbisyo/Item | Bayad (HKD) | Mga Paliwanag |

| Komisyon sa Trading | Hong Kong Securities (Telepono) | 0.20% (min $90) | Maaaring pag-usapan |

| Hong Kong Securities (Online) | 0.10% (min $30) | Maaaring pag-usapan | |

| IPO Subscription (Cash/Margin) | $20 / $100 | Online cash: Libre | |

| Grey Market (Telepono/Online) | 0.20% / 0.15% (min $90 / $80) | ||

| Regulatory Charges | Stamp Duty | 0.10% | Min $1 |

| SFC Transaction Levy | 0.00% | ||

| Exchange Fee (HKEx) | 0.01% | ||

| Clearing Fee (HKSCC) | 0.005% (min $5, max $200) | ||

| FRC Transaction Levy | 0.00% | ||

| Interest Charges | Margin Account / Cash Account Interest | P+1.8% o ~7.05% | Base sa HSBC Prime Rate |

| Custody & Agent Services | Stock Transfer (SI/ISI) | Libre (deposit), $5/lot (withdraw, min $500) | May bayad na HKSCC |

| Stock Withdrawal (Physical) | $5/lot | Kasama ang $3.5 HKSCC fee | |

| Dividend Collection | 0.5% (min $20, max $10,000) | Kasama ang HKSCC fee na 0.12% | |

| Bonus Shares / Rights Subscription | Libre / $100 + $0.80/lot | Max $10,000 | |

| IPO Handling (Cash/Margin) | $20 / $100 | ||

| Iba pang mga Bayarin | Monthly Statement Reissue / Mailing | $50/buwan bawat isa | Mailing fee epektibo simula Set 2023 |

| SFO Section 329 Request | $4,000 bawat kaso |

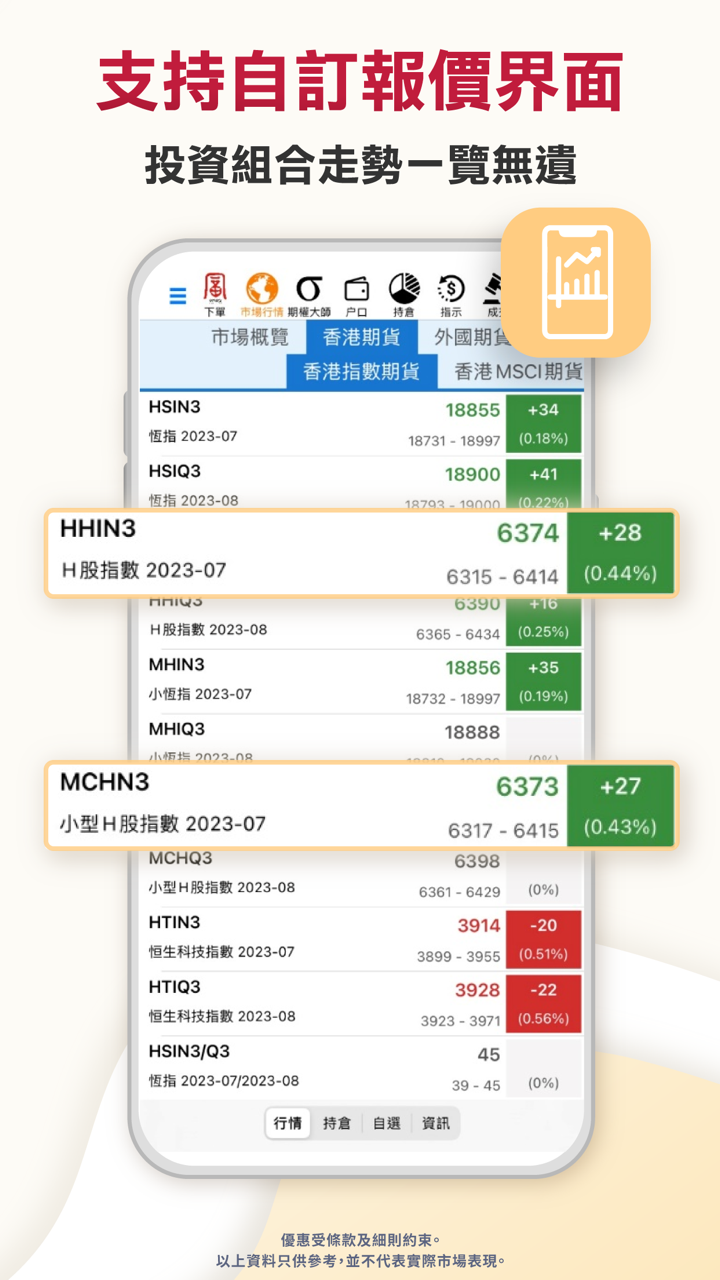

Plataforma ng Trading

| Pangalan ng Plataforma | Supported | Available Devices | Angkop para sa |

| Fulbright App (Mobile) | ✔ | Mobile | Mga Baguhan hanggang Gitnang Traders |

| Fulbright Terminal (PC) | ✔ | PC | Gitnang Traders |

| Fulbright Web Platform | ✔ | Web Browser | Gitnang Traders |

| Fulbright Pro Terminal | ✔ | Desktop Download | Propesyonal na Traders |

| Fulbright Speed Trader | ✔ | Desktop Download | HK High-Frequency Traders |

Deposito at Pag-Wiwithdraw

Fulbright Financial Group ay hindi naniningil ng anumang bayad para sa mga deposito o withdrawals, bagaman maaaring mag-aplay ng bayad ang mga bangko depende sa ginamit na paraan. Hindi ito nagsasaad ng minimum deposit amount.

Mga Pagpipilian sa Pag-iimbak

| Pamamaraan ng Pag-iimbak | Mga Bayad sa Pag-iimbak | Oras ng Pag-iimbak |

| Mabilis na Pag-iimbak ng eDDA | ❌ | Instant |

| FPS (Faster Payment System) | ~2 oras (9:00 – 17:00 sa mga araw ng kalakalan)* | |

| Online Bank Transfer | 1–3 araw ng pagtatrabaho | |

| Tseke o Cashiers Order | 2+ araw ng pagtatrabaho |

Mga Pagpipilian sa Pag-withdraw

| Pamamaraan ng Pag-withdraw | Mga Bayad sa Pag-withdraw | Oras ng Pag-withdraw |

| Bank Transfer | ❌ | Naiproseso sa parehong araw kung isinumite sa 9:00–13:00; kung hindi, sa susunod na araw ng pagtatrabaho |

| Tseke | Ibinigay sa parehong araw kung nasa loob ng oras ng pagproseso |