Company Summary

| Fulbright Financial Group Review Summary | |

| Founded | 1999 |

| Registered Region | Hong Kong |

| Regulation | SFC |

| Market Instruments | Securities, Futures, Options (HK, US, Global) |

| Demo Account | ❌ |

| Trading Platforms | Fulbright App (Mobile), Fulbright Terminal (PC), Fulbright Web Platform, Fulbright Pro Terminal, Fulbright Speed Trader |

| Customer Support | Phone: +852 3108 3333, 4001-200-899 (Mainland) |

| Email: cis@fulbright.com.hk | |

| Wechat: hkfuchang | |

Fulbright Financial Group Information

Fulbright Financial Group, founded in 1999 and headquartered in Hong Kong, is a licensed financial institution regulated by the Hong Kong Securities and Futures Commission, with only its futures trading company currently licensed. It offers securities, futures, and options trading in Hong Kong, the United States, and other global markets, as well as different trading platforms, however there is no demo account or clear minimum deposit disclosure.

Pros and Cons

| Pros | Cons |

| Regulated by Hong Kong SFC | No demo accounts available |

| Offers multi-market access | Minimum deposit not clearly disclosed |

| Multiple trading platforms | Limited information about account types |

Is Fulbright Financial Group Legit?

Yes, Fulbright Financial Group is a licensed organization. However, only Fulbright Futures Limited now maintains an active (regulated) futures contract trading license from the Hong Kong SFC. The other two entities' licenses have expired, thus they are no longer valid.

| Licensed Entity | License Type | License No. | Effective Date | Current Status | Regulated by |

| Fulbright Futures Limited | Dealing in futures contracts | AME963 | 2005/12/5 | Regulated | SFC Hong Kong |

| Fulbright Securities Limited | Dealing in securities | AFB820 | 2004/11/30 | Exceeded | SFC Hong Kong |

| Fulbright Asset Management Limited | Asset management | AYQ254 | 2012/3/22 | Exceeded | SFC Hong Kong |

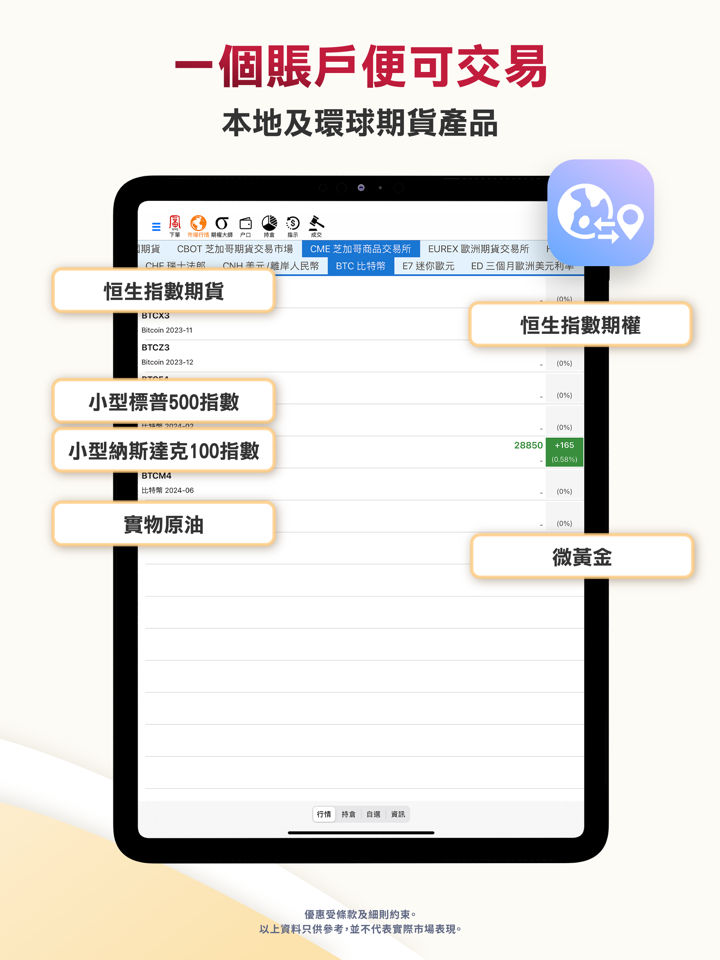

What Can I Trade on Fulbright Financial Group?

Fulbright Financial Group offers a broad range of financial services, including securities, futures, and options trading in Hong Kong and around the world.

| Trading Instruments | Supported |

| Securities | ✔ |

| Futures | ✔ |

| Options | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Stocks | ❌ |

| Cryptos | ❌ |

| Bonds | ❌ |

| ETFs | ❌ |

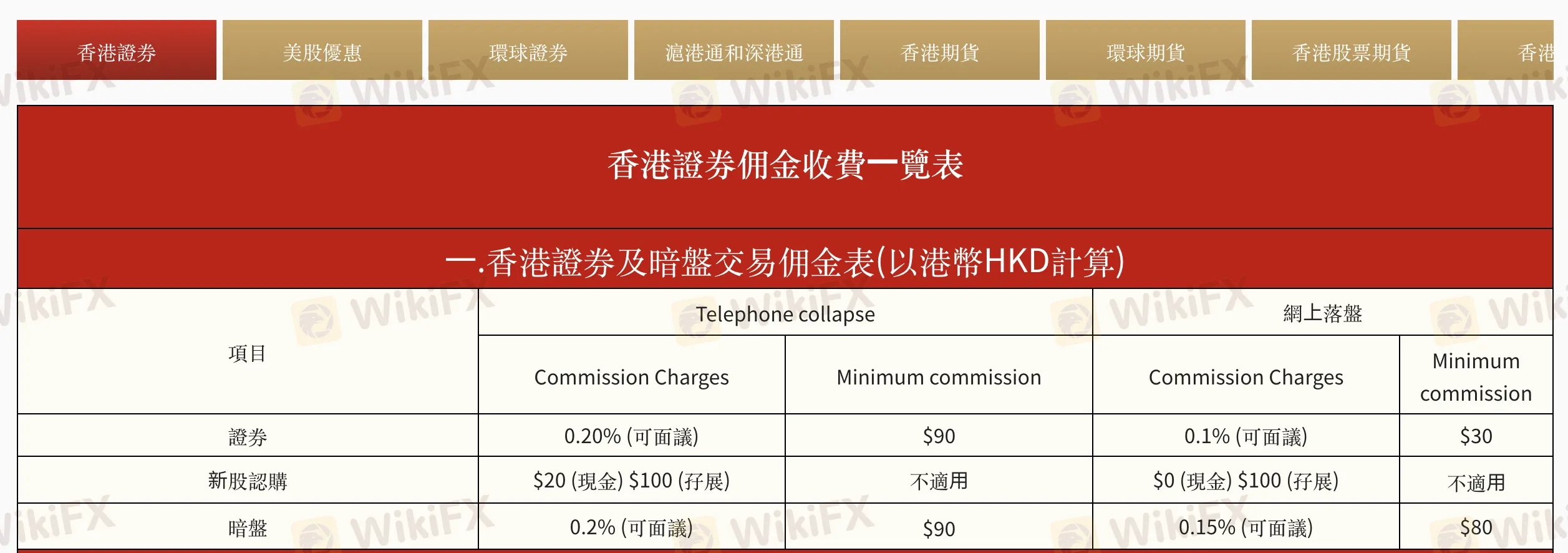

Fulbright Financial Group Fees

Fulbright Financial Group charges slightly lower costs than the industry norm, particularly for online trading. Some charges, such as handling fees and financing interest, vary by client profile and are negotiable, as is common business practice.

| Category | Service/Item | Fee (HKD) | Remarks |

| Trading Commissions | Hong Kong Securities (Phone) | 0.20% (min $90) | Negotiable |

| Hong Kong Securities (Online) | 0.10% (min $30) | Negotiable | |

| IPO Subscription (Cash/Margin) | $20 / $100 | Online cash: Free | |

| Grey Market (Phone/Online) | 0.20% / 0.15% (min $90 / $80) | ||

| Regulatory Charges | Stamp Duty | 0.10% | Min $1 |

| SFC Transaction Levy | 0.00% | ||

| Exchange Fee (HKEx) | 0.01% | ||

| Clearing Fee (HKSCC) | 0.005% (min $5, max $200) | ||

| FRC Transaction Levy | 0.00% | ||

| Interest Charges | Margin Account / Cash Account Interest | P+1.8% or ~7.05% | HSBC Prime Rate Based |

| Custody & Agent Services | Stock Transfer (SI/ISI) | Free (deposit), $5/lot (withdraw, min $500) | HKSCC fees apply |

| Stock Withdrawal (Physical) | $5/lot | Incl. $3.5 HKSCC fee | |

| Dividend Collection | 0.5% (min $20, max $10,000) | Incl. HKSCC fee 0.12% | |

| Bonus Shares / Rights Subscription | Free / $100 + $0.80/lot | Max $10,000 | |

| IPO Handling (Cash/Margin) | $20 / $100 | ||

| Other Fees | Monthly Statement Reissue / Mailing | $50/month each | Mailing fee effective since Sep 2023 |

| SFO Section 329 Request | $4,000 per case |

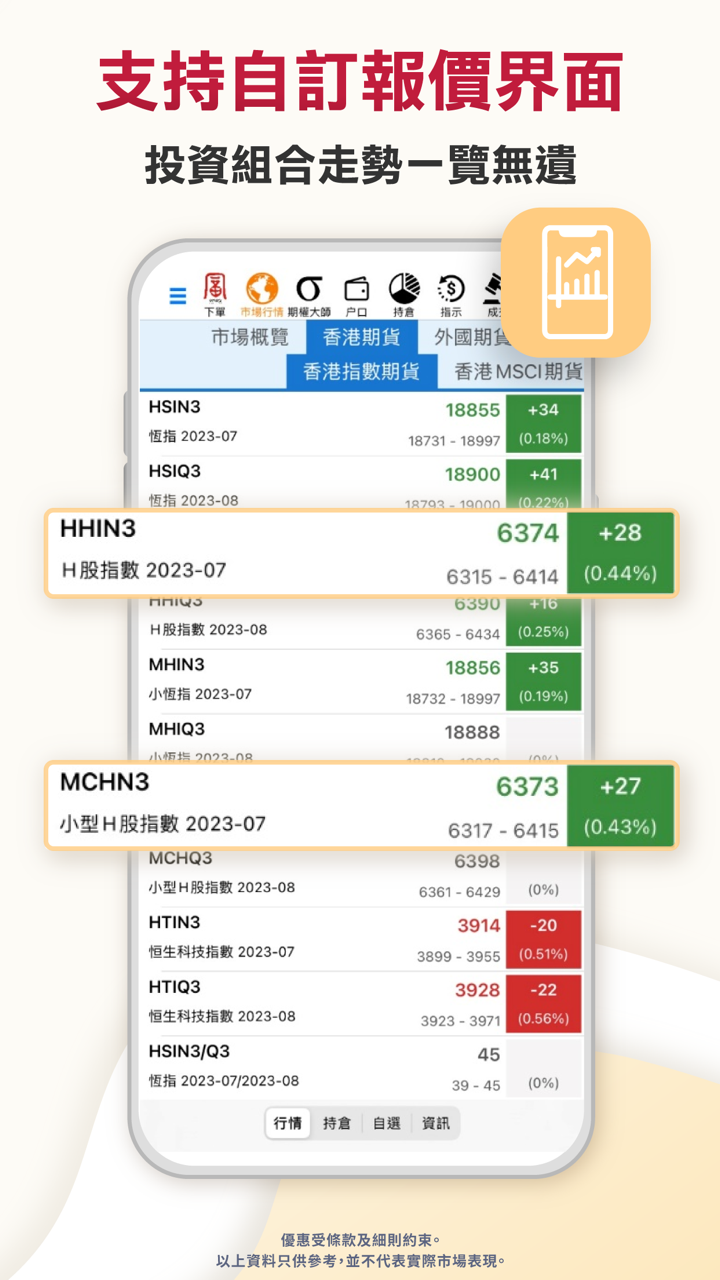

Trading Platform

| Platform Name | Supported | Available Devices | Suitable for |

| Fulbright App (Mobile) | ✔ | Mobile | Beginner to Intermediate Traders |

| Fulbright Terminal (PC) | ✔ | PC | Intermediate Traders |

| Fulbright Web Platform | ✔ | Web Browser | Intermediate Traders |

| Fulbright Pro Terminal | ✔ | Desktop Download | Professional Traders |

| Fulbright Speed Trader | ✔ | Desktop Download | HK High-Frequency Traders |

Deposit and Withdrawal

Fulbright Financial Group does not charge any fees for deposits or withdrawals, though banks may apply charges depending on the method used. It does not mention a minimum deposit amount.

Deposit Options

| Deposit Method | Deposit Fees | Deposit Time |

| eDDA Fast Deposit | ❌ | Instant |

| FPS (Faster Payment System) | ~2 hours (9:00 – 17:00 on trading days)* | |

| Online Bank Transfer | 1–3 working days | |

| Cheque or Cashiers Order | 2+ working days |

Withdrawal Options

| Withdrawal Method | Withdrawal Fees | Withdrawal Time |

| Bank Transfer | ❌ | Processed same day if submitted 9:00–13:00; otherwise next working day |

| Cheque | Issued same day if within processing hours |