Resumo da empresa

| Fulbright Financial Group Resumo da Revisão | |

| Fundação | 1999 |

| Região Registrada | Hong Kong |

| Regulação | SFC |

| Instrumentos de Mercado | Valores Mobiliários, Futuros, Opções (HK, EUA, Global) |

| Conta Demonstrativa | ❌ |

| Plataformas de Negociação | Fulbright App (Móvel), Fulbright Terminal (PC), Fulbright Web Platform, Fulbright Pro Terminal, Fulbright Speed Trader |

| Suporte ao Cliente | Telefone: +852 3108 3333, 4001-200-899 (Continente) |

| Email: cis@fulbright.com.hk | |

| Wechat: hkfuchang | |

Informações sobre Fulbright Financial Group

Fulbright Financial Group, fundada em 1999 e sediada em Hong Kong, é uma instituição financeira licenciada regulada pela Comissão de Valores Mobiliários e Futuros de Hong Kong, com apenas sua empresa de negociação de futuros atualmente licenciada. Oferece negociação de valores mobiliários, futuros e opções em Hong Kong, nos Estados Unidos e em outros mercados globais, bem como diferentes plataformas de negociação, no entanto, não há conta demo ou divulgação clara do depósito mínimo.

Prós e Contras

| Prós | Contras |

| Regulado pela SFC de Hong Kong | Não há contas demo disponíveis |

| Oferece acesso a vários mercados | Depósito mínimo não claramente divulgado |

| Múltiplas plataformas de negociação | Informações limitadas sobre tipos de conta |

Fulbright Financial Group é Legítimo?

Sim, Fulbright Financial Group é uma organização licenciada. No entanto, apenas a Fulbright Futures Limited mantém atualmente uma licença ativa (regulamentada) para negociação de contratos futuros da SFC de Hong Kong. As licenças das outras duas entidades expiraram, portanto, não são mais válidas.

| Entidade Licenciada | Tipo de Licença | Nº de Licença | Data Efetiva | Status Atual | Regulado por |

| Fulbright Futures Limited | Negociação de contratos futuros | AME963 | 2005/12/5 | Regulamentado | SFC Hong Kong |

| Fulbright Securities Limited | Negociação de valores mobiliários | AFB820 | 2004/11/30 | Expirada | SFC Hong Kong |

| Fulbright Asset Management Limited | Gestão de ativos | AYQ254 | 2012/3/22 | Expirada | SFC Hong Kong |

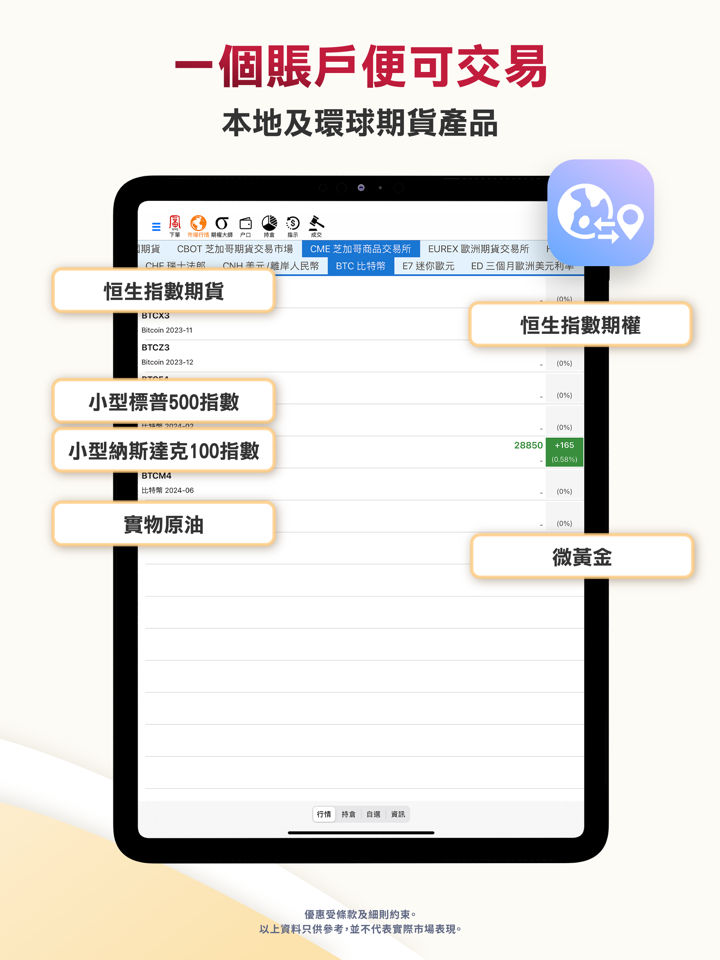

O Que Posso Negociar na Fulbright Financial Group?

Fulbright Financial Group oferece uma ampla gama de serviços financeiros, incluindo negociação de valores mobiliários, futuros e opções em Hong Kong e ao redor do mundo.

| Instrumentos de Negociação | Suportado |

| Valores Mobiliários | ✔ |

| Futuros | ✔ |

| Opções | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Índices | ❌ |

| Ações | ❌ |

| Criptomoedas | ❌ |

| Obrigações | ❌ |

| ETFs | ❌ |

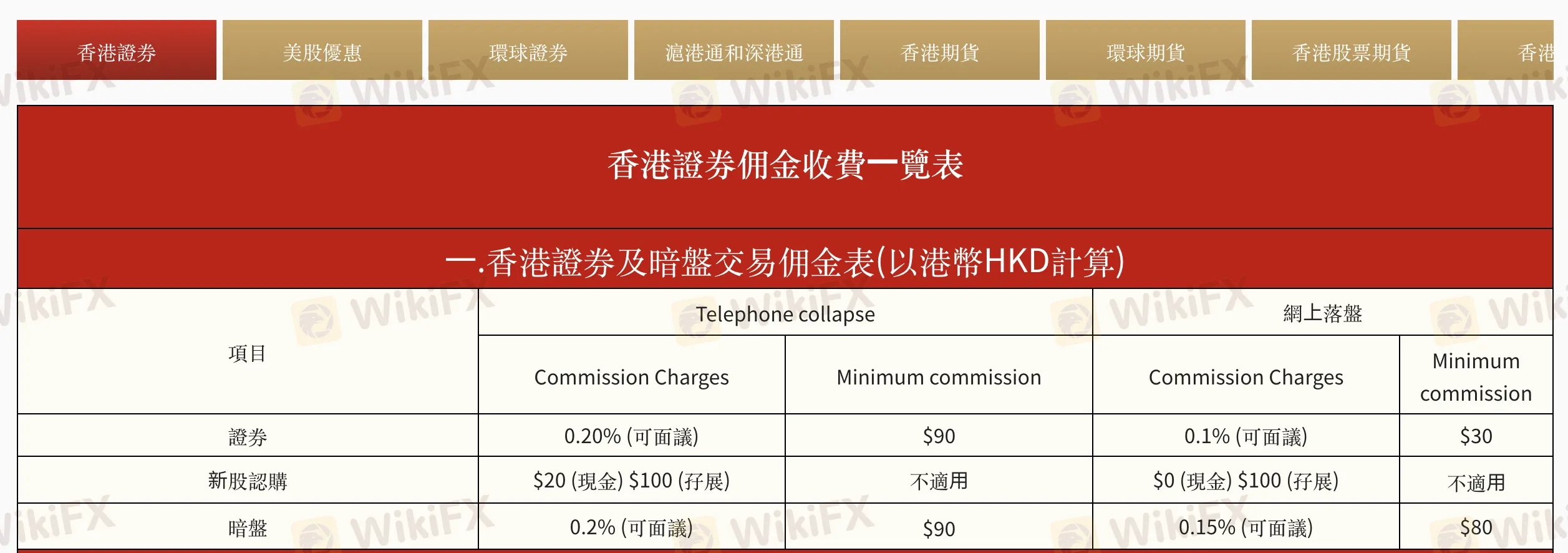

Taxas da Fulbright Financial Group

Fulbright Financial Group cobra custos ligeiramente mais baixos do que a norma da indústria, especialmente para negociações online. Alguns encargos, como taxas de manuseio e juros de financiamento, variam de acordo com o perfil do cliente e são negociáveis, conforme é prática comum nos negócios.

| Categoria | Serviço/Item | Taxa (HKD) | Observações |

| Comissões de Negociação | Valores Mobiliários de Hong Kong (Telefone) | 0,20% (mín $90) | Negociável |

| Valores Mobiliários de Hong Kong (Online) | 0,10% (mín $30) | Negociável | |

| Inscrição em IPO (Dinheiro/Margem) | $20 / $100 | Dinheiro online: Gratuito | |

| Mercado Cinza (Telefone/Online) | 0,20% / 0,15% (mín $90 / $80) | ||

| Taxas Regulatórias | Imposto de Selo | 0,10% | Mín $1 |

| Lei de Transações da SFC | 0,00% | ||

| Taxa de Bolsa (HKEx) | 0,01% | ||

| Taxa de Compensação (HKSCC) | 0,005% (mín $5, máx $200) | ||

| Lei de Transações da FRC | 0,00% | ||

| Taxas de Juros | Conta de Margem / Juros da Conta à Vista | P+1,8% ou ~7,05% | Baseado na Taxa Prime do HSBC |

| Serviços de Custódia e Agente | Transferência de Ações (SI/ISI) | Grátis (depósito), $5/lote (saque, mín $500) | Aplicam-se taxas da HKSCC |

| Retirada de Ações (Física) | $5/lote | Incl. taxa de $3,5 da HKSCC | |

| Recolha de Dividendos | 0,5% (mín $20, máx $10.000) | Incl. taxa da HKSCC 0,12% | |

| Ações Bônus / Subscrição de Direitos | Grátis / $100 + $0,80/lote | Máx $10.000 | |

| Manuseio de IPO (Dinheiro/Margem) | $20 / $100 | ||

| Outras Taxas | Reemissão / Envio Mensal de Extrato | $50/mês cada | Taxa de envio efetiva desde set 2023 |

| Solicitação da Seção 329 da SFO | $4.000 por caso |

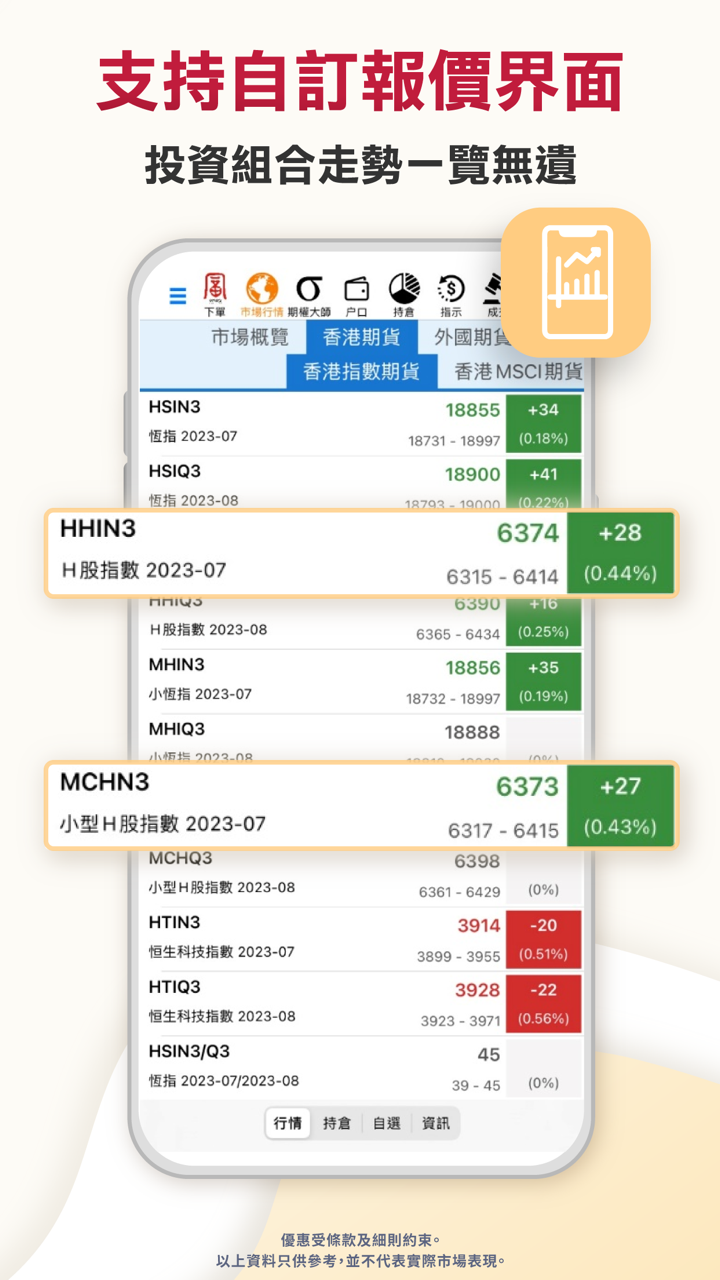

Plataforma de Negociação

| Nome da Plataforma | Suportado | Dispositivos Disponíveis | Adequado para |

| Aplicativo Fulbright (Móvel) | ✔ | Móvel | Traders Iniciantes a Intermediários |

| Terminal Fulbright (PC) | ✔ | PC | Traders Intermediários |

| Plataforma Web Fulbright | ✔ | Navegador Web | Traders Intermediários |

| Terminal Pro Fulbright | ✔ | Download para Desktop | Traders Profissionais |

| Speed Trader Fulbright | ✔ | Download para Desktop | Traders de Alta Frequência de HK |

Depósito e Retirada

Fulbright Financial Group não cobra taxas para depósitos ou retiradas, embora os bancos possam aplicar taxas dependendo do método utilizado. Não menciona um valor mínimo de depósito.

Opções de Depósito

| Método de Depósito | Taxas de Depósito | Tempo de Depósito |

| Depósito Rápido eDDA | ❌ | Instantâneo |

| FPS (Sistema de Pagamento Mais Rápido) | ~2 horas (9:00 – 17:00 nos dias úteis)* | |

| Transferência Bancária Online | 1–3 dias úteis | |

| Cheque ou Ordem de Caixa | 2+ dias úteis |

Opções de Retirada

| Método de Retirada | Taxas de Retirada | Tempo de Retirada |

| Transferência Bancária | ❌ | Processado no mesmo dia se enviado entre 9:00 e 13:00; caso contrário, no próximo dia útil |

| Cheque | Emiitido no mesmo dia se dentro do horário de processamento |